Ten-year term life insurance is a type of temporary life insurance policy that provides coverage for a specific period, typically ten years. It is a cost-effective way to secure financial protection for a defined period, offering a fixed death benefit if the insured individual passes away during the term. This type of insurance is often chosen by individuals who want to cover specific financial obligations, such as a mortgage or children's education, and can be a valuable tool for those seeking short-term coverage without the long-term commitments of permanent life insurance.

What You'll Learn

- Definition: Ten-year term life insurance provides coverage for a specific, fixed period

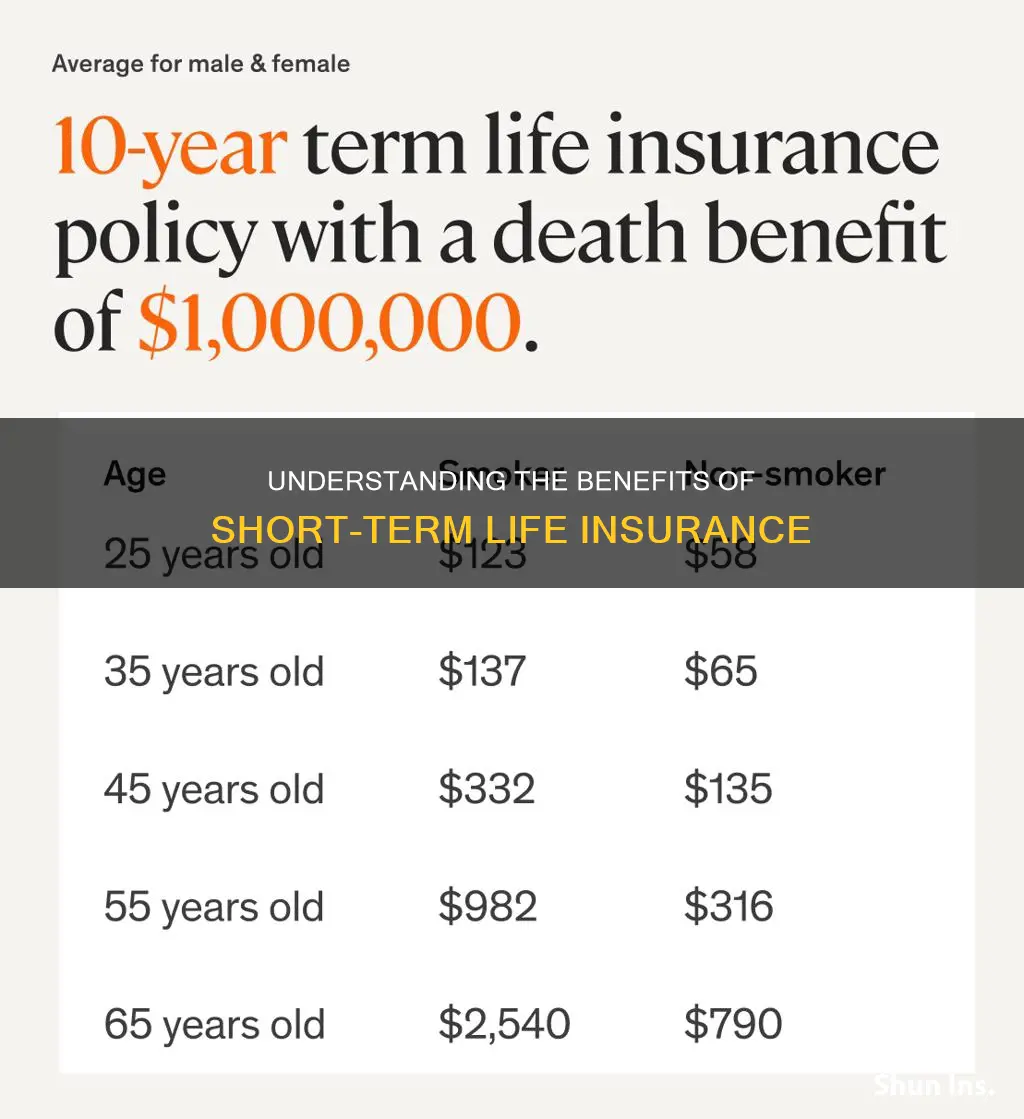

- Cost: Premiums are typically lower than long-term policies due to shorter duration

