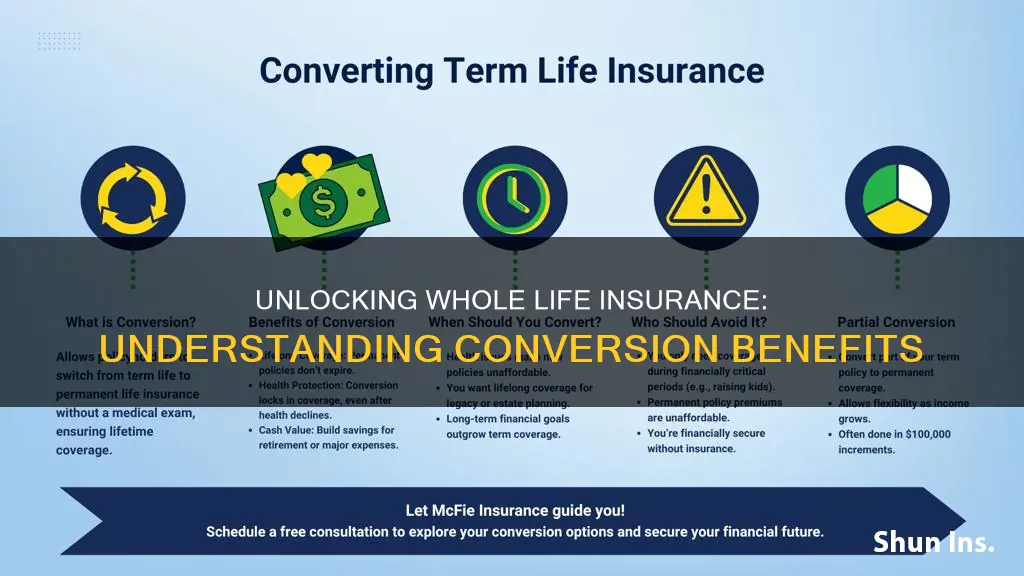

Whole life insurance conversion is a financial strategy that allows policyholders to transform their term life insurance into a permanent whole life policy. This process enables individuals to secure lifelong coverage without the need for a new medical examination, making it an attractive option for those seeking long-term financial protection. By converting, policyholders can ensure their loved ones are financially secure for the rest of their lives, providing a sense of peace and stability. This conversion process often involves a one-time premium payment, which can be a significant financial decision, and it's essential to understand the benefits and potential drawbacks before making the switch.

What You'll Learn

- Definition: Whole life insurance conversion allows policyholders to convert term life to permanent coverage

- Benefits: Conversion offers lifelong coverage, cash value accumulation, and potential investment returns

- Process: It involves reviewing policy terms and fees before making the switch

- Tax Implications: Conversion may have tax consequences, requiring careful consideration of financial planning

- Financial Planning: Policyholders should assess their financial goals and risk tolerance before converting

Definition: Whole life insurance conversion allows policyholders to convert term life to permanent coverage

Whole life insurance conversion is a valuable option for policyholders who initially purchased term life insurance but later desire to switch to a more permanent coverage type. This conversion process allows individuals to transform their existing term life policy into a whole life insurance policy, providing long-term financial protection and a guaranteed death benefit.

When an individual buys term life insurance, they typically select a specific period, such as 10, 20, or 30 years, during which the policy provides coverage. This type of insurance is designed to offer affordable protection for a defined duration, making it suitable for those who need coverage for a particular stage in their lives, such as supporting a family or paying off a mortgage. However, as time passes, the need for insurance may change, and individuals might want to ensure their coverage remains adequate and comprehensive.

Conversion to whole life insurance offers several advantages. Firstly, it provides permanent coverage, ensuring that the policyholder's beneficiaries receive a death benefit regardless of future changes in health or age. This is particularly beneficial for those who want long-term financial security and peace of mind. Secondly, the conversion process often involves a simplified underwriting process, as the policy is already in place, and the insurance company is familiar with the policyholder's details. This can result in a faster and more straightforward transition to the new coverage type.

The conversion process typically involves the insurance company issuing a new whole life policy, which may have different terms and conditions compared to the original term life policy. Policyholders should carefully review the new policy's features, including the death benefit, premiums, and any additional benefits or riders available. It is essential to understand the implications of the conversion to ensure that the new policy meets the individual's needs and expectations.

In summary, whole life insurance conversion is a strategic move for policyholders who want to transition from term life to permanent coverage. It provides an opportunity to enhance long-term financial protection and adapt insurance needs as life circumstances change. By exploring this conversion option, individuals can ensure they have the right level of coverage throughout their lives.

