Life insurance companies often require a medical exam before deciding on your application. This may include a blood test to check your cholesterol levels, as high cholesterol can indicate a higher risk of heart disease. While it may not lead to an outright rejection, it could mean paying higher premiums.

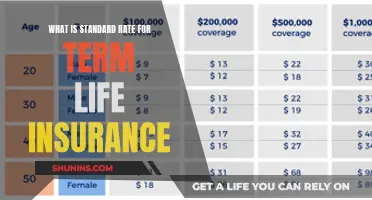

| Characteristics | Values |

|---|---|

| Purpose of blood test | To provide specific information about your health and verify what you have stated in your application. |

| What is tested for | HIV or AIDS, STDs, cholesterol, hemoglobin A1C, glucose levels, kidney disease, diabetes, drugs, nicotine, liver disease, enzyme levels |

| How it affects your life insurance | Your cholesterol level can have an impact on your risk group and policy premium. |

What You'll Learn

How does high cholesterol affect life insurance premiums?

High cholesterol is a common health concern, with 38% of American adults suffering from the condition. It can be a barrier to securing an affordable life insurance policy, as it may cause insurers to charge higher premiums or even deny coverage.

Life insurance companies offer the best rates to those in good health. As such, they will often request blood testing, including cholesterol levels, as an indication of overall health. High cholesterol, especially if it is uncontrolled by medication, can increase the price of life insurance. This is because high cholesterol is associated with an increased risk of heart attacks and strokes, two of the leading causes of death in the US.

However, high cholesterol alone may not cause your life insurance application to be denied, and some insurers do not require blood tests. If your high cholesterol is under control with medication, you may even qualify for some of the most affordable life insurance rates.

Life insurance companies evaluate the potential risk of insuring you when determining your premium. As well as your cholesterol levels, they will consider other factors such as your age, gender, medical history, and lifestyle habits.

If you are able to lower your cholesterol levels through lifestyle changes or medication, you can ask your life insurance company for a reevaluation, which may result in a decrease in your premium. Alternatively, you could apply for a new policy and undergo a new medical exam.

Hartford's Life Insurance Offerings: What You Need to Know

You may want to see also

What are acceptable cholesterol levels for life insurance?

Life insurance companies often request blood testing to determine an applicant's cholesterol levels, as these are an indication of overall health. While there is no universal standard for acceptable cholesterol levels, companies typically look for levels that fall within the standard healthy ranges.

Total Cholesterol

Total cholesterol levels are categorised as follows:

- Desirable: below 200 mg/dL

- Borderline high: between 200 mg/dL and 239 mg/dL

- High: over 240 mg/dL

LDL Cholesterol

LDL cholesterol, often referred to as "bad cholesterol", is further categorised as:

- Optimal: less than 100 mg/dL

- Near optimal/above optimal: 100 to 129 mg/dL

- Borderline high: 130 to 159 mg/dL

- High: 160 to 189 mg/dL

- Very High: 190 mg/dL and above

HDL Cholesterol

HDL cholesterol, known as the "good cholesterol", is categorised as:

- Risk factor for heart disease: below 40 mg/dL

- The higher, the better: 40 to 59 mg/dL

- Protective against heart disease: above 60 mg/dL

Total Cholesterol Ratio

The total cholesterol ratio is calculated by dividing total cholesterol by HDL cholesterol. A ratio below 5:1 is generally considered good.

Impact on Life Insurance Premiums

High cholesterol may increase the price of life insurance, and in rare cases, very high cholesterol combined with other health complications can lead to application denial for the most common types of life insurance. However, if high cholesterol is well-controlled with medication, it is still possible to qualify for some of the most affordable rates. Life insurance companies evaluate multiple factors when determining premiums, including age, gender, overall health profile, and lifestyle habits.

Life Insurance and Short-Form Death Certificates: What's Accepted?

You may want to see also

What is tested for in a life insurance medical exam?

A life insurance medical exam is similar to an annual physical checkup. The exam is usually free and provided by a third party hired by the insurance company. It can take place at your home, workplace, or a local exam center, and the whole process typically takes less than 30 minutes. The examiner will measure your height, weight, pulse, and blood pressure, and take a blood and urine sample.

The blood and urine tests screen for various health markers and conditions, including:

- Sexually transmitted diseases

- Cholesterol levels (LDL, HDL, and triglycerides)

- Hemoglobin A1C, fructosamine, and glucose levels (indicators of diabetes)

- Creatinine, hemoglobin, and proteins (to find kidney disease)

- Urine acidity (for kidney issues or diabetes)

- Confirmation of application responses on drug and tobacco use

The examiner will also ask you a series of questions about your health, lifestyle, and social habits, including current prescriptions.

