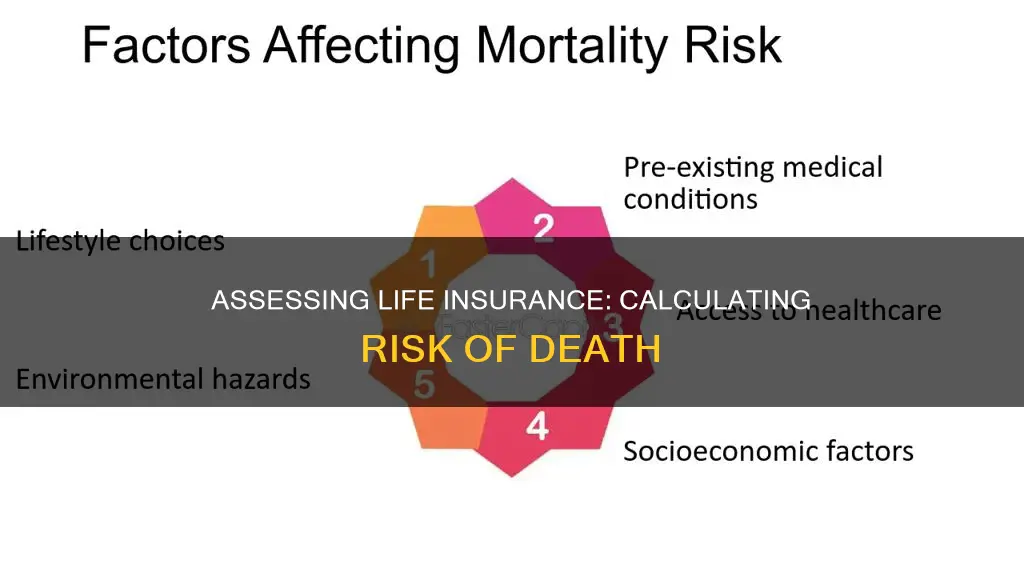

Assessing the risk of death for life insurance is a complex process that involves evaluating various factors to determine the likelihood of an individual's death during the policy period. This process, known as underwriting, helps insurance companies decide whether to accept or reject an applicant and set the premium cost. The primary factor considered is the individual's health, including pre-existing conditions and family medical history. Lifestyle choices, such as smoking or engaging in risky hobbies, also play a significant role. Age and gender influence premiums, with younger individuals and females often paying less due to their longer life expectancy. Additionally, the type of policy, death benefit amount, and riders (additional benefits) attached to the policy impact the cost. Insurance companies use statistical tools like valuation mortality tables to estimate death rates and set premiums accordingly.

| Characteristics | Values |

|---|---|

| Health & Family Medical History | A healthy person tends to have a lower premium compared to someone with pre-existing medical conditions. |

| Age | Younger people are less likely to develop serious health problems and are, therefore, more likely to get lower premiums. |

| Gender | Women tend to live longer than men and hence might have lower premiums. |

| Lifestyle | Smokers are likely to have a higher premium compared to non-smokers. |

| Occupation | If you work in a job that is inherently dangerous, your premium rate might be higher than average. |

| Education Status | Those who are undergraduates or above are more likely to get beneficial premium rates. |

| Credit Score | Insurers take your credit score into account during the risk assessment process, and it may affect your coverage amount. |

| Hobbies | Having risky hobbies could mean you pay higher life insurance rates or that you’re denied coverage altogether. |

What You'll Learn

Medical history

An individual's medical history is one of the most important factors when it comes to life insurance risk assessment. Insurance companies benefit the most when the policyholder reaches the end of their policy term. Thus, the healthier an individual is, the less risky they are to the insurer.

In general, a healthy person tends to have a lower premium compared to someone with pre-existing medical conditions, even when the life cover amount is the same. This is because the insurer is taking on greater risk by providing coverage for someone with health issues. Even if an individual has no current health issues, their family medical history may also lead to higher premiums. If their family is predisposed to certain medical problems, it is likely that they will eventually develop the same diseases, which increases the risk for the insurer.

