Life insurance and life assurance are often used interchangeably, but they are not the same thing. While both are forms of protection designed to pay out after the policyholder dies, they have key differences. Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life.

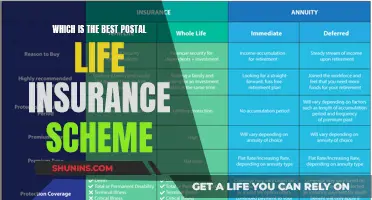

| Characteristics | Values |

|---|---|

| Duration of cover | Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life. |

| Payout | Life insurance pays out a tax-free sum if the policyholder dies during the term of the policy. Life assurance typically pays out a tax-free lump sum when the policyholder dies, but some policies may be investment-focused, meaning the payout depends on the performance of those investments. |

| Premium | Life insurance premiums are typically lower than life assurance premiums, which tend to be higher due to the guaranteed payout. |

| Purpose | Life insurance is designed to provide peace of mind and financial security for loved ones in the event of an unexpected death. Life assurance is considered more of an investment, offering a guaranteed inheritance for beneficiaries. |

| Flexibility | Life insurance allows the policyholder to choose the duration of cover and whether the cover remains the same or decreases over time. Life assurance premiums may be reviewed and increased throughout the life of the policy. |

What You'll Learn

Life insurance covers the policyholder for a specific term

Life insurance and life assurance are often used interchangeably, but there is a difference between the two. Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life.

Life insurance is an agreement between a life insurance company and a policyholder. In return for regular payments, the insurance company agrees to provide cover to the policyholder for a specific period of time (the 'term'). If the policyholder dies during the term of the policy, the insurance company will pay a tax-free sum to the policyholder's beneficiaries. However, if the policyholder outlives the term of the policy, their beneficiaries will not receive any payment.

The most common types of life insurance are level, increasing, and decreasing cover. Level cover provides the same amount of insurance for the entire term of the policy, while increasing cover increases the amount of insurance over time to account for inflation. On the other hand, decreasing cover decreases the amount of insurance over time, as the policyholder's dependents will require less money as more of their mortgage or other loans are paid off.

The specific term of a life insurance policy can vary depending on the policyholder's needs. For example, the term of a life insurance policy may be the same amount of time as the policyholder's mortgage, so that their dependents can pay off the remaining mortgage with the insurance money in the event of the policyholder's death.

Life insurance premiums will depend on factors such as the policyholder's age, health, and lifestyle. For example, a young, non-smoking policyholder in good health will pay less for life insurance than an older policyholder who smokes and has pre-existing medical conditions.

New York Life: Health Insurance Options and Availability

You may want to see also

Life assurance covers the policyholder for their entire life

Life insurance and life assurance are often used interchangeably, but there is a difference between the two. While both are forms of protection designed to pay out after the policyholder dies, life insurance covers the policyholder for a specific term, whereas life assurance covers the policyholder for their entire life. This type of cover is often known as 'whole of life' cover.

Life assurance is a type of life insurance with no term limit. It is an assurance that you will eventually earn a payout. Life insurance policies are taken out for a set period of time, usually between five and 30 years. During the term of the contract, the policyholder pays a set amount of money (the premium) each month or annually. If they die during this time, their provider pays their dependents a lump sum to cover the resulting loss of income.

Life assurance policies, on the other hand, are designed to last almost indefinitely. The monthly premiums are usually higher because a payout is guaranteed. Insurers know with a high degree of certainty that they will have to pay out eventually. There is generally no term limit, so your beneficiaries are almost guaranteed to receive a pre-agreed amount when you die. Some plans require you to pay until you die, while others have a cut-off point—often 85 or 90—after which your cover continues, but payments stop.

Life assurance is considered an investment that offers a guaranteed inheritance for your beneficiaries. It is a good way of bequeathing cash to the next generation. However, it is important to note that premiums for this type of cover tend to be more expensive than for life insurance as a payout is guaranteed. It is also more likely that premiums will be reviewed every few years, meaning they could increase throughout the life of the policy.

