Adjustable life insurance, also known as adjustable universal life, offers policyholders flexibility in managing their coverage. One key feature is the ability to adjust the death benefit and premium payments over time. However, a common misconception is that adjustable life insurance is a one-size-fits-all product. In reality, it requires careful consideration and regular review to ensure it meets the policyholder's evolving needs. This includes understanding the potential risks and benefits associated with adjusting the policy, such as the impact on cash value and the possibility of policy lapse if payments are not made. The statement that adjustable life insurance is a simple, static product is false, as it demands active management and a clear understanding of the policy's mechanics.

What You'll Learn

Adjustable life insurance is a fixed-rate product

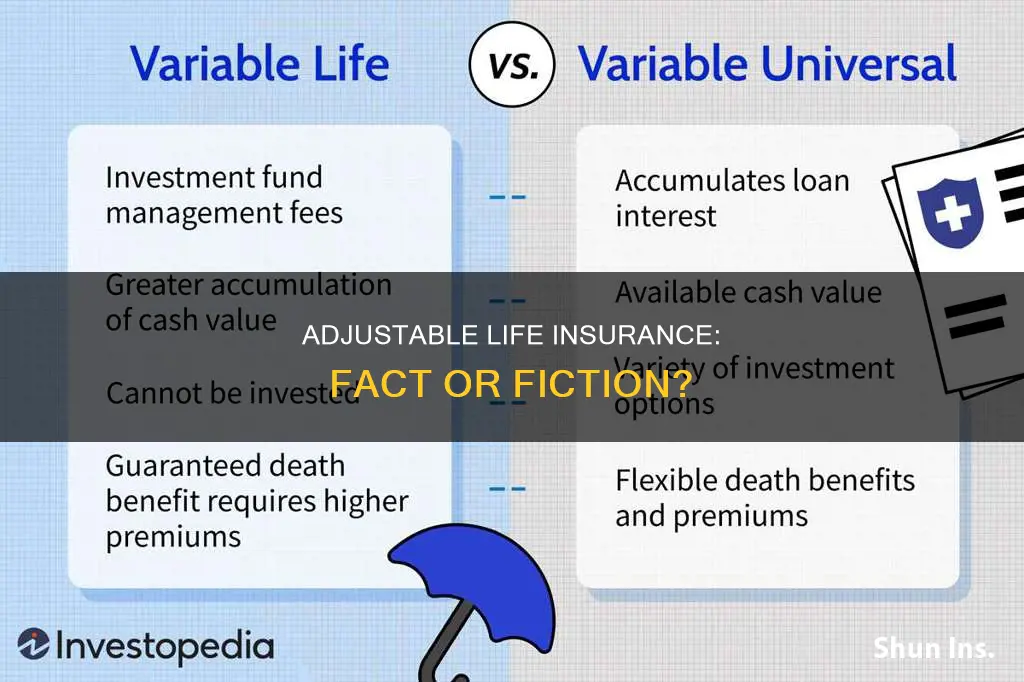

Adjustable life insurance is a type of policy that offers flexibility and adaptability, which is the opposite of a fixed-rate product. This is a crucial distinction to understand when evaluating the nature of adjustable life insurance. Unlike traditional fixed-rate life insurance, where the death benefit and premium remain constant throughout the policy term, adjustable life insurance is designed to adjust based on market conditions and the policyholder's needs.

The key feature that sets adjustable life insurance apart is its ability to change. This means that the death benefit and premiums can vary over time, providing policyholders with a dynamic insurance solution. For instance, if the market interest rates rise, the policy's cash value may increase, allowing the policyholder to borrow against it or use it as collateral. Conversely, if interest rates fall, the policy's cash value could decrease, impacting the overall policy value. This adjustability is a significant advantage for those seeking insurance that can adapt to changing financial circumstances.

The false statement here is that adjustable life insurance is a fixed-rate product. This misconception could lead to confusion and potentially deter individuals from considering this insurance type. Adjustable life insurance is not a one-size-fits-all solution but rather a customizable option that can be tailored to meet specific financial goals and risk management needs. It provides policyholders with the freedom to adjust their coverage as their life circumstances evolve.