When it comes to life insurance, the younger and healthier an individual is, the less of a risk they are to insurance companies, and hence they will be offered a lower premium for the same life cover amount. However, this does not mean that older individuals cannot get insured.

In the case of auto insurance, for example, an insurer may examine the age of the vehicle, the age of the driver, the driver's history, the amount of coverage requested, and the area in which the vehicle is operated. These factors, when taken together, create a profile of a specific type of driver, which can be used by actuaries to determine how drivers in this particular profile act.

For life insurance companies, risk classes are used to determine how likely the insurance company is to have to pay out benefits on behalf of the policyholder if they pass away. In terms of premium costs, a number of factors are used to determine which risk class an individual fits into. These can include whether they engage in risky hobbies or other potentially dangerous behaviours, such as substance or alcohol abuse.

When applying for a life insurance policy, the answers provided to health and lifestyle questions are taken into account by the agent, and an internal underwriting team will provide the most accurate risk class and quote possible. Depending on the type of policy being purchased, the individual may have to complete a paramedical exam in which blood and urine samples are collected.

The insurance risk class for life insurance isn't necessarily set in stone. It's possible to improve an individual's risk and potentially reduce their premium costs, though it usually requires some work. For example, if an individual has been quoted a standard plus rate for life insurance, it's possible that they could qualify for a preferred rate by losing weight to improve their BMI range.

An individual's medical history, along with their lifestyle habits, are considered during the underwriting process. Smokers are likely to have a higher premium compared to non-smokers due to the fact that regular smoking leads to numerous health problems later in life. However, smoking is not the only lifestyle choice that is considered risky for insurers. Some insurance companies also take an individual's current job into consideration. If they work in a job that is inherently dangerous, their premium rate might be higher than average.

Getting Your Life Insurance License in Nevada

You may want to see also

Lifestyle choices

Smoking and Tobacco Use

Smokers typically face higher life insurance premiums compared to non-smokers. Regular smoking is associated with numerous health problems and an increased risk of serious illnesses later in life, making it a significant factor in risk assessment. Insurers may test for the presence of nicotine during routine blood work and classify applicants as smokers, leading to higher premiums. Vaping is often viewed similarly to smoking by insurance companies and can result in higher rates.

Health and Medical History

Insurers are interested in an applicant's overall health status, including pre-existing medical conditions. Chronic health issues or serious illnesses can significantly impact premiums. The insurance company may review medical records, collect blood and urine samples for testing, or request a medical examination to assess the applicant's health. Certain conditions, such as cancer or a recent heart attack, could even result in the denial of coverage.

Family Medical History

In addition to an individual's health, insurance companies also consider the medical history of their immediate family. A strong family history of hereditary diseases or specific health problems can affect premiums. For example, if multiple family members have diabetes, the insurer may anticipate a higher risk of the applicant developing the same condition, leading to higher premiums.

Lifestyle Habits and Hobbies

Risky hobbies or dangerous activities can influence life insurance rates. Skydiving, race car driving, or other extreme sports may result in higher premiums or even denial of coverage. Any habits that increase the risk of health complications or death, such as drug use, will likely result in increased premiums or exclusion from coverage.

Occupation and Job-Related Risks

An applicant's current job can also impact their life insurance rates. Occupations that are inherently dangerous or pose safety risks may result in higher premiums to compensate for the extra risk. This includes jobs such as law enforcement officers, firefighters, or active military members.

Understanding Life Insurance: Calculating Cash Surrender Value

You may want to see also

Age

The older you are when you purchase a policy, the more expensive it will be. This is why it is recommended that you buy life insurance as soon as possible to get affordable premiums.

The maximum value of your life cover value depends on your 'Human Life Value' or HLV. Your HLV is calculated based on your current income. By extrapolating your current income to the point of retirement, the insurer is able to predict how much money you will earn over the course of your working life. This gives the insurance company a good idea of your potential net worth.

Those with a higher HLV will be able to get a higher life cover amount, as their family will require a greater sum to maintain their current standard of living if the insured person passes away.

