Life insurance salespeople are often regarded as pushy, aggressive, and manipulative. This negative perception stems from various factors, including the high cost of certain insurance products, the complex and regulated nature of the industry, and the reluctance of individuals to confront their mortality. Life insurance is typically a challenging sell because it is an intangible product that individuals often consider later in life. The sales practices in the industry have contributed to this perception, with agents from prominent whole-life carriers pushing products that may not be suitable for everyone, leading to misselling.

| Characteristics | Values |

|---|---|

| Life insurance agents' pushy behaviour | Due to the high cost of insurance |

| People are closed-minded about life insurance | |

| People don't like to think about death | |

| People assume it is expensive | |

| People don't understand the product | |

| People don't trust insurance agents | |

| People don't like to be sold to |

What You'll Learn

Life insurance salespeople are considered pushy due to the nature of the product

The high-pressure sales tactics used by life insurance salespeople are often necessary to overcome people's natural resistance to the product. Many people view life insurance as something they don't need to think about until they are older, and the idea of planning for one's death can be uncomfortable and morbid. As a result, life insurance salespeople have to be persistent and aggressive in their sales approach to overcome these objections.

Additionally, the nature of the product itself can also contribute to the pushy sales tactics employed by life insurance salespeople. Life insurance is a complex financial product that can be difficult for people to understand. This complexity can make it challenging for salespeople to explain the benefits of the product clearly and concisely, leading them to rely on high-pressure sales tactics to make a sale.

Furthermore, the commission-based structure of the life insurance industry can also contribute to the pushiness of salespeople. Life insurance salespeople often work on a commission basis, meaning they only earn money when they make a sale. This can create an incentive for them to use aggressive sales tactics to increase their chances of making a sale and earning a commission.

Lastly, the competitive nature of the life insurance industry also plays a role in the pushiness of salespeople. The industry is highly competitive, with many different companies and agents vying for customers. This competition can lead to a more aggressive sales approach as agents try to stand out and convince potential customers to choose their product over a competitor's.

Overall, the pushy nature of life insurance salespeople is a result of the combination of the product they are selling, the sales environment, and the industry structure. While their tactics may be off-putting to some, they are often necessary to overcome people's natural resistance to planning for their death and the complexity of the product itself.

Supplemental Life Insurance: Benefits and Coverage Explained

You may want to see also

People often assume life insurance is expensive

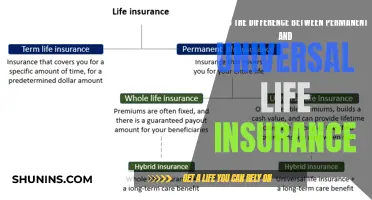

People often assume that life insurance is expensive, but this is not always the case. The cost of life insurance depends on several factors, including the size of the benefit, age, and health. Term life insurance, for example, is a more affordable option with lower premiums, but it only covers a set time period, such as 10, 20, or 30 years. On the other hand, whole life insurance is more expensive, but it lasts a lifetime and builds value, allowing for borrowing or withdrawals.

The perception of high cost may also be influenced by the pushy sales tactics of insurance agents. Life insurance salespeople are often considered aggressive and manipulative, which can create a negative impression of the industry. Misinformation and a lack of understanding about the different types of insurance and their benefits contribute to this assumption as well.

Additionally, life insurance is an intangible product, and some people may not see its value until they are older or have dependents. It can be challenging to convince someone to invest in something they cannot see or feel, especially if they are not ready to confront their mortality. This mindset can lead to a belief that life insurance is a costly and unnecessary expense.

However, life insurance provides financial protection for loved ones in the event of the policyholder's death. It can replace income, ensuring that dependents' needs are met, and beneficiaries are not left with a financial burden. While life insurance may not be necessary for everyone, it is important to consider one's personal circumstances and seek reliable information to make an informed decision.

In summary, while life insurance can be expensive in some cases, it is not a universal truth. The cost varies depending on individual factors, and there are affordable options available. The perception of high cost is influenced by a combination of pushy sales tactics, misinformation, and the intangible nature of the product. Educating oneself and seeking trustworthy sources of information can help dispel the assumption that life insurance is always expensive.

Whole Life Insurance: Living Benefits for Peace of Mind

You may want to see also

Life insurance is an intangible product

Life insurance salespeople are often considered pushy because they are trying to sell a product that people are inherently reluctant to buy. They have to overcome customers' natural resistance to the idea of life insurance, and this can lead to aggressive sales tactics. The industry has not done itself any favors, with a history of misselling and a reputation for being expensive, complicated, and full of misinformation.

Life insurance is a financial product, and the big money is in whole life insurance. Agents with prominent whole-life carriers are incentivized to sell these products, which offer more long-term value to the customer but come at a higher price point. Term life insurance, on the other hand, is more affordable but offers less profit potential for agents.