- Benefits: Offers financial protection for a defined period, e.g., mortgage repayment

- Flexibility: Can be renewed or converted to permanent coverage at the end of the term

- Risks: May not be suitable for those needing long-term coverage or with changing needs

Definition: Ten-year term life insurance provides coverage for a specific, fixed period

Ten-year term life insurance is a type of life insurance policy that offers coverage for a predetermined period, typically ten years. This insurance product is designed to provide financial protection and peace of mind during a specific timeframe, ensuring that your loved ones are cared for in the event of your untimely passing. It is a straightforward and cost-effective way to secure coverage for a defined period, making it an attractive option for individuals seeking temporary protection.

The key feature of this insurance is its fixed duration. When you purchase a ten-year term policy, you are guaranteed coverage for exactly ten years from the date of inception. This means that if you survive the entire term without making a claim, the policy expires, and no further payments are required. The simplicity of this structure allows for easy understanding and comparison, making it a popular choice for those seeking temporary coverage without the complexities of permanent life insurance.

During the ten-year period, the policyholder's beneficiaries will receive a death benefit if the insured individual passes away. This benefit can be used to cover various expenses, such as mortgage payments, children's education, or any other financial obligations that may arise. The coverage amount is typically determined by the policyholder, providing flexibility to tailor the policy to individual needs. Ten-year term life insurance is particularly appealing to those who want to protect their family during a specific life stage, such as when they have young children or significant financial commitments.

One of the advantages of this type of insurance is its affordability. Since the coverage is limited to a fixed period, the premiums are generally lower compared to long-term or permanent life insurance policies. This makes it accessible to a broader range of individuals who may not have qualified for more extensive coverage options. Additionally, if you outlive the term, you can choose to renew the policy or explore other insurance alternatives without the need for a medical examination, as the initial risk assessment has already been made.

In summary, ten-year term life insurance offers a concise and effective solution for individuals seeking temporary financial protection. Its fixed-term nature provides a clear understanding of coverage duration and costs, making it an excellent choice for those with specific short-term needs. By providing a safety net for a defined period, this insurance product ensures that your loved ones are cared for, even in the absence of the policyholder.

Term Life Insurance: Is It Costly?

You may want to see also

Cost: Premiums are typically lower than long-term policies due to shorter duration

Ten-year term life insurance is a type of temporary life insurance that provides coverage for a specific period, typically ten years. One of the key advantages of this policy is its cost-effectiveness compared to long-term life insurance. The lower premiums are primarily due to the shorter duration of coverage.

When considering life insurance, the term length is a critical factor that directly impacts the cost. Long-term policies, such as whole life or universal life, offer coverage for the entire lifetime of the insured individual, often until age 100 or beyond. These policies accumulate cash value over time, which can be borrowed against or withdrawn, providing financial flexibility. However, the extended coverage period results in higher premiums to account for the longer-term risk.

In contrast, ten-year term life insurance focuses on providing coverage for a specific, defined period. During this term, the insurance company guarantees a death benefit if the insured individual passes away. The shorter duration reduces the overall risk for the insurer, as they only need to provide benefits for a limited time. This reduced risk translates to lower premiums for the policyholder, making it an affordable option for those seeking temporary coverage.

The lower cost of ten-year term life insurance is particularly beneficial for individuals who want coverage for a specific financial commitment or goal. For example, it can be an excellent choice for covering mortgage payments, providing a safety net for families, or funding a child's education. By opting for a shorter term, individuals can secure the necessary financial protection without the long-term financial burden associated with more extensive coverage.

