The Florida Life Insurance Exam is a crucial assessment for professionals in the insurance industry, and understanding the passing grade is essential for success. This examination evaluates candidates' knowledge and skills in various areas of life insurance, including underwriting, policy administration, and customer service. The passing score is typically set at a specific threshold, ensuring that successful applicants possess the necessary expertise to handle life insurance-related responsibilities. Achieving this grade is a significant milestone, as it signifies a candidate's readiness to enter or advance in the field of life insurance in Florida.

| Characteristics | Values |

|---|---|

| Passing Grade | 70% |

| Exam Type | Life Insurance |

| State | Florida |

| Regulatory Body | Florida Office of Financial Regulation (OFR) |

| Exam Duration | 2 hours |

| Content | Questions cover various topics related to life insurance, including insurance principles, underwriting, policy types, and regulations. |

| Passing Score Calculation | The exam is scored on a curve, and the passing score is determined by the percentage of questions answered correctly by the passing candidates. |

| Recertification | Life insurance agents in Florida need to renew their license every 2 years, and they must complete a continuing education requirement. |

What You'll Learn

- Exam Structure: Understand the format, including multiple-choice and essay questions

- Content Coverage: Know the specific areas of life insurance regulation in Florida

- Passing Score: Familiarize yourself with the minimum score required to pass

- Study Resources: Identify recommended textbooks, practice exams, and study guides

- Preparation Tips: Learn effective study strategies and time management techniques

Exam Structure: Understand the format, including multiple-choice and essay questions

The Florida Life Insurance Exam is a comprehensive assessment designed to evaluate an individual's knowledge and understanding of various aspects of life insurance. It is a crucial step for those seeking to become licensed life insurance agents in the state of Florida. Understanding the exam structure is essential for candidates to prepare effectively and achieve success.

The exam is divided into two main sections: the Knowledge Test and the Examination of Skills and Application. The Knowledge Test is a multiple-choice section, which typically consists of 100 questions. These questions cover a wide range of topics, including life insurance concepts, types of policies, underwriting, claims processing, and regulatory requirements. Each question is designed to test the candidate's understanding and application of knowledge in a specific area. The multiple-choice format allows for a quick assessment of the candidate's grasp of various life insurance principles.

In addition to the multiple-choice section, the exam also includes an essay portion. This part of the exam requires candidates to demonstrate their ability to analyze and solve complex life insurance scenarios. Essay questions may present hypothetical situations or case studies that require in-depth analysis and the application of relevant life insurance principles. These essays assess the candidate's critical thinking, problem-solving skills, and ability to provide well-structured and coherent responses.

The passing grade for the Florida Life Insurance Exam is set by the state's insurance regulatory body. Typically, a passing score is around 70%, ensuring that candidates have a solid understanding of the subject matter. However, it is important to note that the specific passing criteria may vary slightly, and candidates should refer to the official guidelines provided by the Florida Office of Insurance Regulation for the most accurate and up-to-date information.

To excel in this exam, candidates should focus on a comprehensive study plan that covers all the relevant topics. Utilizing study guides, practice questions, and past exam papers can help familiarize oneself with the exam structure and improve performance. Additionally, understanding the weightage of each section and the types of questions asked can further enhance preparation and increase the chances of success.

Life Insurance's BWRP: What You Need to Know

You may want to see also

Content Coverage: Know the specific areas of life insurance regulation in Florida

The Florida Life Insurance Examination is a crucial assessment for individuals seeking to become licensed life insurance agents in the state. Understanding the specific areas of regulation is essential to ensure a comprehensive preparation and a successful outcome. Here's an overview of the key content areas you should focus on:

Insurance Regulation Basics: Familiarize yourself with the fundamental principles of insurance regulation in Florida. This includes the state's insurance regulatory body, the Florida Office of Insurance Regulation (OIR), and its role in overseeing the insurance industry. Learn about the regulatory framework, licensing requirements, and the purpose of these regulations to protect consumers and maintain market stability.

