Unum Whole Life Insurance is a comprehensive and permanent life insurance policy that offers both death benefit coverage and a guaranteed cash value accumulation. Unlike term life insurance, which provides coverage for a specified period, whole life insurance provides lifelong coverage, ensuring that your loved ones are financially protected even in the long term. This type of policy builds cash value over time, which can be borrowed against or withdrawn, providing financial flexibility and security. Unum Whole Life Insurance is designed to meet the needs of individuals and families seeking a reliable and enduring financial safety net.

What You'll Learn

- Definition: Unum Whole Life Insurance is a permanent policy offering lifelong coverage and fixed premiums

- Benefits: It provides guaranteed death benefit, cash value accumulation, and income riders

- Premiums: Premiums remain level throughout the insured's lifetime, ensuring predictable costs

- Flexibility: Policyholders can access cash value through loans or withdrawals, offering financial flexibility

- Longevity: Designed to provide financial security for the insured and beneficiaries over a long period

Definition: Unum Whole Life Insurance is a permanent policy offering lifelong coverage and fixed premiums

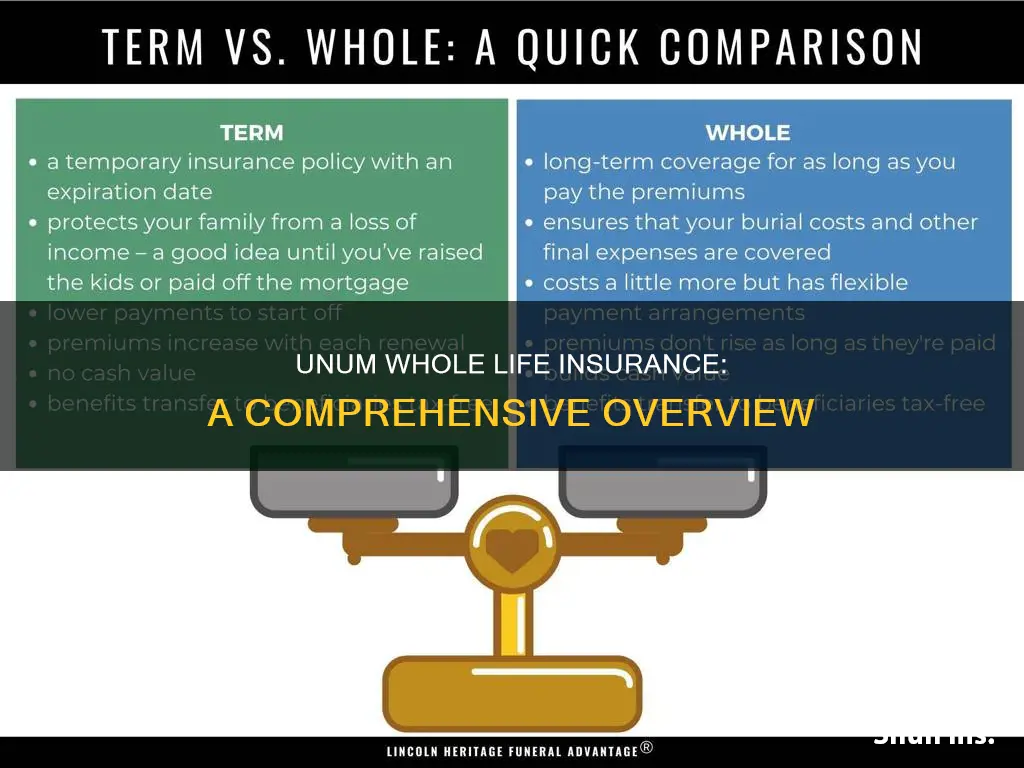

Unum Whole Life Insurance is a type of permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. This means that as long as the policyholder remains alive, the insurance company is obligated to pay out the death benefit to the designated beneficiaries. One of the key advantages of Unum Whole Life is its predictability and stability. Policyholders pay a fixed premium for the entire duration of the policy, ensuring that the cost of insurance remains consistent over time. This fixed-premium structure is particularly attractive to those seeking long-term financial security and planning for the future.

The policy offers lifelong coverage, which is a significant benefit for individuals and families. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force as long as the premiums are paid. This ensures that the insured individual's loved ones are protected financially, even in the event of the insured's passing, providing peace of mind and financial security.

In addition to lifelong coverage, Unum Whole Life Insurance also accumulates cash value over time. This means that a portion of the premium payments goes towards building a cash reserve, which can be borrowed against or withdrawn if needed. The cash value grows tax-deferred, providing a potential source of funds for various financial goals or emergencies. This feature allows policyholders to build equity within the policy, making it a valuable long-term financial asset.

Furthermore, whole life insurance policies typically have an investment component. The insurance company invests a portion of the premiums in various investment vehicles, such as stocks, bonds, or mutual funds. This investment aspect can potentially provide higher returns compared to traditional savings accounts, allowing the policy's value to grow faster over time. The investment performance is a critical factor in the overall success of the policy, and it is essential to review and understand the investment strategies employed by the insurance company.

