Preneeding life insurance is a smart financial decision that can provide peace of mind and security for your loved ones. By purchasing life insurance in advance, you ensure that your family is protected in the event of your untimely passing. This proactive step allows you to lock in rates and secure coverage at a younger, healthier age, often at a lower cost compared to purchasing later in life. Additionally, preneeding life insurance can be a valuable asset for estate planning, tax planning, and even as a tool to build wealth over time through investment options. It's a way to safeguard your loved ones' financial future and provide them with the support they need when it matters most.

What You'll Learn

- Financial Security: Preneeding ensures your family's financial stability in your absence

- Peace of Mind: Knowing your loved ones are protected brings reassurance

- Long-Term Savings: Life insurance can grow your money over time

- Tax Benefits: Preneeding policies offer tax advantages, saving you money

- Customizable Plans: Tailor coverage to your specific needs and budget

Financial Security: Preneeding ensures your family's financial stability in your absence

Preneeding life insurance is a crucial step towards securing your family's financial future and ensuring their long-term stability. When you preneed, you're essentially locking in a guaranteed death benefit for your loved ones, providing them with a financial safety net during a challenging time. This is especially important as it offers peace of mind, knowing that your family will be taken care of even if you're no longer around.

The primary benefit of preneeding is the financial security it provides. By purchasing life insurance in advance, you're securing a fixed amount of coverage that will be paid out upon your death. This payout can cover various expenses, such as mortgage payments, children's education fees, daily living costs, and even funeral arrangements. It ensures that your family won't have to face the burden of financial debt or struggle to make ends meet after your passing.

Preneeding also allows you to plan for the future and make informed decisions. You can choose the appropriate coverage amount based on your family's needs and financial goals. This proactive approach enables you to select the right policy, ensuring that the death benefit is sufficient to cover your family's essential expenses and maintain their standard of living. With preneeding, you have the flexibility to customize the policy, including the term length and premium payments, to fit your unique circumstances.

Furthermore, preneeding life insurance can be a strategic financial move. It can help you build a substantial cash value over time, which can be borrowed against or withdrawn if needed. This feature provides additional financial flexibility, allowing you to access funds for various purposes, such as investing in your child's education or starting a business. The cash value accumulation also ensures that your investment grows, providing a potential return on your premiums.

In summary, preneeding life insurance is a powerful tool for financial security. It guarantees that your family will have the necessary financial resources to maintain their lifestyle and cover essential expenses after your passing. With preneeding, you take control of your family's future, providing them with the stability and peace of mind that come from knowing they are financially protected. It is a wise decision that can offer long-term benefits for your loved ones.

Selling Life Insurance Part-Time: Is It Possible?

You may want to see also

Peace of Mind: Knowing your loved ones are protected brings reassurance

Preneeding life insurance is a thoughtful and proactive step that can provide immense peace of mind for you and your loved ones. It is a way to ensure that your family is financially secure and protected in the event of your untimely passing. By taking this action, you are essentially creating a safety net for your loved ones, allowing them to focus on healing and moving forward without the added stress of financial worries.

The primary benefit of preneeding life insurance is the reassurance it brings. When you have a policy in place, you can rest easy knowing that your family's financial future is at least partially secured. This peace of mind is invaluable, as it allows you to approach life with a sense of security and confidence. You can make decisions and plan for the future without constantly worrying about what might happen if something were to happen to you.

Imagine the relief of knowing that your children's education is funded, your mortgage is paid off, and your spouse's living expenses are covered. Preneeding life insurance means that these essential financial obligations are taken care of, and your loved ones won't have to struggle with unexpected bills or the burden of making difficult financial choices during an already challenging time. This financial security can help your family maintain their standard of living and even provide a foundation for future growth and stability.

Furthermore, preneeding life insurance can also provide a sense of closure and comfort for your loved ones. Knowing that you've taken the necessary steps to protect them can ease the emotional strain associated with your passing. It allows your family to grieve and remember you in a positive light, knowing that they are in a better position to cope with life's challenges.

In summary, preneeding life insurance offers a powerful sense of peace of mind. It empowers you to take control of your family's financial future, ensuring that your loved ones are protected and secure. This proactive approach allows you to focus on living a fulfilling life, knowing that you've made a wise decision to safeguard your family's well-being.

Should You Sell Your Life Insurance?

You may want to see also

Long-Term Savings: Life insurance can grow your money over time

Life insurance is often seen as a tool for providing financial security and peace of mind, but it also offers a unique opportunity for long-term savings and wealth accumulation. By preneeding life insurance, you can take advantage of its potential as a powerful financial instrument. Here's how it works:

When you purchase life insurance, you essentially enter into a contract with an insurance company. You pay regular premiums in exchange for a guaranteed death benefit that will be paid out to your beneficiaries upon your passing. This death benefit is a fixed amount, and it can be a valuable financial asset. Over time, as you continue to pay premiums, the insurance company invests these funds, often in a diversified portfolio of assets. This investment component of life insurance allows your money to grow and accumulate value.