When purchasing adjustable life insurance, it is essential to understand the potential for changes in the policy's terms. Policyholders should be aware that the death benefit and premiums can fluctuate, and these adjustments are typically tied to market performance. This feature allows for better risk management, especially in a volatile market, as it provides a safety net for policyholders. However, it also means that the policy's value and cost can vary, requiring careful financial planning and regular reviews to ensure the policy remains aligned with the policyholder's objectives.

In summary, the statement that adjustable life insurance is a fixed-rate product is false. This type of insurance is designed to be adaptable, allowing policyholders to adjust their coverage as needed. Understanding the dynamic nature of adjustable life insurance is crucial for making informed decisions about life insurance, ensuring that the chosen policy aligns with one's financial goals and risk tolerance.

Life Insurance and Suicide: What Coverage Entails

You may want to see also

Premiums are guaranteed to increase over time

The statement "Premiums are guaranteed to increase over time" is often associated with adjustable life insurance, but it is not entirely accurate. While it is true that adjustable life insurance policies typically have premiums that can change, the idea that these premiums are guaranteed to increase is a misconception.

In adjustable life insurance, the premium payments are usually flexible and can be adjusted based on various factors. These factors often include the policyholder's age, health, and the overall cost of insurance at that time. The premiums can go up or down depending on these circumstances, and this flexibility is one of the key advantages of adjustable life insurance. For example, if the policyholder's health improves significantly, the insurance company may reduce the premium to reflect the lower risk. Conversely, if the policyholder's health deteriorates, the premium might increase to cover the higher risk.

The term "guaranteed to increase" implies a fixed and certain outcome, which is not the case in adjustable life insurance. The premiums are not locked in and will always increase; they can remain the same, decrease, or increase, depending on the policy's terms and the individual's circumstances. This flexibility allows policyholders to manage their insurance costs more effectively, especially as their financial situation and health change over time.

It is essential for individuals considering adjustable life insurance to understand the potential variations in premiums. By doing so, they can make informed decisions about their insurance coverage and ensure that the policy remains suitable for their long-term needs. While the premiums may not be guaranteed to increase, this feature of adjustable life insurance provides a level of adaptability that can be beneficial for many policyholders.

Child Term Life Insurance: What Parents Need to Know

You may want to see also

Policyholders can adjust death benefits annually

Adjustable life insurance is a type of policy that offers flexibility in terms of its coverage, allowing policyholders to adjust various aspects of their insurance plan over time. One of the key features of this type of insurance is the ability to adjust the death benefit, which is the amount paid out to the beneficiary upon the insured's death. This feature is particularly useful for individuals who want to ensure that their insurance coverage keeps up with their changing financial needs and circumstances.

The process of adjusting the death benefit typically involves the policyholder providing updated information to the insurance company, such as changes in income, family size, or financial goals. For example, a policyholder who has recently started a new high-paying job might choose to increase the death benefit to better provide for their family in the event of their passing. Conversely, if a policyholder's financial situation has improved, they may opt to decrease the death benefit to avoid over-insuring and potentially paying unnecessary premiums.

Annual adjustments can be made through a process known as "re-rating." This involves the insurance company reviewing the policyholder's current financial situation and health, and then adjusting the policy's terms accordingly. Re-rating can be a straightforward process, often requiring minimal documentation, as long as the policyholder has maintained a good relationship with the insurance provider. It is important to note that the frequency of these adjustments is typically annual, hence the term "annual re-rating."

However, it is crucial to understand that not all adjustable life insurance policies offer annual adjustments. Some policies may have more frequent or less frequent adjustment periods, and others might not allow for adjustments at all. For instance, a policy with a fixed death benefit would not allow for annual adjustments, making it a false statement to claim that all adjustable life insurance policies enable annual changes to the death benefit.

In summary, the ability to adjust death benefits annually is a valuable feature of adjustable life insurance, providing policyholders with the flexibility to adapt their coverage to their evolving needs. Understanding the terms and conditions of your specific insurance policy is essential to knowing what adjustments, if any, are available to you.

Life Insurance Mistakes: 5 Things to Avoid

You may want to see also

It offers no investment component

Adjustable life insurance, as the name suggests, is a type of life insurance policy that provides flexibility and customization to the policyholder. One of the key features that sets it apart from traditional life insurance is the ability to adjust the policy's death benefit and premium over time. However, it is important to understand that adjustable life insurance does not inherently include an investment component.

