The intricate relationship between insurance and healthcare is a complex one, with insurance playing a pivotal role in shaping the healthcare landscape. Insurance companies, driven by profit motives, often employ various strategies that can inadvertently drive up healthcare costs. These strategies include negotiating higher prices with healthcare providers, offering extensive coverage options, and implementing complex billing practices. As a result, patients may face higher out-of-pocket expenses, and the overall cost of healthcare services can escalate, impacting individuals, businesses, and the healthcare system as a whole. Understanding these dynamics is crucial for policymakers, healthcare providers, and consumers alike to navigate the challenges and complexities of the healthcare industry.

What You'll Learn

- Insurance Companies' Influence on Medical Decision-Making: How insurers steer patient care choices

- Higher Prices for Insured: Insurers often set higher prices for treatments, impacting out-of-pocket costs

- Administrative Burden: Insurance bureaucracy adds complexity, increasing healthcare costs and delays

- Network Constraints: Limited provider networks force patients to pay more for specialized care

- Incentivized Care: Insurance providers may encourage more frequent or unnecessary procedures for profit

Insurance Companies' Influence on Medical Decision-Making: How insurers steer patient care choices

The influence of insurance companies on medical decision-making is a complex and often controversial topic, as it involves a delicate balance between financial considerations and patient care. Insurance providers play a significant role in shaping healthcare practices, and their impact can be both positive and negative, depending on various factors. Here's an exploration of how insurance companies steer patient care choices:

Financial Incentives and Negotiations: Insurance companies often have financial incentives that drive their interactions with healthcare providers. These incentives can include reimbursement rates, which are negotiated between insurers and medical practitioners. Higher reimbursement rates may encourage doctors to recommend specific treatments or procedures, as these choices can lead to more lucrative payments. This dynamic can result in a shift in medical advice, where insurers may prefer treatments that are more profitable rather than those that are clinically optimal for the patient. For instance, a patient might be steered towards a more expensive, insurer-preferred treatment plan, even if a less costly alternative is equally effective.

Network Management: Insurance providers typically manage a network of healthcare providers, including hospitals, clinics, and specialists. These networks are designed to control costs and ensure that patients receive care within a predefined system. However, insurers may also use their network influence to steer patients towards specific doctors or facilities. By limiting patient choice to within their network, insurers can control the flow of information and potentially influence medical decisions. This approach can sometimes lead to patients being denied access to specialists or treatments that are not covered by the insurer's network, forcing them to seek alternative, potentially less effective, care options.

Evidence-Based Guidelines and Formularies: Insurance companies often develop evidence-based guidelines and drug formularies to manage costs and ensure quality care. These guidelines outline recommended treatments, medications, and procedures based on clinical research and expert consensus. While these tools aim to standardize care, they can also limit patient autonomy. Insurers may restrict coverage for certain treatments, forcing patients to choose between adhering to the insurer's guidelines or incurring out-of-pocket expenses. This can lead to patients feeling pressured to accept less-than-ideal care options or even forgoing necessary treatments due to financial constraints.

Prior Authorization and Utilization Management: Prior authorization and utilization management are processes used by insurers to ensure that treatments are medically necessary and cost-effective. While these measures are intended to control costs, they can also delay or deny patients access to care. Insurance companies may require patients to obtain prior authorization for specific treatments, involving a review process that can take weeks or even months. During this time, patients may experience deterioration in their health, making the treatment less effective or even unnecessary. Utilization management, which involves monitoring and controlling the use of medical services, can also lead to patients being steered away from certain treatments or specialists, potentially impacting their overall health outcomes.

In summary, insurance companies' influence on medical decision-making is a multifaceted issue. While insurers aim to manage costs and ensure quality care, their financial incentives, network management, and standardized guidelines can sometimes lead to a shift in patient care choices. Balancing the need for cost-effective healthcare with patient autonomy and clinical expertise is a challenge that requires careful consideration and ongoing dialogue between healthcare providers, insurers, and policymakers.

State Farm Auto Insurance: What Discounts Are Available?