In summary, the shorter duration of ten-year term life insurance results in lower premiums, making it an attractive and cost-efficient option for those seeking temporary coverage. This type of policy allows individuals to address specific financial needs without the higher costs typically associated with long-term life insurance.

Changing Life Insurance Beneficiaries: A Guide for Bankers

You may want to see also

Benefits: Offers financial protection for a defined period, e.g., mortgage repayment

Ten-year term life insurance is a type of coverage that provides a specific level of financial protection for a predetermined period, typically ten years. It is designed to offer a safety net for individuals and their families during a critical time, such as when a mortgage is being repaid. This insurance policy is a straightforward and cost-effective way to ensure that your loved ones are financially secure if something happens to you within the specified term.

One of the key benefits of this insurance is its ability to provide financial protection during a defined period. For those with a mortgage, this can be a crucial aspect of financial planning. If the insured individual passes away within the ten-year term, the policy will pay out a lump sum or regular payments to cover the remaining mortgage balance. This ensures that the financial burden of the mortgage does not fall solely on the surviving family members, providing peace of mind and financial security.

The defined period of coverage is a significant advantage, especially for those who want to protect their families during a specific financial commitment. For instance, if you are in the process of repaying a mortgage, taking out a ten-year term life insurance policy can safeguard your family's financial future. In the event of your untimely death, the insurance payout will directly address the mortgage, preventing any potential negative consequences for your loved ones, such as foreclosure or the need to take on additional debt.

This type of insurance is particularly appealing due to its simplicity and affordability. It is a pure risk transfer, meaning it provides coverage for a specific period without any investment or savings components. The premiums are typically lower compared to permanent life insurance, making it an accessible option for individuals who want to protect their families without a long-term financial commitment.

In summary, ten-year term life insurance offers a tailored solution for those seeking financial protection during a specific period, such as mortgage repayment. It provides a safety net, ensuring that your family's financial stability is not compromised in the event of your passing. With its straightforward nature and affordable premiums, this insurance policy is an excellent choice for individuals who want to protect their loved ones without the complexities of longer-term coverage.

Understanding Life Insurance: Adult Children's Inclusion and Automatic Listing

You may want to see also

Flexibility: Can be renewed or converted to permanent coverage at the end of the term

Ten-year term life insurance offers a unique and flexible approach to life coverage, providing individuals with a tailored solution for their specific needs. This type of policy is designed to offer a defined period of protection, typically lasting ten years, during which the insured individual is covered for a predetermined amount of life insurance. One of the key advantages of this flexibility is the option to renew the policy at the end of the term. This renewal process allows policyholders to extend their coverage without the need for a new application, ensuring continued protection for their loved ones. By renewing, individuals can maintain the same level of coverage they had during the initial term, providing a sense of security and continuity.

The ability to renew is particularly beneficial for those who may have changing circumstances or evolving financial goals. For instance, a young professional starting a family might initially purchase a ten-year term policy to cover any potential financial burdens that may arise. As their career progresses and financial situation improves, they can renew the policy, increasing the coverage amount to better reflect their current financial responsibilities. This flexibility ensures that the insurance policy adapts to the individual's life changes, providing a dynamic and personalized approach to insurance.

Furthermore, ten-year term life insurance also offers the option to convert the policy to permanent coverage at the end of the term. This conversion feature is advantageous for those who may not initially qualify for permanent life insurance due to age or health factors. By converting the term policy, individuals can transition to a permanent life insurance plan, such as whole life or universal life, which provides lifelong coverage. This conversion option ensures that individuals can secure long-term protection without the need to reapply for a new policy, making it an attractive choice for those seeking a seamless transition to permanent coverage.

