Supplemental life insurance is an additional layer of financial protection that complements a primary life insurance policy. It provides extra coverage beyond the basic benefits offered by the main policy, offering policyholders and their beneficiaries additional financial support in the event of the insured's death. This type of insurance is designed to enhance the financial security of individuals and families, ensuring that their loved ones are protected even if the primary insurance falls short. The coverage provided by supplemental life insurance can vary, but it typically includes death benefits, which are paid out as a lump sum or in installments to the designated beneficiaries upon the insured's passing. This extra layer of security can be particularly valuable for those with significant financial responsibilities or dependents, ensuring that their loved ones have the necessary financial resources to maintain their standard of living and cover essential expenses during a difficult time.

| Characteristics | Values |

|---|---|

| Definition | Supplemental life insurance is an additional insurance policy that provides extra coverage beyond the basic life insurance policy. It is designed to supplement the existing coverage and provide additional financial protection for beneficiaries. |

| Purpose | The primary purpose is to offer additional financial security to individuals and their families. It helps ensure that loved ones have sufficient financial resources in the event of the insured's death. |

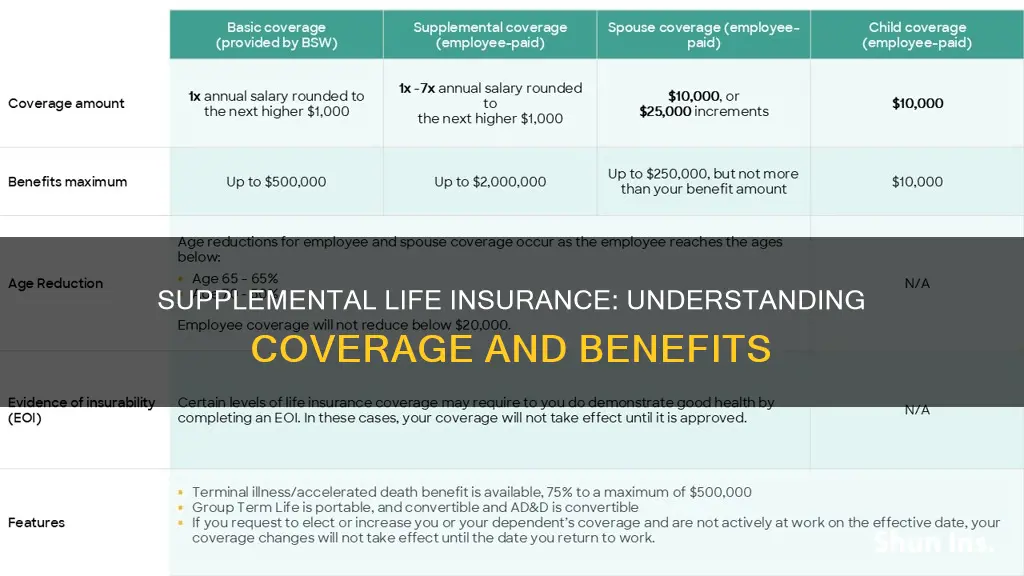

| Coverage Amount | The coverage amount can vary depending on the policy and the insurance company. It often ranges from a few thousand to several hundred thousand dollars, depending on the insured's needs and the policy's terms. |

| Benefits | - Provides additional financial support to beneficiaries. - Can be tailored to fit specific needs and budgets. - Often offers faster and more straightforward claims processing compared to standard life insurance policies. |

| Policy Types | - Term Life Insurance: Provides coverage for a specified term, such as 10, 20, or 30 years. - Permanent Life Insurance: Offers lifelong coverage and includes a cash value component that can accumulate over time. |

| Eligibility Criteria | Typically, employees or members of certain groups (e.g., unions, associations) are eligible for supplemental life insurance. The criteria may vary depending on the offering employer or organization. |

| Cost | The cost is usually a percentage of the basic life insurance premium. It can be more affordable due to group rates and simplified underwriting processes. |

| underwriting | The underwriting process is often simplified, focusing on the insured's health and lifestyle. This can result in quicker approval and potentially lower premiums. |

| Tax Implications | In some cases, the death benefit of supplemental life insurance may be taxable. However, the tax treatment can vary, and it's essential to consult with a financial advisor for specific tax implications. |

| Exclusions | Like any insurance policy, there may be certain exclusions and limitations. These can include pre-existing conditions, high-risk activities, or specific causes of death that are not covered. |