Life Insurance Denial: What You Need to Know

You may want to see also

Gender

When it comes to assessing the risk of death for life insurance, gender is one of the key factors that insurance companies consider. Here are some detailed insights on how gender impacts the evaluation of risk:

Longevity and Life Expectancy

Mortality Rates and Risk Profiles

The difference in life expectancy between genders is influenced by various factors, including biological differences, social and cultural factors, and engagement in risky behaviours. These factors contribute to distinct risk profiles between genders. Actuarial tables, such as the Commissioners Standard Ordinary (CSO) mortality table, incorporate these gender-based differences in life expectancy and mortality rates. Insurance companies utilise these tables to assess the risk associated with insuring individuals of different genders.

Impact on Premium Costs

Due to the statistical differences in life expectancy and risk profiles between genders, insurance companies often offer varying premium costs based on gender. Females, with their longer life expectancy, tend to be considered a lower risk group. As a result, they typically pay lower premiums for life insurance compared to males. This gender-based variation in premiums is particularly evident in younger individuals, where the difference in life expectancy is more pronounced.

However, it is important to note that gender is not the sole determinant of risk assessment. Other factors, such as age, health status, family medical history, lifestyle choices, and occupation, also play a significant role in evaluating the risk of death for life insurance. Insurance companies consider a combination of these factors to determine the overall risk profile of an individual.

In conclusion, when assessing the risk of death for life insurance, insurance companies take into account gender as a significant factor. The differences in life expectancy and mortality rates between males and females directly influence the premium costs. However, it is essential to recognise that gender is just one aspect of a comprehensive risk assessment process that involves multiple variables to determine the likelihood of an individual filing a claim.

Life Insurance Payouts: Taxed in Canada?

You may want to see also

Occupation

When it comes to assessing the risk of death for life insurance, a person's occupation is a key factor. Certain jobs are considered high-risk due to the potential dangers and hazards associated with them. These occupations often involve working in unsafe environments, handling dangerous equipment or substances, or engaging in activities that increase the likelihood of injury or death.

- Active-duty military personnel, especially those deployed to high-risk areas or involved in combat operations.

- Law enforcement officers, including municipal police officers and those in specialised units such as SWAT teams.

- Firefighters, particularly those who engage in high-risk activities like smoke jumping or wildfire suppression.

- First responders, who often work in dangerous and unpredictable situations.

- Oil refinery workers, who are exposed to hazardous chemicals and flammable materials that pose health and safety risks.

- Ranchers and farm workers, who may work with heavy machinery and hazardous substances.

- Construction workers, as falls from heights and accidents involving heavy machinery are common causes of workplace fatalities.

- Pilots and flight engineers, especially those operating private aircraft, as transportation incidents are a leading cause of death.

- Drivers, including sales and truck drivers, due to the high risk of road accidents.

- Fishers and hunters, as they work in remote and isolated areas, often with live ammunition and hazardous terrain.

- Structural iron and steel workers, who often work at great heights and with heavy machinery.

- Farmers, ranchers, and agricultural managers, who face risks from transportation-related incidents and hazardous worksites.

It's important to note that the impact of occupation on life insurance rates varies among insurers. Some companies may offer more favourable rates for certain high-risk occupations, while others may have stricter guidelines. Additionally, life insurance underwriters will consider other factors beyond occupation, such as medical history, driving records, financial statements, and background checks, to determine an individual's overall risk profile.

Life Insurance: 5-Year Term Option Explained

You may want to see also

Frequently asked questions

A key factor is the individual's health and family medical history.

Age is a significant factor in the risk assessment, with younger individuals generally considered lower risk and having lower premiums.

Yes, gender is a factor as women tend to live longer than men, resulting in lower premiums. Family history is also considered, especially if there is a history of hereditary diseases.

Lifestyle factors such as smoking, alcohol consumption, diet, and exercise habits can impact the risk assessment. Engaging in risky hobbies or behaviours can also increase the risk and premiums.

Yes, working in a dangerous job or having a risky occupation can lead to higher insurance costs or even exclusion from certain life insurance policies.