Voluntary life insurance is a type of life insurance policy that is offered by employers as an optional benefit to their employees. It provides a death benefit to a beneficiary upon the death of the insured employee. The employee is responsible for paying the monthly premiums, usually through payroll deductions, in exchange for the insurer's guarantee of payment upon their death. This type of insurance is typically less expensive than individual life insurance policies due to employer sponsorship and group rates. However, it may not carry over when an employee leaves the company, resulting in a potential gap in coverage. Understanding the pros and cons of voluntary life insurance is essential before deciding whether to opt for this benefit or explore other insurance options.

What You'll Learn

Voluntary life insurance is a benefit offered by employers

With voluntary life insurance, employees have the opportunity to purchase the amount of insurance they need at a group rate, which is typically much lower than the premiums for individual life insurance policies. The premiums are often deducted directly from the employee's paycheck, making it convenient and ensuring timely payment. This type of insurance is usually available to employees immediately upon hiring or shortly thereafter.

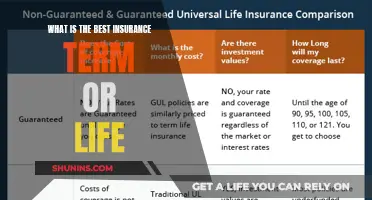

There are two main types of voluntary life insurance: voluntary whole life and voluntary term life insurance. Voluntary whole life insurance provides coverage for the entire life of the insured, while voluntary term life insurance offers protection for a limited period, such as 10, 20, or 30 years. Voluntary term life insurance is also known as group term life insurance.

The coverage amounts for voluntary life insurance are typically multiples of the employee's salary, and there may be coverage limits lower than what would be available in an individual policy. Employees can also purchase additional coverage for their spouses, domestic partners, or dependents, as defined by the insurance company.

One of the advantages of voluntary life insurance is its portability. In most cases, employees can continue their life insurance coverage after leaving their employer, although they will be responsible for paying the premiums directly to the insurance company.

Voluntary life insurance is a valuable benefit offered by employers, providing employees with affordable and convenient access to life insurance protection for themselves and their loved ones.

Navy Federal Credit Union: Life Insurance Options Explored

You may want to see also

It is a type of term life insurance

Voluntary life insurance is a type of term life insurance that is offered by employers as an optional benefit to their employees. Term life insurance is a type of life insurance policy that has a specified end date, such as 20 years from the start date. It guarantees a death benefit to the policyholder's beneficiaries if the insured person dies during the specified term. The death benefit is a lump-sum payment or annuity that is paid out to the beneficiaries, which can be used to settle healthcare and funeral costs, consumer debt, mortgage debt, or other expenses.

Voluntary term life insurance differs from standard term life insurance in that it is offered through employers and provides employees with the opportunity to purchase the amount of insurance they need at a group rate. The size of a voluntary life insurance policy can be extremely high, sometimes exceeding one million dollars, and it does not require answering standard health questions to receive coverage. This type of insurance is also less expensive than individual life insurance policies due to employer sponsorship, making it an attractive option for employees.

Voluntary term life insurance policies have a limited coverage period, such as 10, 20, or 30 years. During this period, the insurance provider guarantees payment of the death benefit to a named beneficiary upon the death of the insured. The employee is responsible for paying the monthly premiums, which are often deducted directly from their salary, making it convenient and ensuring timely payment.

Voluntary term life insurance policies do not accumulate cash value, and as a result, the premiums are less expensive than their whole life insurance equivalents. Premiums during the policy term are level but can increase upon renewal. This type of insurance is ideal for people who want substantial coverage at a low cost and may be a good option for employees who want to ensure their loved ones are protected in the event of their untimely death.

Thrivent's Whole Life Insurance: Is It Worth the Investment?

You may want to see also

It is paid for by a monthly premium

Voluntary life insurance is a type of life insurance that is offered by employers as an optional benefit to their employees. It is typically much cheaper than individual life insurance policies, as employer sponsorship brings down the cost of premiums. The employee is responsible for paying the monthly premium, usually in the form of a payroll deduction, and in exchange, the insurance provider will pay out a death benefit to a named beneficiary when the insured passes away.

The amount of coverage provided by voluntary life insurance is usually in multiples of the employee's salary or stated values, such as $20,000, $50,000, or $100,000. This type of insurance is available to employees immediately upon hiring or shortly thereafter, and employees who opt out may be able to enrol during the next open enrolment period or after a major life event, such as marriage or the birth of a child.

