Life insurance is not a legal requirement for getting a mortgage, but it could provide financial support to your loved ones in the event of your death. This could be used to pay off, or at least support, mortgage payments, providing stability during a difficult time. There are various types of life insurance, including dedicated mortgage life insurance.

| Characteristics | Values |

|---|---|

| Purpose | To pay off the remaining mortgage when the borrower dies |

| Who it covers | The borrower |

| Who receives the payout | The mortgage lender |

| Who it benefits | The borrower's family |

| Who sells it | Banks, mortgage lenders, or independent insurance companies |

| When to buy it | When buying a home or shortly after |

| Length of coverage | Coincides with the number of years left on the mortgage |

| Cost | Potentially higher than term life insurance |

| Flexibility | Low; the death benefit can only be used to pay off the remaining mortgage |

| Medical exam required | No |

What You'll Learn

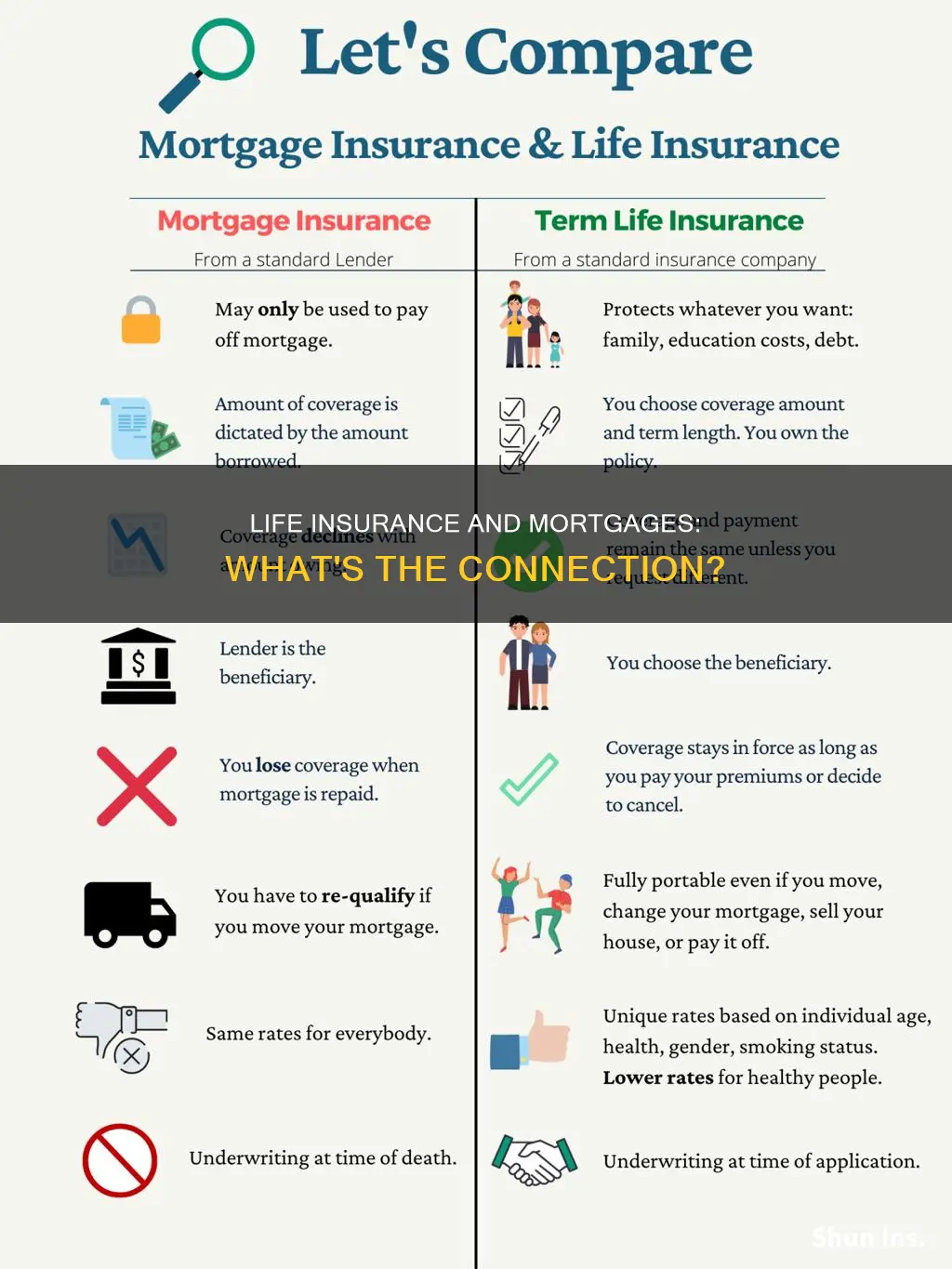

Mortgage life insurance vs. term life insurance

When you take out a mortgage, you'll likely be offered mortgage life insurance by your lender or broker. This is a type of insurance that will pay off your mortgage in the event of your death. However, you can also use a term life insurance policy to cover your mortgage. So, what's the difference, and which one should you choose?

