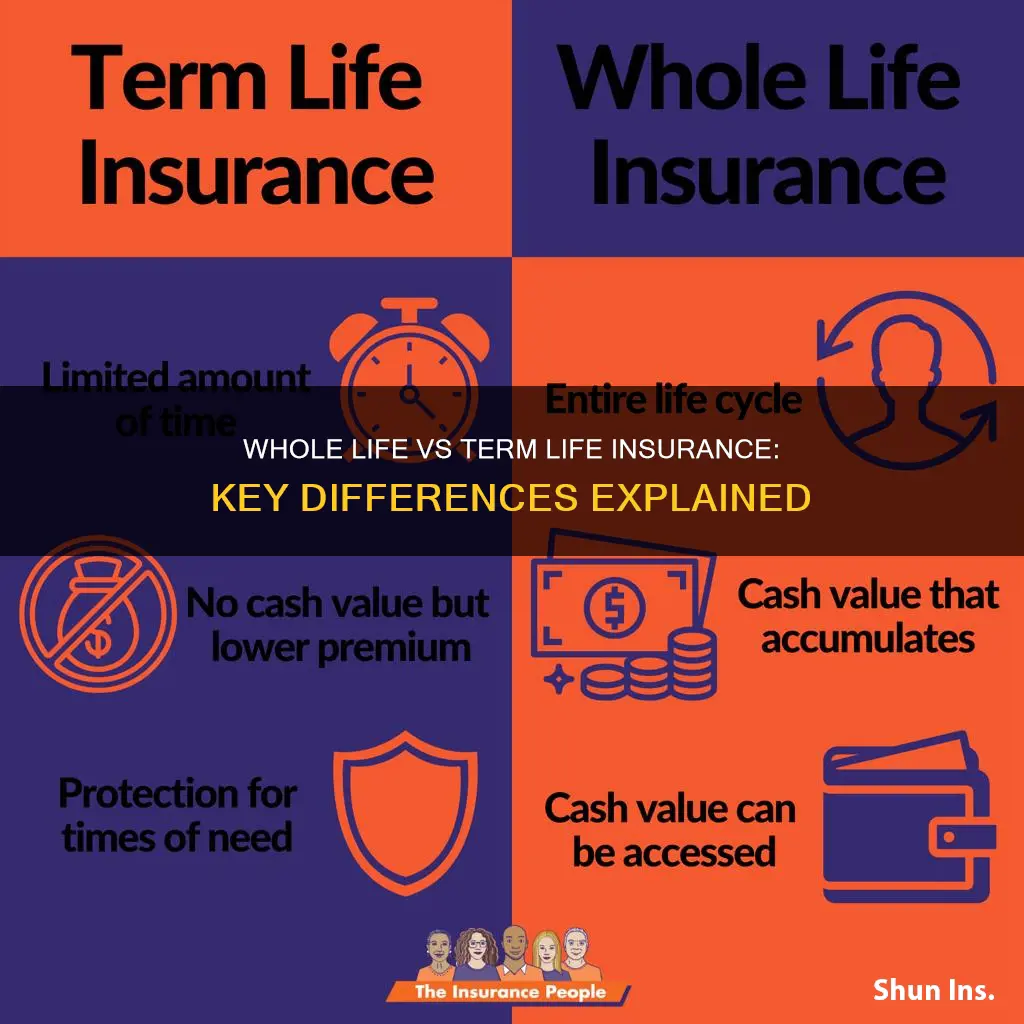

Whole life insurance and term life insurance are two of the most common types of life insurance available. Term life insurance is a good option for those seeking low-cost, temporary coverage. It offers coverage for a set period, typically between 10 and 30 years, and tends to be much cheaper than whole life insurance. On the other hand, whole life insurance provides permanent coverage for as long as the policyholder lives and pays their premiums. It also includes a cash value savings component that grows over time, which can be borrowed against or withdrawn. Whole life insurance is a more expensive and complex option, but it provides lifelong protection and builds cash value, making it a good choice for those seeking lifelong coverage and greater financial flexibility.

What You'll Learn

- Cost: Whole life insurance is more expensive than term life insurance

- Coverage length: Whole life insurance covers you for your entire life, while term life insurance only covers you for a set number of years

- Cash value: Whole life insurance has a cash value component that grows over time, while term life insurance does not

- Complexity: Whole life insurance is more complex than term life insurance due to its cash value component

- Conversion: Term life insurance can often be converted to whole life insurance, but not the other way around

Cost: Whole life insurance is more expensive than term life insurance

Whole life insurance is significantly more expensive than term life insurance. This is because whole life insurance offers lifelong coverage and accumulates cash value over time, whereas term life insurance only covers a set period of time and does not accrue any cash value.

