Life insurance can provide financial security and support to a surviving spouse in the event of their partner's death. While most life insurance payouts are tax-free, there are certain circumstances where the beneficiary may have to pay taxes. This paragraph aims to explore the tax implications of spousal life insurance and provide an overview of when a beneficiary may be required to pay taxes on the proceeds.

| Characteristics | Values |

|---|---|

| Are life insurance proceeds taxable? | In most cases, life insurance proceeds are not taxable. |

| Are there any exceptions? | Yes, if the proceeds are paid out in installments and the remaining portion earns interest, that interest is taxable. |

| Are there other circumstances where a beneficiary may have to pay taxes? | If the money is paid to the insured's estate rather than a particular beneficiary, it could be taxable. If the owner and the insured are different, the payout to the beneficiary could be considered a taxable gift. |

| What are some tips to avoid paying taxes on a life insurance payout? | Transfer policy ownership, create an irrevocable life insurance trust (ILIT), be aware of gift tax limits. |

What You'll Learn

Are there different types of spousal life insurance?

Yes, there are different types of spousal life insurance. The most common way for spouses to obtain life insurance protection is to purchase individually-underwritten policies. While it is common for both spouses to be insured, it is not always necessary. Here are some of the different types of spousal life insurance:

- Term life insurance: This type of insurance covers a specific period, such as 10, 20, or 30 years. It offers a death benefit if the insured person dies within the term. This type of policy can be suitable for spousal protection during specific periods, such as when children are young or when there are outstanding debts.

- Whole life insurance: Whole life insurance provides lifelong coverage and accumulates cash value over time. It offers a death benefit to the surviving beneficiaries whenever the insured person passes away. This type of insurance provides long-term spousal protection and financial stability.

- Universal life insurance: Universal life insurance is a flexible policy that combines a death benefit with a savings component. It allows policyholders to adjust premium payments and death benefits over time. This type of insurance can be used for spousal protection while providing potential cash value growth.

- Group life insurance through an employer: Employers often offer group life insurance as a benefit to their employees. The coverage amount is typically based on the individual's salary or a predetermined fixed amount. Group life insurance policies are generally more affordable and easier to obtain than individual or joint life insurance policies.

- Spousal rider: This is an additional provision to a life insurance policy that extends coverage to the spouse of the primary policyholder. The spouse rider allows the spouse to be included under the same policy, usually with a separate coverage amount. This provides a convenient and cost-effective way to ensure spousal protection within a single policy.

- Joint life insurance: This type of insurance covers two people, usually spouses, under one policy. Joint life insurance can be beneficial in rare circumstances, such as when a couple shares a significant amount of assets or when one spouse wouldn't be eligible for individual insurance due to health or age reasons.

Each type of spousal life insurance has its own advantages and disadvantages, and the best option for a couple will depend on their unique circumstances and financial goals. It is important for spouses to carefully consider their needs and consult with a financial advisor or insurance professional to determine the most suitable type of life insurance for their situation.

Life Insurance for NFL Players: What's the Deal?

You may want to see also

When is spousal life insurance taxable?

Spousal life insurance payouts are generally not taxable. However, there are certain scenarios where spousal life insurance proceeds can be taxed.

Spousal life insurance proceeds are generally not taxable, and the beneficiary does not have to report the payout on their taxes. However, there are a few exceptions where the money may be taxable:

- The beneficiary receives interest: If the beneficiary receives interest on the payout, that interest is taxable. For example, if the beneficiary chooses to receive their payout as an annuity (a series of payments over several years) instead of a lump sum, any interest accrued by the annuity account may be subject to taxes.

- The money is paid to an estate: If the money is paid to the insured's estate instead of a specific beneficiary, it may be taxable. In 2024, estates over $13.61 million owe estate tax.

- The owner and the insured are different: If the owner of the policy is not the same as the insured, the payout to the beneficiary could be considered a taxable gift.

