Life insurance is meant to help your family avoid financial hardship in the event of your death. However, you may want to cancel your life insurance policy if it no longer serves your needs or has become unaffordable. Cancelling a permanent life insurance policy is more complicated than cancelling a term life insurance policy. This is because permanent life insurance policies are designed to provide lifelong coverage and typically include a cash value component. As a result, cancelling a permanent life insurance policy may involve more than just stopping payments.

| Characteristics | Values |

|---|---|

| Can you cancel permanent life insurance? | Yes |

| How to cancel permanent life insurance | Contact your insurance company |

| When to cancel permanent life insurance | When you no longer need coverage, when you are changing your investment strategy, when you cannot afford the premiums, when you are switching policies or insurance companies |

| Do you get money back when cancelling permanent life insurance? | Yes, but the amount depends on factors such as the type of policy, timing of cancellation, surrender charges, outstanding loans, and withdrawals |

| Can you cancel permanent life insurance at any time? | Yes, but you will only get a full refund during the initial "free look" period |

What You'll Learn

Cancelling permanent life insurance: the basics

Permanent life insurance policies are designed to provide lifelong coverage, with maximum coverage ages ranging from 95 to 121, and typically include a cash value component. Because of this, cancelling or "surrendering" a permanent life insurance policy can be more complex than cancelling a term life insurance policy.

Cancelling permanent life insurance: what you need to know

When you cancel a permanent life insurance policy, you may receive a payout from the cash value that has built up over time, but this is often reduced by surrender charges, especially if you haven't held the policy for long. Surrender fees can significantly reduce or even eliminate the cash value you receive, so it's important to check your policy's guidelines before cancelling.

In addition, if you have any outstanding policy loans, your surrender value will be reduced by the balance (unpaid loan plus accrued interest). Withdrawals will also permanently reduce the available cash surrender value. Therefore, cancelling a permanent life insurance policy can have financial implications, and it's crucial to fully understand the consequences before proceeding.

Cancelling permanent life insurance: your options

If you're thinking about cancelling your permanent life insurance policy, consider the alternatives first. Permanent policies often come with options that might make it unnecessary to fully surrender the policy. Here are some things you could do instead:

- Use the cash value to pay the premium: Depending on how much cash value you've built up, you may be able to withdraw from the cash value or borrow against it to cover your premium payments or mortality costs. However, this could reduce the death benefit your beneficiaries will receive, and if the loan isn't repaid, the outstanding amount plus interest will be deducted from the policy's death benefit.

- Perform a tax-free exchange: You may be able to swap your permanent life insurance policy for a similar insurance product, like an annuity or another life insurance policy, without paying taxes. This is known as a "1035 exchange".

- Take a life settlement: You might be able to sell your permanent life insurance policy for cash if you're around 65 or older and your life insurance death benefit is $100,000 or more. In a life settlement, an investor becomes the policy owner and beneficiary, paying the premiums and receiving the full death benefit upon your death. However, you may be taxed on a portion of the money you get from the settlement, and you could lose some privacy as the investor can request your medical records.