Life Insurance Products and Policies: A deep understanding of various life insurance products is vital. Study the different types of life insurance, such as term life, whole life, universal life, and variable life. Grasp the features, benefits, and potential drawbacks of each. Additionally, explore the components of a life insurance policy, including death benefits, premiums, policy terms, and rider options. Understanding the intricacies of these products will enable you to advise clients effectively.

Regulatory Compliance and Ethics: Florida's insurance regulations emphasize compliance and ethical conduct. Study the rules and guidelines set by the OIR regarding agent conduct, customer interactions, and policy administration. Learn about the legal and ethical obligations of life insurance agents, including disclosure requirements, anti-fraud provisions, and the importance of maintaining client confidentiality. Understanding these regulations will help you navigate potential challenges and ensure a professional practice.

Rate Filing and Pricing: Life insurance companies in Florida must file their rates with the OIR for approval. Study the process of rate filing, including the factors considered in setting premiums and the regulatory review process. Understand the concepts of underwriting, risk assessment, and how these influence pricing. Additionally, learn about the regulatory guidelines for rate changes and the impact of market fluctuations on insurance rates.

Customer Protection and Claims: Florida regulations prioritize consumer protection. Study the rights and responsibilities of both agents and policyholders. Learn about the claims process, including the steps involved in filing a claim and the regulatory oversight during this process. Understand the regulations regarding dispute resolution, policy cancellations, and the rights of insured individuals. This knowledge will empower you to provide excellent customer service and ensure fair practices.

By focusing on these specific areas, you can ensure that your preparation for the Florida Life Insurance Examination is comprehensive and aligned with the state's regulatory requirements. It is essential to study the relevant laws, regulations, and industry practices to excel in this field and provide valuable guidance to your clients.