Tips to avoid paying taxes on a spousal life insurance payout

If you are concerned about taxes on a spousal life insurance policy, there are a few things you can do:

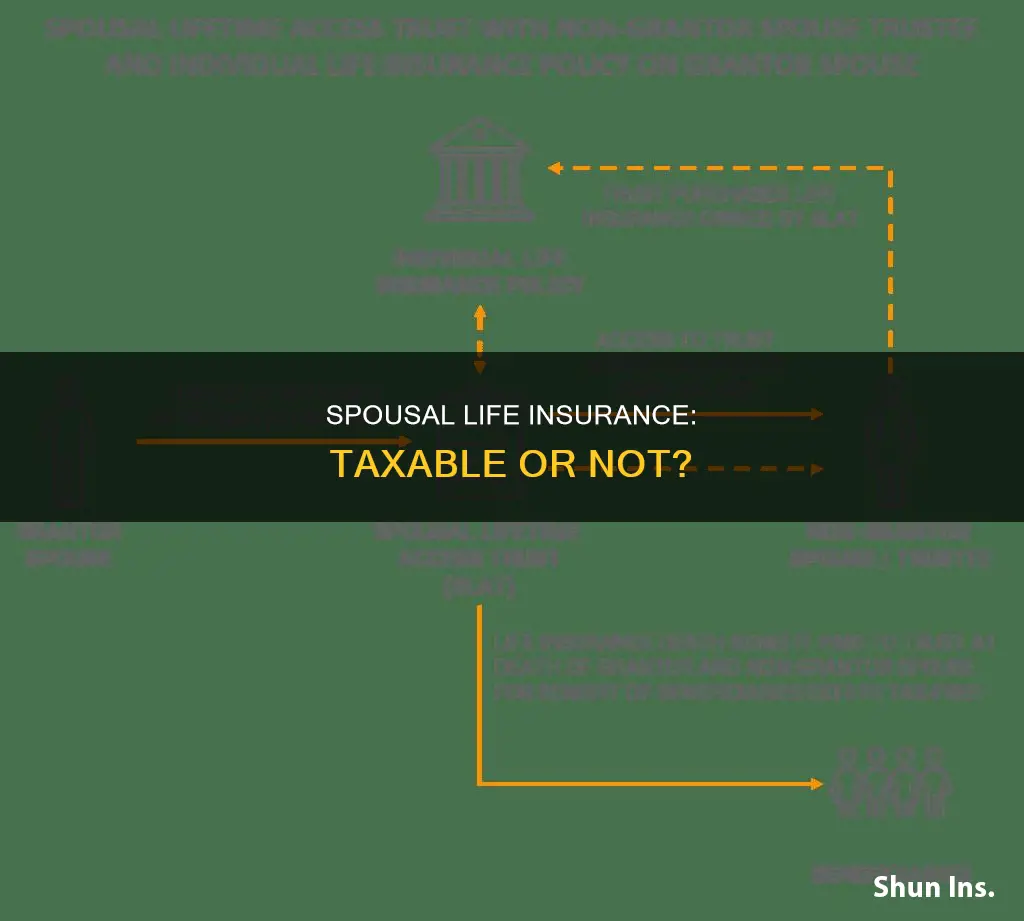

- Transfer policy ownership: You may consider transferring ownership of the policy. However, note that any value beyond what was paid for the policy will be regarded as taxable. Additionally, if you transfer it within three years of your death, the IRS will treat it as if it still belongs to you.

- Create an irrevocable life insurance trust (ILIT): You can transfer ownership of the policy from yourself to an ILIT, removing it from your estate. However, this type of trust cannot be revoked after it is set up.

- Be aware of gift tax limits: The annual gift tax exemption and lifetime exclusion amount can help you avoid taxation if you ensure your policy's cash value does not exceed these limits.

Life Insurance for Seniors: Permanent Options Available?

You may want to see also

When is spousal life insurance not taxable?

Spousal life insurance is generally not taxable. However, there are specific scenarios where you may have to pay federal or state taxes on the payout. Here are the instances where spousal life insurance is not taxable:

- Lump-sum payout: In most cases, the beneficiary of a spousal life insurance policy receives the death benefit as a lump sum, which is typically not considered taxable income.

- No interest accrued: If the spousal life insurance policy is paid out in a lump sum and does not accrue any interest, it is not taxable.

- Paid to an individual or entity: When the spousal life insurance payout is made to a designated beneficiary, such as a spouse, child, or parent, it is generally not taxable.

- Policy owner and insured are the same: If the owner of the spousal life insurance policy is the same as the insured person, the payout to the beneficiary is usually not considered a taxable gift.

It is important to note that while spousal life insurance is generally not taxable, there may be other factors to consider, such as the type of policy, the size of the estate, and how the benefit is paid out. Consulting a tax advisor or a financial professional is always recommended to understand the tax implications of your specific situation.

