Cashing in a life insurance policy can be a complicated process, and it's important to understand the potential tax implications. In most cases, the cash value of life insurance is not taxable, but there are certain situations where taxes may apply. For example, if you withdraw more than the total amount of premiums paid into the policy, you may owe taxes on the excess amount. Similarly, if you surrender or cash out your policy, you may incur taxes on any amount above the total premiums paid. It's also important to note that if your policy is a modified endowment contract (MEC), the tax implications may be different, and you may owe taxes on any earnings or withdrawals. To fully understand the tax consequences of cashing in your life insurance policy, it's recommended to consult with a financial advisor or tax professional.

| Characteristics | Values |

|---|---|

| Tax on cashing in life insurance | Depends on the situation. Generally, you only pay taxes on the amount above what you paid in. |

| Tax on death benefits | Generally not taxable. |

| Tax on interest on beneficiary life insurance proceeds | Generally taxable. |

What You'll Learn

Withdrawing from a life insurance policy

Withdrawals

Generally, you can make limited withdrawals from your life insurance policy, depending on the type of policy and the issuing company. Withdrawals are not taxable up to your policy basis if your policy is not a modified endowment contract (MEC). An MEC is a life insurance policy where the funding exceeds federal tax law limits. Withdrawals above your policy basis may be subject to taxation.

Policy Loans

Most cash-value policies allow you to borrow money from the issuer, using your cash-accumulation account as collateral. The loan amount is based on the value of the policy's cash-accumulation account and the contract's terms. Policy loans are not taxable, but if the policy lapses with an outstanding loan balance, the amount exceeding your basis in the contract will be taxed as income.

Surrendering the Policy

You can surrender (cancel) your policy in full or in part and receive the cash surrender value, which is the cash value minus any fees charged by the insurance company. Surrendering the policy may incur taxes if the cash surrender value is higher than the amount of premiums you've paid into the policy (your cost basis). The excess amount is typically taxed as ordinary income.

It's important to note that withdrawing, taking out a loan, or surrendering your life insurance policy may reduce your death benefit or cause your policy to lapse if you don't maintain the required premiums.

When considering withdrawing from your life insurance policy, it's always best to consult with a financial advisor or tax professional to understand the specific tax implications for your situation.

Life Insurance for Navy Reserves: What's on Offer?

You may want to see also

Borrowing from a life insurance policy

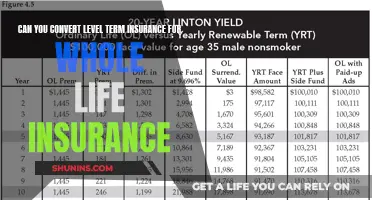

Firstly, it's important to note that you can only borrow against a permanent life insurance policy, such as a whole life insurance or universal life insurance policy. These policies are more expensive than term life insurance but have no predetermined expiration date. If sufficient premiums are paid, the policy is in force for the lifetime of the insured. While the monthly premiums are higher than term life insurance, money paid into the policy that exceeds the cost of insurance builds up a cash value account that is part of the policy. The purpose of the cash value is to offset the rising cost of insurance as you age, allowing premiums to remain level throughout life and preventing them from becoming unaffordable in your later years.

The cash value of a permanent life insurance policy grows over time and can be borrowed against. However, there are a few things to keep in mind. Firstly, the insurance company will charge interest on the loan, which, if unpaid, can cause the policy to lapse. Secondly, borrowing against a life insurance policy will reduce the death benefit if it is not paid off. Finally, if the policy lapses or is surrendered with an outstanding loan balance, the borrowed amount may become taxable.

When borrowing from a life insurance policy, there is usually no approval process or credit check, and you can use the money for anything you want. The loan is also generally tax-free as long as the policy stays active and is not a modified endowment contract. However, it is important to pay back the loan with interest to avoid reducing the death benefit and possibly owing taxes on the borrowed amount.

In conclusion, borrowing from a life insurance policy can be a convenient way to access cash, but it is important to understand the risks and potential consequences, such as reduced death benefits and tax implications.