The convenience of paying premiums through payroll deductions ensures timely payment and eliminates the need for employees to remember to pay bills. Additionally, the lower cost of premiums makes voluntary life insurance an attractive option for those seeking additional coverage on top of their individual policies. However, it is important to note that voluntary life insurance typically does not carry over when an employee leaves the company, and conversion fees to individual policies can be prohibitive.

Voluntary life insurance is a valuable benefit offered by employers, providing financial protection and peace of mind for employees and their loved ones. The convenience and affordability of this type of insurance make it a worthwhile consideration for those seeking additional coverage or facing challenges in obtaining private policies due to health conditions.

Suicid and Life Insurance: What's the Verdict?

You may want to see also

Coverage ceases upon termination of employment

Voluntary life insurance is a benefit that employers can offer their employees. It is a type of life insurance policy that offers a death benefit to beneficiaries when the policyholder passes away. The employee is responsible for paying the monthly premiums on this type of insurance policy.

Voluntary life insurance coverage ceases upon termination of employment. This means that if an employee is no longer working for the company, they will lose their voluntary life insurance coverage. This can be a significant disadvantage, especially if the employee is unable to find new insurance at a reasonable rate due to their age or health status.

To avoid a gap in coverage, some individuals may choose to continue paying for their voluntary life insurance coverage on their own after leaving their employer. This option is known as "porting" the policy and is typically allowed for a period of 30 to 60 days after termination. However, it is important to note that the premiums may be higher than what the employee was previously paying through their employer.

Another option for employees who wish to retain their coverage is to convert their voluntary life insurance policy into a new individual policy. This option is also likely to result in higher premiums, and it may be more cost-effective for younger, healthier individuals to purchase a new policy directly from an insurance company.

The decision to continue or convert voluntary life insurance coverage after leaving a job depends on various factors, including age, health status, and the specifics of the policy. It is essential to carefully review the guidelines provided by the employer and consult a reputable insurance agent to make an informed decision.

Overall, while voluntary life insurance can be a valuable benefit offered by employers, it is important to be aware of the limitations, such as the loss of coverage upon termination of employment.

GSK Retirement Benefits: Life Insurance Coverage Explained

You may want to see also

It is usually less expensive than individual life insurance

Voluntary life insurance is usually less expensive than individual life insurance policies. This is primarily due to employer sponsorship, which brings down the cost of premiums.

Voluntary life insurance is a benefit offered by employers to their employees, who are responsible for paying the monthly premiums. The insurance provider pays out a death benefit to a named beneficiary when the insured passes away. The premiums for voluntary life insurance are considerably less expensive than those for individual life insurance policies. This is because employer sponsorship drives down the cost of premiums.

Voluntary life insurance is typically offered in multiples of the employee's salary, rather than arbitrary amounts. For example, if an employee earns $40,000 a year, they can purchase voluntary life insurance in increments of 40, 80, or 120 thousand dollars. Voluntary life insurance is usually cheaper for amounts under $50,000, whereas term life insurance policies are more affordable for higher values.

Another factor contributing to the lower cost of voluntary life insurance is the convenience of payroll deductions for premium payments. Most employers offer the option to deduct premiums directly from the employee's salary, eliminating the need for the employee to remember to pay the bill. This also ensures timely and effortless payment of premiums.

Additionally, voluntary life insurance policies often do not require a medical exam, making them more accessible to individuals with pre-existing health conditions. The absence of a medical exam contributes to keeping the premiums lower compared to individual life insurance policies.

It is important to note that while voluntary life insurance is generally less expensive, it may not offer the same level of coverage and flexibility as individual life insurance policies. The coverage amounts for voluntary life insurance are typically limited and may not meet all the individual's life insurance needs.

Essential Life Insurance: Cash Surrender Value Explained

You may want to see also

Frequently asked questions

Voluntary life insurance is a type of life insurance policy that is offered by employers as an optional benefit to their employees. It offers a death benefit to beneficiaries when the policyholder passes away. The employee is responsible for paying the monthly premiums.

Voluntary life insurance is offered by employers, which brings down the cost of premiums. The employee pays a monthly premium in exchange for the insurer's guarantee of payment upon the insured's death. The benefit is typically paid to a named beneficiary.

There are two main types of voluntary life insurance: voluntary whole life and voluntary term life (also known as group term life insurance). Voluntary whole life insurance offers permanent coverage, while voluntary term life insurance provides coverage for a predetermined period.

Voluntary life insurance policies are usually tied to your employment. If you leave your job, your coverage may end. However, some policies offer portability, allowing you to continue the policy after termination. There may be additional paperwork and higher premiums associated with this option.