Life insurance payouts can be a significant financial benefit for beneficiaries, but understanding when these payments might be taxable is essential. Tax laws vary depending on the type of insurance policy and the circumstances of the payout. Generally, life insurance proceeds received by beneficiaries are typically not taxable, as they are considered a form of gift or inheritance. However, if the policyholder paid significant premiums over a long period, the insurance company may consider the payout as a return of premium, which could be taxable. Additionally, if the policy is a modified endowment policy or a limited pay life policy, the payout might be subject to taxation. It's crucial to consult tax professionals to ensure compliance with the relevant tax regulations and to understand the specific tax implications based on the policy details and the beneficiary's tax situation.

| Characteristics | Values |

|---|---|

| Type of Payout | Terminal Illness, Accidental Death, Pre-Death Care |

| Tax Treatment | Generally tax-free, but may be taxable if used for non-qualified expenses |

| Income Tax | Taxable if the payout exceeds the annual exclusion amount |

| Age of Beneficiary | No impact, as long as the beneficiary is a U.S. resident |

| Policy Type | Term, Whole Life, Universal Life |

| Investment Component | Taxable if the policy has an investment component and gains are realized |

| State Residency | Varies by state; some states exempt life insurance proceeds from state income tax |

| Charitable Gifts | Tax-deductible if the payout is used for charitable purposes |

| Business Interruption | Taxable if the payout is used for business-related expenses |

| Estate Tax | Not taxable as part of the estate, but may be subject to estate tax if the policy is owned by the insured |

What You'll Learn

- Payout Timing: Tax implications vary based on when the policyholder receives the payment

- Excess Proceeds: Payouts exceeding the death benefit may be taxable as ordinary income

- Policy Type: Different life insurance types have distinct tax treatment for payouts

- Tax-Free Status: Certain policies offer tax-free benefits under specific conditions

- State Variations: Tax laws differ by state, affecting payout taxation

Payout Timing: Tax implications vary based on when the policyholder receives the payment

When it comes to life insurance payouts, the timing of the payment can significantly impact the tax implications for the policyholder. The tax treatment of these payouts is an important consideration for individuals and their financial planning. Here's an overview of how the timing of the payout can affect taxation:

Lump-Sum Payouts: If a life insurance policyholder receives a lump-sum payment as a result of the insured's death, the tax treatment can vary. In many jurisdictions, the first $500,000 of a lump-sum life insurance payout is typically tax-free. This means that the policyholder can receive a significant amount without incurring immediate tax liabilities. However, any amount exceeding this threshold may be subject to income tax. The tax rate applied to the excess amount will depend on the policyholder's overall income and tax bracket for that year. It's important to note that the tax rules can be complex, and the specific tax treatment may vary based on the country or region.

Regular Income Streams: In some cases, life insurance policies may provide regular income payments to the policyholder or their beneficiaries. These payments can be structured as periodic installments over a specific period. When the policyholder receives these regular payouts, they are generally considered taxable income. The tax treatment is similar to other forms of income, and the amount received will be subject to income tax based on the policyholder's tax bracket. It is advisable for policyholders to consult tax professionals to understand the tax implications and plan their financial affairs accordingly.

Tax-Deferred Growth: Some life insurance policies offer tax-deferred growth, allowing the cash value of the policy to accumulate tax-free until it is withdrawn. This feature can be particularly beneficial for long-term financial planning. When the policyholder receives a payout, the accumulated cash value, including any interest or earnings, may be subject to taxation. The tax rules for tax-deferred policies can be intricate, and it is essential to understand the specific regulations to ensure compliance.

Policyholder's Residence: The tax implications of life insurance payouts can also depend on the policyholder's residence and the tax laws of the country or state they reside in. Different jurisdictions have varying rules regarding the taxation of life insurance proceeds. It is crucial for policyholders to be aware of the tax laws applicable to their location to make informed decisions and plan their finances effectively.

Understanding the tax implications of life insurance payouts is essential for policyholders to make informed financial decisions. The timing of the payout, whether it is a lump sum or regular payments, can significantly impact the tax treatment. Consulting with tax professionals and financial advisors can provide valuable guidance in navigating the complex tax regulations surrounding life insurance.

Life Insurance Cash Value: An IRA Alternative?

