Life insurance is a crucial financial tool that provides a safety net for individuals and their families. It offers peace of mind by ensuring that loved ones are protected financially in the event of the insured's death. With various types of life insurance policies available, such as term life, whole life, and universal life, individuals can choose the coverage that best suits their needs and budget. Understanding the importance of life insurance is essential for anyone looking to secure their family's future and provide financial stability during challenging times.

What You'll Learn

- Financial Security: Protects loved ones financially in the event of your death

- Peace of Mind: Provides reassurance and reduces stress about the future

- Debt Management: Helps pay off debts and mortgages, preventing financial strain

- Education Funding: Ensures children can access education and achieve their goals

- Legacy Planning: Allows you to leave a financial legacy for future generations

Financial Security: Protects loved ones financially in the event of your death

Life insurance is a crucial financial tool that provides a safety net for your loved ones in the event of your untimely demise. It offers a sense of security and peace of mind, knowing that your family will be taken care of financially even when you're no longer around. The primary purpose of life insurance is to ensure that your loved ones are protected and provided for, especially during challenging times.

When you purchase a life insurance policy, you essentially make a commitment to your family. You agree to pay a premium, a regular amount of money, to an insurance company in exchange for a promise that a lump sum payment, known as a death benefit, will be paid out to your designated beneficiaries upon your passing. This death benefit can be a significant financial cushion, providing the means to cover various expenses and maintain the standard of living your family is accustomed to.

The financial security aspect of life insurance is particularly vital as it helps cover essential costs that your loved ones might otherwise struggle with. These costs can include mortgage payments, rent, utility bills, and other regular expenses. Additionally, the death benefit can be used to pay for educational expenses, especially if you have children who are still in school or planning to pursue higher education. It can also provide funds for funeral and burial expenses, ensuring that your final wishes are respected without placing a financial burden on your family.

Furthermore, life insurance can be a powerful tool to ensure that your family's long-term financial goals are met. It can provide the necessary funds to pay off any outstanding debts, such as personal loans or credit card debt, preventing your loved ones from incurring additional financial strain. The policy can also be used to build a legacy, such as funding a trust or a charitable foundation, which can benefit your family for generations to come.

In summary, life insurance is an essential safeguard that offers financial security and peace of mind. It ensures that your loved ones are protected and provided for, even in your absence. By making a relatively small investment in the form of regular premiums, you can secure a substantial financial safety net, allowing your family to maintain their lifestyle, achieve their goals, and build a secure future.

Unum Whole Life Insurance: A Comprehensive Overview

You may want to see also

Peace of Mind: Provides reassurance and reduces stress about the future

Life insurance is a powerful tool that offers a sense of security and peace of mind, allowing individuals to navigate life's uncertainties with confidence. It provides a safety net for the future, ensuring that loved ones are protected and financial goals are met, even in the event of an untimely passing. This financial product is designed to alleviate the stress and anxiety associated with the unknown, giving you the freedom to focus on the present and create a brighter future.

One of the primary benefits of life insurance is the reassurance it provides. Knowing that your family or beneficiaries will be financially secure in your absence can be incredibly comforting. It allows you to rest easy, knowing that your loved ones will have the necessary resources to maintain their standard of living, cover essential expenses, and achieve their financial aspirations. This peace of mind is invaluable, as it enables you to approach life with a sense of stability and confidence.

The stress associated with the future can be significantly reduced with life insurance. Without it, the uncertainty of what might happen can be overwhelming. Life's unpredictable nature means that unexpected events, such as accidents, illnesses, or natural disasters, can occur at any time. Having life insurance means you've taken a proactive step to protect your loved ones from the financial impact of such events. It ensures that your family can continue their lives without the added burden of financial worries, allowing them to focus on healing, adjusting, and moving forward.

Moreover, life insurance provides a sense of control and preparedness. It allows you to plan for the future, ensuring that your family's financial needs are met even if you're not around. You can choose the policy that best suits your circumstances, selecting coverage amounts and terms that align with your goals. This personalized approach empowers you to make decisions that provide the maximum benefit to your loved ones, offering a sense of security and control over an otherwise uncertain situation.