In summary, Unum Whole Life Insurance is a permanent policy that offers lifelong coverage, fixed premiums, and the potential for cash value accumulation and investment growth. It provides a reliable and stable financial solution for individuals and families, ensuring long-term financial security and peace of mind. Understanding the features and benefits of whole life insurance is crucial for making informed decisions about one's financial protection and planning.

Understanding Life Insurance: Death Benefits Explained

You may want to see also

Benefits: It provides guaranteed death benefit, cash value accumulation, and income riders

Unum Whole Life Insurance offers a comprehensive range of benefits that provide financial security and flexibility for policyholders. One of its key advantages is the guaranteed death benefit, which ensures that the beneficiary receives a specified amount of money upon the insured's passing. This guarantee is a significant feature, offering peace of mind and financial protection for the policyholder's loved ones. The death benefit is typically tax-free and can be used to cover various expenses, such as funeral costs, outstanding debts, or everyday living expenses, ensuring that the family's financial obligations are met.

In addition to the death benefit, Unum Whole Life Insurance also allows for cash value accumulation. This means that a portion of the premiums paid by the policyholder is invested and grows over time. The cash value can be borrowed against or withdrawn, providing a source of funds that can be utilized for various purposes. This feature is particularly beneficial for long-term financial planning, as it allows individuals to build a substantial cash reserve that can be used for retirement, education, or other significant life goals.

The policy also offers income riders, which provide an additional layer of financial security. These riders allow policyholders to convert a portion of their death benefit into a guaranteed income stream. This income can be useful for retirement planning, as it provides a steady stream of cash flow that can be tailored to the individual's needs. Income riders offer flexibility, allowing policyholders to choose the amount and frequency of the income payments, ensuring that their financial needs are met during retirement.

Furthermore, the income riders can be particularly advantageous for those who want to ensure a consistent income for their spouse or partner. By converting a portion of the death benefit into an income stream, the policyholder can provide financial security for their loved one, even in the event of their passing. This feature is especially valuable for couples who want to ensure that their financial obligations are covered, regardless of life's uncertainties.

In summary, Unum Whole Life Insurance provides a robust set of benefits, including a guaranteed death benefit, cash value accumulation, and income riders. These features offer financial protection, flexibility, and the ability to build a substantial cash reserve. With these advantages, Unum Whole Life Insurance becomes a valuable tool for individuals seeking long-term financial security and the means to provide for their loved ones.

Life Insurance Agents: Continuing Education Hours Essential

You may want to see also

Premiums: Premiums remain level throughout the insured's lifetime, ensuring predictable costs

Unum Whole Life Insurance is a type of permanent life insurance that offers a unique and attractive feature: level premiums. This means that the cost of your insurance remains constant throughout your entire life, providing a sense of financial stability and predictability. Unlike term life insurance, where premiums increase over time, Unum Whole Life ensures that your monthly, quarterly, or annual payments stay the same, making it easier to budget and plan for the future.

The concept of level premiums is a significant advantage for policyholders. It allows individuals to secure their loved ones' financial future without the worry of increasing insurance costs. With traditional life insurance, beneficiaries might face higher premiums as the insured person ages, which can be a concern for those relying on the policy's financial support. However, with Unum Whole Life, the premium structure is designed to provide long-term financial security without the burden of rising costs.

This type of insurance is particularly beneficial for those who want to ensure their family's financial well-being over an extended period. By locking in premiums, policyholders can rest assured that their insurance coverage will remain affordable, even as their needs and circumstances change. This predictability is a powerful tool for financial planning, especially for those with long-term financial goals and obligations.

The level premium structure also simplifies the insurance process. Policyholders can easily calculate their future expenses without the complexity of adjusting premiums annually. This transparency and simplicity make Unum Whole Life Insurance an attractive option for individuals seeking a straightforward and reliable insurance solution.

In summary, Unum Whole Life Insurance's level premium structure is a key feature that sets it apart from other life insurance products. It provides policyholders with the peace of mind that their insurance costs will remain stable, ensuring that their financial plans and commitments are secure for the long term. This predictability is a valuable asset for anyone looking to protect their loved ones and maintain financial stability.

Canceling Gerber Life Insurance: A Step-by-Step Guide for Parents

You may want to see also

Flexibility: Policyholders can access cash value through loans or withdrawals, offering financial flexibility

Unum Whole Life Insurance offers a unique feature that provides policyholders with a level of financial flexibility rarely seen in traditional insurance products. This flexibility is derived from the concept of cash value accumulation within the policy. As the policyholder pays premiums, a portion of these payments goes towards building a cash reserve, which grows tax-deferred over time. This cash value can be a valuable asset, allowing policyholders to access funds when needed without sacrificing the long-term growth potential of their investment.

