When replacing existing life insurance, an agent must carefully consider several key factors to ensure the client's needs are met. This involves a comprehensive assessment of the client's current policy, financial situation, and future goals. The agent should evaluate the policy's coverage, term, and any potential gaps in protection. Additionally, they must consider the client's age, health, and lifestyle to determine the most suitable replacement policy. The agent should also provide clear explanations of the new policy's terms, benefits, and any associated costs to ensure the client fully understands their decision.

| Characteristics | Values |

|---|---|

| Regulatory Compliance | Agents must adhere to insurance regulations and industry standards when replacing existing policies. This includes disclosing all relevant information to the client and ensuring the new policy meets legal requirements. |

| Client Assessment | Conduct a thorough review of the client's current financial situation, health, and insurance needs. This involves understanding the client's goals, risk tolerance, and any changes in their circumstances that may impact their insurance requirements. |

| Policy Comparison | Compare the new policy with the existing one to ensure it provides adequate coverage. This includes evaluating the policy's benefits, coverage limits, premiums, and any additional features or riders. |

| Transparency | Provide clear and transparent communication throughout the process. Explain the reasons for replacing the policy, the benefits of the new one, and any potential drawbacks or limitations. |

| Client Consent | Obtain the client's informed consent before finalizing the replacement. Ensure they understand the changes, implications, and any associated costs. |

| Documentation | Maintain detailed records of the replacement process, including all communications, assessments, and policy documents. This documentation should be stored securely and be accessible to the client and regulatory authorities if needed. |

| Ethical Considerations | Act in the best interest of the client, avoiding conflicts of interest. Avoid pushing unnecessary or unsuitable products and provide recommendations based on the client's best interests. |

| Regular Review | Schedule periodic reviews of the new policy to ensure it remains appropriate and relevant. This is especially important if the client's circumstances change significantly. |

What You'll Learn

- Assess Current Policy: Evaluate existing policy coverage, terms, and beneficiaries

- Understand Client Needs: Determine client's financial goals, health, and lifestyle for new plan

- Compare Options: Research and compare different insurance providers and policies

- Provide Recommendations: Offer tailored suggestions based on client's needs and budget

- Facilitate Application: Guide clients through the application process, ensuring accuracy and completeness

Assess Current Policy: Evaluate existing policy coverage, terms, and beneficiaries

When an insurance agent is tasked with replacing an existing life insurance policy, a crucial step is to thoroughly assess the current policy in place. This evaluation is essential to ensure that the new policy meets the client's needs and provides adequate coverage. Here's a detailed breakdown of what an agent must do during this assessment:

Review Policy Documents: The first step is to gather and examine all relevant documents related to the existing life insurance policy. These documents typically include the policy contract, rider forms, and any endorsements. By studying these, the agent can understand the policy's terms, conditions, and any specific provisions or exclusions. It is important to identify the policy's coverage amount, death benefit, and any additional benefits or riders that may be included.

Analyze Coverage and Terms: Assess the current policy's coverage by examining the death benefit amount. Determine if it aligns with the client's financial goals and obligations, such as covering mortgage payments, children's education, or other dependent expenses. Evaluate the policy's term, which is the duration for which the coverage is in effect. Longer terms provide more extended protection, but they may also be more expensive. Check for any conversion options that allow the policy to be changed to a permanent life insurance product later on.

Identify Policy Gaps and Strengths: During this evaluation, identify any gaps in coverage that the existing policy might have. For instance, if the current policy has a lower death benefit than the client's needs, this could be a gap to address. Conversely, look for any unique strengths or benefits that the policy offers, such as an accelerated death benefit or a waiver of premium provision. Understanding these aspects will help in comparing and contrasting with potential new policies.

Beneficiary Information: Reviewing the policy's beneficiary provisions is vital. Ensure that the beneficiaries named in the policy are still appropriate and up-to-date. Life events like marriages, births, or deaths may require changes to the beneficiary list. It is the agent's responsibility to verify and update this information to ensure a smooth transfer of the death benefit to the intended recipients.

By completing this assessment, an insurance agent can provide an informed recommendation for a new policy that complements the existing one or addresses any identified shortcomings. This process ensures that the client receives the best possible coverage to meet their needs and provides a comprehensive understanding of the current policy's strengths and weaknesses.