Mortgage life insurance is sold by financial institutions and lenders to pay off your mortgage in the event of your death. The cost is usually added to your monthly mortgage payments. The lender is the beneficiary of the policy, and the money goes directly to them to pay off the mortgage. The coverage decreases over time as you pay off your mortgage, and it ends if you pay off the mortgage, sell your home, or change lenders. Mortgage life insurance usually doesn't require a medical exam, and it's easy to qualify for coverage. It's marketed towards new homeowners who are concerned about leaving their loved ones with a large mortgage.

Term life insurance is sold by insurance companies and provides a lump-sum benefit to your beneficiaries (usually your family) in the event of your death. The money can be used for anything, including paying off the mortgage, covering debts, or paying living expenses. Term life insurance is sold in set lengths of time, such as 5-, 10-, or 20-year terms. The benefit amount remains the same and never changes. Term life insurance is portable and remains in place even if you move, pay off your mortgage, or change lenders. It's more flexible than mortgage life insurance, as your beneficiaries can use the payout for various expenses, not just the mortgage.

Key Differences:

- Beneficiaries: With mortgage life insurance, the lender is the sole beneficiary. With term life insurance, you choose the beneficiary.

- Coverage: Mortgage life insurance coverage decreases over time as your mortgage amount gets smaller. Term life insurance coverage stays the same.

- Flexibility: Term life insurance offers more flexibility, as your beneficiaries can use the payout for various expenses, not just the mortgage.

- Medical exams: Mortgage life insurance usually doesn't require a medical exam, while term life insurance usually does.

- Portability: Term life insurance is portable and can be extended or converted to another policy when the term is up. Mortgage life insurance ends when your mortgage is paid off or you change lenders.

- Cost: Term life insurance is generally more affordable, especially if you're young and in good health when you apply.

Both mortgage life insurance and term life insurance can protect your loved ones by ensuring that your mortgage is paid off in the event of your death. However, term life insurance offers more flexibility, as it allows your beneficiaries to use the payout for various expenses, not just the mortgage. Term life insurance is also generally more affordable and provides coverage for a set length of time, giving you peace of mind. On the other hand, mortgage life insurance is convenient and easy to obtain, but it lacks flexibility and doesn't allow you to choose the beneficiary. Ultimately, the decision depends on your individual needs and preferences, but it's important to consider the pros and cons of each option carefully.

Divorce and Life Insurance: Virginia's Law and Your Policy

You may want to see also

Mortgage protection insurance pros and cons

Mortgage protection insurance (MPI) is an optional insurance policy that pays off the remainder of your mortgage if you pass away or become disabled and can't work. It is similar to life insurance but with some key differences. Here are some pros and cons to help you decide if MPI is right for you.

Pros of Mortgage Protection Insurance

- Guaranteed acceptance: MPI policies typically offer guaranteed acceptance, which means you can't be denied coverage based on your health condition. This is beneficial for those with pre-existing medical conditions who may struggle to obtain traditional life insurance or would have to pay higher rates.

- No underwriting required: MPI plans usually don't require underwriting, so most policies won't require you to submit a medical exam to qualify for coverage. This makes it easier to obtain than traditional life insurance.

- Peace of mind for your family: MPI ensures that your mortgage payments will be covered if you pass away or become disabled, giving your family peace of mind and protecting them from the risk of losing their home due to foreclosure.

Cons of Mortgage Protection Insurance

- Extra monthly payment: MPI requires an additional monthly payment, so you'll need to ensure it fits within your budget.

- Limited payout options: If you pass away, the MPI payout only goes towards your mortgage debt. It won't provide your family with money to cover other expenses such as taxes, bills, or funeral costs.

- Alternative policies may be better: If you want an insurance policy that provides a more comprehensive financial safety net for your family, a traditional life insurance policy may be a better option than MPI.

- May not be the best use of your money: If your mortgage is almost paid off or you have sufficient funds to cover the remaining payments, MPI may not be a necessary expense. In such cases, you might be better off putting the money towards an emergency fund or retirement savings.

- Payoff amount declines: The payout amount of MPI decreases as you pay off your mortgage, which can be a major drawback. Some newer MPI policies offer a level death benefit, meaning the payouts won't decline, but these may be harder to find.

- Potentially better alternatives: Since MPI is paid directly to your lender, it won't provide financial protection to your loved ones beyond paying off the mortgage. A life insurance policy might be preferable as the payout goes directly to your beneficiaries, giving them more flexibility in how the funds are used.

Florida's Insurance Agent Licensing: Life and Health Exclusivity

You may want to see also

Who gets the life insurance payout?

Mortgage life insurance is a type of insurance policy offered by banks and lenders that ensures your mortgage is paid off if you die before the loan is repaid. The beneficiary of the policy is the mortgage lender, not your spouse or other family members. This means that the insurer will pay the lender the remaining balance on the mortgage if you pass away. The money does not go to your family.

