Getting life insurance when you have kidney disease is possible, but it may be challenging and more expensive. The application process is often more complicated, and the cost and coverage options depend on the severity of your condition, age, overall health, and lifestyle. People with kidney disease may be eligible for Medicare Advantage plans, which provide additional benefits such as prescription drug coverage or dental benefits. Additionally, those with chronic kidney disease (CKD) can explore term life insurance and whole life insurance options, while those on dialysis may consider guaranteed issue life insurance or group life insurance.

| Characteristics | Values |

|---|---|

| Is life insurance possible with kidney disease? | Yes, but it may be more complicated and expensive. |

| What factors do insurance companies consider? | Kidney Function Test (KFT) results, underlying causes of kidney disease, family history, dialysis status, and specific kidney disorder |

| What are the challenges? | Higher premiums, limited coverage options, denial of coverage |

| How can individuals improve their chances? | Regularly monitor and maintain KFT results, effectively manage underlying conditions, consider specialized brokers and policies |

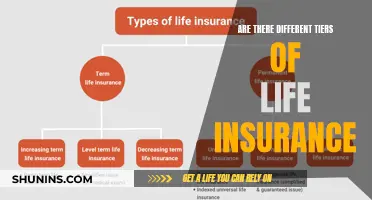

| What are some policy options? | Medicare Advantage, group life insurance, spousal insurance rider, guaranteed issue life insurance, term life insurance, whole life insurance |

What You'll Learn

Kidney Function Test (KFT)

The Kidney Function Test (KFT), also known as the Renal Function Test (RFT), is a diagnostic test that evaluates how well your kidneys are working. The kidneys are vital organs that maintain overall health and wellness. They are part of the urinary system and are located in the lower back, on either side of the spine. Here's what you need to know about the KFT:

Purpose of KFT

The KFT evaluates kidney function, diagnoses any kidney disease or damage, and monitors the response to treatment for ongoing kidney conditions. It can help detect kidney problems early, such as kidney stones, kidney failure, or infections. The test is often done as part of routine health checkups, especially for individuals with risk factors like obesity, diabetes, or a family history of kidney disease.

Procedure for KFT

The KFT typically involves blood tests, but in some cases, a urine sample may also be required. There is usually no need for fasting before the test, and you can eat and drink as per your daily routine. However, it is important to follow any specific instructions provided by your doctor. The blood test is a simple procedure where a technician collects a blood sample using a small needle and test tube. For the urine test, you will be given a container to collect your urine over a 24-hour period.

Parameters Measured in KFT

The KFT assesses several key parameters that provide valuable insights into kidney function:

- Urea/Blood Urea Nitrogen (BUN): Measures the level of urea, a waste product cleared by the kidneys. Elevated levels may indicate kidney dysfunction.

- Creatinine: Determines creatinine levels in the blood, a waste product of muscle metabolism. High levels suggest reduced kidney filtration efficiency.

- Uric Acid: Tests uric acid levels in blood or urine. High levels are associated with conditions like gout and certain cancers.

- Estimated Glomerular Filtration Rate (eGFR): Provides an estimate of kidney filtration efficiency, indicating how well the kidneys remove waste from the blood.

- Urea-Creatinine Ratio (UCR): Checks the balance between urea and creatinine in the blood, with elevated levels indicating possible kidney injury.

- Electrolytes: Measures essential minerals like calcium, potassium, sodium, chloride, and phosphorus to evaluate the body's mineral balance.

Interpreting KFT Results

Interpreting KFT results involves comparing the values obtained to normal ranges. Elevated levels of urea, creatinine, or other parameters may indicate kidney disease, dehydration, or underlying conditions like diabetes or hypertension. It's important to consult a nephrologist to understand the results and determine the next steps.

Benefits of KFT

Regular KFTs offer several advantages:

- Early Detection of Kidney Issues: KFTs enable timely identification of potential kidney problems, allowing for prompt intervention.

- Monitoring of Existing Conditions: KFTs help track kidney function in individuals with chronic conditions, ensuring effective disease management.