When considering the flexibility of ten-year term life insurance, it is essential to understand the potential benefits for various life stages. For example, young adults starting their careers might find this policy appealing as it provides a temporary safety net while they establish their financial stability. As they progress in their careers and start families, the renewal option allows them to adjust the coverage accordingly. Additionally, older individuals who may have already built a substantial financial foundation could benefit from the conversion feature, ensuring their loved ones are protected even in their later years.

In summary, ten-year term life insurance provides a flexible and adaptable solution for individuals seeking temporary life coverage with the option to renew or convert to permanent protection. This type of policy empowers individuals to make informed decisions about their insurance needs, ensuring they can adapt to life's changes while providing financial security for their families. Understanding the flexibility offered by this insurance product is crucial for making the right choice in life coverage.

Creating an Insurance Safety Net: Accounting for Freedom

You may want to see also

Risks: May not be suitable for those needing long-term coverage or with changing needs

Ten-year term life insurance is a type of coverage that provides a fixed amount of protection for a specific period, typically ten years. It is a straightforward and affordable way to secure financial protection for a defined period, making it an attractive option for individuals who want temporary coverage for a particular goal or responsibility. For instance, someone might choose a ten-year term policy to cover the cost of their child's education or to secure a mortgage payment for a set period.

However, this type of insurance may not be the best fit for everyone, especially those who require long-term financial security or have needs that could change over time. One of the primary risks associated with ten-year term life insurance is its temporary nature. As the name suggests, the policy is designed to last for a decade, and once the term ends, the coverage automatically expires unless the policyholder renews it. This could be a significant issue for individuals who need coverage for an extended period, such as those with long-term financial commitments or those who want to ensure their family's financial stability over a more extended duration.

For those with changing needs, the fixed nature of a ten-year term policy can also be a drawback. Life circumstances can evolve, and what was once a suitable level of coverage might no longer meet their requirements. For example, a young professional might initially take out a ten-year term policy to cover their mortgage payments, but as they progress in their career and their financial situation changes, they may require more comprehensive coverage. In such cases, switching to a different type of policy or increasing the coverage amount might be necessary, which could be more complex and costly.

Additionally, individuals with long-term financial goals, such as retirement planning or building an inheritance for their children, might find that a ten-year term policy does not align with their needs. The limited coverage period may not provide the necessary support for these long-term objectives, and they might need to explore other insurance options that offer more flexibility and extended coverage. It is essential to consider one's future plans and potential changes in circumstances when deciding on the appropriate insurance coverage.

In summary, while ten-year term life insurance offers a simple and cost-effective solution for temporary coverage, it may not be suitable for those seeking long-term financial protection or individuals with evolving needs. Understanding the limitations of this type of policy is crucial in making informed decisions about one's insurance coverage and ensuring that it aligns with personal financial goals and circumstances.

Maturity Amounts: Unlocking SBI Life Insurance Claims

You may want to see also

Frequently asked questions

Ten-year term life insurance is a type of temporary life insurance policy that provides coverage for a specific period, typically ten years. It is designed to offer financial protection during a defined period, often for specific commitments or goals, such as paying off a mortgage or covering children's education expenses.

Unlike permanent life insurance, which provides coverage for the entire life of the insured, ten-year term life insurance is a short-term policy. It offers a fixed death benefit if the insured person passes away during the term, but it does not accumulate cash value or have an investment component. This makes it more affordable and suitable for specific needs that are expected to last only a decade.

Ten-year term life insurance can be advantageous for several reasons. Firstly, it provides coverage during a critical period when financial obligations are often at their highest. Secondly, it is generally more affordable than permanent life insurance because it doesn't build cash value. This policy is ideal for those who want coverage for a specific goal or commitment without the long-term financial commitment of permanent insurance.

Yes, many insurance companies offer the option to convert a ten-year term policy to a permanent life insurance policy, such as whole life or universal life, before the term ends. This conversion allows you to continue the coverage beyond the initial ten years and potentially build cash value over time. However, the conversion process may vary, and it's essential to review the terms and conditions of your policy to understand the conversion options and any associated costs.