What You'll Learn

- Supplemental life insurance provides additional coverage beyond basic policies

- It covers accidental death, natural causes, and terminal illnesses

- Benefits are paid out as a lump sum to beneficiaries

- Coverage can be tailored to individual needs and preferences

- It offers financial security for dependents in the event of death

Supplemental life insurance provides additional coverage beyond basic policies

Supplemental life insurance is a type of policy that offers additional coverage to complement an individual's existing life insurance. It is designed to provide extra financial protection and benefits that go beyond the standard coverage provided by a basic life insurance policy. This type of insurance is often sought by those who want to ensure their loved ones are adequately protected in the event of their passing, especially if the primary life insurance coverage seems insufficient.

The primary purpose of supplemental life insurance is to bridge the gap between the desired level of coverage and the existing policy's limits. For instance, an individual might have a basic life insurance policy that provides a certain amount of coverage, but they may feel this is not enough to secure their family's financial future. Supplemental insurance then acts as an add-on, providing an extra layer of financial security. This can be particularly important for families with significant financial obligations or those with high-income earners who wish to ensure their dependents are taken care of.

This additional coverage can take various forms, such as an increased death benefit, accelerated death benefits, or an option to convert the policy to a whole life insurance policy at a later date. For example, it might offer a higher payout in the event of the insured's death, providing more financial support to the beneficiaries. It could also include features like waiver of premium, which means the policyholder doesn't have to pay premiums if they become unable to work due to illness or injury.

One of the key advantages of supplemental life insurance is its flexibility. Policyholders can often customize the coverage to suit their specific needs. This might include choosing the amount of coverage, the duration of the policy, and the beneficiaries. Additionally, some policies offer the option to increase the coverage amount over time, ensuring that the insurance keeps pace with the policyholder's changing financial circumstances.

In summary, supplemental life insurance is a valuable tool for individuals who want to enhance their existing life insurance coverage. It provides an extra layer of financial protection, ensuring that beneficiaries receive the necessary support in the event of the insured's passing. With its customizable features, this type of insurance allows people to tailor their coverage to their unique circumstances, providing peace of mind and financial security.

Real Life Insurance: Making Money by Protecting Lives

You may want to see also

It covers accidental death, natural causes, and terminal illnesses

Supplemental life insurance is an additional layer of coverage that provides financial protection beyond a primary life insurance policy. It is designed to offer extra benefits and coverage options to individuals, often as a complement to their existing life insurance. This type of insurance is particularly valuable for those seeking to enhance their financial security and ensure their loved ones are protected in various life circumstances.

When it comes to the coverage provided, supplemental life insurance typically includes several key aspects. Firstly, it covers accidental death, which means that if the insured individual dies as a result of an accident, the policy will provide a death benefit to the designated beneficiaries. This coverage is especially important for those with active lifestyles or professions that may involve higher risks, such as athletes, military personnel, or those working in hazardous environments.

Secondly, natural causes are also included in the coverage. This means that if the insured person passes away due to a natural illness or disease, the policy will pay out the death benefit. Natural causes can include conditions like heart disease, cancer, or other chronic illnesses that develop over time. Having this coverage ensures that individuals and their families are financially protected even in the face of terminal illnesses.

Lastly, supplemental life insurance covers terminal illnesses. A terminal illness is a serious medical condition that is expected to result in death within a specific period, often within a year or less. This coverage is crucial as it provides financial support during the challenging times leading up to the insured individual's passing. It allows for the allocation of funds to cover expenses, such as medical bills, funeral costs, and any outstanding debts, ensuring that the family can focus on their well-being and emotional support during this difficult period.