The key advantage of this long-term savings aspect is compound interest. As your premiums are invested, the earnings generated can be reinvested, leading to exponential growth. This is similar to how a savings account or investment portfolio can grow, but with the added benefit of being tax-deferred, meaning your money can grow faster without the immediate impact of taxes. As time passes, the death benefit amount will increase, providing a substantial financial cushion for your loved ones.

Furthermore, life insurance policies often offer various investment options, allowing you to customize your savings strategy. You can choose between different investment accounts, such as fixed-rate accounts for stable growth or variable-rate accounts that offer potential for higher returns but also come with more risk. This flexibility enables you to align your savings with your financial goals and risk tolerance.

In summary, preneeding life insurance provides an opportunity to build a substantial long-term savings plan. It offers the potential for significant growth through compound interest and investment returns, all while providing essential financial protection for your loved ones. By understanding the investment side of life insurance, you can make informed decisions to secure your financial future and that of your beneficiaries.

Life Insurance for IBM Retirees: What's the Deal?

You may want to see also

Tax Benefits: Preneeding policies offer tax advantages, saving you money

Preneeding life insurance can be a smart financial decision, especially when considering the potential tax benefits it offers. When you purchase a life insurance policy, whether it's a term life, whole life, or universal life policy, you may be eligible for tax advantages that can help reduce your taxable income and overall tax liability. One of the key tax benefits is that the premiums you pay for your life insurance policy can often be deducted from your taxable income. This means that the money you spend on insurance premiums can be subtracted from your annual income, thus lowering the amount of income subject to taxation. This deduction can result in significant savings, especially over the long term, as it directly impacts your taxable income and, consequently, the amount of tax you owe.

In addition to the premium deductions, the death benefit of your life insurance policy is generally not subject to income tax. When the insured individual passes away, the death benefit is paid out to the designated beneficiaries. This amount is typically considered a form of insurance proceeds and is often exempt from income taxation. As a result, the entire death benefit can be received tax-free, providing financial support to your loved ones without the burden of additional taxes. This aspect of preneeding life insurance is particularly valuable, as it ensures that the financial security you've provided for your family remains intact and is not diminished by tax obligations.

The tax benefits of preneeding life insurance can be especially advantageous for high-income earners or those in higher tax brackets. By deducting insurance premiums, you can effectively lower your taxable income, which may push you into a lower tax bracket or reduce the overall tax amount you owe. This can result in substantial savings, allowing you to retain more of your hard-earned income. Moreover, the tax-free nature of the death benefit ensures that the full value of your policy is available to your beneficiaries, providing a more comprehensive financial safety net.

It's important to note that tax laws and regulations can vary, and it's advisable to consult with a financial advisor or tax professional to fully understand the tax implications of preneeding life insurance in your specific situation. They can provide personalized guidance on how to structure your policy to maximize these tax benefits while ensuring compliance with the latest tax codes. By taking advantage of these tax advantages, you can make your life insurance policy even more valuable, offering both financial protection and potential savings.

Life Insurance: Is Dependent Coverage Worth the Cost?

You may want to see also

Customizable Plans: Tailor coverage to your specific needs and budget

When it comes to life insurance, one of the most appealing aspects of preneeding is the ability to customize your plan according to your unique circumstances and financial goals. Unlike off-the-shelf insurance products, preneeding life insurance allows you to tailor the coverage to your specific needs, ensuring that you and your loved ones are adequately protected. This level of customization is a significant advantage, as it empowers you to make informed decisions about your future and the future of your family.

The process of customizing your life insurance plan begins with a comprehensive assessment of your current situation and future objectives. This involves evaluating your age, health, lifestyle, and financial obligations. For instance, if you have a young family that relies on your income, you might opt for a higher death benefit to ensure their financial security in the event of your passing. Similarly, if you have substantial debts or a mortgage, you may want to consider a larger policy to cover these financial commitments. The key is to identify the areas where your loved ones would be most vulnerable without adequate insurance coverage.

