Life insurance is a crucial financial tool that provides a safety net for individuals and their families. It offers peace of mind by ensuring that loved ones are financially protected in the event of the insured's death. There are several scenarios where life insurance becomes essential. For instance, if you have dependents, such as children or a spouse, who rely on your income, life insurance can provide them with financial security. It can also be beneficial if you have significant financial obligations, such as a mortgage or business loans, as it ensures these debts are covered. Additionally, life insurance can be a valuable asset if you want to leave a legacy for your beneficiaries or if you have a substantial estate that needs to be managed. Understanding when to consider life insurance is the first step towards making an informed decision about your financial future.

What You'll Learn

- Financial Dependents: If you have family relying on your income, life insurance provides financial security

- Debt Management: It helps pay off debts, like mortgages or loans, ensuring your loved ones aren't burdened

- Final Expenses: Covers funeral costs and other end-of-life expenses, easing the financial strain on survivors

- Income Replacement: Provides income replacement for dependents, ensuring their financial stability in your absence

- Legacy Planning: Life insurance can be used to leave a financial legacy for beneficiaries, supporting their long-term goals

Financial Dependents: If you have family relying on your income, life insurance provides financial security

If you have financial dependents, such as a spouse, children, or other family members who rely on your income for their daily needs and long-term goals, life insurance becomes an essential tool to ensure their financial security. The primary purpose of life insurance is to provide financial protection and peace of mind for those who depend on your earnings. Here's why it is crucial:

Income Replacement: When you have a family that depends on your income, a life insurance policy can act as a safety net. In the event of your untimely passing, the death benefit from the insurance policy can replace your lost income, ensuring that your family members can maintain their standard of living. This financial support can cover essential expenses like mortgage or rent, utilities, groceries, and other daily costs, providing stability during a challenging time.

Education and Future Expenses: For families with children, life insurance can be a powerful tool to plan for their future. The death benefit can be used to cover the costs of their education, whether it's for college, university, or vocational training. Additionally, it can provide funds for other significant expenses, such as a down payment on a house, starting a business, or any other long-term financial goals your family may have. By securing these financial needs, you give your dependents the opportunity to focus on their dreams and aspirations without the added stress of financial burdens.

Debt Management: Financial dependents often have various financial obligations, such as mortgages, car loans, or student debt. In the event of your death, life insurance proceeds can be used to pay off these debts, preventing your loved ones from incurring additional financial strain. This ensures that your family can maintain their assets and property, providing a sense of security and stability.

Emotional Support: Beyond the financial aspect, life insurance offers emotional reassurance. Knowing that your family is protected financially can provide peace of mind and reduce the stress associated with unexpected life events. This allows your loved ones to grieve and focus on healing without the added worry of financial matters.

In summary, if you have financial dependents who rely on your income, life insurance is a critical component of your financial plan. It ensures that your family can maintain their lifestyle, achieve their goals, and manage financial obligations even in your absence. By providing financial security, life insurance empowers your dependents to make the most of life's opportunities, knowing that their future is protected.

Children and Life Insurance: Can They Contest Policies?

You may want to see also

Debt Management: It helps pay off debts, like mortgages or loans, ensuring your loved ones aren't burdened

Life insurance is a crucial financial tool that often goes overlooked until it's too late. One of the most compelling reasons to consider it is debt management. When you have significant debts, such as a mortgage or loans, life insurance can be a powerful asset to ensure your loved ones are protected and your financial obligations are met. Here's how it works:

Protecting Your Family's Financial Future: Life insurance provides a safety net for your family in the event of your passing. When you have outstanding debts, your loved ones might struggle to cover these expenses, especially if you are the primary breadwinner. By taking out a life insurance policy, you can allocate a portion of the death benefit to specifically pay off these debts. This ensures that your family's financial stability is maintained, and they won't have to worry about the additional burden of repaying loans or mortgages. For example, if you have a $200,000 mortgage and a $50,000 car loan, your policy could be structured to pay off these debts, providing peace of mind for your family.

Long-Term Financial Security: Debt management is about more than just immediate relief; it's also about long-term financial security. By incorporating life insurance into your debt management strategy, you can create a comprehensive plan. You can choose a policy that aligns with your debt obligations and ensures that your family can maintain their standard of living. This is particularly important if you have a growing family or significant financial responsibilities. The proceeds from the life insurance policy can be used to cover not only the debts but also other essential expenses, such as education costs for your children or daily living expenses for your spouse.