Assessing Life Insurance: Calculating Risk of Death

You may want to see also

Understand Client Needs: Determine client's financial goals, health, and lifestyle for new plan

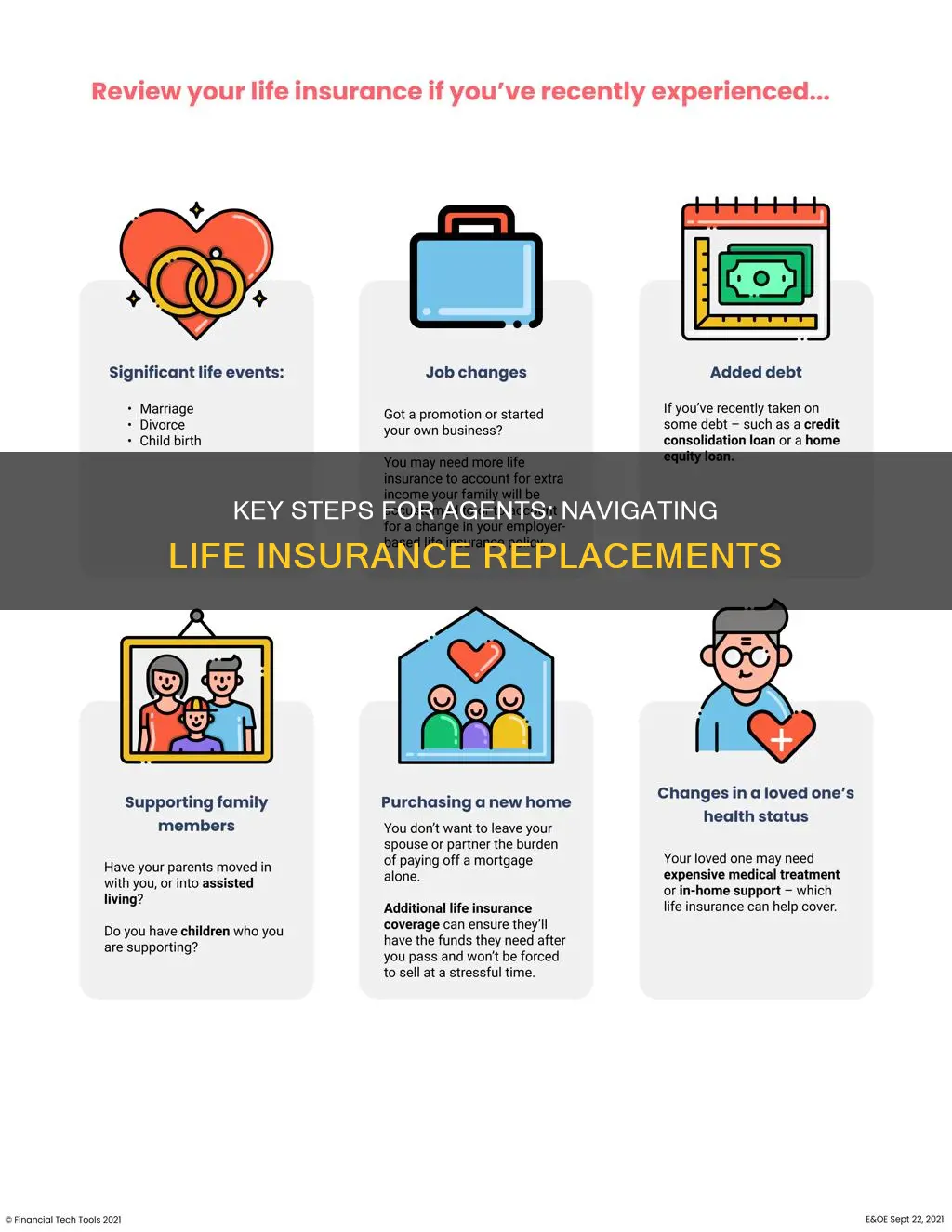

When replacing an existing life insurance policy, it is crucial for an agent to thoroughly understand the client's needs and circumstances. This involves a comprehensive assessment of the client's financial goals, health status, and lifestyle choices. By gathering this information, the agent can ensure that the new policy is tailored to the client's specific requirements, providing adequate coverage and peace of mind.

Financial goals are a fundamental aspect of the decision-making process. Agents should inquire about the client's short-term and long-term financial objectives, such as saving for children's education, paying off a mortgage, or funding retirement. Understanding these goals helps in determining the appropriate death benefit and policy term to meet the client's financial needs. For instance, a client aiming to secure their family's financial future might require a higher death benefit and a longer policy term to cover potential long-term expenses.

Health and lifestyle factors play a significant role in life insurance underwriting. Agents must assess the client's overall health, including any pre-existing medical conditions, medications, and recent health screenings. This information is vital as it directly impacts the client's insurability and premium rates. For example, a client with a history of chronic illness may require a more comprehensive medical examination and potentially higher premiums. Additionally, lifestyle choices such as smoking, excessive alcohol consumption, or dangerous hobbies can influence the insurance company's assessment of risk and, consequently, the policy terms and costs.

