Life insurance is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. It is an asset that many people use in long-term financial planning, providing financial support to loved ones after the policyholder's death. While life insurance is typically associated with death, it can also provide benefits to the policyholder if they become terminally ill or critically ill. This is known as a living benefit rider, which allows the policyholder to access a portion of the death benefit while still alive. Additionally, disability income insurance is a separate type of insurance that provides financial protection in the event of disability, helping to maintain one's lifestyle and income if they are unable to work due to an injury or illness.

| Characteristics | Values |

|---|---|

| Purpose | Provide financial support to loved ones after the policyholder's death |

| Definition | A contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away |

| Types | Term, Permanent, Whole, Universal, Variable Universal, Simplified Issue, Guaranteed Issue |

| Payout Options | Lump-sum payments, Installment payments, Annuities, Retained Asset Accounts |

| Beneficiaries | Individuals or organizations |

| Riders | Accelerated Benefit, Return-of-Premium, Waiver of Premium, Long-Term Care |

| Considerations | Coverage amount, Type of policy, Premium cost, Optional coverages |

| Underwriting Factors | Nature of disability, Medical treatments, Employment, Lifestyle choices, Risky hobbies |

| Application Tips | Work with an experienced agent, Apply for appropriate coverage, Focus on health |

What You'll Learn

Life insurance for the disabled

Life insurance is a contract between a policyholder and an insurance company that pays out a death benefit when the insured person passes away. There is no separate life insurance for disabled people. However, having a disability does not necessarily mean that a person will not qualify for life insurance. In fact, denying someone a life insurance policy solely because they have a disability may violate the Americans with Disabilities Act.

The nature of the disability will affect the available policy choices. For instance, if the disability is due to a physical impairment, such as blindness or deafness, the person may be able to qualify for a traditional term policy, especially if their spouse also has life insurance. In this case, most insurance providers will allow the purchase of a policy that offers at least half of the coverage that the spouse has.

If the disability affects life expectancy, it can impact a life insurance policy by limiting life insurance options. If the disability is severe or if there are other compounding health problems, most traditional life insurance providers will likely deny the application.

If a disability makes it difficult to qualify for a traditional policy, there are other options available, such as:

- Simplified issue life insurance: These policies work like traditional insurance but do not require a medical exam. They typically have health-related questions in the application and can be more expensive while providing less coverage.

- Guaranteed issue life insurance: These policies do not require a medical exam and do not ask any health-related questions. They are more expensive and provide less coverage, but they can be a way for disabled adults to get a policy if they are otherwise unable to qualify.

Riders for Disabled Adults

Adding a life insurance rider to a policy can provide additional support for adults with disabilities. Some useful riders include:

- Accelerated death benefit rider: Allows the policyholder to use some of the policy's death benefit while they are still alive if they are diagnosed with a qualifying serious or terminal illness.

- Term conversion rider: Gives the option to convert a term life insurance policy to a whole life policy at the end of the term, extending coverage for the rest of the policyholder's life and providing a cash value feature.

- Guaranteed insurability rider: Allows the policyholder to increase their death benefit at certain points in their life without undergoing a medical exam.

- Long-term care rider: Allows the policyholder to use their death benefit for qualifying long-term care costs.

Qualifying for Life Insurance with a Disability

To increase the chances of receiving a more affordable rate and qualifying for the desired coverage, it is recommended to work with an experienced life insurance agent who knows which companies are most likely to offer coverage for specific conditions. It is also important to focus on health, as insurance companies favour those in good health despite a disability.

Life Insurance for a Child with a Disability

If a parent wants to ensure their child with a disability will be financially supported when they die, they may consider buying life insurance on themselves. The special needs child can be the beneficiary, and a special needs trust can be set up to ensure the child is taken care of without disqualifying them from government assistance.

Another option is to add a child rider to the parent's life insurance policy. If the child dies before a certain age, the rider will pay a death benefit, usually limited to $25,000 or less per child. A separate life insurance policy for the child can also be purchased from some insurers.

Life Insurance and Stillbirth: What Coverage is Offered?

You may want to see also

Qualifying for life insurance with a disability

Work with an Experienced Professional

It is recommended to work with an experienced life insurance agent who knows which companies are more likely to offer coverage for specific disabilities. They can anonymously shop your application to find insurers willing to provide coverage.