One of the key advantages of this flexibility is the ability to take out loans against the cash value. Policyholders can borrow money from their policy's cash reserve, providing a source of funds that can be used for various purposes. This could include financing major purchases, starting a business, or even covering unexpected expenses. The loan process is typically straightforward, with the borrowed amount repaid with interest, ensuring the policy's value remains intact.

In addition to loans, policyholders can also opt for withdrawals, which provide access to the accumulated cash value in a more immediate manner. Withdrawals allow individuals to take out a portion of the cash value as needed, providing a financial safety net during challenging times. This feature is particularly useful for those who may require quick access to funds, such as during a period of unemployment or when facing unexpected medical expenses.

The flexibility offered by Unum Whole Life Insurance is a significant benefit, especially for those who value financial control and the ability to adapt to changing circumstances. It provides a sense of security, knowing that the policy's cash value can be utilized to meet various financial goals and obligations. This level of flexibility is a powerful tool for policyholders, allowing them to make the most of their insurance investment while maintaining a high degree of financial autonomy.

Furthermore, the ability to access cash value through loans and withdrawals can be a strategic advantage for long-term financial planning. Policyholders can use these funds to invest in other opportunities, such as starting a business or investing in real estate, potentially growing their wealth over time. This strategic use of the policy's cash value can contribute to a more comprehensive financial strategy, ensuring that the policyholder's assets are utilized efficiently and effectively.

Life Insurance vs. Assurance: What's the Real Difference?

You may want to see also

Longevity: Designed to provide financial security for the insured and beneficiaries over a long period

Unum Whole Life Insurance is a type of permanent life insurance designed to offer financial security and peace of mind for both the insured individual and their beneficiaries over an extended period. This insurance product is structured to provide coverage for a lifetime, ensuring that the insured individual's loved ones are financially protected, even in the event of the insured's passing. The primary purpose of Unum Whole Life Insurance is to provide a reliable and consistent source of financial support, which can be crucial for various life events and long-term financial goals.

One of the key features of this insurance is its longevity aspect. Unlike term life insurance, which provides coverage for a specific period, Unum Whole Life Insurance offers coverage for the entire lifetime of the insured. This means that the policy remains in force as long as the insured individual pays the premiums, providing a sense of security that extends far into the future. The policy's longevity ensures that the beneficiaries receive the death benefit when the insured passes away, which can be a significant financial cushion during challenging times.

The financial security provided by Unum Whole Life Insurance is particularly valuable for several reasons. Firstly, it guarantees a fixed death benefit, which means the beneficiaries will receive a predetermined amount upon the insured's death. This can be essential for covering various expenses, such as mortgage payments, education costs, or even the daily living expenses of the beneficiaries. Secondly, the policy's cash value accumulation allows the insured to build a substantial amount of money over time, which can be borrowed against or withdrawn to meet financial needs. This feature provides flexibility and financial flexibility, allowing the insured to utilize the policy's value for various purposes.

Moreover, Unum Whole Life Insurance offers a sense of stability and predictability in an uncertain world. Knowing that one's loved ones are financially protected can provide immense comfort and peace of mind. This type of insurance is particularly beneficial for individuals who want to ensure their family's long-term financial well-being, especially in the face of unexpected events or life changes. The policy's longevity and financial security features make it a valuable tool for anyone seeking to protect their loved ones and achieve their financial goals.

In summary, Unum Whole Life Insurance is a comprehensive and long-term financial solution designed to provide stability and security. Its ability to offer coverage for a lifetime, along with the potential for cash value accumulation, makes it an attractive option for those seeking to protect their loved ones and build a financial safety net. By understanding the features and benefits of this insurance, individuals can make informed decisions about their financial future and the well-being of their beneficiaries.

Endometriosis and Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Unum Whole Life Insurance is a type of permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a combination of death benefit protection and a cash value component, which grows over time. This policy is designed to provide financial security and peace of mind to policyholders and their beneficiaries.

When you purchase a Unum Whole Life Insurance policy, you pay regular premiums to the insurance company. The policy accumulates cash value, which can be borrowed against or withdrawn as long as the loan is paid back with interest. The death benefit is guaranteed and will be paid out to the designated beneficiaries upon your passing. The policy also has an investment component, allowing the cash value to grow tax-deferred.

Unum Whole Life Insurance offers several advantages. Firstly, it provides lifelong coverage, ensuring that your loved ones are financially protected even if you pass away. The cash value can be used for various purposes, such as funding education, starting a business, or covering retirement expenses. Additionally, the policy offers a fixed premium, which means your payments remain consistent over time, providing long-term financial planning.

Unum Whole Life Insurance is suitable for individuals who want long-term financial security and are looking for a permanent life insurance solution. It is often chosen by those who have a family or financial dependents and want to ensure their loved ones are taken care of in the event of their passing. This type of policy can also be a valuable part of a comprehensive financial plan, especially for those seeking tax-advantaged savings and investment options.