In summary, supplemental life insurance offers an additional layer of financial protection by covering accidental death, natural causes, and terminal illnesses. It provides peace of mind, knowing that individuals and their families will receive financial support in various life-changing events. This type of insurance is a valuable addition to any comprehensive financial plan, especially for those seeking to ensure their loved ones' financial security.

Employers' Life Insurance: Term or Whole?

You may want to see also

Benefits are paid out as a lump sum to beneficiaries

Supplemental life insurance is a type of policy that provides an additional layer of financial protection beyond a standard life insurance policy. It is designed to offer extra coverage to individuals who may have gaps in their existing insurance coverage or those who want to ensure their loved ones are financially secure in the event of their passing. One of the key features of supplemental life insurance is that the benefits are paid out as a lump sum to the designated beneficiaries. This lump-sum payment can be a significant financial advantage for the recipients, providing them with a substantial amount of money to cover various expenses and financial obligations.

When an individual purchases supplemental life insurance, they typically choose the amount of coverage they desire, which is often a percentage of their standard life insurance policy. This additional coverage can be particularly useful for those with high-risk occupations, individuals with pre-existing health conditions, or anyone looking to supplement their existing life insurance. The lump-sum payment from supplemental insurance can be used for a wide range of purposes, such as paying off debts, covering funeral expenses, providing education funds for children, or simply ensuring financial stability for the family during a difficult time.

The process of receiving the lump sum is straightforward. Upon the insured individual's passing, the beneficiary(ies) submit a claim to the insurance company, providing the necessary documentation to prove the death. The insurance company then reviews the claim and, if approved, processes the payment. This payment is typically tax-free and can be a vital source of financial support for the beneficiaries, especially if the primary life insurance policy has a lower death benefit or no additional coverage.

It is essential to understand the terms and conditions of the supplemental life insurance policy, including any exclusions or limitations. Some policies may have specific requirements for the beneficiary, such as being a spouse or dependent, and may also have restrictions on the age of the insured or the maximum coverage amount. Additionally, the lump-sum payment might be subject to income tax, and the tax implications can vary depending on the jurisdiction and the individual's circumstances.

In summary, supplemental life insurance provides an extra layer of financial security by offering a lump-sum benefit to beneficiaries. This type of insurance is valuable for individuals who want to ensure their loved ones are protected financially beyond what a standard life insurance policy offers. Understanding the terms, benefits, and potential tax implications is crucial for making informed decisions about supplemental life insurance coverage.

Understanding Standard Life Insurance Policies: A Guide

You may want to see also

Coverage can be tailored to individual needs and preferences

Supplemental life insurance is a type of policy that provides additional coverage beyond the basic life insurance policy. It is designed to offer extra financial protection to individuals and their families, ensuring that their loved ones are financially secure in the event of their passing. One of the key advantages of supplemental life insurance is the flexibility it offers in terms of coverage customization.

When it comes to tailoring coverage, supplemental life insurance policies can be adjusted to meet specific needs and preferences. This customization allows individuals to ensure that their loved ones receive the necessary financial support during a challenging time. For example, policyholders can choose the amount of coverage they desire, which can vary depending on their financial goals and the level of protection they wish to provide. Higher coverage amounts can be selected for those with larger families or significant financial responsibilities, ensuring that their dependents are adequately cared for.

Additionally, supplemental life insurance often provides various coverage options, such as term life, whole life, or universal life. Term life insurance offers coverage for a specified period, which can be particularly useful for those seeking temporary financial protection. Whole life insurance provides lifelong coverage and includes an investment component, allowing the policy to accumulate cash value over time. Universal life insurance offers flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage as their needs change.

The customization options in supplemental life insurance also extend to the inclusion of additional benefits. These benefits can provide extra financial support and peace of mind. For instance, some policies may offer an accelerated death benefit, allowing the policyholder to access a portion of the death benefit if they are diagnosed with a terminal illness, providing immediate financial assistance. Other features might include waiver of premium, which ensures that policy payments are waived if the insured becomes disabled, and critical illness coverage, offering financial support if the insured is diagnosed with a critical illness.