Apply for an Appropriate Amount of Life Insurance

It is crucial to apply for a reasonable amount of coverage based on your income prior to your disability. Applying for too much coverage may result in denial.

Focus on Your Health

Insurance companies favour applicants in good health, so it is important to demonstrate that you are actively working to improve your health. This includes following medical treatments, exercising, eating well, regulating blood pressure, and not smoking.

Types of Life Insurance for People with Disabilities

The types of life insurance available will depend on the individual's risk, including overall health and life expectancy. Here are some traditional options:

Term Life Insurance

Term life insurance covers you for a specific length of time, such as 20 years, and you can choose the coverage amount. Rates typically do not change during the term, and your beneficiaries will receive a payout if you die while the policy is in force.

Permanent Life Insurance

Permanent life insurance is more expensive than term life insurance as it guarantees lifelong protection and a death payout, regardless of when you die. It also usually allows you to build cash value, which can accumulate on a tax-deferred basis.

Life Insurance Options if You Are Denied Coverage

If you cannot qualify for traditional life insurance, there are alternative options:

Guaranteed Issue Life Insurance

With guaranteed acceptance life insurance, you cannot be turned down, and there are no medical questions or exams. However, coverage limits are typically minimal, ranging from $5,000 to $25,000. These policies also have graded death benefits, meaning beneficiaries will not receive the full benefit if the insured passes away within two to three years of purchasing the policy.

Group or Supplemental Life Insurance

Many employers offer group life insurance plans that provide affordable coverage to workers, often without an underwriting process. Base coverage is usually equal to one year of the employee's salary.

Funeral and Burial Insurance

These policies are designed to help beneficiaries pay for final expenses and typically do not require a medical exam or extensive health questions.

If you have a child with special needs, you may want to ensure they are financially supported when you die. Here are some options:

Life Insurance for Parents of a Child with a Disability

The most straightforward option is to set up a special needs trust, which will not impact government benefits eligibility for your child. The trust can be listed as the beneficiary on your life insurance policy.

Life Insurance for a Child with a Disability

You can add a child rider to your own life insurance policy, which will pay a death benefit if the child dies before a certain age. Alternatively, you can purchase a separate life insurance policy for the child, although coverage limits may be smaller.

While qualifying for life insurance with a disability can be challenging, it is not impossible. By working with an experienced professional, applying for an appropriate amount of coverage, focusing on your health, and exploring alternative options, individuals with disabilities can find suitable coverage to meet their needs.

Geico's Life Insurance: What You Need to Know

You may want to see also

Types of life insurance for people with disabilities

The types of life insurance available for people with disabilities will depend on each individual’s risk, including overall health and life expectancy. Here are some of the options available:

Term Life Insurance

Term life insurance is a policy where you choose the length of the level term period, such as a 20-year term. Your rates do not change during the level term period. You’ll also choose your coverage amount, such as $500,000. If you die while the policy is in force, your beneficiaries will receive the payout. The policy expires if you outlive the length of your term without renewing the policy.

Permanent Life Insurance

Permanent life insurance typically guarantees lifelong protection and a death payout to your beneficiaries, no matter when you die. It also usually provides the opportunity to build cash value, which accumulates on a tax-deferred basis. The coverage length and cash value are why permanent life is much more expensive than term life.

Whole Life Insurance

This type of permanent life insurance has fixed and guaranteed premiums, rate of return on cash value and death benefit. The cash value component of a whole life insurance policy increases over time based on your interest rate. You can take out a loan against the cash value or withdraw funds.

Universal Life Insurance

This type of policy has more flexibility than whole life, and you may be able to adjust your death benefit and premium payments within certain parameters. The cash value gains in a universal life insurance policy depend on what type you buy, such as guaranteed universal life, indexed universal life or variable universal life.

Variable Universal Life Insurance

This type of policy offers a cash value component that you can allocate across a variety of investments such as bonds, stocks and money market funds. Variable universal life insurance is designed for those willing to assume more risk when it comes to investment gains and losses.

Life Insurance: Asset or Liability?