Whole life insurance premiums can cost approximately 17 times more than term policies with the same death benefit. This makes whole life insurance less accessible to those on a budget or with limited financial resources. Term life insurance, on the other hand, is known for being affordable and a good option for those who want basic protection without breaking the bank.

The higher cost of whole life insurance is due to its dual nature as both an insurance and investment product. The premiums for whole life insurance are higher because they include a savings component that grows tax-free over time. This cash value can be accessed by the policyholder during their lifetime, providing a source of funds for future needs. In contrast, term life insurance is purely insurance, providing coverage for a fixed period without any savings or investment benefits.

While whole life insurance offers the advantage of lifelong coverage and a cash value component, the trade-off is the significantly higher cost. Term life insurance, on the other hand, offers simplicity and affordability, making it a popular choice for those who want basic protection without a long-term commitment.

The decision between whole life and term life insurance ultimately depends on an individual's financial situation, goals, and needs. For those seeking lifelong coverage and the ability to build cash value, whole life insurance may be worth the higher cost. However, for those on a budget or with more short-term needs, term life insurance can provide a more affordable and flexible solution.

Life Insurance and Disability: Payout Scenarios for the Permanently Disabled

You may want to see also

Coverage length: Whole life insurance covers you for your entire life, while term life insurance only covers you for a set number of years

Whole life insurance and term life insurance differ in terms of coverage length. Term life insurance offers coverage for a set number of years, typically ranging from 10 to 30 years. In contrast, whole life insurance provides coverage for an individual's entire life, as long as they continue to pay the premiums. This means that whole life insurance does not expire, whereas term life insurance does.

Term life insurance is often chosen by individuals who only require coverage for a specific period, such as the duration of their mortgage or until their children become financially independent. On the other hand, whole life insurance is suitable for those seeking lifelong coverage, such as for end-of-life planning or to provide ongoing care for loved ones with special needs.

The length of coverage also influences the complexity of the policies. Term life insurance is generally simpler and more straightforward, with fixed premiums and a death benefit that remains unchanged. Whole life insurance, on the other hand, can be more complex due to its lifelong nature and the presence of a cash value component that grows over time. This cash value can be borrowed against or withdrawn, but it also adds a layer of complexity to the policy, as the death benefit amount may change if there is an outstanding loan against the cash value.

In summary, the key difference in coverage length between term and whole life insurance lies in their temporal nature. Term life insurance offers temporary coverage for a fixed period, while whole life insurance provides permanent coverage for an individual's entire life, assuming they continue to pay the premiums. This distinction is an essential consideration when choosing the most suitable type of life insurance policy for one's needs.

Haven Life Insurance: Is It Worth It?

You may want to see also

Cash value: Whole life insurance has a cash value component that grows over time, while term life insurance does not

Term life insurance and whole life insurance differ in their cash value offerings. Term life insurance is a straightforward insurance plan that does not accrue any cash value. It is a good option for those who want low-cost coverage for a specific period, such as while their children are still financially dependent on them. On the other hand, whole life insurance has a cash value component that grows over time. This means that the policyholder can borrow against or withdraw from the policy for other financial needs. Whole life insurance is a good option for those who want lifelong coverage and the ability to build cash value.

Whole life insurance's cash value grows at a guaranteed, fixed rate over time, and this growth is tax-deferred. This means that the cash value can be withdrawn or borrowed against without any tax implications. The ability to withdraw or borrow from a whole life insurance policy provides more financial flexibility than a term life insurance policy. The cash value of a whole life insurance policy can be used for various purposes, such as paying college tuition or making home repairs.

However, it is important to note that if the policyholder borrows against the cash value of their whole life insurance policy, the death benefit will be reduced by the amount borrowed if it is not repaid. Additionally, withdrawing from the cash value of a whole life insurance policy may also reduce the death benefit. Despite these considerations, the cash value component of whole life insurance provides a valuable source of funds that can be accessed during the policyholder's lifetime.

In contrast, term life insurance does not offer any cash value component. This means that there is no opportunity to build wealth or save on taxes with this type of insurance. Term life insurance is purely insurance, providing a death benefit to the beneficiary if the insured person passes away during the specified term. While term life insurance is more affordable than whole life insurance, it does not offer the same financial flexibility in terms of cash value.

Overall, the difference in cash value between term life insurance and whole life insurance is a key consideration when choosing between these two types of insurance. Term life insurance offers no cash value, while whole life insurance provides a valuable source of funds that can be accessed during the policyholder's lifetime.

Accidental Death Rider: Necessary Add-on to Your Life Insurance?