You may want to see also

Higher Prices for Insured: Insurers often set higher prices for treatments, impacting out-of-pocket costs

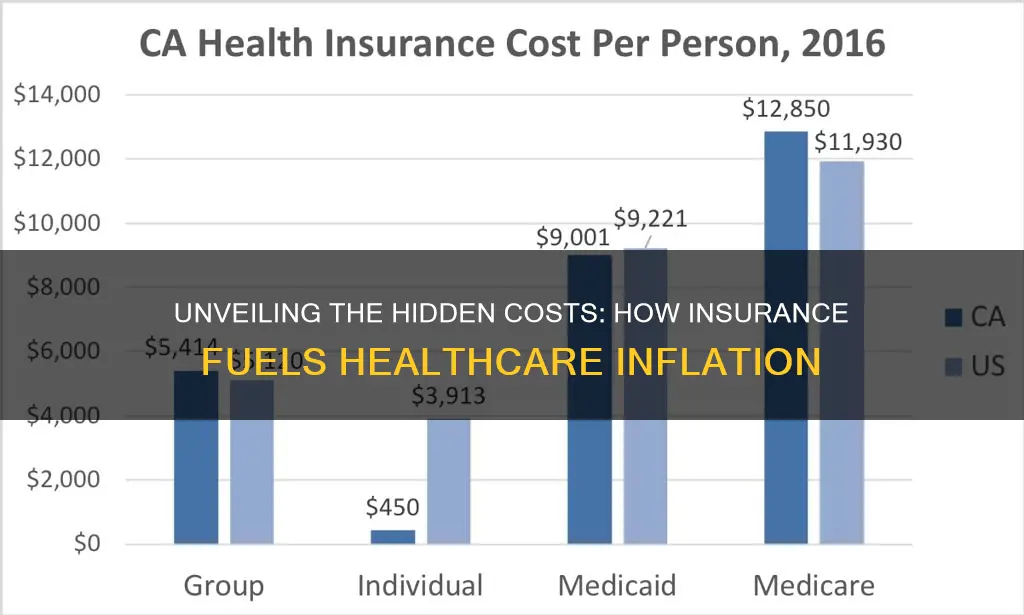

The relationship between insurance and healthcare costs is a complex one, and it often results in higher prices for insured individuals. Insurance companies, while aiming to provide coverage, have a business model that can inadvertently drive up healthcare expenses. One of the primary ways this occurs is through the pricing strategies they employ.

Insurers often negotiate rates with healthcare providers, including hospitals, doctors, and specialists. These negotiations can lead to higher prices for insured patients. When an insurance company agrees to cover a certain percentage of a treatment's cost, the healthcare provider may increase the overall price to ensure they receive a higher reimbursement rate. This practice can result in insured individuals paying more out-of-pocket for their medical procedures and treatments. For example, a routine surgery might have a higher price tag when an insurance company is involved, as the insurer has negotiated a higher rate for their coverage.

The impact of these higher prices is significant. Insured individuals may find themselves facing increased copayments, deductibles, and overall out-of-pocket expenses. This can be particularly challenging for those with chronic conditions or complex medical needs, as they may require frequent or specialized care. As a result, many insured patients might opt for less comprehensive or delayed treatment to avoid these higher costs, which can potentially worsen their health conditions over time.

Furthermore, insurance companies may also influence healthcare costs through their network of providers. They often have preferred provider networks, which can limit patients' choices and potentially lead to higher prices. Insured individuals might be encouraged or even required to use these network providers, who may charge higher rates for the same services compared to out-of-network providers. This practice can further contribute to the overall increase in healthcare costs for insured individuals.

In summary, the intricate relationship between insurance and healthcare pricing can result in higher prices for insured patients. Insurers' negotiations with healthcare providers, their network preferences, and the subsequent impact on out-of-pocket costs are all factors that contribute to this phenomenon. Understanding these dynamics is crucial for both patients and policymakers to address the challenges of rising healthcare expenses.

