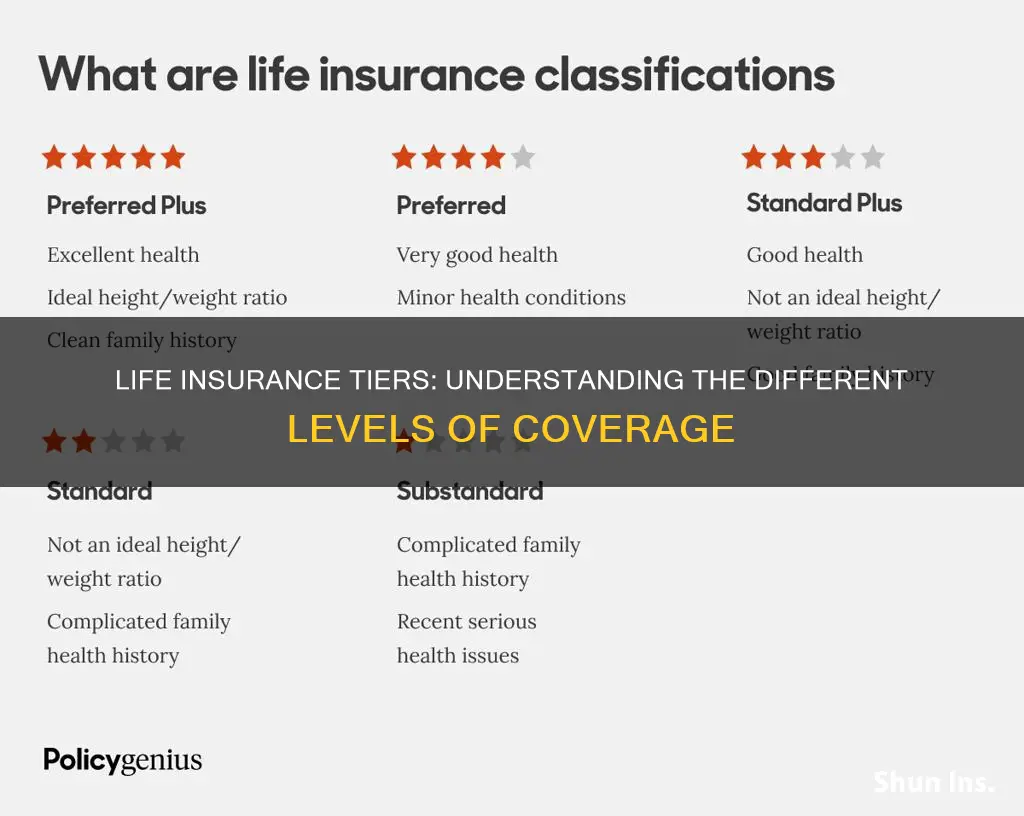

Life insurance is a policy that provides a death benefit payout to beneficiaries if the insured person dies while it’s active. There are several types of life insurance policies, and the best one for you will depend on your specific needs and budget. The two main types are term life insurance and permanent life insurance. Term life insurance is temporary and provides coverage for a set term or a specific amount of time, whereas permanent life insurance lasts for the insured person's entire life as long as premium payments are maintained. Within these two main types, there are several subtypes of life insurance policies, including whole life insurance, universal life insurance, burial insurance, survivorship life insurance, mortgage life insurance, credit life insurance, and supplemental insurance.

What You'll Learn

Whole life insurance

The cash value can be accessed by the policyholder while they are still alive and offers a living benefit. Withdrawals up to the value of the total premiums paid are tax-free, but withdrawals and outstanding loans will reduce the death benefit. Interest is charged on policy loans, with rates varying depending on the insurer, but are generally lower than personal loan or home equity loan rates.

Funeral Expenses: Life Insurance Payouts Explained

You may want to see also

Universal life insurance

The main disadvantage of universal life insurance is that the death benefit and cash value growth are not guaranteed. If your investments underperform or you underpay for too long, it could affect your death benefit or cause your policy to lapse. Additionally, universal life insurance premiums may increase over time, and the interest rate is not guaranteed, as it is set by the insurer and can change frequently.

Life Insurance: Understanding the Safe Age for Coverage

You may want to see also

Term life insurance

Fixed Term

The most popular type of term life insurance is the fixed-term option, which offers coverage for 10, 20, or 30 years. The premiums remain the same throughout the policy's duration, providing stability and predictability.

Increasing Term

Increasing term life insurance allows policyholders to increase the value of their death benefit over time, resulting in slightly higher premiums. These policies tend to be more costly but usually provide a larger payout.

Decreasing Term

In contrast, decreasing term life insurance reduces the premium payments over the policy's duration, which may result in a smaller death benefit. This type of insurance is suitable for those who anticipate having fewer financial obligations as they age.

Annual Renewable

Annual renewable term life insurance provides coverage on a yearly basis and must be renewed by the end of the policy term to continue coverage. The premiums typically increase with each renewal, making this option more expensive but suitable for those seeking short-term coverage.

Group Term

Group term life insurance is purchased through an employer and functions as a workplace plan, providing coverage for all employees.

Convertible Term

Convertible term life insurance includes a conversion rider, allowing policyholders to convert their term policy to permanent coverage without undergoing additional underwriting or providing proof of insurability. This guarantees approval for whole life insurance, which is more expensive but provides lifetime coverage.

Credit Score Impact on Life Insurance: What's the Link?

You may want to see also

Variable life insurance

The cash value component of variable life insurance is invested in assets like mutual funds, meaning it may rise or fall in value. This makes variable life insurance policies riskier compared to other life insurance policies. However, you can often allocate a portion of your premium to a fixed account, which guarantees a rate of return, to reduce the overall risk.

Variable universal life insurance is a type of variable life insurance that offers the ability to allocate among purely market-driven and fixed options. This provides a wide range of investment options to meet various growth objectives and risk tolerances in a single flexible policy.

Canceling Life Insurance: What You Need to Know

You may want to see also

Group life insurance

In the US, Servicemembers' Group Life Insurance (SGLI) offers low-cost term coverage to eligible service members, including those in the Army, Navy, Air Force, Space Force, Marines, and Coast Guard. The Federal Employees' Group Life Insurance (FEGLI) Program is the largest group life insurance program in the world, covering over 4 million federal employees, retirees, and their families.

Maximizing Life Insurance: Strategies to Boost Your Coverage

You may want to see also

Frequently asked questions

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance is temporary and usually the most affordable option, whereas permanent life insurance lasts for your whole life and is more expensive.

Term life insurance is a simple, low-cost policy that is sufficient for most people. However, if you outlive your policy, your beneficiaries won't receive a payout, and you may find renewal rates unaffordable.

Permanent life insurance offers lifelong coverage and includes a cash value component that grows over time. It is more expensive than term life insurance and not as flexible.

Some common subtypes of permanent life insurance include whole life insurance, universal life insurance, variable life insurance, and burial insurance.