Life Insurance: Voluntary, but Taxed by Social Security?

You may want to see also

Surrendering a life insurance policy

Whole and Universal Policies

Whole and universal policies accrue cash value, making them the most likely option for surrender. Depending on the type and age of the policy, they may have accrued a significant amount of cash value. The cash surrender value of a life insurance plan is based on the policy's duration, growth, and assets. Surrendering your policy earlier in the term may result in a lower cash surrender value since the cash value will be smaller, and you may owe surrender charges.

Surrender Fees

If your policy isn't very old, you may incur surrender fees, which will reduce the amount of cash you receive. Surrender charges can last about 10 to 15 years after you buy the policy. Over time, surrender fees tend to decrease, so it's ideal to wait until the fee is minimal or non-existent.

Tax Implications

The cash surrender value of a life insurance policy is generally taxable as income if it exceeds the amount paid in premiums. Consult a tax professional to understand the tax implications of surrendering your life insurance policy.

Life Insurance for Survivor Widows: What OPM Offers

You may want to see also

Interest earned on beneficiary proceeds

Interest earned on life insurance proceeds is generally considered taxable income. If the beneficiary of a life insurance policy is a minor, interest accrues from the date of the insured's death to the date of payment, regardless of when the claim is filed. The interest rate is determined by the rate in effect on the date of death, and it is subject to fluctuations during the period before payment.

In the United States, the Internal Revenue Service (IRS) states that life insurance proceeds received by a beneficiary due to the death of the insured are not usually considered taxable income. However, any interest earned on these proceeds is taxable and should be reported. This is in accordance with N.Y. Ins. Law § 3214(c) (McKinney 2000), which specifies that interest is computed daily and added to the total sum paid to the beneficiary.

If the policy is paid out in installments rather than a lump sum, the interest accumulated on those payments is also taxed as regular income. This is because the original death benefit is typically not taxed, but the interest earned is considered taxable income.

It is important to note that the tax implications of life insurance can be complex and may vary depending on the specific circumstances and location. Seeking expert tax advice is recommended to understand how taxes may apply to your unique situation.

Using Life Insurance: Your Options and Benefits Now

You may want to see also

Estate taxes

The death benefit from a life insurance policy is usually not taxed as income. However, if the policyholder leaves the death benefit to their estate instead of naming a person as the beneficiary, estate taxes may be triggered. This is because the death benefit becomes part of the taxable estate, and if the total value exceeds the federal estate tax exemption, taxes may be incurred. In 2024, the federal estate tax exemption is $13.61 million, although this figure changes annually.

To avoid estate taxes, it is recommended to name a person as the beneficiary of the life insurance policy, rather than leaving it to your estate. Regularly reviewing your policy and keeping your beneficiary designations up-to-date is important to ensure your beneficiaries receive the full benefit.

Get a Life Insurance License: Kentucky Requirements Guide

You may want to see also

Frequently asked questions

Cashing in a life insurance policy is generally not considered income and is tax-free up to the total amount of premiums paid. However, if you cash out more than the total premiums paid, the amount exceeding the premiums may be taxed as ordinary income or capital gains.

Yes, there can be tax consequences for cashing in a life insurance policy. If you cash out more than the total premiums paid, the excess amount may be taxed as ordinary income or capital gains. Additionally, if there are any unpaid loans against the policy, they will be deducted from the cash value, resulting in a lower payout.

Surrendering a policy is typically done through the insurance provider, and the cash surrender value is usually similar to or less than the total premiums paid. Selling a policy, on the other hand, is done with a third party, and the payout is often significantly higher than the total premiums paid.

Yes, there may be state-specific tax laws and regulations that impact the taxation of life settlement proceeds. These can include factors such as the tax treatment of income, potential exemptions or deductions, and reporting requirements.

Cashing in a life insurance policy would be considered taxable income if the amount withdrawn exceeds the total premiums paid. Additionally, if the policy is a modified endowment contract (MEC), the withdrawals may be taxed differently, with earnings taxed first.