Lifestyle assessments also extend to the client's daily routines, employment, and hobbies. Agents should consider factors like occupation-related risks, commuting habits, and recreational activities. For instance, a high-risk occupation or a dangerous hobby might lead to higher premiums or specific policy exclusions. By gathering this data, agents can provide accurate advice and recommendations, ensuring the client's new life insurance policy aligns with their unique circumstances.

In summary, understanding the client's financial goals, health, and lifestyle is essential when replacing existing life insurance. This comprehensive approach allows agents to offer tailored solutions, ensuring the new policy meets the client's needs and provides the necessary protection. It also enables agents to navigate the complexities of life insurance underwriting, ultimately delivering a successful outcome for both the client and the insurance provider.

Pilot's Guide: Top Life Insurance Options Explored

You may want to see also

Compare Options: Research and compare different insurance providers and policies

When it comes to replacing an existing life insurance policy, it's crucial to thoroughly research and compare various insurance providers and their offerings. This process ensures that you make an informed decision and select the best policy to meet your needs. Here's a step-by-step guide to help you navigate this important task:

- Understand Your Current Policy: Begin by reviewing your existing life insurance policy. Understand the coverage, benefits, and any specific terms and conditions. Take note of the policy's duration, the amount of coverage, and any exclusions or limitations. This knowledge will help you identify the gaps or improvements you want to make.

- Assess Your Current Needs: Evaluate your current financial situation, family circumstances, and future goals. Consider factors such as income replacement, debt obligations, mortgage payments, or any specific needs that your beneficiaries should be covered for. This self-assessment will guide you in determining the appropriate level of coverage you require.

- Research Insurance Providers: Start by researching reputable insurance companies that offer life insurance policies. Look for providers with a strong financial rating, indicating their stability and ability to honor their commitments. Online resources, customer reviews, and ratings can provide valuable insights into the experiences of other policyholders. Make a list of potential insurers to compare.

- Compare Policy Features: Once you have a list of insurance providers, carefully compare the features and benefits of their life insurance policies. Look for the following:

- Coverage Amount: Ensure that the policy offers sufficient coverage to meet your needs. Compare the death benefit amounts and consider any potential future increases.

- Policy Type: Decide between term life insurance (for a specific period) and permanent life insurance (with cash value accumulation). Understand the differences and choose based on your long-term financial goals.

- Premiums: Compare the monthly or annual premiums for each policy. Lower premiums might be appealing, but ensure that the coverage and terms are not compromised.

- Riders and Add-ons: Check for additional riders or add-ons that can provide extra benefits, such as accidental death coverage or critical illness insurance.

- Conversion Options: If you opt for a term policy, understand the conversion privilege, allowing you to convert it to permanent insurance later.

- Evaluate Customer Service and Support: Consider the reputation of the insurance provider for customer service. Prompt and efficient support is essential when dealing with insurance claims and policy changes. Look for companies with a history of positive customer feedback and quick response times.

- Review Policy Terms and Conditions: Pay close attention to the fine print of each policy. Understand the terms regarding policy cancellations, surrender charges (if applicable), and any restrictions or limitations. Ensure that the policy aligns with your expectations and provides clear guidelines for policyholders.

- Seek Professional Advice: If you feel overwhelmed or unsure, consult a licensed insurance agent or financial advisor. They can provide personalized recommendations based on your unique circumstances. An agent can also assist in understanding the complexities of different policies and help you navigate the decision-making process.

By following these steps, you can make a well-informed decision when replacing your existing life insurance policy, ensuring that you receive the best coverage and value for your money.

Life Insurance Proceeds: Taxable to an S Corporation?

You may want to see also

Provide Recommendations: Offer tailored suggestions based on client's needs and budget

When it comes to replacing existing life insurance, an agent must provide tailored recommendations that align with the client's unique needs and budget. Here are some detailed suggestions to guide the process:

Assess Current Coverage: Begin by evaluating the client's existing life insurance policy. Understand the coverage amount, term, and any additional benefits or riders. Identify any gaps or limitations in the current policy that may not adequately meet the client's current or future needs. This assessment forms the basis for making informed recommendations.

Analyze Financial Situation: Consider the client's financial circumstances, including income, assets, and liabilities. Determine their risk tolerance and financial goals. For instance, a young, healthy individual with a growing family might require more comprehensive coverage to secure their loved ones' financial future. In contrast, an older individual with a substantial nest egg might opt for a more conservative approach, focusing on cost-effectiveness.