Life Insurance Agents: Quick Money or Long Game?

You may want to see also

Benefits: Conversion offers lifelong coverage, cash value accumulation, and potential investment returns

Whole life insurance conversion is a powerful feature that allows policyholders to transform their existing whole life insurance policy into a more comprehensive and flexible financial tool. This conversion process offers several significant advantages, providing individuals with a range of benefits that can enhance their financial security and planning.

One of the primary benefits of conversion is the assurance of lifelong coverage. Traditional whole life insurance provides a death benefit that remains in force as long as the policy is in effect, ensuring financial protection for the insured's beneficiaries. By converting the policy, individuals can ensure that their loved ones are protected throughout their entire lives, providing peace of mind and a sense of security. This lifelong coverage is particularly valuable as it guarantees that the policyholder's family will receive the intended financial support, regardless of changes in health or age.

Additionally, conversion enables the accumulation of cash value within the policy. As premiums are paid, a portion of the money goes towards building a cash reserve, which grows over time. This cash value can be borrowed against or withdrawn, providing policyholders with a valuable financial asset. The accumulation of cash value offers a unique advantage, allowing individuals to access funds for various purposes, such as funding education, starting a business, or planning for retirement. It provides a source of financial flexibility and can be a valuable tool for those seeking to build wealth over time.

Furthermore, the potential for investment returns is another attractive aspect of whole life insurance conversion. Policyholders can choose to allocate a portion of their premiums into investment options offered by the insurance company. These investments can include stocks, bonds, or other diversified portfolios, allowing the policy's cash value to grow at a potentially higher rate than traditional savings accounts. The investment returns can contribute to the overall growth of the policy, providing an opportunity to build wealth and potentially outpace the rate of return on other investment vehicles.

In summary, whole life insurance conversion offers a range of benefits that enhance the value and flexibility of the policy. It provides lifelong coverage, ensuring financial protection for beneficiaries, while also allowing for cash value accumulation and potential investment returns. This conversion process empowers individuals to make the most of their insurance policy, turning it into a comprehensive financial tool that can support their long-term financial goals and provide a sense of security.

Transferring Your Life Insurance: Is It Possible?

You may want to see also

Process: It involves reviewing policy terms and fees before making the switch

Whole life insurance conversion is a process that allows policyholders to switch from a term life insurance policy to a permanent whole life policy. This conversion option is available to those who have a term life insurance policy and want to ensure long-term financial protection for their loved ones. The process of converting involves a thorough review of the existing policy and the potential new policy to ensure a smooth transition.

Before initiating the conversion, it is crucial to carefully examine the terms and conditions of the current term life insurance policy. This includes understanding the coverage amount, the duration of the policy, and any associated fees or penalties. Policyholders should also review the premium payments, ensuring they are aware of any changes in cost that may occur during the conversion process. This step is essential to avoid any surprises and to make an informed decision.

The next step is to research and compare different whole life insurance policies. There are various types of whole life insurance plans available, each with its own set of benefits and costs. Policyholders should consider factors such as the death benefit, investment options, and any additional features like riders or waivers. It is advisable to obtain quotes from multiple insurance providers to find the best policy that suits individual needs and budget.

During the conversion process, it is vital to carefully review the fees associated with the switch. These fees may include surrender charges, which are typically applied for the first few years of the term policy. Understanding these charges is essential to ensure that the conversion is financially beneficial in the long run. Additionally, policyholders should be aware of any additional costs, such as application fees or medical exams, which may be required during the conversion process.

By thoroughly reviewing policy terms and fees, individuals can make an informed decision about converting their term life insurance to a whole life policy. This process ensures that the new policy provides the desired coverage and financial security while also considering the potential costs. It is a strategic approach to life insurance, allowing individuals to adapt their protection as their needs and circumstances evolve.

Fabric Life Insurance: Is It Worth the Hype?

You may want to see also

Tax Implications: Conversion may have tax consequences, requiring careful consideration of financial planning

Whole life insurance conversion is a strategic decision that policyholders can make to change their insurance policy from a term life insurance to a permanent whole life insurance policy. This conversion process can be a significant financial move, and understanding the tax implications is crucial for making an informed choice. When considering conversion, individuals should be aware that it may trigger certain tax consequences, which can vary depending on the specific circumstances and the jurisdiction.

One potential tax impact is the treatment of the cash value accumulation within the policy. Over time, term life insurance policies can accumulate cash value, which is the portion of the premium payments that are invested and grow tax-deferred. When converting to whole life, this accumulated cash value becomes a part of the new policy. The tax treatment of this conversion can be complex. In some cases, the cash value may be subject to taxation as ordinary income, especially if the policyholder has not paid sufficient premiums to build up a substantial cash value. This can result in a significant tax liability for the policyholder.

