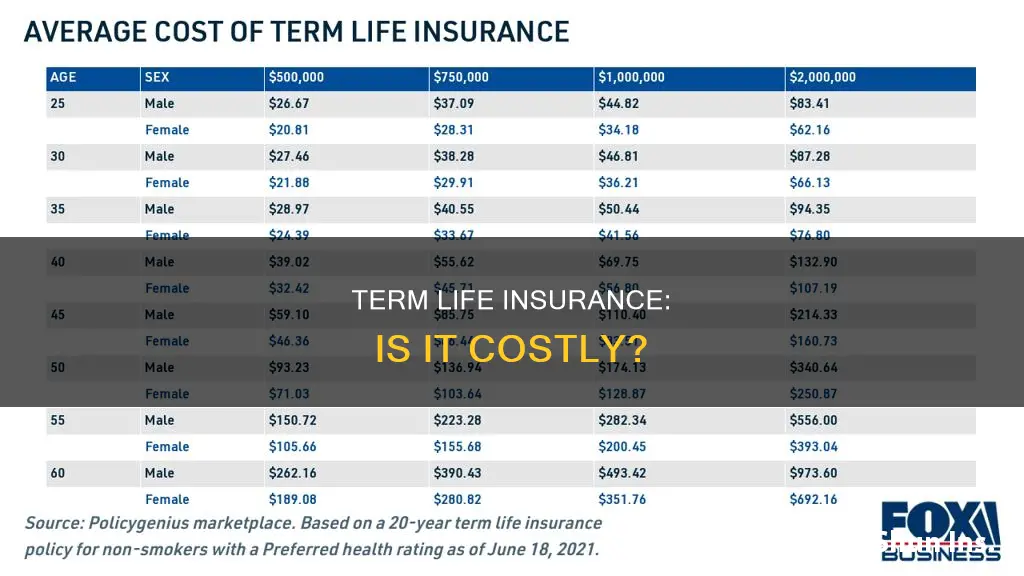

Term life insurance is a type of insurance that provides coverage for a set number of years and typically does not build cash value. The cost of term life insurance can vary depending on several factors, including age, gender, health status, lifestyle choices, and the amount of coverage. On average, a 20-year term life insurance policy with a $500,000 payout can cost around $26 to $50 per month for a healthy 40-year-old individual. However, rates can be significantly higher for older individuals, with a 65-year-old paying about $593 per month for a similar policy. Additionally, men tend to pay more than women due to their shorter life expectancy, and smokers can expect to pay higher premiums as well.

| Characteristics | Values |

|---|---|

| Average cost of life insurance | $26 a month |

| Average cost of term life insurance | $50 a month for a 40-year-old with $500,000 in coverage |

| Average cost of life insurance without a medical exam | $147 per month for a term life insurance policy lasting 20 years and providing a death benefit of $500,000 |

| Average cost of term life insurance by age | $31 per month at age 25 |

| Average cost of term life insurance by age | $593 per month at age 65 |

| Average cost of whole life insurance by age | $16 a month for a 40-year-old female |

| Average cost of universal life insurance by age | $19 a month for a 40-year-old male |

| Average cost of term life insurance by risk class | $26.15 per month for a 30-year-old non-smoker preferred applicant |

| Average cost of term life insurance by term length | $29.32 a month for a 30-year-old non-smoking male |

| Average cost of term life insurance by term length | $22.99 a month for a 30-year-old non-smoking female |

| Average cost of term life insurance for smokers | $82.64 a month for $500,000 in coverage |

| Average cost of whole life insurance | $197 a year for a 40-year-old female |

| Average cost of universal life insurance | $227 a year for a 40-year-old male |

What You'll Learn

How much does term life insurance cost per month?

The cost of term life insurance per month depends on several factors, including age, gender, health, lifestyle, the type and length of the policy, and the amount of coverage.

Age

Age is one of the most significant factors in determining the cost of term life insurance. The younger you are, the lower your premiums will be. This is because the likelihood of the insurance company having to pay out a claim increases as you get older. The difference in premiums can be significant, with a 6% increase in premiums between the ages of 25 and 30, but an 86% increase between the ages of 60 and 65.

Gender

Gender also plays a role in determining term life insurance costs, with men typically paying more than women. This is because women tend to have a longer life expectancy than men.

Health

Your health is another critical factor in calculating term life insurance costs. The better your health, the lower your premiums will be. This includes factors such as pre-existing conditions, blood pressure, cholesterol levels, height, and weight.

Lifestyle

Your lifestyle choices can also impact your term life insurance costs. For example, if you smoke or drink alcohol regularly, you may pay higher premiums. Additionally, participating in high-risk activities such as skydiving can increase your premiums due to the increased risk of death associated with these activities.

Type and Length of Policy

The type and length of the term life insurance policy you choose will also affect the cost. Term life insurance is generally cheaper than permanent life insurance, and the longer the term, the higher the premiums will be.

Amount of Coverage

The amount of coverage you choose will also impact the cost of term life insurance. The higher the death benefit, the more you will have to pay in premiums.

Average Costs

According to various sources, the average cost of term life insurance per month can range from $12 to $50, depending on the age and gender of the insured. For example, a 40-year-old male with $500,000 in coverage can expect to pay around $50 per month, while a 30-year-old female with the same coverage may pay around $12 to $14 per month.

Life Insurance: Haram's Financial Risk and Uncertainty

You may want to see also

How does age affect the cost of term life insurance?

Age is one of the most important factors in determining the cost of term life insurance. As a rule, the older you are, the more you will pay for insurance. This is because the cost of life insurance is based on actuarial life tables that assign a likelihood of dying while the policy is in force. The older you are, the more likely you are to pass away while under coverage.