Offer Customized Options: Based on the analysis, present the client with tailored options. For instance, suggest increasing the coverage amount if the client's family size has grown or if there are significant financial obligations to consider. Alternatively, recommend converting a term life policy to a permanent life insurance plan if the client desires lifelong coverage. Provide clear explanations of the benefits and potential drawbacks of each option.

Consider Cost-Effective Strategies: Help the client balance their need for coverage with their budget constraints. For example, suggest increasing the policy term if the client is comfortable with a longer-term commitment, as this can often result in lower monthly premiums. Additionally, explore the option of adding riders or taking out additional policies to enhance coverage without significantly increasing costs.

Review and Compare Quotes: Obtain quotes from multiple insurance providers to ensure competitive pricing. Present these quotes to the client, highlighting any differences in coverage, exclusions, and premiums. This transparency empowers the client to make an informed decision, ensuring they receive the best value for their money.

By offering these tailored suggestions, an agent can ensure that the client's new life insurance policy meets their specific requirements while also being financially viable. This approach demonstrates a client-centric mindset, fostering trust and long-term satisfaction.

Canada Life Insurance: Is It Worth the Hype?

You may want to see also

Facilitate Application: Guide clients through the application process, ensuring accuracy and completeness

When an insurance agent is replacing an existing life insurance policy, it's crucial to guide clients through the application process meticulously to ensure accuracy and completeness. This is a critical step to avoid any potential issues during the underwriting process and to ensure the client receives the coverage they need. Here's a step-by-step guide to facilitate the application process:

- Understand the Client's Current Policy: Begin by gathering all the necessary information about the client's existing life insurance policy. This includes policy details such as the type of coverage (term, whole life, universal life), the death benefit amount, the policy term, and any riders or additional benefits. Understanding the current policy will help you identify any unique circumstances or changes that need to be addressed in the new policy.

- Gather Required Documentation: Compile a list of documents that the client will need to provide. This typically includes proof of identity (e.g., driver's license, passport), recent bank statements or tax returns, medical records or health history, and any other relevant financial or health-related documents. Ensure that you explain to the client why each document is necessary and how it will impact the application process.

- Explain the Application Process: Provide a clear and detailed explanation of the application process to the client. Outline the steps involved, including filling out the application form, providing supporting documents, and undergoing a medical examination if required. Address any potential concerns or questions the client might have about the process. It's essential to set clear expectations and ensure the client understands their role in the process.

- Facilitate the Application: Guide the client through the application form, ensuring that all sections are accurately completed. Double-check for any missing information and prompt the client to provide the necessary details. If the client is uncomfortable with certain aspects of the application, offer to assist or provide resources to help them understand and complete the form. Ensure that all information provided is truthful and up-to-date.

- Review and Verify: After the client has submitted the application, thoroughly review the entire package. Verify that all required documents are included and that the information provided is accurate and consistent. Pay close attention to any health-related details, as these can significantly impact the underwriting process. If any discrepancies or missing information is found, promptly contact the client to address the issues.

- Provide Ongoing Support: Throughout the application process, maintain open communication with the client. Keep them informed about the progress and any additional steps required. Offer assistance with any follow-up actions, such as scheduling a medical exam or providing additional documentation. Regular updates will ensure the client feels supported and understood, fostering a positive relationship.

By following these steps, insurance agents can ensure that the application process for replacing existing life insurance is smooth, efficient, and accurate, ultimately benefiting both the client and the insurance company. It is a critical aspect of providing excellent customer service and ensuring the client receives the appropriate coverage.

Finding Life Insurance: Mortgage Payoff Notices Explained

You may want to see also

Frequently asked questions

When an agent is assisting a client with replacing existing life insurance, they should first understand the client's current coverage, including the policy type, term, and any potential gaps in coverage. It's crucial to assess the client's current financial situation, health, and lifestyle to determine the appropriate new policy. The agent should also consider the client's long-term goals and ensure the new policy aligns with their needs.

Determining the right coverage amount involves analyzing the client's financial obligations, such as outstanding debts, mortgage, or any future financial commitments. The agent should also consider the client's income, assets, and the number of dependents. A thorough review of the client's financial plan will help in recommending an appropriate death benefit that provides adequate financial security for the client's loved ones.

Yes, agents must adhere to industry regulations and guidelines set by insurance regulatory bodies. These rules ensure fair practices and protect consumers. Agents should provide transparent information about the new policy's terms, conditions, and any potential exclusions. They should also disclose any fees or commissions associated with the replacement policy and obtain the client's informed consent before making any changes to their existing coverage.