Peace of Mind: Perhaps the most valuable aspect of this approach is the peace of mind it provides. Knowing that your loved ones are protected and that your debts are managed can significantly reduce stress and anxiety. It allows you to focus on the present and future, knowing that you've taken the necessary steps to secure your family's financial well-being. This is especially important if you have a young family or if your financial obligations are substantial.

In summary, life insurance is a powerful tool for debt management, ensuring that your loved ones are protected and your financial obligations are met. It provides a safety net, long-term security, and peace of mind, all of which are essential when considering your family's financial future. By incorporating life insurance into your financial plan, you can create a more secure and stable environment for your loved ones, even in the face of unexpected circumstances.

Check Your California Life Insurance Prelicensing Number

You may want to see also

Final Expenses: Covers funeral costs and other end-of-life expenses, easing the financial strain on survivors

When considering life insurance, it's important to recognize that it can be a valuable tool for managing the financial impact of end-of-life expenses, which are often overlooked but can be a significant burden for loved ones. This type of insurance, specifically designed to cover final expenses, provides a safety net during a challenging time.

Final expense insurance, as the name suggests, is tailored to cover the costs associated with funerals, burials, or cremations. These expenses can include funeral services, casket or urn costs, transportation to the funeral site, and even legal and administrative fees. The primary goal is to ensure that the deceased's family and beneficiaries are not left with a substantial financial burden when dealing with the emotional aftermath of a loved one's passing. By having a policy in place, individuals can provide peace of mind, knowing that their final wishes will be honored without causing financial hardship for their survivors.

The benefits of final expense insurance extend beyond just funeral costs. It can also cover other related expenses, such as medical bills, especially if the death was unexpected and required emergency care. Additionally, it may include proceeds for outstanding debts, such as mortgages or loans, ensuring that the family's financial situation is not further complicated by outstanding financial obligations. This comprehensive coverage allows individuals to plan for their own and their family's future, ensuring that the focus remains on honoring the deceased rather than dealing with financial matters.

For those who may be hesitant to consider life insurance, it's essential to understand that final expense policies are designed to be straightforward and accessible. They are typically designed for individuals who may have pre-existing health conditions or are older, as they might be considered higher-risk. However, this does not mean that everyone in these demographics should be excluded. Many providers offer flexible payment options and customizable plans to accommodate various needs and budgets. This flexibility ensures that anyone can benefit from this type of insurance, providing a sense of security and financial protection.

In summary, final expense insurance is a crucial aspect of life insurance that focuses on covering the costs associated with end-of-life arrangements and related expenses. It eases the financial strain on survivors, allowing them to grieve without the added worry of financial obligations. By considering this type of insurance, individuals can ensure that their final wishes are respected and that their loved ones are protected during a difficult time. It is a thoughtful and practical way to provide financial security for the future, ensuring that the focus remains on honoring the deceased.

Whole Life Insurance Riders: Understanding the Benefits and Drawbacks

You may want to see also

Income Replacement: Provides income replacement for dependents, ensuring their financial stability in your absence

Life insurance is a crucial financial tool that can provide a safety net for your loved ones, especially when it comes to ensuring their financial stability. One of the primary reasons to consider life insurance is the ability to replace income for your dependents, which is a critical aspect of financial planning.

Income replacement through life insurance is a powerful way to guarantee that your family can maintain their standard of living even if you are no longer there to provide financially. This is particularly important if you are the primary breadwinner or if you have a significant financial responsibility towards your family. By taking out a life insurance policy, you can ensure that your dependents receive a regular income stream, which can cover essential expenses such as mortgage or rent, utility bills, groceries, and other daily costs. This financial support can last for a predetermined period, such as a number of years or until your children reach a certain age, ensuring that your family's financial needs are met during challenging times.

The amount of income replacement coverage you should consider depends on various factors. It is essential to evaluate your family's current and future financial obligations. For instance, if you have a large mortgage or a family with multiple dependents, you might need a substantial income replacement to cover these expenses. Additionally, consider the duration of coverage needed; will it be for a short period to cover immediate financial gaps, or a longer-term solution to provide for your family's future? Calculating the potential loss of income and understanding the impact on your dependents' financial situation is key to determining the appropriate coverage.