Cancelling permanent life insurance: the process

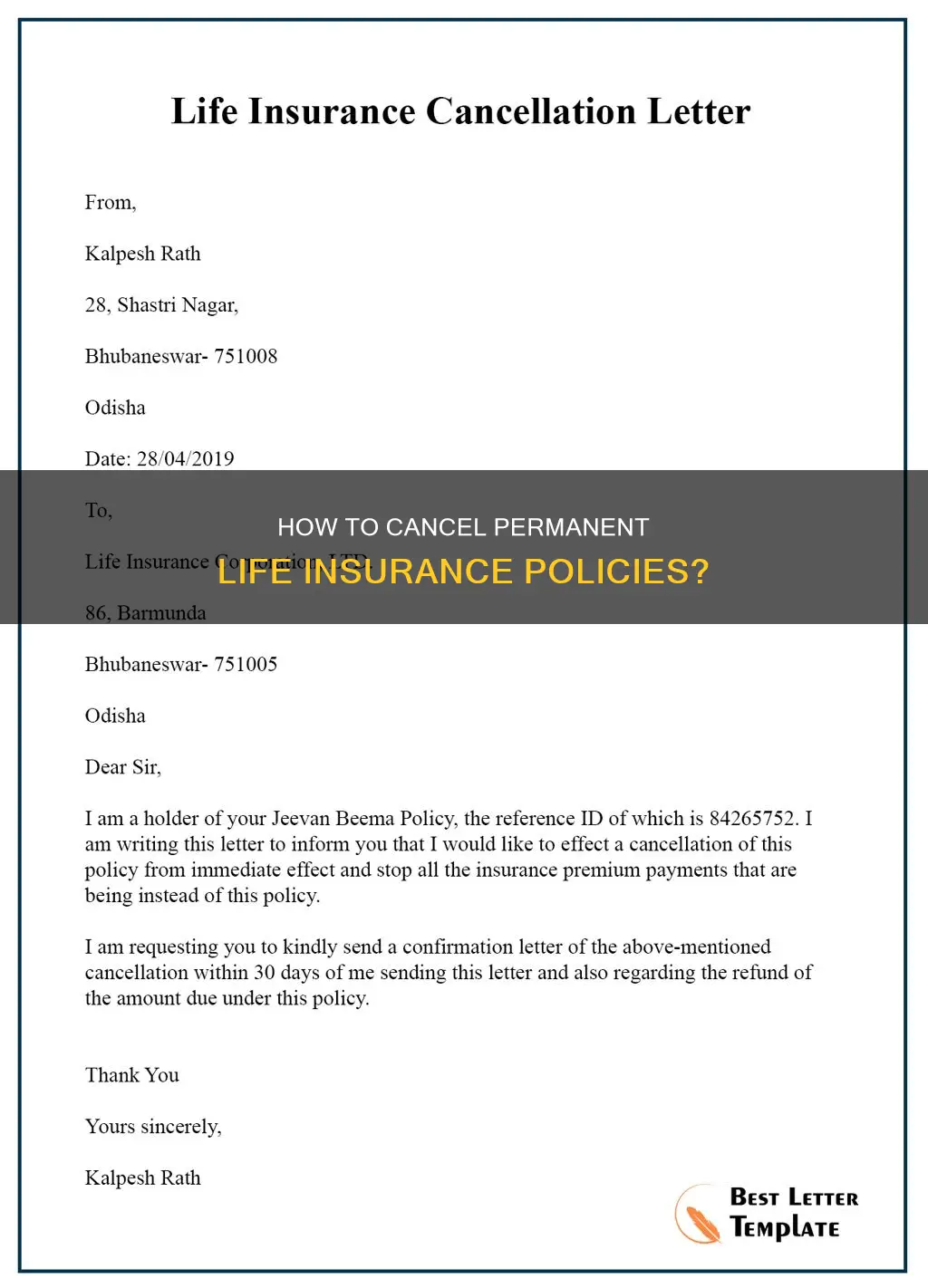

To cancel a permanent life insurance policy, contact your insurance company to discuss your options, as each policy has slightly different rules around cancellation. You may be able to cancel by stopping your premium payments, but this could result in surrender charges and a reduced payout. Alternatively, you can call or send a letter to your insurance company notifying them of the cancellation.

Simple Life Insurance: Haven's Peace of Mind

You may want to see also

Surrendering permanent life insurance

To surrender a permanent life insurance policy, you will need to review your policy documents, speak with your insurer, fill out the necessary paperwork, and then receive the cash surrender value. It is recommended that you consult a tax expert and financial advisor after receiving the payout.

It is important to note that surrendering a permanent life insurance policy will result in the loss of life insurance protection, and there may be tax consequences depending on the amount of the payout. There are alternatives to surrendering a policy, such as withdrawing from the cash value or borrowing against it.

Family Life Insurance: Do Children Get Covered for Free?

You may want to see also

Cancelling permanent life insurance: tax implications

Cancelling permanent life insurance can have tax implications, depending on the specifics of your policy and how long you've had it. Here are some key points to consider:

Surrender Charges and Fees

When you cancel a permanent life insurance policy, you may be charged surrender fees, especially if you do so within the first 10 years of owning the policy. These fees are intended to recoup the insurance company's expenses from selling and setting up the policy. Surrender fees typically start at 10% in the first year and then decrease by 1% each year until they reach 0% in the 10th year. However, some policies may have surrender charges for a longer period.

Cash Surrender Value

When you cancel your policy, you will receive the cash surrender value, which is the cash value of the policy minus any surrender fees and outstanding loan balances. The cash surrender value may be lower than the cash value you have accumulated, especially if you cancel within the first few years of the policy.

Taxable Gain

If the cash surrender value you receive is higher than the total amount of premiums you have paid into the policy, the difference is considered taxable income by the IRS. This taxable amount is subject to ordinary income tax, which is typically higher than capital gains tax rates. The percentage you will owe in taxes depends on your marginal tax rate or income tax bracket for the year.