Life Insurance Evolution: Adapting to Changing Times

You may want to see also

Passing Score: Familiarize yourself with the minimum score required to pass

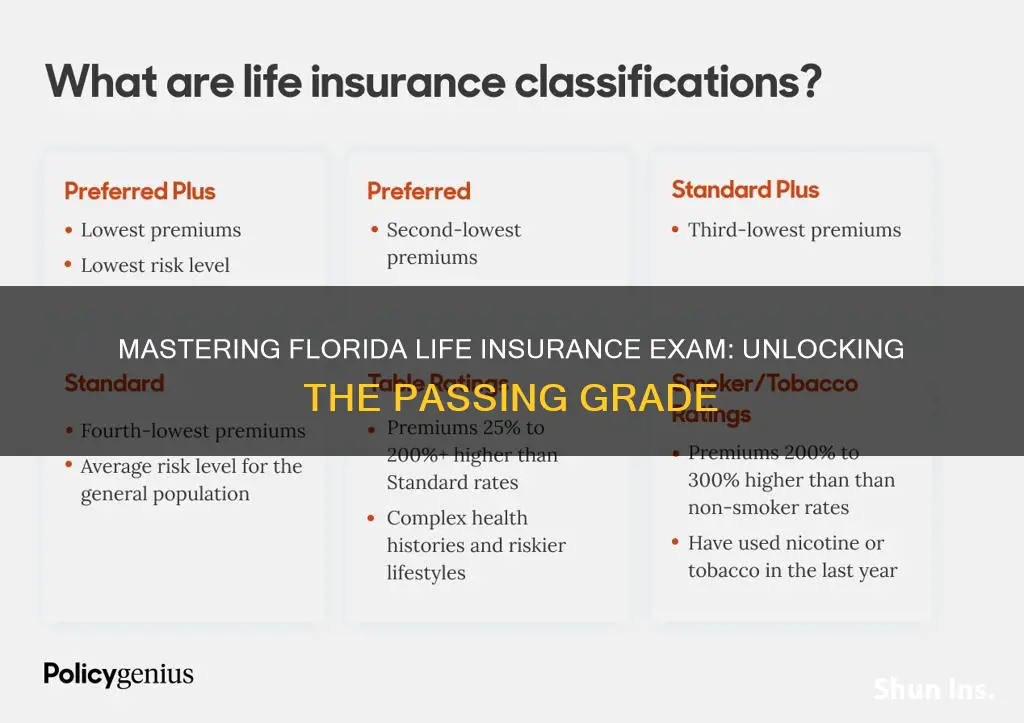

The Florida Life Insurance Exam, a crucial assessment for those seeking to enter the life insurance industry in the state, has a specific passing grade that candidates must achieve. This passing score is a critical threshold that ensures individuals possess the necessary knowledge and skills to excel in their roles. Understanding this minimum requirement is essential for anyone preparing to take the exam, as it sets the benchmark for success.

When it comes to the passing score, it is important to note that the exact figure may vary slightly depending on the specific exam version and the regulatory body overseeing it. However, a common understanding is that the passing grade for the Florida Life Insurance Exam typically falls within a range of 70% to 75%. This percentage indicates the proportion of questions that must be answered correctly to achieve a passing status. For instance, if the exam consists of 100 questions, a candidate would need to answer at least 70 of them correctly to meet the passing criteria.

Achieving this passing score is not merely about memorizing facts but also about demonstrating a comprehensive understanding of the subject matter. The exam covers a wide range of topics, including insurance principles, risk assessment, policy types, and regulatory compliance. It is designed to evaluate an individual's ability to apply this knowledge in a practical context. Therefore, a passing score signifies not only the acquisition of relevant knowledge but also the development of critical thinking and problem-solving skills.

Preparing for the Florida Life Insurance Exam requires a strategic approach. Candidates should familiarize themselves with the exam syllabus, which outlines the specific areas of focus. This includes studying the various types of life insurance policies, understanding mortality tables, and grasping the concepts of risk and underwriting. Additionally, practicing with sample questions and past exam papers can significantly enhance one's chances of success, as it allows for a realistic assessment of knowledge retention and exam readiness.

In summary, the passing score for the Florida Life Insurance Exam is a critical aspect of the evaluation process, ensuring that only qualified individuals progress in their careers. By understanding the minimum score required, aspiring life insurance professionals can tailor their preparation strategies accordingly. Achieving this passing grade is a testament to one's expertise and a crucial step towards a successful career in the life insurance industry.

Life Insurance Options Post-Prostate Cancer Treatment

You may want to see also

Study Resources: Identify recommended textbooks, practice exams, and study guides

When preparing for the Florida Life Insurance Exam, it's crucial to utilize a variety of study resources to ensure you are well-equipped to succeed. Here are some recommended resources to help you achieve your goal:

Textbooks:

- "Life and Health Insurance Licensing Examination" by Robert J. Johnson: This comprehensive textbook covers all the essential topics for the exam, including insurance principles, life and health coverage, and regulatory requirements. It provides a solid foundation for understanding the material and is widely regarded as a go-to resource for insurance licensing exams.

- "Life and Health Insurance: Theory and Practice" by James M. Langabeer: Langabeer's book offers a practical approach to learning insurance concepts. It includes real-world examples and case studies, making it easier to grasp complex ideas. The text also provides practice questions at the end of each chapter, allowing you to test your understanding.

- "The Insurance and Financial Services Professional's Handbook" by Michael A. Arnold: While not solely focused on life insurance, this book is an excellent companion for the exam. It covers a broad range of insurance topics, including life, health, and property insurance, and includes practice questions and quizzes to reinforce learning.

Practice Exams:

- Florida Insurance Department's Sample Questions: The official website of the Florida Office of Insurance Regulation provides a set of sample questions that closely resemble the actual exam. These questions cover various topics and are a great way to familiarize yourself with the exam format and types of questions asked.