Understanding Texas Auto Insurance: The 30-60-25 Rule Explained

You may want to see also

Administrative Burden: Insurance bureaucracy adds complexity, increasing healthcare costs and delays

The intricate web of insurance bureaucracy often serves as a significant contributor to the rising costs and delays in the healthcare system. This administrative burden is a critical aspect of how insurance drives up healthcare expenses and affects patient care. When patients seek medical treatment, the process of navigating insurance claims and authorizations can be a complex and time-consuming ordeal. Insurance companies often require extensive documentation, including medical records, referrals, and detailed explanations of the patient's condition, which can lead to significant delays in receiving necessary treatment. This delay can exacerbate the patient's condition, potentially leading to more severe health issues and increased medical costs in the long run.

The complexity of insurance processes is a major factor in this issue. Insurance companies often have strict guidelines and numerous steps to approve treatments, medications, and hospital stays. For instance, a patient might need to obtain pre-authorization for a specific procedure, which involves multiple parties, including the patient, the healthcare provider, and the insurance company. This multi-step process can result in significant administrative overhead, with each step requiring time and resources. As a consequence, healthcare providers often spend a considerable amount of time on paperwork and administrative tasks, rather than focusing on patient care.

Moreover, the administrative burden extends beyond the initial treatment process. After a patient receives medical care, the insurance company's follow-up procedures can be equally demanding. This includes processing claims, verifying services rendered, and ensuring compliance with insurance policies. These tasks often require extensive documentation and communication between the healthcare provider, the patient, and the insurance company. The time and effort required to navigate these processes can lead to increased operational costs for healthcare facilities, which are ultimately passed on to patients and taxpayers.

The impact of this insurance bureaucracy is twofold. Firstly, it directly affects the efficiency of healthcare delivery, causing delays in treatment and potentially impacting patient outcomes. Secondly, it contributes to the overall financial strain on the healthcare system. As insurance processes become more complex, the administrative costs rise, leading to higher healthcare expenses. This is particularly concerning in a system where access to healthcare is already a challenge for many, as the administrative burden can further deter individuals from seeking necessary medical attention.

Addressing this issue requires a comprehensive approach. Streamlining insurance processes, reducing paperwork, and implementing electronic health record systems can significantly alleviate the administrative burden. Additionally, educating both healthcare providers and patients about the importance of accurate and timely documentation can help ensure smoother insurance processes. By simplifying these procedures, the healthcare system can focus more on patient care, ultimately improving health outcomes and reducing the financial strain on all stakeholders.

Gender Pricing: Auto Insurers' Use of Gender in Pricing

You may want to see also

Network Constraints: Limited provider networks force patients to pay more for specialized care

The concept of insurance driving up healthcare costs is often associated with network constraints, which can significantly impact patients' access to specialized care. When insurance companies design their provider networks, they typically negotiate rates with a select group of healthcare providers, including doctors, hospitals, and specialists. This network of approved providers is then offered to policyholders as a benefit. While this approach can simplify the administration of insurance, it often results in limited provider options for patients.

Limited provider networks can lead to several issues for patients seeking specialized care. Firstly, patients might find themselves in a situation where their preferred specialist or a provider with specific expertise in their condition is not included in the network. As a result, they may need to choose between accessing the necessary care or paying out-of-pocket for a specialist outside the network. This constraint can be particularly challenging for individuals with complex medical needs or rare conditions, as they may have limited options for finding suitable specialists within the network.

Secondly, patients on insurance plans with restricted provider networks often face higher out-of-pocket costs when they require specialized care. Insurance companies typically set higher copayments or coinsurance rates for services provided by out-of-network specialists. These increased costs can deter patients from seeking the specialized care they need, especially if the network includes adequate primary care and general practitioner options. As a result, patients might opt for less comprehensive or less timely care, potentially impacting their health outcomes.

Furthermore, the network constraint can contribute to a phenomenon known as "provider exclusivity," where insurance companies encourage or even require patients to use specific providers within the network. This exclusivity can limit patients' choices and lead to a lack of competition among providers, potentially reducing the quality of care and increasing costs. When patients are forced to use only the approved providers, it can result in a lack of negotiation power, as they have no other options to compare prices or services.

