If you're looking to find an old life insurance policy, there are a few steps you can take. While there isn't one centralized place to look up life insurance policies, you can start by searching through the deceased's documents and correspondence, including paper and digital files, bank deposit boxes, and other storage spaces for insurance-related documents. You can also check their bank statements, tax returns, and mail for any evidence of payments or notices from insurance companies. If you come up empty-handed, there are free online tools like the NAIC Life Insurance Policy Locator Service that can help you locate life insurance policies and annuity contracts. These tools require specific information, such as the deceased's name, mailing address, Social Security number, and date of birth. Alternatively, you can contact the state's Unclaimed Property Office or insurance departments, such as the one in Washington state, which offer similar search services.

| Characteristics | Values |

|---|---|

| Difficulty of finding an old life insurance policy | There isn't just one place to check and find out if someone who's passed away had a life insurance policy. |

| Tips to find an old life insurance policy | The name of the insured, the policy itself, a certified copy of the death certificate, search through the person's financial records, look through old mail, check with their auto or home insurer, contact the person's last workplace, review their income tax statements, contact their bank |

| NAIC Life Insurance Policy Locator Service | A free online tool that helps consumers find their deceased loved one's life insurance policies and annuity contracts |

| NAIC Life Insurance Policy Locator Service requirements | Social Security number, Decedant's veteran status, relationship to the deceased |

| NAIC Life Insurance Policy Locator Service process | Review welcome page, agree to terms of use, enter your name, mailing address and email address, submit a search request by entering the deceased's information from the death certificate |

| NAIC Life Insurance Policy Locator Service results | If a policy is found and you are the beneficiary, the life insurance or annuity company will contact you directly. If no policy is found or you are not the beneficiary, you will not be contacted. |

What You'll Learn

How to find an old life insurance policy

Locating an old life insurance policy can be challenging, especially when a loved one has passed away. However, there are several steps you can take to find the information you need. Here is a comprehensive guide to help you in your search:

Search the Deceased's Documents and Correspondence:

Go through the deceased's paper and digital files, including their emails, bank safe deposit boxes, and other storage spaces for any insurance-related documents. Look for the policy itself, as it will contain the insured's name and policy number.

Review Financial Records:

Check the deceased's bank statements for any checks or automatic drafts made to life insurance companies. Also, review their income tax statements for interest income earned and expenses paid to insurance companies.

Check Mail and Email:

Look through the deceased's mail and email for premium or dividend notices. Even if the policy payments are up to date, the insurance company may still send annual notices regarding the policy's status or dividend statements.

Contact Relevant Parties:

Speak with the deceased's banker, financial adviser, and attorney. They may have information about the insurance policy or can guide you in the right direction. Additionally, contact the person's last workplace to inquire about any employer-provided insurance policies.

Submit a Request to the NAIC Life Insurance Policy Locator Service:

The National Association of Insurance Commissioners (NAIC) offers a free online tool called the Life Insurance Policy Locator Service. This service allows you to submit a request to locate a deceased loved one's life insurance policies. You will need information from the death certificate, including the social security number, legal name, date of birth, and date of death.

Contact the State's Unclaimed Property Office:

When an insured client passes away, and the beneficiary cannot be found, the life insurance company must turn over the death benefit to the state where the policy was purchased as "unclaimed property." Contact the state's Unclaimed Property Office or use the National Association of Unclaimed Property Administrators' search tool to access your state's unclaimed property database.

Be Aware of Special Challenges:

Keep in mind that insurance companies may change their names, merge with other companies, or sell policies to different companies. The NAIC provides tips on how to locate insurance companies that have undergone such changes. Additionally, consider the possibility that the insurance company may have gone bankrupt. In such cases, contact the state life and health guaranty association through the National Organization of Life & Health Insurance Guaranty Associations' search tool.

Consider Fee-Based Services:

If you are unable to find the policy through the above methods, you can opt to pay a search company to run the person's name against insurance industry databases. Several private companies offer fee-based services to assist in your search for a lost life insurance policy.

Tricare for Life: Insurance Card Essentials for Enrollees

You may want to see also

Tips for finding a lost life insurance policy

Locating a lost life insurance policy can be challenging, but there are several steps you can take to find the information you need. Here are some tips to guide your search:

Search the deceased's documents and correspondence:

Look through paper and digital files, bank safe deposit boxes, and other storage spaces for insurance-related documents. Check bank statements for checks or automatic drafts to insurance companies. Review the deceased's tax returns for records of interest income or expenses paid to insurance companies.

Contact relevant people and organizations:

Speak to the deceased's banker, financial adviser, and attorney. Contact their past employers, associations, and the relevant state government departments to see if they had a policy through their workplace or other affiliations.