- Prevention of Complications: Regular testing supports the prevention of severe complications, such as kidney failure or electrolyte imbalances.

- Cost-Effectiveness: KFTs provide an affordable way to assess kidney health regularly, reducing the likelihood of costly treatments for advanced kidney disease.

In summary, the Kidney Function Test (KFT) is an important diagnostic tool for evaluating kidney health and detecting potential issues early. It involves a set of blood and, occasionally, urine tests that measure various parameters related to kidney function. KFTs play a crucial role in early detection, monitoring, and preventing complications associated with kidney diseases.

Life Insurance Checks: Impact on Social Security?

You may want to see also

Underlying causes of kidney disease

Kidney disease is a condition where the kidneys are damaged and unable to filter blood and remove waste products, extra fluid, and toxins from the body effectively. It can also affect red blood cell production and vitamin D metabolism, which are essential for maintaining bone health. While anyone can get kidney disease, certain risk factors increase the likelihood of developing this condition. Here are some of the underlying causes:

High Blood Pressure and Diabetes:

High blood pressure (hypertension) and diabetes are the two most common causes of chronic kidney disease (CKD). Over time, high blood sugar levels associated with diabetes can harm the kidneys, and high blood pressure creates wear and tear on the blood vessels, including those supplying the kidneys.

Glomerulonephritis:

This type of kidney disease involves damage to the glomeruli, the tiny filters inside the kidneys responsible for removing waste from the blood.

Polycystic Kidney Disease:

This is a genetic disorder characterised by the growth of numerous fluid-filled cysts in the kidneys. These cysts reduce the kidneys' ability to function properly and filter waste.

Membranous Nephropathy:

In this condition, the body's immune system mistakenly attacks the waste-filtering membranes in the kidneys, impairing their function.

Obstructive Urologic Diseases:

Obstructions in the urinary tract, such as kidney stones, an enlarged prostate, or cancer, can hinder the normal flow of urine and contribute to kidney disease.

Vesicoureteral Reflux:

Vesicoureteral reflux is a condition where urine flows backward from the bladder into the kidneys, which can lead to kidney damage over time.

Nephrotic Syndrome:

Nephrotic syndrome is a collection of symptoms, including proteinuria (excess protein in the urine), hypoalbuminemia (low protein levels in the blood), and edema (swelling), which indicate kidney damage.

Recurrent Kidney Infections:

Repeated kidney infections, such as pyelonephritis, can scar and damage the kidneys, leading to impaired function.

Lupus and Other Immune System Diseases:

Autoimmune diseases like lupus, polyarteritis nodosa, sarcoidosis, Goodpasture syndrome, and Henoch-Schönlein purpura can cause the body's immune system to attack and damage the kidneys.

Genetic Factors:

Kidney disease can be hereditary and passed down from parents to children through gene mutations. Additionally, certain ethnic groups may have a higher risk of specific gene mutations, such as the APOL1 gene mutation, which increases the risk of kidney disease.

Medications and Toxins:

Long-term use of certain medications, such as NSAIDs (ibuprofen, naproxen), and exposure to toxins like lead poisoning or IV street drugs, can permanently damage the kidneys. Alcohol consumption, especially binge drinking, can also increase the risk of acute kidney failure and chronic kidney disease.

How to Find Your Old Life Insurance License?

You may want to see also

Kidney transplant

Overview

When it comes to life insurance, a kidney transplant is considered a pre-existing medical condition that can affect your eligibility and premium costs. The availability and cost of life insurance after a kidney transplant depend on various factors, including the success of the transplant, overall health, and stability of the condition.

Waiting Period

It is generally recommended that individuals wait for at least one year after the kidney transplant procedure before applying for life insurance. This waiting period allows insurance providers to assess the stability of your health condition and the success of the transplant.

Underwriting Considerations

When evaluating life insurance applications for individuals with a kidney transplant, insurance underwriters will consider several factors:

- The underlying cause or reason for the transplant.

- The time that has passed since the transplant.

- The source of the donated kidney, whether from a living donor or a deceased donor.

- The response to ongoing treatment and any scheduled dialysis.