Should You Tell Life Insurance About Quitting Tobacco?

You may want to see also

How does spousal life insurance work?

Spouse life insurance is a way to ensure that if either spouse or partner dies unexpectedly, the surviving spouse or beneficiaries are less likely to be burdened by financially devastating costs. Spouse life insurance is more of a category than a specific type of insurance, and it can be purchased by one partner to cover the other.

There are two basic policy types: term insurance and permanent insurance. There are also separate and joint life insurance policies.

Separate life insurance policies

Each spouse takes out an individual policy. Typically, the owner and insured are the same person, and they name their spouse as the beneficiary. In the event of one spouse's death, the death benefit is paid out to the surviving spouse. The advantage of separate life insurance policies is that each spouse has their own coverage and they're able to maintain control of that policy regardless of life circumstance. This is a good option for couples who have different life insurance needs, which is common.

Joint life insurance policy

Joint life insurance policies, also known as survivorship life insurance or second-to-die life insurance, cover two people under one policy. In other words, both spouses own the policy and are insured under the same policy. The death benefit is only paid out when both spouses have passed away. This type of policy is often used to cover expenses, such as final arrangements, mortgage payments or any outstanding debts. The cost of a joint life insurance policy varies since the premiums depend on factors like the age and health of both parties.

Group life insurance

It's common for full-time employees to receive employer-sponsored life insurance as part of their benefits package. This involves minimal to no underwriting, and costs can be low. These packages typically offer options to add coverage for spouses or domestic partners for minimal to no cost. Because these policies are usually limited, they're best used to supplement a privately owned life insurance policy.

Spousal rider

Some private insurance policies offer riders that provide protection for your spouse. These also come with limitations, but some offer a spouse the ability to convert the rider into their own independent policy at some point in the future. A spousal rider is an additional provision to a life insurance policy that extends coverage to the spouse of the primary policyholder. This rider allows the spouse to be included under the same policy, typically with a separate coverage amount. By adding a spousal rider, the primary policyholder can provide life insurance protection to their spouse without needing a separate policy. In the event of the spouse's death, the rider provides a death benefit to the primary policyholder. Spousal riders are often available for various types of life insurance policies, such as term life insurance or whole life insurance, and they provide a convenient and cost-effective way to ensure spousal protection within a single policy.

Life Insurance for Felons: Is It Possible?

You may want to see also

Where can I purchase spousal life insurance?

Spousal life insurance is an important consideration for couples, providing financial protection and peace of mind. If you're thinking about purchasing a spousal life insurance policy, there are several channels through which you can typically do so. Here are some options:

Through the Workplace

If your employee benefits package includes life insurance, you may have the option to purchase spousal life insurance directly through your workplace. Employer-sponsored group plans are often more affordable than privately purchased individual plans, although they may offer less flexibility in terms of coverage options.

From a Private Company

You can purchase spousal coverage directly from a life insurance company. Many insurers now provide simple ways to buy policies online or over the phone. This option may be particularly attractive if you already have multiple insurance policies with a single provider, as bundling can often result in lower premiums.

Through an Insurance Broker or Agent

Insurance brokers and agents can assist you in shopping around and comparing carriers and plans to find a policy that suits your unique needs and budget. They can guide you in navigating the complex world of insurance and help you secure the best coverage for your situation.

As a Rider to Your Life Insurance Policy

If you're purchasing individual life insurance for yourself, some plans allow you to include a rider that provides spousal coverage. This spousal insurance rider is typically added when you purchase the base policy and expires when the base policy expires. While the coverage may be lower than a standalone spousal policy, it is also less expensive.

When considering where to purchase spousal life insurance, it's important to weigh your options and seek guidance from professionals to ensure you make the most informed decision for your specific circumstances.

Understanding Your Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Life insurance payouts are generally not subject to income taxes or estate taxes. However, there are certain exceptions. For example, if the policy is paid out in installments and the remaining portion earns interest, that interest is taxable.

The money from a spousal life insurance policy may be taxable if it's paid to the insured's estate instead of an individual or entity. If the owner of the policy is not the same as the insured, the payout to the beneficiary could also be considered a taxable gift.

If you're concerned about taxes on a life insurance policy, you may be able to avoid them by transferring ownership of the policy or creating an irrevocable life insurance trust (ILIT).