You may want to see also

Excess Proceeds: Payouts exceeding the death benefit may be taxable as ordinary income

When it comes to life insurance, understanding the tax implications of payouts is crucial for policyholders and beneficiaries alike. While life insurance policies provide financial security and peace of mind, certain payouts can be subject to taxation, which can impact the overall value of the policy. One specific scenario where this occurs is when the payout exceeds the death benefit, leading to what is known as "excess proceeds."

In the event of a policyholder's death, the life insurance company typically pays out the death benefit, which is the amount specified in the policy. However, if the policy's cash value or other assets are greater than the death benefit, the excess amount becomes taxable. This excess is considered ordinary income and is subject to taxation at the beneficiary's regular income tax rate. For example, if a life insurance policy has a death benefit of $500,000 but the policy's cash value is $600,000, the $100,000 excess would be taxable.

The key factor here is the excess nature of the payout. If the payout is equal to or less than the death benefit, it is generally not taxable. However, when the payout surpasses the specified amount, it triggers tax consequences. This rule applies to both term and permanent life insurance policies, although the tax treatment may vary depending on the type of policy.

It's important to note that the tax laws surrounding life insurance payouts can be complex and may vary based on individual circumstances and the jurisdiction's regulations. Policyholders should consult with financial advisors or tax professionals to fully understand their tax obligations and explore potential strategies to minimize the tax impact of excess proceeds. Proper planning and awareness can help individuals navigate these tax considerations effectively.

Life Insurance Payouts: Are They Taxable Income?