Additionally, the conversion process itself might be taxable. When a term life policy is converted, the insurance company may consider it a surrender or a surrender charge, which could be subject to income tax. The tax rate applied to this surrender charge may vary, and it is essential to understand the specific tax laws in your region to avoid unexpected tax burdens. Proper financial planning is necessary to ensure that the conversion process is executed smoothly and that any tax liabilities are managed effectively.

Furthermore, the timing of the conversion can also play a role in tax considerations. If the conversion is done during a period of low market value or when the policy has a low cash value, the tax implications might be less severe. However, if the conversion occurs when the cash value is substantial, the tax consequences could be more significant. It is advisable to consult with a financial advisor or tax professional to assess the potential tax impact and develop a strategy that aligns with your financial goals and tax situation.

In summary, whole life insurance conversion can have tax implications that require careful financial planning. Understanding the tax treatment of cash value accumulation, the potential taxation of the conversion process, and the impact of timing can help individuals make informed decisions. Seeking professional advice is essential to navigate these tax considerations and ensure a successful conversion that aligns with one's financial objectives.

New York Life: Exploring Disability Insurance Options

You may want to see also

Financial Planning: Policyholders should assess their financial goals and risk tolerance before converting

Whole life insurance conversion is a process that allows policyholders to change their existing whole life insurance policy into a different type of insurance product, often with more favorable terms or features. This conversion can be a strategic move for individuals who want to optimize their insurance coverage and align it with their evolving financial goals. However, it is crucial for policyholders to approach this decision with careful consideration and a comprehensive understanding of their financial situation.

Before embarking on the conversion process, policyholders should engage in a thorough financial assessment. This involves evaluating their short-term and long-term financial objectives. For instance, an individual might be planning for retirement, funding their child's education, or building an emergency fund. Understanding these goals will help determine whether converting to a different policy type is beneficial. For example, if a policyholder's primary goal is to secure long-term financial stability, they might consider converting to a policy with a higher death benefit or additional riders that provide enhanced coverage.

Risk tolerance is another critical factor in this decision-making process. Policyholders need to assess how much risk they are willing to take on. Whole life insurance, especially when converted, can offer various levels of coverage and flexibility. Some policies may provide guaranteed death benefits, while others might offer investment components that allow for potential growth. Understanding one's risk tolerance helps in choosing the right policy type. For instance, a conservative investor might prefer a policy with a fixed death benefit and minimal investment risk, while a more aggressive investor could opt for a policy with higher investment potential.

Additionally, policyholders should consider the potential impact of conversion on their overall financial strategy. Converting to a new policy might involve changing the premium payments, coverage amounts, or policy terms. These changes could have tax implications or affect the overall cost of insurance. It is essential to review the financial implications of the conversion and ensure that the new policy aligns with the policyholder's risk management and financial planning objectives.

In summary, whole life insurance conversion is a significant decision that requires policyholders to evaluate their financial goals and risk tolerance. By assessing these factors, individuals can make informed choices, ensuring that the converted policy supports their financial objectives and provides the desired level of protection. This approach enables policyholders to optimize their insurance coverage and maintain a robust financial plan.

Understanding Life Insurance: Free Look Period Explained

You may want to see also

Frequently asked questions

Whole life insurance conversion is a feature offered by some insurance companies that allows policyholders to convert their term life insurance policy into a permanent whole life policy. This option provides a way for individuals to ensure long-term coverage without the need to reapply for insurance or undergo a new medical examination.

When a policyholder decides to convert, they typically notify their insurance company, who will then review the request. The insurance provider will assess the policyholder's eligibility and may require a medical questionnaire or a simple health assessment to verify their current health status. If approved, the term policy is extended, and the coverage becomes a whole life policy with a guaranteed death benefit.

Yes, there are several advantages. Firstly, it provides lifelong coverage, ensuring that the policyholder's loved ones are protected even if their health changes over time. Secondly, the conversion process is often quicker and less complex compared to purchasing a new whole life policy, as it doesn't require a new application or medical exam. Additionally, the premiums for the converted policy might be lower, especially if the policyholder has maintained a healthy lifestyle.

In most cases, yes. Insurance companies usually offer a return-of-premium option, allowing policyholders to convert their whole life policy back to a term life policy and receive the accumulated cash value. This flexibility enables individuals to adapt their insurance needs as their financial situation or health changes.