Check the deceased's mail and email:

Look for premium or dividend notices from insurance companies. Even if policy payments are up to date, companies may still send annual notices regarding the policy's status or statements of dividends.

Check with insurance companies:

If you have the name of the insured, you can contact insurance companies directly to inquire about any policies in the deceased's name. Be aware that companies may change their names, merge, or sell policies to other companies, so it may be necessary to investigate this.

Submit a request to a policy locator service:

The National Association of Insurance Commissioners (NAIC) offers a free online Life Insurance Policy Locator Service. This tool can assist in locating life insurance policies by asking participating companies to search their records. If a policy is found and you are the designated beneficiary, the company will contact you directly.

Contact the state's Unclaimed Property Office:

When an insured client dies and the beneficiary cannot be found, insurance companies must turn the death benefit over to the state where the policy was purchased as "unclaimed property." You can search the state's unclaimed property database if you know or can guess the state where the policy was bought.

Consider fee-based services:

If all else fails, you can engage the services of private companies that specialize in finding lost insurance policies for a fee.

Whole Life vs Term Life Insurance: Key Differences Explained

You may want to see also

Free online tools to find old life insurance policies

If you're looking to find an old life insurance policy, there are several free online tools and methods you can use to help with your search. Here are some detailed steps and instructions to guide you through the process:

Search through Documents and Correspondence

Firstly, it's important to search through the deceased's documents and correspondence. This includes going through paper and digital files, bank safe deposit boxes, and other storage spaces for any insurance-related documents. Check bank statements for checks or automatic drafts to life insurance companies, as well as mail and email for premium or dividend notices. Even if policy payments are up to date, the insurance company may still send annual notices regarding the policy's status.

Review Tax Returns

Review the deceased's tax returns for the past two years to look for any records of interest income or expenses paid to life insurance companies. Life insurance companies often pay interest on accumulations on permanent policies and chart interest on policy loans.

Check Applications

If you come across any life insurance policy applications, be sure to check them. These documents typically list any other life insurance policies owned at the time of the application.

Talk to Relevant Professionals

It's also a good idea to talk to the deceased's banker, financial advisor, and attorney. They may have information about the insurance policy or can point you in the right direction.

Use the NAIC Life Insurance Policy Locator Service

If your search hasn't yielded any results, you can submit a request to the National Association of Insurance Commissioners (NAIC) Life Insurance Policy Locator Service. This free online tool can assist you in locating life insurance policies by asking participating companies to search their records. To use this service, you will need information from the death certificate, including the social security number, legal name, date of birth, and date of death.

Contact the State's Unclaimed Property Office

When a life insurance company is aware of a client's death but cannot find the beneficiary, they must turn the death benefit over to the state where the policy was purchased as "unclaimed property." If you know or can guess the state where the policy was purchased, you can search that state's unclaimed property database. The National Association of Unclaimed Property Administrators (NAUPA) has a free tool to help you locate lost or unclaimed insurance money and other property.

Contact Previous Employers

Many companies offer life insurance as part of their employee benefits packages. Contacting the HR department of the deceased's previous employers can help determine if they had a life insurance policy through their work.

Try the State Insurance Department

Unclaimed life insurance eventually gets passed on to the state insurance department if the insurer is aware of the policyholder's death but the beneficiary hasn't filed a claim. The NAIC can provide you with the insurance department contact details for the state in which the policy was held.

While finding an old life insurance policy can be challenging, these free online tools and methods can help streamline your search and increase your chances of success.

Life Insurance: USAA's Comprehensive Coverage Options

You may want to see also

What to do if you can't find the policy

If you can't find the policy, don't panic. There are several steps you can take to track down a lost policy and get the information you need to file a claim. Here are some suggestions:

Firstly, gather as much information as possible about the insured person. This includes their name, date of birth, Social Security number, insurer, and any other relevant documents. Having this information to hand will be useful when making enquiries.

Next, you can try searching through the person's financial records, including bank statements, tax returns, and emails for any payments, checks, or correspondence to insurance companies. Check for premium payment reminders, annual statements, dividend notices, or marketing materials. Also, look for any contact details of insurance agents or brokers in the person's phone or address book.

You can also try contacting the person's last workplace to see if they had a policy through their employer. Many people have group life insurance connected to their employment. If the person was still employed when they passed away, the company's benefits or HR department may be able to help.

Another option is to contact the person's financial advisor, accountant, banker, or lawyer. These professionals may know if the person had a life insurance policy in place.

If you are a beneficiary, you can also try using a life insurance policy locator tool, such as the National Association of Insurance Commissioners' (NAIC) Life Insurance Policy Locator Service. This free online tool can assist you in locating life insurance policies by asking participating companies to search their records. You will need to provide the deceased's personal details, including their Social Security number, legal name, date of birth, and date of death.