The cost of life insurance is a significant factor in people's reluctance to purchase it. Life insurance premiums are based on several factors, including the size of the benefit, age, and health. The older someone is and the shorter their life expectancy, the more expensive life insurance becomes. This can create a Catch-22 situation where those who most need life insurance find it cost-prohibitive.

Despite the negative reputation of life insurance salespeople, it is important to recognize that life insurance can offer many advantages. It provides financial security for loved ones in the event of the policyholder's death, replacing income that may have been supporting dependents. However, it is not a one-size-fits-all solution, and individuals need to consider their unique circumstances to determine if life insurance is right for them.

Borrowing Against Life Insurance in Canada: What You Need to Know

You may want to see also

Misinformation and a lack of understanding contribute to pushiness

Life insurance salespeople are often viewed as pushy, and this perception has contributed to the negative reputation of the industry. This pushiness can be attributed to various factors, including misinformation, a lack of understanding, and aggressive sales targets.

Misinformation and a lack of transparency in the industry contribute significantly to the pushiness associated with life insurance sales. The life insurance industry is complex, and consumers often struggle to understand the different types of policies, such as term life and whole life insurance, and their respective benefits and drawbacks. This complexity creates an opportunity for misinformation and confusion, with consumers sometimes making decisions based on incomplete or inaccurate information. The industry has been regulated to address these issues, but the prevalence of technical jargon and acronyms can still deter customers from seeking clarification.

Additionally, life insurance agents themselves may not always possess a comprehensive understanding of the products they are selling. This lack of understanding can lead to a disconnect between the customer's needs and the policy being sold, resulting in a pushy sales approach. Agents may rely on aggressive tactics to meet their sales targets without considering the unique circumstances and preferences of each client. This approach further contributes to the negative perception of life insurance salespeople.

Furthermore, the structure of the life insurance industry incentivizes pushy sales practices. Agents working with prominent whole-life carriers, for example, tend to prioritize selling these more profitable products, even if a term life policy might better suit the customer's needs. The focus on revenue and sales targets can lead to high-pressure sales tactics and a disregard for the customer's best interests.

The negative reputation of life insurance salespeople is also influenced by the intangible nature of the product they are selling. Life insurance is often seen as an abstract concept, and people may not fully appreciate its value until later in life. This intangibility can make it challenging for agents to convey the importance of their product, leading them to resort to pushy sales strategies.

To address these issues, it is essential for both consumers and salespeople to prioritize education and transparency. Consumers should feel empowered to ask questions and seek clarification to make informed decisions. Salespeople, on the other hand, should adopt a more consultative approach, taking the time to understand their clients' unique circumstances and providing personalized recommendations. By fostering a culture of trust and understanding, the life insurance industry can move away from pushy sales practices and towards a more customer-centric model.

Life Insurance After 50: Worth the Cost?

You may want to see also

Whole-life insurance agents want to sell the product for big money

Whole-life insurance policies also have a cash value component, which allows the insured to invest their premiums and accumulate tax-deferred interest. This cash value can be borrowed against or withdrawn later in life, providing a source of funds for large purchases or retirement income supplementation. This feature makes whole-life insurance particularly attractive to high-income earners seeking to diversify their investments and grow their wealth beyond traditional investment accounts.

Additionally, whole-life insurance policies offer a guaranteed death benefit, ensuring that the insured's family receives a payout upon their death, regardless of when it occurs. This can provide peace of mind and financial security for families, especially those reliant on the income of a single person.

However, it is important to note that whole-life insurance also has significantly higher costs compared to term life insurance. The premiums for whole-life insurance are generally higher, and the cash value component may take years or even decades to build up significant value. As a result, some individuals may find the policy too expensive, especially if they are already in their mid-40s or older when purchasing it.

Despite the potential drawbacks, whole-life insurance agents can benefit significantly from selling these policies due to the high commission rates and the opportunity to market it as a valuable investment and financial security product.

Life Insurance and Veteran Suicide: What Families Need to Know

You may want to see also

Frequently asked questions

Life insurance salespeople are often considered pushy due to the nature of the product they are selling. Many people are closed-minded about life insurance because they believe it is expensive, intangible, and morbid. As a result, agents may adopt aggressive sales tactics to overcome customer resistance and meet their sales targets.

People often associate life insurance with high costs, even though term life insurance can be quite affordable. Additionally, it is something that people typically don't think about until they are older, as it is not a tangible product.

One common misconception is that life insurance is only for the breadwinner or those with financial dependents. However, life insurance is designed for anyone who wants to provide financial support to loved ones after their death.

The life insurance industry has not always done itself favors with its sales practices. Misinformation, complex terminology, and miss-selling of "cash value" life insurance have contributed to a negative perception of insurance agents.

When considering life insurance, it is important to do your own research and understand your personal needs. Find a trustworthy agent who is willing to listen and explain the different types of life insurance without using aggressive sales tactics.