The premium amount typically increases by about 8% to 10% for every year of age. This can be as low as 5% annually in your 40s, and as high as 12% annually if you're over 50. For example, a 45-year-old male will pay on average $1,125 for a new, 20-year term policy with $1,000,000 of coverage. The same policy purchased at age 46 will cost $1,225, and $1,345 a year if purchased at age 47.

The increase in the premium amount with age is due to simple math: every birthday puts you one year closer to your life expectancy, and thus, you are more expensive to insure.

In addition to age, other factors that can influence term life insurance rates include medical history, gender, coverage goals, and harmful habits such as smoking.

Personal Health History: Impacting Your Life Insurance Premiums

You may want to see also

How does gender affect the cost of term life insurance?

The cost of term life insurance is influenced by several factors, including age, health, lifestyle, and gender. While gender may not be the primary determinant of insurance rates, it does play a significant role in how much one pays for their policy. Here's how gender affects the cost of term life insurance:

Life Expectancy and Risk Assessment

Actuarial tables, which insurers use to assess insurance risk, show that men, on average, have shorter life expectancies than women. According to the Centers for Disease Control and Prevention, life expectancy in the US is 79.3 years for women and 73.5 years for men. This difference in life expectancy directly impacts insurance rates, as the likelihood of an insurer having to pay out a death benefit increases with shorter life spans.

Health Risks

Gender-specific health risks also influence insurance rates. Men are statistically at higher risk of an early heart attack, with the average age for a first heart attack being 65 for men and 72 for women. Additionally, men are more likely to develop certain cancers, such as prostate or testicular cancer. These gender-specific health risks contribute to higher insurance rates for men.

Premium Differences

On average, men pay higher premiums than women for term life insurance. Women often pay around 23% to 24% less for their policies due to their longer life expectancy. However, it's important to note that other factors, such as age, health history, and lifestyle choices, also significantly impact insurance rates and may outweigh the influence of gender.

Shopping for Insurance

While gender does affect insurance rates, shopping around for quotes from multiple insurers can help mitigate some of the differences caused by gender. Comparing policies from different companies can help individuals find the best coverage at the most affordable price, regardless of their gender.

Term Life Insurance: Can It Outlast 30 Years?

You may want to see also

How does health affect the cost of term life insurance?

The cost of term life insurance is determined by several factors, including age, gender, health, lifestyle, the type and length of the policy, and the amount of coverage. Generally, younger and healthier individuals pay lower rates. Here's how health affects the cost of term life insurance:

Health Classification

Insurers typically classify applicants as super preferred, preferred, or standard, with super preferred being the healthiest category. The healthier you are, the lower your premiums will be. A medical exam is often required to determine your health classification, and factors such as blood pressure, smoking status, and cholesterol levels are considered.

Chronic Health Issues

If you have chronic health issues that increase your risk of mortality, you will likely pay higher premiums. Life insurance companies assess your risk of mortality and adjust rates accordingly.

Lifestyle Choices

Your lifestyle choices can also impact your health classification and, consequently, your premiums. For example, if you drink alcohol regularly or participate in high-risk activities like skydiving, your rates may increase due to the increased risk of death associated with these activities.

Family Medical History

Insurers will also consider your family medical history. If you have a family history of serious health conditions like heart disease, cancer, or diabetes, it may increase your premiums as it indicates a higher risk of developing these conditions yourself.

Smoking Status

Smoking significantly impacts the cost of term life insurance. Smokers pay substantially higher premiums than non-smokers due to the increased health risks associated with tobacco use. However, quitting smoking can help lower your premiums over time.

In summary, the cost of term life insurance is strongly influenced by your health and lifestyle choices. Insurers assess your overall health, including any pre-existing conditions, to determine your risk of mortality and set your premiums accordingly. Maintaining a healthy lifestyle and managing any medical conditions can help keep your term life insurance costs lower.

Farm Insurance: Whole Life Coverage Options and Benefits

You may want to see also

How does lifestyle affect the cost of term life insurance?

A person's lifestyle can have a significant impact on the cost of their term life insurance. Here are some key ways in which lifestyle choices can affect insurance premiums:

- Smoking status: Smokers often pay higher premiums than non-smokers due to the increased risk of developing health issues associated with smoking. This includes the use of e-cigarettes, which most insurers view similarly to smoking.

- Alcohol consumption: Regular alcohol consumption can increase the cost of life insurance.

- High-risk activities: Participating in dangerous activities such as skydiving or racing cars can lead to higher premiums due to the increased risk of injury or death.

- Driving record: A history of DUIs, DWIs, or major traffic violations can result in higher rates, as it indicates a higher risk to the insurer.

- Occupation: Certain occupations, such as police officers or race car drivers, are considered hazardous or high-risk, which can lead to increased premiums.

- Criminal history: A criminal record, including arrests, convictions, or DUIs, may affect your rate or even disqualify you from coverage.

It's important to note that being honest about your lifestyle choices when applying for insurance is crucial. Misrepresenting or failing to disclose relevant information may result in higher premiums, policy cancellation, or denial of a claim.

Term Life Insurance: Understanding Level Death Benefit

You may want to see also

Frequently asked questions

Term life insurance costs $26 per month or $305 per year on average. However, the cost varies based on age, gender, health, and lifestyle choices.

The average cost of a 20-year term life insurance policy for a 40-year-old with $500,000 in coverage is $50 per month.

Term life insurance is the cheapest option and costs significantly less than whole life insurance.

Smokers typically pay premiums that are 218% higher than non-smokers.

On average, men pay 23% more for term life insurance than women due to their shorter life expectancy.