Additionally, you can contact your state's Unclaimed Property Office. When an insurance company is aware of a client's death but cannot locate the beneficiary, they must turn the death benefit over to the state where the policy was purchased as "unclaimed property." You can search the National Association of Unclaimed Property Administrators' database to locate the relevant state office.

Finally, if all else fails, you could consider paying a search company to run the person's name against insurance industry databases. This may be a more costly option, but it could be worthwhile if other methods have been unsuccessful.

Life Insurance and THC: What You Need to Know

You may want to see also

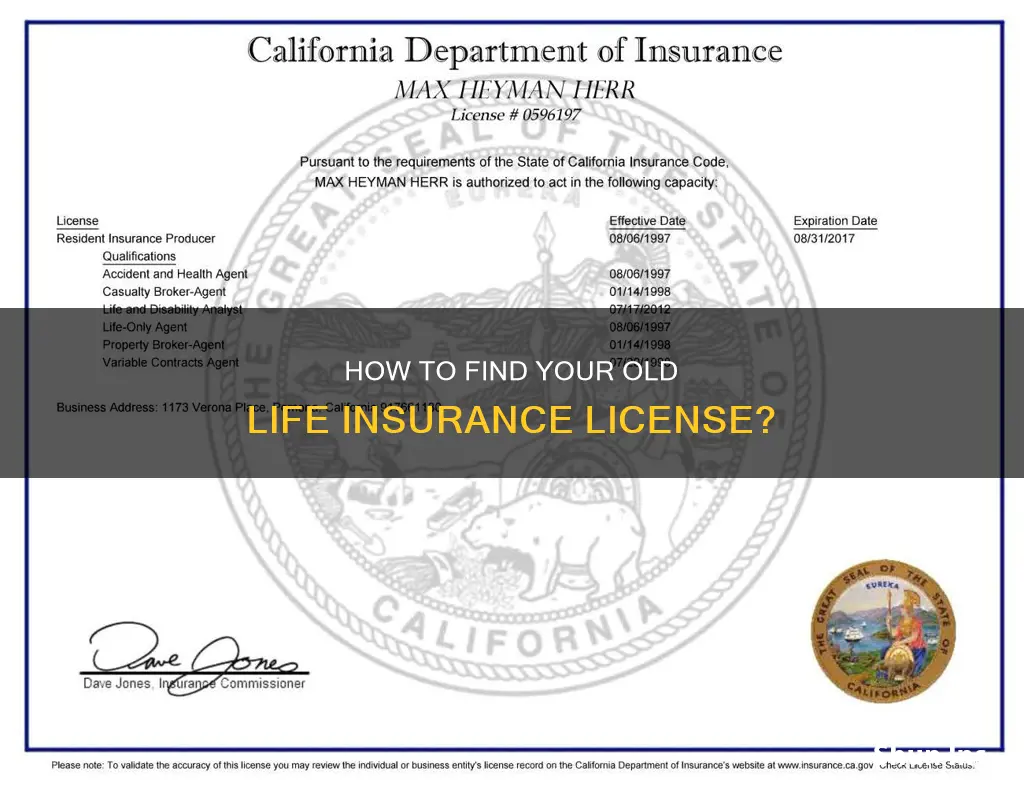

How to check the status of a licence

To check the status of a licence, you can use the Check a License online service. This requires the use of a Microsoft Edge, Google Chrome, Safari, or Firefox browser. You can use either a licence number or name to retrieve the licence status and discipline history of an agent, broker, adjuster, bail agent, business entity, or another licensee. From there, you can select the available links on the licence record to review additional licence details.

States typically request that you allow them up to 7-10 business days to review the transaction and provide a response or request additional information. If you have not received an update within this time frame, you may contact the state directly to request a status update and determine if additional documentation is required.

If you frequently use the Check a License online service, it is recommended that you save the Check a License link in your browser's favourites.

Marriott's Employee Benefits: Life Insurance Coverage

You may want to see also

Frequently asked questions

You can check the status of your old life insurance license by visiting the National Insurance Producer Registry (NIPR) website. They provide a one-stop resource with everything you need to know about obtaining, renewing, and managing producer and adjuster licenses.

To check the status of your old life insurance license, you will need your National Producer Number (NPN). You can use the NIPR website to look up your NPN.

Yes, you can renew your old life insurance license. The process may vary depending on your state and license type. You can find more information on the NIPR website or by contacting your state's insurance licensing department.

If you cannot find your old life insurance license information, you can contact the NIPR or your state's insurance licensing department for assistance. They may be able to help you locate your license information or provide guidance on how to proceed.