Life Insurance Options After Military Service

You may want to see also

Life assurance is a mix of investment and insurance

Life insurance and life assurance are often used interchangeably, but they are not the same thing. While both are forms of protection designed to pay out after the policyholder dies, they work differently. Life insurance covers the policyholder for a specific term, whereas life assurance covers the policyholder for their entire life.

Life assurance policies are more complex than life insurance policies because they involve more of an investment structure. Some life assurance products are linked to investments, so part of the premium is invested. This means the payout received on death will depend on how well the investment performs.

Life assurance is a vital tool for wealth management and tax planning. It is a vehicle of choice for wealthy clients and an invaluable tool for inheritance and succession planning, asset management, and tax optimisation. Life assurance is considered an investment that offers a guaranteed inheritance for beneficiaries.

Life assurance is a long-term, tax-efficient capital growth strategy. It pays out either a guaranteed minimum or its investment valuation, including the accumulated value of annual bonuses paid by the life assurance company, at the time it is redeemed.

Cholesterol and Life Insurance Blood Tests: What's the Link?

You may want to see also

Life insurance is protection for the term of the cover

There are different types of life insurance cover, including level, increasing, and decreasing cover. Level cover provides the same amount of cover for the whole term of the policy, while increasing cover increases over time to account for inflation, and decreasing cover decreases over time as the policyholder pays off their mortgage or other loans. The type of cover chosen will determine the premium, with increasing cover resulting in higher premiums.

Life insurance can provide peace of mind that loved ones will be taken care of financially if the policyholder passes away. It can help ensure that dependents are able to cover the resulting loss of income, pay off the mortgage, or handle other essential expenses. The main benefit of life insurance is that premiums are typically lower than those for life assurance, and policyholders can choose the length of their coverage.

However, it is important to note that if the policyholder outlives the term of the policy, their beneficiaries will not receive any payment. Additionally, life insurance policies have no cash value, and if premiums cease, the coverage ends.

Trustee's Life Insurance: Inter Vivos Trust Eligibility

You may want to see also

Life assurance is also known as 'whole of life' cover

Life assurance, also known as whole-of-life cover, is a type of insurance that continues indefinitely and pays out a lump sum once a policyholder dies, provided they have met their monthly payments. It is a guarantee that you will eventually earn a payout. Life assurance is often chosen by those who want peace of mind that their loved ones will receive a lump sum, no matter when they pass away.

Life assurance is different from life insurance, which covers the policyholder for a specific term. Life insurance is protection for the term of the insurance cover. If the policyholder dies during the term of the policy, the insurance company will pay a tax-free sum to their beneficiaries. However, if the policyholder outlives the term of the policy, their beneficiaries will not receive any payment.

Life assurance, on the other hand, covers the policyholder for their entire life. It is not based on protection for a fixed term and instead means you are covered until you die. Therefore, with life assurance, a payment is typically made when the policyholder dies.

Life assurance policies tend to be more expensive than life insurance as a payout is guaranteed. Premiums for this type of cover are usually higher, as insurers know with a high degree of certainty that they will have to pay out eventually. Life assurance premiums are also likely to be reviewed every few years, meaning they could increase over time.

Some life assurance products are linked to investments, so part of the premium is invested. This means the payout received upon death will depend on how well the investment performs.

Life Insurance Payouts: Can You File for Bankruptcy?

You may want to see also

Frequently asked questions

Life insurance is designed to pay out a tax-free lump sum if the policyholder dies during the term of the policy.

Life assurance is a type of life insurance that covers the policyholder for their entire life. It is often known as 'whole of life' cover.

Life insurance covers the policyholder for a specific term, while life assurance covers the policyholder for their entire life.

Life insurance premiums will typically be lower than those for life assurance, and you can pick how long you want to be covered for.

The main benefit of life assurance is that you will be covered for your entire life. It is also considered more of an investment that offers a guaranteed inheritance for your beneficiaries.