You may want to see also

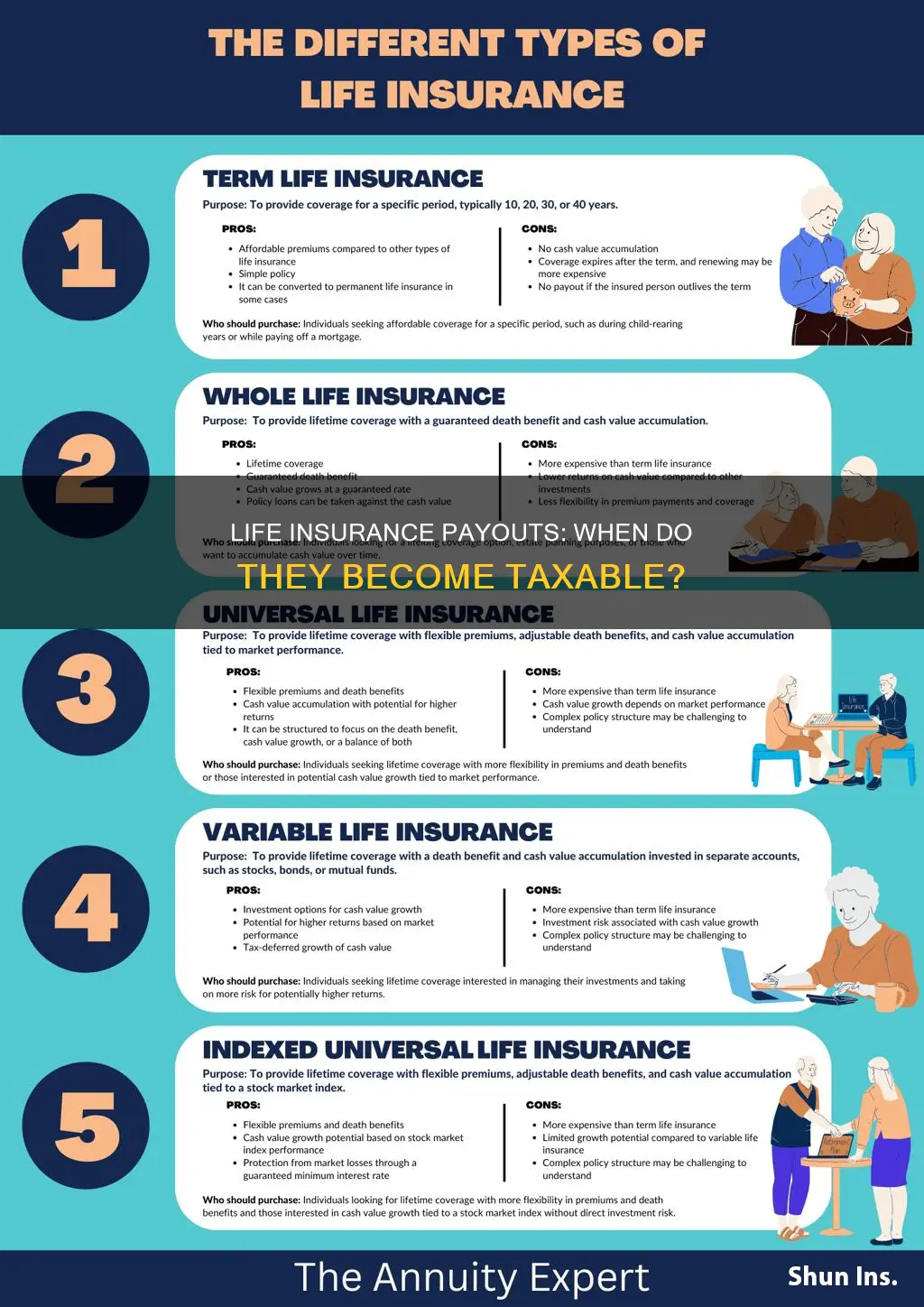

Policy Type: Different life insurance types have distinct tax treatment for payouts

When it comes to life insurance, the tax implications of payouts can vary depending on the type of policy. Understanding these differences is crucial for policyholders to make informed financial decisions. Here's an overview of how different life insurance policies are taxed:

Term Life Insurance: This is a temporary policy designed to provide coverage for a specific period, typically 10, 20, or 30 years. If the insured individual dies during the term, the beneficiary receives a tax-free death benefit. However, if the policy lapses or the insured outlives the term without a claim, the premiums paid may not be fully recoverable as they are not tax-deductible. Term life insurance is generally more affordable and offers coverage for a defined period, making it a popular choice for those seeking temporary protection.

Whole Life Insurance: This is a permanent policy with a cash value component and a death benefit. The death benefit is typically tax-free when paid out to the beneficiary. Additionally, the cash value portion of the policy grows tax-deferred, meaning it can accumulate savings over time. Whole life insurance provides long-term financial security and is often used for wealth accumulation and estate planning. Policyholders can also borrow against the cash value, but loans must be repaid to avoid potential tax consequences.

Universal Life Insurance: This type of policy offers flexibility in premium payments and death benefit amounts. It also has a cash value component that grows tax-deferred. When the insured dies, the death benefit is generally tax-free. Universal life insurance allows policyholders to adjust their coverage and premium payments according to their financial needs. It provides a level of customization that other policies may not offer.

Variable Universal Life Insurance: This policy combines investment features with life insurance. The death benefit is tax-free, but the cash value component is subject to market fluctuations. Policyholders can invest a portion of their premiums in various investment options, which may offer higher returns but also come with investment risks. This type of policy is suitable for those who want to align their insurance with investment goals.

Understanding the tax treatment of different life insurance policies is essential for maximizing the benefits of your coverage. Consulting with a financial advisor or insurance professional can provide personalized guidance based on your specific circumstances and goals.

Understanding Life Cover: A Comprehensive Guide to Term Insurance

You may want to see also

Tax-Free Status: Certain policies offer tax-free benefits under specific conditions

Life insurance policies can provide financial security for beneficiaries, but understanding the tax implications of these payouts is essential for both policyholders and recipients. While many life insurance benefits are generally not taxable, there are specific conditions under which payouts may be subject to taxation. This article aims to clarify these circumstances and highlight the tax-free status that certain policies offer.

In the United States, for instance, life insurance proceeds are typically not taxable if the policy meets certain criteria. One such condition is when the policy is owned by an individual, and the death of the insured occurs outside of a business context. This means that if the policyholder is not an employee of the company that owns the policy, and the death occurs outside of a business-related activity, the payout is generally tax-free. For example, if a business owner has a life insurance policy on their life and passes away in a non-business-related accident, the beneficiary will likely receive the proceeds tax-free.

Additionally, certain types of life insurance policies, such as term life insurance, often provide tax-free benefits. Term life insurance is designed to provide coverage for a specific period, and if the insured individual dies during this term, the beneficiary receives a tax-free payout. This type of policy is particularly popular for those seeking temporary coverage, such as parents wanting to secure their children's future or individuals with a short-term financial goal.