Mortgage life insurance should not be confused with traditional life insurance policies, where the death benefit is paid out to the policyholder's chosen beneficiaries after they die. With traditional life insurance, beneficiaries can use the money for anything, including paying off the mortgage, but also things like final expenses, childcare, future education costs, credit card debt, and more.

Mortgage life insurance policies also differ from traditional life insurance in that they are designed specifically to cover the cost of the mortgage. The term of the policy matches the term of the mortgage, and the death benefit is usually reduced each year to correspond with the amortized mortgage balance outstanding as payments are made. This means that while the premiums of the policy remain level during the term, the policy's value decreases over time as the mortgage is paid off.

In summary, who gets the life insurance payout depends on the type of insurance policy in place. With mortgage life insurance, the payout goes directly to the mortgage lender. With traditional life insurance, the payout goes to the policyholder's chosen beneficiaries.

Gerber Life Insurance: Does It Have an Expiry Date?

You may want to see also

Mortgage life insurance vs. private mortgage insurance

Mortgage life insurance, also known as mortgage protection insurance, is a type of life insurance policy that pays off your remaining mortgage debt if you die. This type of insurance is designed to ensure that your family can remain in their home without the burden of mortgage payments. The length of the policy coincides with the number of years left on your mortgage, and the death benefit decreases each year as you pay off your mortgage.

Mortgage life insurance is typically sold by the mortgage lender or an affiliated insurance company. The premiums can be rolled into your loan payments, but they tend to be high compared to other types of insurance. It's important to note that the lender is the beneficiary of this policy, not your family or chosen beneficiaries. This means that the death benefit is paid directly to the lender to settle the remaining mortgage balance, and your loved ones do not receive any money.

Private mortgage insurance (PMI) is designed to protect the lender in case the borrower defaults on their mortgage loan. If you take out a conventional mortgage loan and put down less than 20%, your lender will likely require you to obtain PMI. This type of insurance reimburses the lender if you default on your loan and the house's value is insufficient to cover the remaining debt through a foreclosure sale. It's important to note that PMI does not cover your mortgage payments if you lose your job, become disabled, or die.

Key Differences:

The main difference between mortgage life insurance and private mortgage insurance is who they protect. Mortgage life insurance protects the borrower and their family by ensuring the mortgage is paid off if the borrower dies. On the other hand, private mortgage insurance protects the lender by reimbursing them if the borrower defaults on their loan.

Another key difference is the beneficiary of the policies. With mortgage life insurance, the lender is the beneficiary and receives the death benefit directly. In contrast, private mortgage insurance benefits the lender by reimbursing them for the loan default and does not involve a death benefit.

Additionally, mortgage life insurance tends to have high premiums, while PMI increases your monthly mortgage payments. Mortgage life insurance also lacks flexibility, as the death benefit can only be used to pay the mortgage, whereas PMI is temporary and can be cancelled once you reach 20% equity.

Family Life Insurance: Do Children Get Covered for Free?

You may want to see also

Do you need life insurance for a mortgage?

While it is not a legal requirement to have life insurance to get a mortgage, it is worth considering as it could provide financial stability for your loved ones in the event of your death.

Mortgage life insurance, also known as mortgage protection insurance, is a type of insurance policy that pays off your mortgage debt if you die. The beneficiary of the policy is the mortgage lender, who will receive the remaining balance of the mortgage. This means that your loved ones won't receive any death benefit but will be able to keep the house.

Pros and Cons of Mortgage Life Insurance

Mortgage life insurance offers peace of mind that your mortgage will be paid off when you pass away. It is also convenient as it aligns with your loan balance and pays the lender directly. Additionally, it does not require a medical exam, making it an option for those with pre-existing health conditions.

However, one of the biggest drawbacks of mortgage life insurance is the lack of flexibility. Your loved ones won't have the freedom to spend the money as they wish, as the payout goes directly to the lender. The payout also decreases over time as you pay down your mortgage, while your premiums stay the same. Mortgage life insurance can also be more expensive than term life insurance, especially for individuals in good health.

Alternatives to Mortgage Life Insurance

If you are looking for more flexibility, term life insurance may be a better option. With term life insurance, you can choose the coverage amount and policy length, and the payout can be used for any purpose, including paying off the mortgage. Whole life insurance is another alternative that can provide funds to pay off a mortgage while leaving some money for other expenses.

Child Life Insurance: Rollover Options for Parents

You may want to see also

Frequently asked questions

You are not legally required to have life insurance to get a mortgage. However, life insurance can provide financial support to your loved ones in the event of your death, which could be used to pay off your mortgage.

Mortgage life insurance is a type of term life insurance that pays off your mortgage when you die. The beneficiary of a mortgage life insurance policy is the mortgage lender, whereas with term life insurance, your chosen beneficiaries receive the death benefit and can choose how to use the money.

Mortgage life insurance offers peace of mind that your mortgage will be paid off when you die. It is also a "guaranteed issue" policy, meaning there is no medical exam required to qualify for coverage. However, mortgage life insurance offers little flexibility as your loved ones won't receive the death benefit directly and can only use it to pay off the mortgage. Additionally, as you pay off your mortgage, the coverage decreases, while the premiums remain the same.