You may want to see also

Life insurance options if you're denied coverage

Being denied life insurance can be worrying, especially if you have a family that relies on your income. However, it's important to remember that you're not alone in this situation, and there are alternative options available. Here are some steps you can take to secure coverage:

Contact the Insurer and Seek Clarification

Get in touch with the insurance company or your insurance agent to understand the reason behind the denial. It could be due to medical or non-medical reasons, such as a serious medical condition, poor results from a medical exam, bankruptcy, a criminal record, risky hobbies, or even an old driving offense. Knowing the exact reason will help you take the next steps.

Confirm the Results and Consider an Appeal

If poor health is the reason for denial, consult your physician to verify if there is a genuine cause for concern. If the denial is based on incorrect or insufficient medical information, you have the right to appeal the decision. Ask your doctor to provide the insurer with detailed and up-to-date information from your medical file. You can also appeal non-medical reasons, such as outdated financial records or incorrect details about your job and hobbies.

Check with Your Workplace

Your employer may offer a group term life insurance plan that you can sign up for. While it may not provide the same level of coverage as an individual policy, it offers some form of death benefit. These group plans usually don't require a medical exam, making it easier to obtain coverage. However, keep in mind that if you leave your job, you will lose this coverage.

Reach Out to an Independent Life Insurance Agent

An independent life insurance agent can be a valuable resource when facing difficulties in getting insured. They have extensive knowledge of the underwriting process and can help navigate any red flags in your application. They can also search across a wider market to find a suitable policy for you.

Allow for a Waiting Period and Make Necessary Changes

Sometimes, it's beneficial to take a step back and focus on improving your health and overall situation. Use the denial as motivation to adopt healthier habits, quit smoking, improve your financial situation, or address any other issues that led to the denial. After making positive changes, you can reapply with a better chance of approval.

Apply for a Different Policy or Consider Alternative Coverage Options

If you're reaching an age where your usual insurer doesn't offer the desired life insurance, consider applying for a shorter term. For older individuals, the term length for term life insurance becomes shorter. You can also explore no-exam life insurance options, such as simplified issue life insurance or guaranteed issue life insurance. These options may have lower coverage limits and higher costs, but they can be a viable solution if you're facing challenges in obtaining traditional coverage.

Hawaii Life Insurance: Tax-Free or Not?

You may want to see also

Disability insurance and life insurance compared

Disability insurance and life insurance are two different types of insurance policies that offer financial protection in distinct scenarios. Here is a detailed comparison of the two:

Nature of Insurance

Disability Insurance: Disability insurance is designed to provide financial support if you become unable to work due to injury, illness, or disability. It replaces a portion of your income to help maintain your lifestyle and support your loved ones during the disability period.

Life Insurance: Life insurance, on the other hand, is a contract between the policyholder and the insurance company. It provides a death benefit to the beneficiaries upon the insured person's death. It helps safeguard loved ones against financial hardship and can be used to cover expenses such as mortgage payments, everyday bills, and education costs.

Types of Coverage

Disability Insurance: There are two main types of disability insurance: short-term and long-term. Short-term disability insurance provides coverage for a few weeks or months, while long-term disability insurance offers a steady income stream for a prolonged period or even until retirement.

Life Insurance: Life insurance can be categorized into term life insurance and permanent life insurance. Term life insurance covers a set period, such as 10, 20, or 30 years, while permanent life insurance provides coverage for the policyholder's entire life as long as premiums are paid.

Cost and Premiums

Disability Insurance: The cost of disability insurance typically ranges from 1% to 3% of your annual income. Factors influencing the cost include age, gender, health status, smoking status, occupation, and the chosen coverage amount and period.

Life Insurance: Life insurance premiums depend on factors such as age, health, gender, lifestyle, and coverage amounts. Term life insurance is generally cheaper than permanent life insurance, which offers added benefits like cash value accumulation.