- The stability of renal function and the potential for rejection of the new kidney.

Impact on Premiums

Life insurance premiums for individuals who have received a kidney transplant are typically higher than average. The increased cost reflects the higher risk associated with the medical history. The source of the donated kidney may also impact premiums, with some insurers offering better rates if the kidney is from a living donor, especially a close relative.

Availability of Coverage

Obtaining traditional life insurance coverage after a kidney transplant can be challenging. Some insurers may decline coverage or offer coverage at higher rates. However, specialist life insurance policies may be available during the first year after the transplant. Guaranteed issue whole life insurance policies, which do not require a medical exam, are also an option for individuals who have faced complications or rejection after the transplant.

Additional Considerations

It is important to note that maintaining good health and stability after a kidney transplant can improve your chances of obtaining life insurance coverage. Staying healthy, avoiding smoking, eating a balanced diet, and exercising regularly can all contribute to maximizing the success of the transplant. Additionally, individuals who have donated a kidney may also experience an increase in insurance rates, and it is recommended to seek clarification from the transplant center regarding any potential impact on life expectancy.

Life Insurance Proceeds: Tax-Free Transfer for Beneficiaries

You may want to see also

Family history of kidney issues

A family history of kidney issues can affect your life insurance policy as it indicates a genetic predisposition to the disease. While a diagnosis of kidney disease will not disqualify you from getting life insurance, it can make the application process more complicated and you may have to pay higher premiums.

If you have a family history of kidney disease, insurance companies will want to know about it when you apply for life insurance. They will ask specific questions about your immediate family's health history, such as whether any of your parents or siblings were diagnosed with kidney disease before the age of 60 or 70. The agent working on your application will then ask follow-up questions to get a better understanding of your family history. For example, they may ask which relative had the condition, at what age they were diagnosed, and whether they are still alive.

The impact of a family history of kidney disease on your life insurance premiums will depend on a range of factors, including your own personal health profile and age. While your family history is an indicator of your future health risks, your personal health is a much larger factor in determining the cost of your life insurance. If you are older, you are also less likely to be affected by your family health history.

If you have a family history of kidney disease, you may be able to lower your insurance premiums by improving your overall health through diet and exercise, and by cutting out tobacco use. Shopping around for different premiums based on your age is also a good idea, as one company may offer lower premiums than another.

Life Insurance and Child Support: New York's Complex Reality

You may want to see also

Dialysis

If you are on dialysis, you won't be eligible for traditional life insurance coverage. However, there are still some options available to you.

Guaranteed Issue Life Insurance

This type of insurance is aimed at covering end-of-life expenses such as funeral or medical bills. Coverage amounts are usually capped at $25,000, but approval is almost guaranteed. This type of insurance is typically available to people aged 45 and over.

Group Life Insurance

Group policies are often provided by employers for free or at a subsidised rate. While they offer low payouts, usually one to two times your salary, coverage is guaranteed.

Spousal Insurance Rider

If your spouse has life insurance coverage, they may be able to get additional coverage for you through a spousal rider. This would add a small amount of coverage for you on top of their own death benefit.

Medicare

Medicare is a federal health insurance programme that covers health care costs for eligible people under 65 with certain disabilities and those who have received Social Security Disability Insurance (SSDI) for two years. It also covers people of any age with end-stage renal disease (ESRD) who are being treated with dialysis or a kidney transplant.

Other Options

Other sources of financial help for dialysis patients include joint federal-state programs, private health insurance, private organisations, and medication assistance programs.

Pregnancy and Health Insurance: Qualifying Life Events Explained

You may want to see also

Frequently asked questions

Yes, you can still get life insurance if you have kidney disease. However, the application process may be more complicated and the cost and coverage options will depend on the severity of your condition, age, overall health, and lifestyle.

The insurance company will consider your kidney condition when determining the cost and coverage options for your policy. If your condition is severe, it may lead to higher premiums or you may not be eligible for traditional life insurance coverage.

Yes, it is important to disclose any medical conditions, including kidney disease, when applying for coverage. Failure to do so could result in a denial of benefits if you pass away during the policy term.