In summary, life insurance is a powerful tool for achieving peace of mind and reducing stress. It provides the reassurance that your loved ones will be taken care of, even in your absence. By offering financial protection and the ability to plan for the future, life insurance allows you to navigate life's challenges with confidence, knowing that you've made a wise investment in the well-being of your family. This sense of security is a valuable asset, enabling you to live each day with a clearer mind and a brighter outlook.

Haven Life: Insuring Innovation for the Reporter's Life

You may want to see also

Debt Management: Helps pay off debts and mortgages, preventing financial strain

Life insurance is a powerful financial tool that can provide a safety net and peace of mind, especially when it comes to managing debts and financial obligations. One of the primary reasons to consider life insurance is its ability to help with debt management, ensuring that your loved ones and your financial affairs remain secure even in the event of your passing.

When you have outstanding debts, such as a mortgage, car loans, or personal loans, life insurance can be a crucial component of your financial strategy. The death benefit from a life insurance policy can be used to settle these debts, preventing them from becoming a burden on your family. For instance, if you have a substantial mortgage, the insurance payout can be utilized to clear the remaining balance, ensuring that your family doesn't inherit a large debt. This is particularly important as it allows your loved ones to focus on grieving and adjusting to life without the added stress of financial liabilities.

The process is straightforward: upon your death, the life insurance company pays out the death benefit to the designated beneficiaries. This amount can then be used to pay off the debts, leaving your estate with a clear and debt-free status. By doing so, you are actively managing your financial affairs and providing a financial cushion for your family, which is a key aspect of responsible debt management.

Moreover, life insurance can also be a strategic tool for those with existing debts. It can provide the necessary funds to pay off these debts, preventing the need for your family to take on additional financial burdens. This is especially relevant for high-interest debts, as the interest can accumulate rapidly, making it even more challenging to manage. With life insurance, you can ensure that your debts are addressed, and your family's financial stability is maintained.

In summary, life insurance plays a vital role in debt management by offering a financial safety net. It enables individuals to pay off debts and mortgages, providing peace of mind and financial security for their loved ones. By incorporating life insurance into your financial plan, you can take control of your debts and ensure a more stable future for your family, even in the face of unexpected circumstances. This is a practical and thoughtful approach to managing financial obligations and a key reason why life insurance is an essential consideration for anyone looking to protect their loved ones and assets.

Choosing Term Life Insurance: A Guide for Indians

You may want to see also

Education Funding: Ensures children can access education and achieve their goals

Life insurance is a powerful tool that can provide financial security and peace of mind, especially when it comes to planning for the future of your children. One of the most important aspects of ensuring a child's success and well-being is education funding. By securing life insurance, you can create a financial safety net that will enable your children to access quality education and achieve their dreams.

Education is a fundamental right and a key to unlocking countless opportunities. It empowers individuals to develop their skills, gain knowledge, and build a brighter future. However, the cost of education, whether it's for primary school, college, or university, can be a significant financial burden. This is where life insurance steps in as a valuable asset. When you purchase a life insurance policy, you are essentially investing in your child's future. The proceeds from the policy can be used to cover various educational expenses, such as tuition fees, books, and living costs. This financial support can make a world of difference, ensuring that your child has the resources needed to pursue their academic goals without the added stress of financial constraints.

The benefits of education funding through life insurance are far-reaching. Firstly, it provides financial stability, allowing your child to focus on their studies and personal growth. With the financial burden reduced, they can make the most of their educational journey, exploring various subjects, engaging in extracurricular activities, and developing a well-rounded skill set. Moreover, education funding can open doors to a wide range of opportunities. It enables your child to consider different career paths, pursue higher education, or even start their own business. The financial security provided by life insurance gives them the freedom to make choices that align with their passions and aspirations.

In addition, life insurance can also cover other essential aspects of a child's life. For instance, the policy can provide financial assistance for unexpected medical expenses, ensuring that your child receives the best healthcare without financial worries. It can also offer support during challenging times, such as when a child needs to relocate for educational purposes or when they face financial difficulties post-education. By having this financial safety net, you can provide your child with the stability and confidence to navigate life's twists and turns.