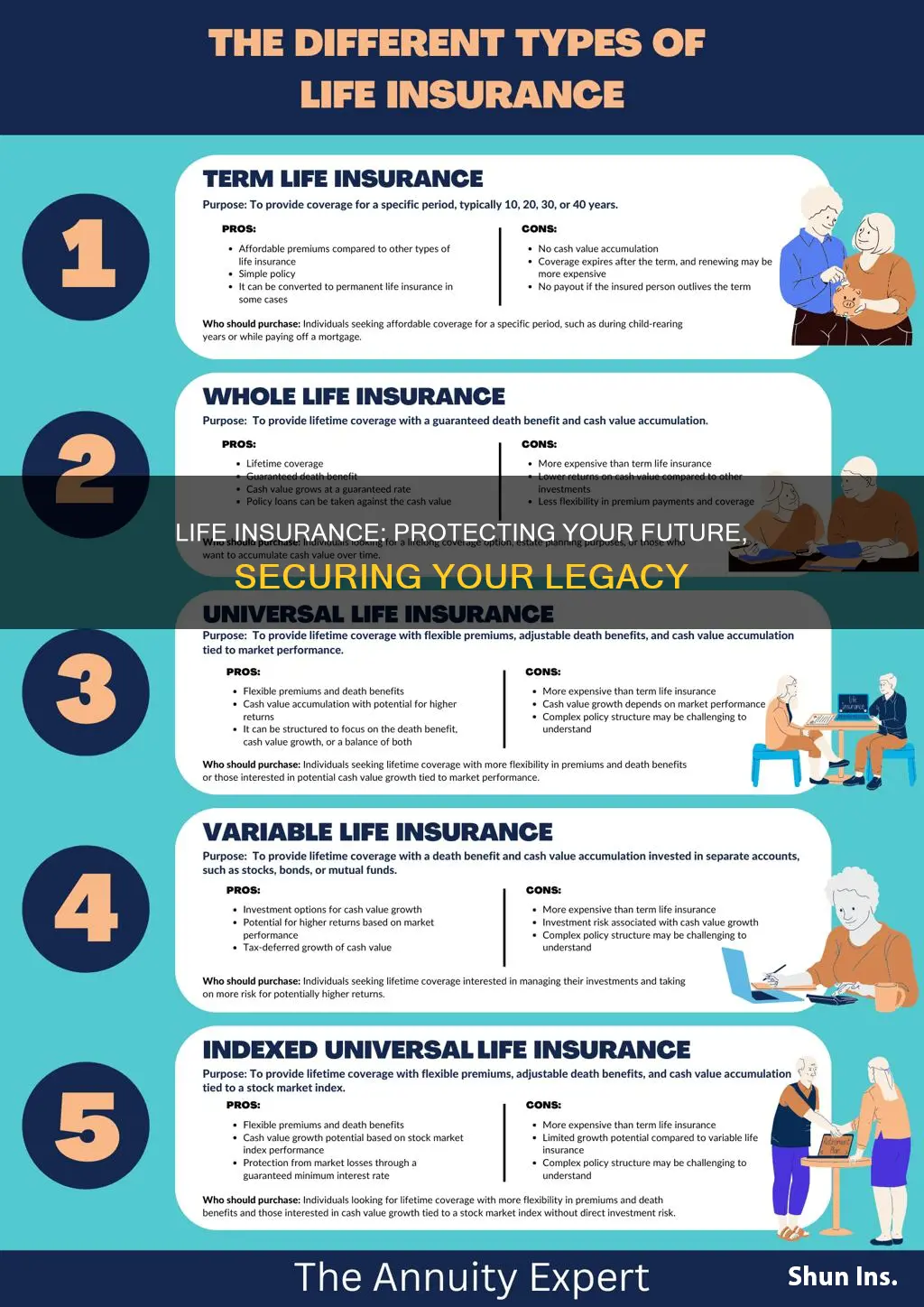

When choosing a life insurance policy for income replacement, it's advisable to opt for term life insurance, which provides coverage for a specific period. This type of policy offers a straightforward solution to meet the temporary income needs of your dependents. Term life insurance is generally more affordable than permanent life insurance, making it an attractive option for those seeking a cost-effective way to secure income replacement. You can choose the term length that aligns with your family's financial goals, ensuring that the coverage ends when it's no longer necessary.