By tailoring the coverage, individuals can ensure that their supplemental life insurance policy aligns perfectly with their unique circumstances and requirements. This level of customization empowers policyholders to make informed decisions, providing the necessary financial security for their loved ones while also considering their personal financial goals and preferences. It is a valuable tool for those seeking to enhance their life insurance coverage and create a comprehensive financial protection plan.

Hashimoto's Thyroiditis: Life Insurance Considerations and Impacts

You may want to see also

It offers financial security for dependents in the event of death

Supplemental life insurance is a type of policy designed to provide additional financial protection beyond what is typically offered by a standard life insurance policy. It is often considered a valuable addition to an individual's insurance portfolio, especially for those who want to ensure their loved ones are financially secure in the event of their passing. This type of insurance is particularly beneficial for individuals who have a higher risk profile or those with specific financial goals, such as providing for a family's long-term needs.

The primary purpose of supplemental life insurance is to offer financial security to the policyholder's dependents, including spouse, children, or other family members who rely on the insured individual's income. When the insured person dies, the supplemental policy pays out a death benefit, which can be used to cover various expenses and provide financial stability for the family. These expenses may include mortgage or rent payments, education costs for children, daily living expenses, and other financial obligations that the family might have.

One of the key advantages of supplemental life insurance is its flexibility. Policyholders can often customize the coverage to fit their specific needs. This customization allows individuals to determine the amount of death benefit they want to provide for their dependents. For instance, a policyholder might choose a higher death benefit to cover more significant expenses or to ensure that the family's standard of living remains unchanged. Additionally, some policies offer the option to increase the coverage amount over time, reflecting the changing financial needs of the family.

Another important aspect of supplemental life insurance is its affordability. It is typically designed to be a cost-effective way to secure financial protection. The premiums for this type of insurance are often lower compared to standard life insurance policies, making it accessible to a broader range of individuals. This affordability factor allows people to provide an essential safety net for their loved ones without incurring significant financial strain.

In summary, supplemental life insurance is a valuable tool for individuals who want to ensure their family's financial security in the event of their death. It offers a customizable and affordable way to provide a death benefit, covering various expenses and obligations that dependents might have. By securing this type of insurance, individuals can have peace of mind, knowing that their loved ones will be taken care of, even if they are no longer present.

Insuring Your Child's Future: Life Insurance Options for Parents

You may want to see also

Frequently asked questions

Supplemental life insurance, also known as accidental death and dismemberment (AD&D) insurance, is an additional layer of coverage that complements your primary life insurance policy. It provides extra financial protection beyond the basic benefits offered by your main policy. This type of insurance is designed to offer financial support to your beneficiaries in the event of your accidental death or certain dismembering injuries.

The primary difference lies in the coverage provided. Regular life insurance pays out a death benefit to your designated beneficiaries when you pass away, regardless of the cause. In contrast, supplemental life insurance focuses on accidental deaths and specific dismembering injuries. It provides an additional payout on top of your base policy, offering enhanced financial security for your loved ones.

Supplemental life insurance typically covers accidental death, which means it pays out if you die as a result of an accident, such as a car crash, falling from a height, or being involved in a violent incident. It may also cover certain dismembering injuries, which include the loss of a limb or the severing of a vital body part, such as the loss of a hand, foot, eye, or the severing of the spinal cord. The specific injuries covered can vary by policy, so it's essential to review the terms and conditions of your supplemental insurance.

Yes, like any insurance policy, supplemental life insurance has its exclusions and limitations. Common exclusions may include deaths resulting from pre-existing medical conditions, suicide (often within a specific period after taking out the policy), and certain high-risk activities like skydiving or scuba diving. It's crucial to understand the policy's terms to know what is and isn't covered. Additionally, the amount of coverage provided by supplemental insurance is usually a percentage of your primary life insurance policy, so it's essential to assess your overall insurance needs before opting for supplemental coverage.