In summary, life insurance is a crucial investment when it comes to education funding for your children. It ensures that they have the means to access quality education, pursue their passions, and build a secure future. With the financial security provided by life insurance, you are empowering your child to achieve their goals and unlock their full potential. It is a long-term strategy that not only benefits your child but also provides peace of mind, knowing that their future is protected.

Life Insurance and Child Support: New York's Complex Reality

You may want to see also

Legacy Planning: Allows you to leave a financial legacy for future generations

Legacy planning is an essential aspect of financial strategy that enables individuals to ensure their loved ones are taken care of and their wishes are honored after their passing. It involves creating a comprehensive plan to preserve and transfer wealth to future generations, providing financial security and peace of mind. This process is particularly significant for those who want to leave a lasting impact and support the long-term goals of their family.

When considering legacy planning, life insurance plays a pivotal role. It is a powerful tool that can significantly contribute to building a financial legacy. Here's how:

Wealth Preservation: Life insurance provides a means to preserve wealth that can be passed down through generations. By purchasing a suitable policy, individuals can ensure that their assets are protected and available for their intended beneficiaries. This is especially crucial for families with specific financial goals, such as funding a child's education or supporting a business succession plan. The death benefit from a life insurance policy can be used to cover various expenses, including estate taxes, which can otherwise deplete the estate's value.

Financial Security for Dependents: One of the primary reasons for legacy planning is to provide financial security for dependents, such as children or spouses. Life insurance can offer a steady income stream to cover living expenses, education costs, or even daily household expenses after the insured individual's passing. This financial support can ensure that the family's standard of living is maintained and that the dependents' needs are met, even in the absence of the primary breadwinner.

Charitable Giving and Philanthropy: Legacy planning also allows individuals to incorporate charitable intentions into their strategy. Through life insurance, one can designate a portion of the death benefit to charitable organizations or causes they care about. This enables the insured person to support their favorite charities and make a lasting impact on the community. By integrating philanthropy into legacy planning, individuals can leave a meaningful legacy that reflects their values and contributes to a better world.

Business Continuity: For business owners, life insurance can be a critical component of legacy planning. It can provide funds to continue business operations, buy out a partner's interest, or ensure the smooth transition of the business to the next generation. By incorporating life insurance into their estate plan, business owners can safeguard their enterprise and ensure its longevity, even if they are no longer physically present.

In summary, legacy planning is a comprehensive approach to safeguarding and transferring wealth, and life insurance is a valuable tool within this strategy. It offers a way to preserve assets, provide financial security, and fulfill charitable wishes, all while ensuring that future generations are taken care of according to the individual's desires. By incorporating life insurance into legacy planning, individuals can leave a lasting financial legacy that benefits their loved ones and aligns with their long-term goals.

Life Insurance: The Hidden Gem in Contracts

You may want to see also

Frequently asked questions

Life insurance provides financial protection and peace of mind by ensuring that your loved ones are taken care of in the event of your untimely death. It offers a safety net, allowing your family to cover essential expenses, such as mortgage payments, education costs, or daily living expenses, even when you're gone.

When you purchase a life insurance policy, you agree to pay a premium (a regular payment) to the insurance company. In return, the insurer promises to pay a death benefit (a lump sum amount) to your designated beneficiaries if you pass away during the policy's term. The death benefit can be used to fulfill various financial obligations and provide financial security to your family.

Life insurance is crucial for your family's financial well-being because it ensures that your loved ones won't face a sudden financial burden after your passing. It helps maintain their standard of living, covers funeral expenses, and provides the means to raise children or support other dependents. The policy's proceeds can also be used to pay off debts, ensuring your family's long-term financial stability.

Yes, it is possible to obtain life insurance with pre-existing health conditions, but the process might be more complex. Insurers may require a medical examination or ask for detailed health information to assess the risk. Some companies offer specialized policies for individuals with health issues, while others might provide coverage with certain exclusions or limitations. It's best to shop around and compare offers to find the most suitable option.