In summary, life insurance with a focus on income replacement is a vital consideration for anyone who wants to provide financial security for their dependents. It ensures that your family can maintain their lifestyle and cover essential expenses even in your absence. By carefully assessing your financial obligations and goals, you can determine the appropriate coverage amount and term, offering peace of mind and a reliable financial safety net for your loved ones.

Understanding Family Heritage Life Insurance: A Comprehensive Guide

You may want to see also

Legacy Planning: Life insurance can be used to leave a financial legacy for beneficiaries, supporting their long-term goals

Life insurance is a powerful tool for legacy planning, allowing individuals to leave a financial legacy that can significantly impact their beneficiaries' lives. When considering life insurance as part of your estate planning, it's essential to understand its potential to support long-term goals and provide financial security for those you care about. Here's how life insurance can be a valuable asset in your legacy planning strategy:

Leaving a Financial Legacy: One of the primary purposes of life insurance is to provide financial security for your loved ones after your passing. By purchasing a life insurance policy, you can ensure that a substantial sum of money is available to your beneficiaries when you're no longer around. This financial legacy can be a lifeline for your family, covering various expenses and helping them maintain their standard of living. For example, the proceeds from a life insurance policy can be used to pay off any outstanding debts, provide for the education of your children or grandchildren, or even start a business venture that your beneficiaries can build upon.

Supporting Long-Term Goals: Life insurance can be tailored to meet specific long-term objectives. For instance, you might want to use the policy to fund your child's education, ensuring they have the financial resources to pursue their dreams. Alternatively, if you have a passion project or a business idea that you wanted to pass on, life insurance can provide the capital needed to bring these visions to life. By strategically planning the payout of a life insurance policy, you can ensure that your beneficiaries have the means to achieve their goals, whether it's buying a home, starting a career, or pursuing higher education.

Flexibility and Customization: Life insurance policies offer flexibility in terms of coverage and payout options. You can choose the amount of coverage that aligns with your financial goals and the needs of your beneficiaries. Some policies even allow for flexible payment options, ensuring that the insurance remains affordable throughout your life. Additionally, you can customize the policy to include various riders and benefits, such as accelerated death benefits, which can provide financial support during critical illnesses or injuries.

Peace of Mind: Perhaps the most significant aspect of using life insurance for legacy planning is the peace of mind it provides. Knowing that your loved ones will be taken care of financially can alleviate stress and allow you to focus on living your best life. It ensures that your family can make important decisions and move forward with confidence, knowing they have a financial safety net in place.

In summary, life insurance is a versatile tool for legacy planning, offering financial security and the means to support your beneficiaries' long-term goals. By incorporating life insurance into your estate planning, you can leave a lasting legacy that goes beyond what you might have achieved in your lifetime, ensuring your loved ones are provided for and empowered to build a bright future.

Life-Altering Events: Understanding Health Insurance Changes

You may want to see also

Frequently asked questions

Life insurance is a crucial aspect of financial planning, and the right time to consider it is often when you are starting a family, buying a home, or have significant financial responsibilities. It becomes especially important when you have people or assets that depend on your income, as it provides financial security and peace of mind.

Yes, young and healthy individuals can still benefit from life insurance. While it might not be as essential as when you have a family or financial commitments, term life insurance can be a good option to build a financial safety net. It offers coverage for a specific period, providing financial protection during your working years.

Having a mortgage or debts is a common reason to consider life insurance. If your death would result in financial strain for your loved ones, covering the remaining mortgage or helping to pay off debts, life insurance can be a valuable tool. It ensures that your family can maintain their standard of living and avoid financial hardship.

While a pension and savings can provide some financial security, life insurance offers additional benefits. It provides a tax-free lump sum or income to your beneficiaries, which can cover expenses like funeral costs, outstanding debts, or daily living expenses. Life insurance ensures that your loved ones are financially protected even if your pension or savings fall short.

For self-employed individuals or those with variable income, life insurance can be especially important. It provides financial protection during periods of lower income or when you might not have access to employer-provided benefits. Term life insurance can offer affordable coverage, ensuring that your family's financial situation remains stable even if your income fluctuates.