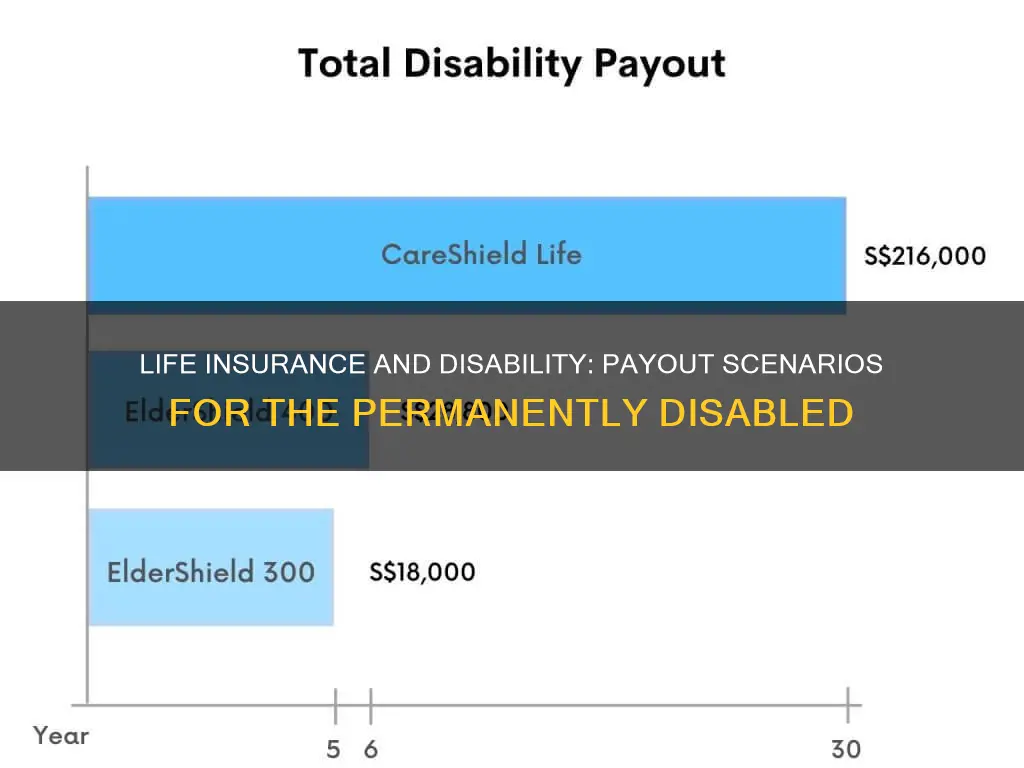

Benefits and Payouts

Disability Insurance: Disability insurance benefits are designed to replace a portion of your lost income. Payouts typically range from 60% to 80% of your pre-disability income, ensuring you can still meet your financial obligations and cover expenses.

Life Insurance: Life insurance provides a death benefit to the beneficiaries, which can be paid as a lump sum, installments, annuities, or retained asset accounts. The benefit amount is determined by the policy's terms and can range from several thousand to several million dollars.

Applicability

Disability Insurance: Disability insurance is applicable when you are unable to work due to injury, illness, or disability. It covers a wide range of conditions, including physical injuries, mental illness, and pregnancy-related complications.

Life Insurance: Life insurance is applicable when the insured person passes away. It covers both natural and accidental causes of death and, in some cases, suicide. It helps protect loved ones from financial hardship and provides income replacement.

Tax Implications

Disability Insurance: Whether or not disability insurance benefits are taxable depends on who pays the premiums. If both the employer and employee contribute, only the amount received due to the employer's payments is reported as income.

Life Insurance: Life insurance proceeds received by beneficiaries due to the death of the insured are generally not taxable. However, any interest earned on the proceeds is taxable, and there may be tax implications for certain policy transfers or in specific situations.

Genworth Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Life insurance provides financial protection for your loved ones when you die. Disability insurance, on the other hand, pays out benefits if you become disabled and cannot work.

While life insurance does not typically cover disability, some policies include or offer the option to add a disability income rider. This rider uses part of your death benefit to replace a portion of your monthly income if you become disabled.

Yes, in most cases, people with disabilities can obtain life insurance. The nature and severity of the disability, overall health, and life expectancy will impact the available policy choices and premium costs.

The types of life insurance accessible to individuals with disabilities include term life insurance and permanent life insurance, such as whole life insurance and universal life insurance. Additionally, guaranteed-issue life insurance is an option that does not require a medical examination, but it tends to have higher costs and lower coverage amounts.

To improve your chances of obtaining life insurance with a disability, it is advisable to work with an experienced life insurance agent who can guide you toward insurers more likely to offer coverage for your specific condition. Maintaining good health, adhering to medical treatments, and quitting unhealthy habits like smoking can also enhance your prospects for approval and lower premiums.