Loans and Withdrawals

It's important to note that if you have an outstanding loan balance against the policy when you cancel it, this may be treated as taxable income. Additionally, withdrawals from the policy may also be subject to taxes if they exceed the total amount of premiums paid, unless the policy is a modified endowment contract, in which case taxes may need to be paid on earnings first.

Alternatives to Cancellation

Before cancelling your permanent life insurance policy, consider other options such as borrowing against the cash value, reducing your death benefit, or exchanging the policy for another insurance product or an annuity in a tax-free exchange. These alternatives can help you reduce costs or adjust your coverage without completely losing your life insurance protection.

Pets as Life Insurance Beneficiaries: Is It Possible?

You may want to see also

Cancelling permanent life insurance: alternatives

Cancelling permanent life insurance may not always be the best option. Here are some alternatives to consider:

Reduce your life insurance coverage

If you need coverage but can't afford your current premiums, contact your life insurance company to discuss your options. They may be able to temporarily reduce your coverage amount.

Withdraw or borrow from your cash value

If you have a whole life insurance policy, you can withdraw from or borrow against the policy's cash value in a financial crunch. Keep in mind that a policy loan will incur interest, and if you pass away before you repay the loan, your loved ones will receive a lower death benefit.

Ask for a new medical exam

If your premiums are high because you were in poor health when you bought your policy, you could request a new medical exam. If your health has improved, you may be eligible for a more competitive premium. This may be a good option if you've quit smoking or recovered from a past health issue.

Get a new life insurance policy

Shop around and compare quotes to see if you can find a new life insurance policy with more competitive rates.

Use the cash value to pay the premium

If you have a permanent life insurance policy, you might be able to use the accumulated cash value of your policy to cover your premium payments or mortality costs. However, this could reduce the death benefit your beneficiaries will receive. Borrowing against your cash value or withdrawing from it could also diminish the policy's value or even cause it to lapse if the cash value is depleted. Before making this decision, it's advisable to consult with a financial advisor or your insurance agent.

Perform a tax-free exchange

You may be able to swap your life insurance policy for a similar insurance product, such as an annuity, long-term care insurance, or another life insurance policy, without paying taxes. This option, known as a "1035 exchange," can be useful if the reasons you bought the original policy are no longer valid or if newer policies better align with your current needs. Be sure to work with a qualified life insurance advisor to ensure the exchange is done correctly.

Health and Life Insurance: Taxable or Not?

You may want to see also

Cancelling permanent life insurance: the pros and cons

Permanent life insurance policies are designed to provide lifelong coverage, with maximum coverage ages ranging from 95 to 121, and typically include a cash value component. Cancelling such a policy is a significant decision that can arise due to various reasons. Here are the pros and cons of cancelling permanent life insurance to help you make an informed decision.

Pros of Cancelling Permanent Life Insurance:

- If you no longer need the coverage: As your family becomes financially independent or your spouse can manage finances independently, you may no longer need the death benefit coverage provided by permanent life insurance.

- Changing your investment strategy: You may find that the investment options offered by your permanent life policy are not as lucrative as other financial vehicles like annuities or mutual funds. Cancelling your policy and investing in these alternatives may provide better returns.

- Affordability: If you are struggling to afford the premiums on your permanent life insurance policy, cancelling it may provide financial relief.

Cons of Cancelling Permanent Life Insurance:

- Loss of coverage: Cancelling your permanent life insurance policy means losing the protection it offered to your loved ones. This could leave them vulnerable in the event of your untimely demise.

- Higher premiums for a new policy: If you decide to purchase a new life insurance policy after cancelling your existing one, you will likely face higher premiums due to your increased age.

- Surrender charges and fees: Surrendering your permanent life insurance policy, especially during the early years, often incurs significant surrender charges and fees, reducing the cash payout you receive.

- Impact on cash value: Cancelling your policy may result in a reduced cash value, as surrender fees and outstanding loans are deducted from the total amount.

- Tax implications: The money you receive from surrendering your policy may be subject to income tax if it exceeds the total amount you have paid in premiums.

Before making a decision, carefully consider your options and alternatives, such as reducing the death benefit, using the cash value to pay premiums, or exploring a 1035 exchange to transfer your policy to a different insurance product. Weigh the pros and cons to make the choice that best aligns with your financial goals and circumstances.

McDonald's Life Insurance: What You Need to Know

You may want to see also