To address these challenges, some insurance companies are implementing strategies to improve patient access to specialized care. These include offering more comprehensive networks, providing incentives for out-of-network providers, and implementing value-based payment models that reward quality and efficiency in healthcare delivery. By expanding provider networks and reducing the financial barriers to accessing specialized care, insurance companies can help ensure that patients receive the necessary treatment without incurring excessive out-of-pocket expenses.

Huntington Bank's Auto Insurance: What You Need to Know

You may want to see also

Incentivized Care: Insurance providers may encourage more frequent or unnecessary procedures for profit

The relationship between insurance companies and healthcare providers often involves a complex interplay of financial incentives, which can sometimes lead to an overemphasis on procedure and potential unnecessary care. This phenomenon, known as "Incentivized Care," occurs when insurance providers have financial incentives to encourage more frequent or unnecessary medical procedures, treatments, or services. Here's a detailed exploration of this issue:

Financial Incentives and Profit Motive: Insurance companies operate with a profit motive, and their primary goal is to ensure financial stability and growth. When insurance providers offer coverage for specific medical services, they may have financial incentives to encourage patients to undergo these procedures more frequently. This can be achieved through various means, such as negotiated rates with healthcare providers, where insurance companies agree to pay higher fees for certain procedures, thus incentivizing doctors to perform more of them.

Overutilization of Services: As a result of these incentives, healthcare providers might feel pressured to recommend or perform more procedures than necessary. For instance, an insurance company might offer higher reimbursement rates for diagnostic tests, surgeries, or specific medical interventions. This could lead to overutilization, where patients undergo unnecessary tests or procedures, increasing costs without necessarily improving health outcomes. For example, a patient might be encouraged to have a routine MRI for a minor injury, even though a simpler diagnostic method could have been sufficient.

Impact on Patient Care: The consequences of incentivized care can be far-reaching. Patients may experience increased anxiety and stress due to unnecessary procedures, which can lead to higher medical bills and potential complications. Moreover, the focus on profit might divert attention from preventive care and patient education, which are essential for long-term health management. This shift in focus can result in a lack of emphasis on patient well-being and a greater emphasis on revenue generation.

Addressing the Issue: To mitigate the negative effects of incentivized care, regulatory bodies and healthcare organizations should implement measures to ensure transparency and accountability. This includes regular audits of insurance provider practices, clear guidelines on reimbursement rates, and promoting patient-centered care. Additionally, encouraging patients to be actively involved in their healthcare decisions and promoting shared decision-making can help reduce the impact of financial incentives on medical choices.

In summary, the insurance industry's profit-driven approach can inadvertently drive up healthcare costs and potentially compromise the quality of patient care. Recognizing and addressing these incentives is crucial to ensuring that healthcare remains patient-centric and focused on long-term health outcomes.

Auto Insurance and Theft: What You Need to Know

You may want to see also

Frequently asked questions

Insurance companies often negotiate lower rates with healthcare providers, which can lead to reduced costs for patients. However, this can also result in a complex billing process, where patients may face higher out-of-pocket expenses due to copayments, deductibles, and coinsurance. Additionally, insurance plans may encourage patients to use in-network providers, which can limit their choice of doctors and potentially lead to higher costs if out-of-network care is necessary.

Yes, insurance companies can indirectly influence healthcare prices through their reimbursement policies. When insurance covers a procedure or treatment, it sets a reimbursement rate, which can impact the overall cost structure for healthcare providers. Higher reimbursement rates may encourage providers to charge more, knowing that insurance will cover a significant portion of the bill.

Insurance networks, or provider networks, are groups of healthcare professionals and facilities that have agreed to provide services to insured individuals at negotiated rates. While these networks help manage costs by offering discounted rates, they can also restrict patient choice. Patients may need to choose from a limited list of providers, and if they require specialized care, they might face higher costs or have to seek out-of-network care, which is often less affordable.

Insurance policies, especially those with high deductibles and out-of-pocket maximums, can contribute to healthcare inflation. When patients are responsible for a larger portion of their medical expenses, they may delay or forgo necessary treatments, leading to more severe and costly health issues in the long run. This can result in higher overall healthcare costs, including emergency room visits and complex treatments, which may be more expensive to manage.