You may want to see also

Complexity: Whole life insurance is more complex than term life insurance due to its cash value component

Whole life insurance is more complex than term life insurance due to its cash value component. Term life insurance is straightforward insurance without a savings or investment component. It is a simple product that offers a fixed benefit for a fixed period. In contrast, whole life insurance is a permanent life insurance product that offers lifelong coverage and includes a cash value account that grows over time. This cash value component adds complexity to the product in several ways.

Firstly, the cash value component in a whole life insurance policy grows over time, and the policyholder can borrow against or withdraw from this cash value. This introduces complexity in terms of policy management, as the policyholder now has the option to access these funds. The policyholder needs to consider the impact of withdrawing or borrowing against the cash value, as it will reduce the death benefit and may require repayment to restore the full benefit.

Secondly, the cash value component in a whole life insurance policy is subject to tax considerations. The cash value grows tax-free over time, and any loans or withdrawals are generally tax-free as well. This adds complexity to the product as the policyholder needs to understand the tax implications of their actions.

Thirdly, the cash value component in a whole life insurance policy affects the premiums. A portion of the premium goes towards the insurance component, while the other part contributes to building the cash value. This allocation of premiums between insurance and investment components adds complexity to the product, as it is not a simple insurance transaction but rather a combination of insurance and investment.

Finally, the cash value component in a whole life insurance policy may pay dividends. Some whole life policies are "participating" policies, which means they may pay dividends based on the insurance company's financial performance. The policyholder can choose to use these dividends to boost the policy's cash value. This adds complexity to the product as the policyholder now has the option to receive and manage dividends.

In summary, whole life insurance is more complex than term life insurance due to the presence of a cash value component. This cash value component introduces complexities related to policy management, tax considerations, premium allocation, and dividend payments. These factors make whole life insurance a more intricate and multifaceted financial product compared to the straightforward nature of term life insurance.

Primerica Life Insurance: Is It a Smart Choice?

You may want to see also

Conversion: Term life insurance can often be converted to whole life insurance, but not the other way around

Term life insurance is a good option for those who want to keep their premiums low and only need coverage for a specific period. For example, you may only want coverage for the length of your mortgage. However, if you want lifelong coverage, whole life insurance is the way to go. It's more expensive, but it lasts your whole life and has an added cash value component that earns interest over time.

Term life insurance is often a good choice for parents with young children and a mortgage, as their family may be dependent on their income to meet basic expenses. Whole life insurance is a good option if you want to build cash value that you can access while you're still alive, or if you want to ensure your final expenses are covered regardless of when you die.

If you're unsure about committing to whole life insurance, you can always start with a term life insurance policy and convert it to whole life later. Many term life insurance policies include a term life conversion option that allows you to switch to a permanent life insurance policy. However, there is usually a deadline for doing this, so check your policy for the conversion period.

It's important to note that not all insurers offer convertible term life insurance, and your new premium will likely be much higher as whole life insurance is more expensive than term coverage. Additionally, some insurers may impose a deadline or age limit for converting your policy. Depending on the insurer, a medical exam may not be required.

Converting from whole life to term life insurance is also possible through a provision called an extended term insurance option. This option allows you to surrender your policy and use the available cash value to buy an equal amount of term life insurance. This may be worth considering if you can no longer afford your whole life premiums. Keep in mind that the new term life policy might not last the rest of your life.

Life Insurance: Haven's Affiliate Program Explained

You may want to see also

Frequently asked questions

Whole life insurance provides coverage for your entire life, whereas term life insurance only covers you for a set period, such as 10, 20 or 30 years. Whole life insurance also has an investment or cash value component that grows over time, whereas term life insurance is purely insurance with no cash value.

Whole life insurance offers permanent coverage, which means your loved ones will receive a guaranteed payout when you die. It also includes a cash value component that you can borrow against or withdraw. Whole life insurance premiums are predictable and locked in, so you know what you'll be paying. On the downside, whole life insurance is more expensive than term life insurance, and its complexity can make it harder to evaluate. Borrowing against the cash value may also carry interest.

Term life insurance is much cheaper than whole life insurance, making it a good option if you're on a budget. It's also easier to understand and get approved for. However, term life insurance only offers temporary coverage, and there is no cash value component. If you outlive the term, your coverage will end and you won't receive any benefits.

Whether you choose whole life or term life insurance depends on your budget, how long you want coverage for, and your financial goals. If you're mainly looking for affordable coverage for a specific period, such as while your children are still dependent on you, term life insurance may be the best option. If you want lifelong coverage and are willing to pay higher premiums, whole life insurance could be a better fit.