However, it's important to note that there are exceptions and variations. Some policies may offer tax-free benefits only if the death is deemed accidental or occurs under specific circumstances. For instance, in the case of accidental death insurance, the payout is often tax-free if the death results from an unforeseen and unexpected event. Moreover, if the policy is owned by a trust or an entity other than an individual, the tax treatment may differ, and additional rules and regulations come into play.

Understanding the tax implications of life insurance payouts is crucial for effective financial planning. By recognizing the conditions that make certain policies tax-free, individuals can make informed decisions when selecting and managing their life insurance coverage. It is always advisable to consult with financial advisors or tax professionals to ensure compliance with relevant laws and to maximize the tax-free benefits offered by specific life insurance policies.

Life Insurance and Globulin: Understanding the Rating Connection

You may want to see also

State Variations: Tax laws differ by state, affecting payout taxation

The taxation of life insurance payouts can vary significantly depending on the state where the policy was purchased and the beneficiary's location. This is primarily due to the diverse tax laws and regulations across different states in the United States. When an individual purchases a life insurance policy, they typically choose the state where the policy will be issued, which can have a substantial impact on the tax implications of future payouts.

In some states, life insurance proceeds are generally not taxable to the beneficiary. For instance, in California, New York, and New Jersey, life insurance payments are not subject to state income tax. This means that the full amount of the payout is received tax-free by the beneficiary. However, it's important to note that federal tax laws may still apply, and the beneficiary should be aware of any potential estate or inheritance taxes.

On the other hand, other states have different approaches. For example, in Florida, life insurance payouts are not taxable to the beneficiary, but the policy itself may be subject to a premium tax. This means that while the payout is tax-free, the ongoing cost of the policy could be taxed differently. In contrast, states like Pennsylvania and Texas may impose state income tax on life insurance proceeds, even if the policy was purchased in a different state. This variation in state laws can significantly impact the overall tax burden for beneficiaries.

Additionally, the residence of the beneficiary can also play a role in taxation. If the beneficiary lives in a state with no income tax, they may not be subject to state-level taxation, but federal tax laws still apply. For instance, if a beneficiary resides in a state with no income tax but receives a payout from a policy issued in a state with higher taxes, they might still need to report the income and pay federal taxes.

Understanding these state variations is crucial for individuals and their financial advisors when selecting a life insurance policy. It ensures that the chosen state of issuance aligns with the tax laws in the beneficiary's state of residence, helping to minimize potential tax liabilities and provide a more comprehensive financial plan.

Understanding the Key Differences: Permanent vs. Whole Life Insurance

You may want to see also

Frequently asked questions

Life insurance payouts are generally not taxable to the beneficiary if the policy is considered a "term" or "temporary" policy. These policies provide coverage for a specific period and do not accumulate cash value. However, if the policy is a "permanent" or "whole life" policy, and the beneficiary receives a lump sum or a series of payments over time, it may be taxable depending on the tax laws in the beneficiary's country or state.

Yes, there are a few scenarios where life insurance payouts might be taxable. For instance, if the policyholder or the beneficiary is in a higher tax bracket, the entire payout could be taxable. Additionally, if the policy is considered a "modified endowment contract" (MEC) in the US, the death benefit may be taxable as ordinary income.

Tax regulations regarding life insurance vary significantly worldwide. In some countries, life insurance payouts are tax-free, while in others, they may be partially or fully taxable. For example, in the United States, life insurance proceeds are generally tax-free, but in the UK, they are typically taxable as ordinary income. It's essential to consult the tax laws specific to your jurisdiction.

Yes, the tax treatment of life insurance can evolve. For instance, if a policy is converted from term to permanent life insurance, the tax implications might change. Additionally, changes in tax laws or policies can affect the tax status of life insurance proceeds, so it's crucial to stay updated on any legislative changes.

Yes, there are several strategies to consider. One approach is to choose a term policy with a higher death benefit to potentially reduce the tax burden. Another strategy is to utilize life insurance as part of a larger financial plan, such as combining it with other tax-efficient investments or retirement accounts. Consulting a financial advisor can help tailor a strategy to your specific circumstances.