When considering the investment aspect, it is crucial to recognize that adjustable life insurance is primarily a form of insurance rather than an investment vehicle. The primary purpose of this policy is to provide financial protection and peace of mind to the policyholder and their beneficiaries in the event of the insured's death. The death benefit is the main feature, ensuring a financial safety net for the loved ones left behind.

In contrast to some other financial products, adjustable life insurance does not offer an investment option where policyholders can grow their money over time. The policy's cash value, if any, is typically used to adjust the death benefit and may also be used to pay for future premiums. However, the accumulation of cash value is not the primary goal of this insurance. Instead, it provides a means to ensure that the policy remains in force even if the insured's financial situation changes.

The absence of an investment component in adjustable life insurance is a defining feature that sets it apart from other financial products. This lack of investment aspect makes it a more straightforward and focused insurance product. Policyholders can rely on the insurance coverage without the added complexity of investment growth, making it an attractive option for those seeking pure insurance protection.

Understanding the difference between adjustable life insurance and investment products is essential for making informed financial decisions. While adjustable life insurance focuses on providing insurance coverage, other financial instruments, such as mutual funds or stocks, offer investment opportunities with the potential for long-term growth. Therefore, when evaluating insurance options, it is crucial to recognize the unique nature of adjustable life insurance and its lack of an investment component.

Haven Life Insurance: Is It Worth It?

You may want to see also

False: Adjustable life insurance is not a savings vehicle

Adjustable life insurance is a type of permanent life insurance that offers a unique feature: the ability to adjust the death benefit and premium over time. This flexibility sets it apart from traditional life insurance policies, making it an attractive option for those seeking both insurance coverage and potential savings opportunities. Contrary to the statement that adjustable life insurance is not a savings vehicle, it indeed serves as a powerful tool for building long-term wealth.

One of the key advantages of adjustable life insurance is its potential to accumulate cash value. As the policyholder, you can choose to allocate a portion of your premium payments towards building cash value. This cash value grows over time, earning interest, and can be borrowed against or withdrawn, providing a source of funds that can be utilized for various financial goals. The growth of cash value in adjustable life insurance policies is often more rapid compared to other savings vehicles, making it an efficient way to build a financial cushion.

The adjustable aspect of this insurance allows policyholders to customize their coverage to meet changing needs. As your financial situation evolves, you can adjust the death benefit and premium to ensure that your insurance coverage remains appropriate. This flexibility is particularly beneficial for those who want to maximize their insurance benefits during their most productive years while also building savings. For instance, a young professional might opt for a higher death benefit to provide for a family, and as they advance in their career, they can adjust the policy to reflect their increased financial stability and potentially lower insurance needs.

Furthermore, the cash value in adjustable life insurance can be a valuable asset that can be utilized in various ways. Policyholders can access the cash value through loans, providing immediate funds for significant purchases or investments. Over time, the accumulated cash value can be substantial, offering a financial safety net and a potential source of funds for retirement or other long-term financial goals. This aspect of adjustable life insurance transforms it into a comprehensive financial tool, combining insurance protection with a savings component.

In summary, the statement that adjustable life insurance is not a savings vehicle is false. It offers a unique blend of insurance and savings, allowing individuals to build cash value, customize their coverage, and access funds for various financial needs. By understanding and utilizing the adjustable nature of this insurance, individuals can create a comprehensive financial strategy that provides both protection and wealth-building opportunities.

Life Insurance: Millions of Americans Unprotected

You may want to see also

Frequently asked questions

Adjustable life insurance, also known as adjustable universal life, offers flexibility in premium payments and death benefits. It allows policyholders to adjust the amount of coverage and premiums over time, providing more control compared to a fixed-term policy.

The cash value in adjustable life insurance is an investment component that grows over time. Policyholders can borrow against this cash value or withdraw funds, providing a source of emergency funds. However, it is important to note that withdrawals may impact the policy's coverage and long-term growth.

Yes, one of the key features is the ability to increase the death benefit. Policyholders can enhance the coverage amount by paying additional premiums, ensuring that the insurance keeps pace with changing financial circumstances.

Yes, many adjustable life insurance policies offer a conversion option. This allows policyholders to convert their adjustable policy into a fixed-term life insurance policy, providing a sense of security and predictability in the future. However, it is not a universal feature, and conversion terms may vary by insurer.