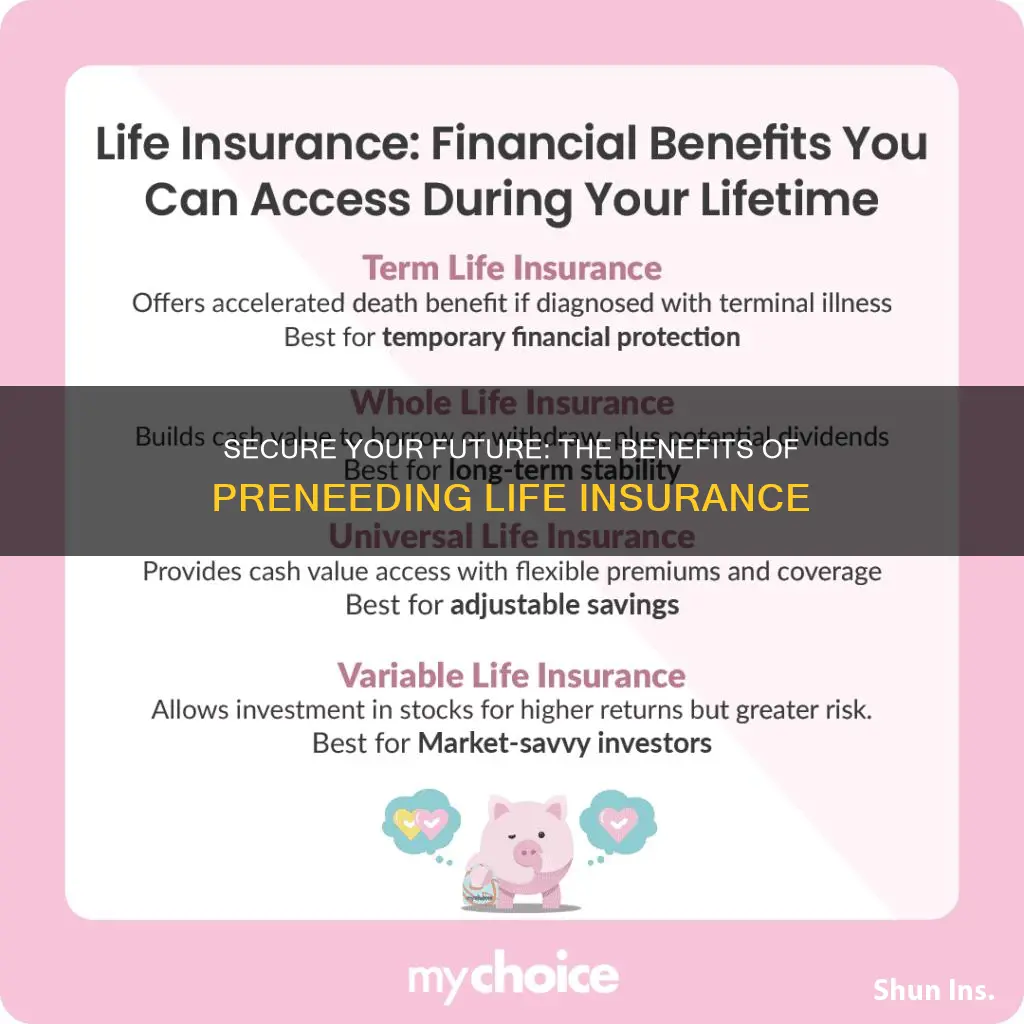

Another critical aspect of customization is the flexibility to choose the duration and type of coverage that best suits your circumstances. You can opt for a term life insurance policy, which provides coverage for a specified period, often at a lower cost compared to permanent life insurance. This type of policy is ideal if you want to ensure coverage for a specific goal, such as paying off a mortgage or funding your child's education. Alternatively, permanent life insurance offers lifelong coverage and a cash value component, which can be used to build wealth over time. The choice between term and permanent insurance depends on your long-term financial goals and the level of security you wish to provide for your family.

Furthermore, preneeding life insurance allows you to make adjustments to your policy as your life changes. Life events such as marriage, the birth of a child, or a career change can significantly impact your insurance needs. With preneeding, you can easily modify your policy to reflect these changes, ensuring that your coverage remains relevant and appropriate. For example, if you start a new business, you might want to increase your coverage to protect your enterprise and its future. This flexibility ensures that your life insurance remains a dynamic tool that adapts to your evolving life situation.

In summary, preneeding life insurance offers the advantage of customization, allowing you to create a plan that perfectly fits your unique circumstances and financial objectives. By tailoring the coverage, you can ensure that your loved ones are protected in the ways that matter most to you. This level of personalization, combined with the ability to adapt to life changes, makes preneeding life insurance a powerful tool for securing your family's future. It empowers you to make proactive decisions about your life and the lives of those you care about, providing a sense of peace and financial security.

Understanding Pre-Tax Group Life Insurance Benefits

You may want to see also

Frequently asked questions

Pre-need life insurance, also known as pre-paid funeral insurance, offers several advantages. Firstly, it provides peace of mind by ensuring that your final arrangements are covered according to your wishes, even if you pass away before making all the necessary plans. This can save your loved ones from the stress and financial burden of making funeral arrangements during a difficult time. Additionally, pre-need insurance often has guaranteed acceptance, meaning individuals with pre-existing conditions or health issues may qualify, which is not always the case with traditional life insurance policies.

Pre-need life insurance is purchased in advance, allowing you to pay for funeral expenses in full or in installments. You typically choose a policy with a death benefit that covers the agreed-upon funeral costs. When you pass away, the insurance company pays the designated beneficiary the amount specified in the policy, ensuring that your funeral expenses are fully covered. This process can provide financial security for your family and simplify the grieving process.

Pre-need life insurance can be a valuable investment for several reasons. Firstly, it locks in the current cost of funeral services, protecting you from potential future price increases. This is especially beneficial as funeral costs can be significant and may escalate over time. Secondly, it provides financial security for your loved ones, ensuring they don't have to worry about the financial aspects of your funeral arrangements during an already emotional time. Additionally, pre-need insurance can be a thoughtful gift to your family, showing your consideration for their well-being even after your passing.