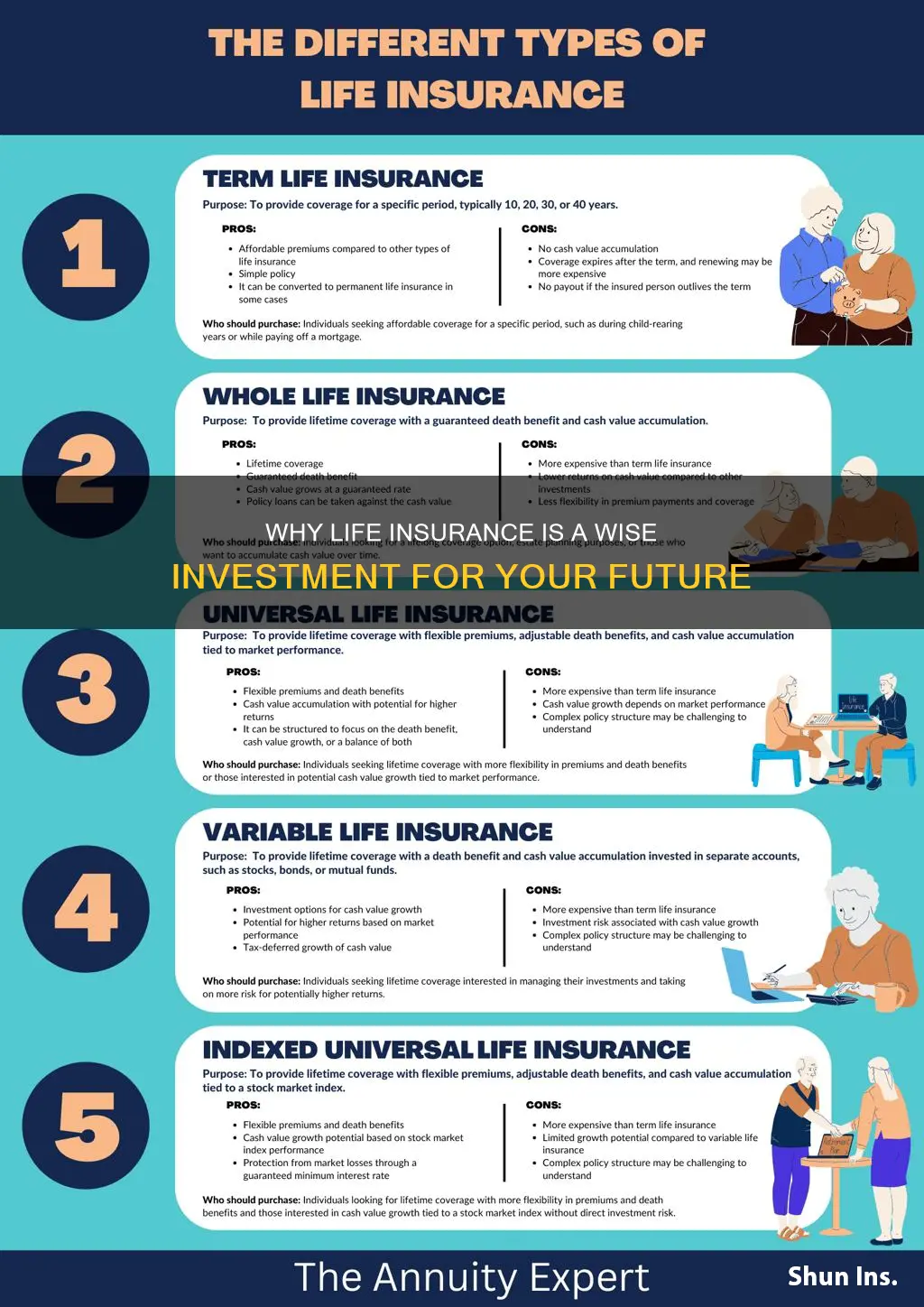

There are several types of life insurance policies to choose from, including:

- Term Life Insurance: Provides coverage for a specific period, offering a fixed death benefit if the insured dies during that term.

- Permanent Life Insurance: Offers lifelong coverage and includes a cash value component that can accumulate over time.

- Whole Life Insurance: A type of permanent life insurance with guaranteed death benefits and a fixed premium.

- Universal Life Insurance: Provides flexible coverage with adjustable premiums and death benefits, allowing policyholders to customize their policy.