- Online Practice Platforms: Numerous online platforms offer practice exams specifically tailored to the Florida Life Insurance Exam. Websites like ExamTime, Insurance Practice Exams, and Insurance License Exam provide comprehensive question banks with detailed explanations. These platforms often include timed simulations, helping you manage your time effectively during the actual exam.

Study Guides:

- "Cracking the Florida Life Insurance Exam" by Exam Solutions: This study guide is designed to help you master the key concepts and pass the exam with flying colors. It provides a structured approach, covering all the essential topics, and includes practice questions with instant feedback. The guide also offers tips and strategies to enhance your exam preparation.

- "Florida Life Insurance Exam Study Guide" by Insurance Study Guides: This resource is specifically tailored to the Florida exam and provides a comprehensive overview of the curriculum. It includes chapter summaries, key terms, and practice questions. The study guide is regularly updated to reflect any changes in the exam syllabus.

Additionally, consider forming or joining a study group where you can discuss complex topics, quiz each other, and gain different perspectives. Flashcards can also be a useful tool to memorize key terms and definitions. Remember, consistent practice and a well-rounded study approach are key to success in passing the Florida Life Insurance Exam.

Nationwide Insurance: Drug Testing for Life Insurance Policies

You may want to see also

Preparation Tips: Learn effective study strategies and time management techniques

When preparing for the Florida Life Insurance Exam, effective study strategies and time management techniques are crucial to your success. This exam is comprehensive and requires a thorough understanding of various life insurance concepts, regulations, and practices specific to the state of Florida. Here are some tips to help you excel in your preparation:

Create a Study Plan: Start by making a structured study plan that covers all the relevant topics. Break down the syllabus into manageable sections and allocate specific time slots for each. For instance, you could dedicate a week to understanding the different types of life insurance policies, followed by a week on regulatory requirements, and so on. A well-organized plan ensures you don't cram and helps you stay focused.

Utilize a Variety of Study Resources: Gather a range of resources to cater to different learning styles. Textbooks, online tutorials, practice questions, and study guides can all be valuable tools. For example, use textbooks to gain a deep understanding of the subject matter, online resources for quick reference and clarification, and practice questions to reinforce your learning. Diversifying your resources will make your study journey more engaging and effective.

Practice Time Management: The exam likely has a strict time limit, so practicing time management is essential. Simulate exam conditions by setting timers for each section of your study material. This practice will help you stay within the allocated time for each topic and improve your ability to prioritize tasks. Additionally, learn to recognize and minimize distractions to maintain focus during study sessions.

Active Learning Techniques: Engage with the material actively to enhance your understanding and retention. Instead of passively reading, try explaining concepts aloud as if teaching someone, or create flashcards to summarize key points. Active learning improves memory and makes studying more enjoyable. You can also discuss topics with peers or form study groups to gain different perspectives and clarify doubts.

Regular Review and Assessment: Implement a regular review process to reinforce your memory and identify areas that need improvement. Spaced repetition is a powerful technique where you review material at increasing intervals. Assess your progress through practice tests or quizzes, and analyze your performance to pinpoint weak areas. This iterative process ensures you're not just memorizing but truly comprehending the material.

Life Insurance Exam: California's Question Quota

You may want to see also

Frequently asked questions

The passing score for the Florida Life Insurance Exam is 70 out of 100. This is the minimum score required to demonstrate a candidate's knowledge and understanding of the subject matter and to obtain a license to sell life insurance in the state of Florida.

Yes, the Florida Life Insurance Exam has a time limit of 2 hours (120 minutes). Test-takers are expected to complete the exam within this timeframe.

The exam is scored using a raw score, which is the number of correct answers. The raw score is then converted to a scaled score, which is a percentage. The scaled score is used to determine the passing status.

Yes, the Florida Department of Financial Services provides accommodations for test-takers with disabilities. These accommodations may include extended time, a quiet testing environment, or other reasonable adjustments. Test-takers should contact the department to request accommodations and provide the necessary documentation.