If you are over 50 years old and applying for a large amount of life insurance, you may also be required to take an electrocardiogram (EKG) and a treadmill stress test.

Haemochromatosis: Life Insurance Considerations and Impacts

You may want to see also

How to prepare for a life insurance blood test

A life insurance blood test is usually part of a medical exam that assesses your health, confirms the information on your application, and screens for illegal drug use. The test can be done at your home, workplace, or a local exam centre. Here are some tips to help you prepare for a life insurance blood test:

- Schedule your exam carefully: Many people prefer to schedule their exam first thing in the morning so they feel energised and relaxed. You may want to take a couple of hours off work so you can prepare for the exam without feeling rushed.

- Stay hydrated and eat well: In the days and hours leading up to your exam, focus on drinking plenty of water and eating balanced meals. Avoid alcohol and nicotine, as these can increase your blood pressure. Also, limit your consumption of salty foods, red meat, and foods high in cholesterol, such as eggs and cheese.

- Get adequate sleep: Getting enough sleep will ensure you feel well-rested for the exam and might help keep your blood pressure in check.

- Bring relevant medical information and identification: Bring a copy of your medical history and a government-issued ID to prove your identity at the exam.

- Avoid strenuous activities: Avoid intense exercise the day of the exam as it can change your blood pressure readings. However, a light workout a few hours before your exam may help you feel calm and relaxed.

- Wear lightweight clothing: Wearing comfortable, loose clothing may help you feel relaxed and could make the blood-drawing process easier.

In addition to these tips, it is important to follow any specific instructions provided by the life insurance company or medical examiner.

Kobe Bryant's Life Insurance: What Was His Plan?

You may want to see also

What to do if your application is declined

If your life insurance application is declined, don't panic. You still have options. Here are some steps you can take:

Ask for More Information

Find out the reason for the denial by contacting your insurance agent or company. Insurance companies consider both medical and non-medical factors when evaluating applications, so understanding the specific reason for the denial will help you determine your next steps.

Appeal the Decision

If the denial is based on incorrect or outdated information, you have the right to appeal. Provide the insurance company with up-to-date medical information from your doctor, especially if your health has improved since the initial application. You can also appeal non-medical reasons, such as outdated financial records, old driving offences, or incorrect details about your job or hobbies.

Check with Your Workplace

Your employer may offer a group term life insurance plan that you can join. While it may not provide the same level of coverage as an individual policy, it can offer some level of protection until you find an alternative. Keep in mind that group plans are usually tied to your employment, so you may lose coverage if you leave your job.

Reach Out to a Life Insurance Agent

An independent life insurance agent can be a valuable resource. They understand the underwriting process and can help you navigate the market to find a policy that suits your needs. They can also advise you on any red flags in your application and suggest improvements to increase your chances of approval.

Make Lifestyle Changes

If your application was denied due to health-related issues, use this as an opportunity to focus on your health. Improve your diet, exercise regularly, and make any necessary lifestyle changes to address the health concerns that led to the denial. This may take time, but it will not only increase your chances of approval in the future but also improve your overall well-being.

Explore Alternative Products

If you are deemed high-risk, consider alternative insurance products such as final expense life insurance, guaranteed issue life insurance, or simplified issue life insurance. These options may have lower death benefit payouts and higher prices, but they can provide coverage when traditional policies are not available.

Remember, each insurance company has its own guidelines for assessing risk. Just because one company denies your application doesn't mean you are uninsurable. Shop around, make any necessary improvements to your application, and don't be afraid to reach out for help.

Erie Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, life insurance blood tests check for cholesterol.

Life insurance blood tests are used to determine eligibility and pricing for certain types of life insurance policies. They provide key details about your medical history and health.

There are two main types of cholesterol: LDL (low-density lipoprotein) cholesterol, also known as "bad" cholesterol, and HDL (high-density lipoprotein) cholesterol, also known as "good" cholesterol.

Healthy cholesterol levels are typically considered to be:

- Total cholesterol: below 200 mg/dL

- LDL cholesterol: below 130 mg/dL

- HDL cholesterol: above 40 mg/dL for men and above 50 mg/dL for women

Here are some steps to prepare for a life insurance blood test:

- Schedule your exam carefully, preferably first thing in the morning.

- Stay hydrated and eat nutritious meals in the days leading up to the exam.

- Get adequate sleep the night before the exam.

- Bring relevant medical information and identification to the exam.

- Avoid strenuous activities and intense exercise prior to the exam.