When is life insurance no longer contested? This question delves into the intriguing aspect of life insurance policies, specifically the period after which the insurance company no longer contests a claim. This phase, often referred to as the contestability period, typically lasts for a year from the policy's inception or the date of the insured's death. During this time, the insurance company may challenge the validity of the claim, especially if there are undisclosed health issues or misrepresentations. However, once the contestability period ends, the claim is generally accepted, and the beneficiary can receive the full death benefit without further scrutiny. Understanding this timeline is crucial for both policyholders and beneficiaries, ensuring a smoother and more secure process when making a life insurance claim.

What You'll Learn

- Legal Deadlines: Insurance companies have time limits to contest claims after a policyholder's death

- Documentation Requirements: Clear and complete documentation is essential to avoid contestation

- Policy Terms: Understanding policy terms can prevent disputes over coverage and benefits

- Death Certificate: A valid death certificate is crucial for a smooth claims process

- Fraud Prevention: Insurance companies take fraud seriously and may contest claims if suspicious activity is detected

Legal Deadlines: Insurance companies have time limits to contest claims after a policyholder's death

When an individual passes away, the process of settling their affairs can be complex and often involves various legal and financial considerations. One crucial aspect that arises is the handling of life insurance claims. Insurance companies typically have specific time limits, known as legal deadlines, to contest or dispute a claim after a policyholder's death. These deadlines are in place to ensure fairness and protect the interests of both the insurance provider and the beneficiaries.

The legal deadlines for contesting a life insurance claim vary depending on the jurisdiction and the specific insurance company's policies. In many cases, insurance companies have a limited time frame, often ranging from a few months to a year, to review the claim and decide whether to accept or deny it. This period allows the insurance provider to investigate the circumstances surrounding the death, verify the accuracy of the policy details, and assess any potential grounds for dispute.

During this time, insurance companies may conduct thorough investigations, including reviewing medical records, death certificates, and any other relevant documentation. They might also interview beneficiaries, witnesses, and other individuals who can provide information about the policyholder's health and activities leading up to their death. The goal is to ensure that the claim is valid and that the death occurred as stated in the policy.

It is essential for beneficiaries to be aware of these legal deadlines to avoid any unnecessary delays or complications in receiving their rightful benefits. If the insurance company contests the claim, they must provide a valid reason within the specified timeframe. Beneficiaries should also be prepared to provide additional documentation or evidence to support their claim if the insurance company requests it.

In summary, insurance companies have legal deadlines to contest life insurance claims after a policyholder's death, ensuring a fair and transparent process. Understanding these deadlines and being proactive in providing necessary documentation can help beneficiaries navigate the claims process more effectively and potentially expedite the resolution of their claim.

Life Insurance for Over 40s: What's the Best Option?

You may want to see also

Documentation Requirements: Clear and complete documentation is essential to avoid contestation

Clear and comprehensive documentation is a critical aspect of life insurance policies, ensuring that the terms and conditions are well-defined and understood by all parties involved. When it comes to avoiding contestation and potential legal disputes, proper documentation is key. Here are some essential documentation requirements to keep in mind:

Policy Details: The life insurance policy itself should be a meticulously crafted document. It must include all the relevant information about the insured individual, such as their name, date of birth, occupation, and any pre-existing medical conditions. Additionally, the policy should clearly state the coverage amount, premium payments, and the duration of the policy. Every clause and condition, including any exclusions or limitations, should be explicitly mentioned to ensure transparency.

Application Forms: During the application process, prospective policyholders must complete detailed application forms. These forms should gather essential personal and medical information, including health history, lifestyle choices, and any relevant financial details. Ensuring that all information provided is accurate and up-to-date is crucial. Incomplete or misleading information can lead to potential disputes, so thorough verification is necessary.

Medical Examinations: In many cases, life insurance companies require medical examinations to assess the insured individual's health. The documentation from these exams should be comprehensive and include all relevant test results, diagnoses, and medical advice. This documentation helps in understanding the insured's health status and can prevent future contestation by providing a clear medical history.

Witnesses and Signatures: When it comes to policy changes, beneficiary nominations, or any significant amendments, proper witnessing and signing procedures are essential. All relevant parties should be present, and their signatures should be obtained. This ensures that the changes made are agreed upon by all involved and reduces the chances of disputes arising later.

Regular Updates: Life insurance policies should be regularly reviewed and updated to reflect any changes in the insured's circumstances. This includes updating personal details, health information, and financial status. Regular reviews ensure that the policy remains relevant and accurate, reducing the potential for contestation due to outdated information.

By maintaining clear and comprehensive documentation throughout the life insurance process, individuals and insurance companies can significantly reduce the risk of contestation. Proper documentation ensures that all parties involved have a clear understanding of the policy's terms, conditions, and any relevant changes, thus promoting a smoother and more transparent insurance experience.

Who Can Sue Whom? Understanding Life Insurance Beneficiaries

You may want to see also

Policy Terms: Understanding policy terms can prevent disputes over coverage and benefits

Understanding the terms and conditions of your life insurance policy is crucial to ensuring a smooth and fair process when it comes to claiming benefits. Policy terms can often be complex and detailed, and without a thorough understanding, disputes and disagreements may arise, potentially delaying or even preventing a claim. Here's a guide to help you navigate the policy terms and avoid common pitfalls:

Read the Policy Document Thoroughly: Start by carefully reading the entire policy document. Insurance policies can be lengthy and filled with legal jargon, so it's essential to take your time. Pay close attention to the definitions of key terms, coverage limits, exclusions, and any specific conditions mentioned. Look for sections related to 'Policy Terms', 'Benefits', 'Claims Process', and 'Dispute Resolution'. Understanding these sections will give you a comprehensive overview of your rights and obligations.

Identify Key Policy Terms: Familiarize yourself with the following critical policy terms:

- Insured Person: This refers to the individual or individuals covered by the policy. Ensure that you are listed as the insured person or that your beneficiary is correctly identified.

- Policyholder: The person or entity who owns the policy and is responsible for paying premiums. Understanding your rights as the policyholder is essential.

- Beneficiary: The person or entity entitled to receive the death benefit or proceeds upon the insured's death. Make sure your beneficiary is up-to-date and aware of their rights.

- Coverage Amount: The maximum benefit payable under the policy. Be aware of any limits to ensure you have adequate coverage.

- Exclusions: Certain events or conditions that are not covered by the policy. Understanding these exclusions is vital to know what is and isn't covered.

- Grace Period: The time allowed after a premium payment is due for the policy to remain in force. Knowing this period can prevent a lapse in coverage.

Review and Update Regularly: Life insurance policies may change over time, and it's essential to review your policy periodically. Insurance companies often update their policies, and these changes can affect your coverage and benefits. Stay informed about any modifications and ensure that your understanding of the policy terms remains current.

Seek Clarification: If any part of the policy is unclear or confusing, don't hesitate to ask for clarification. Contact your insurance provider or a financial advisor to seek guidance. They can explain complex terms in simpler language and help you make informed decisions.

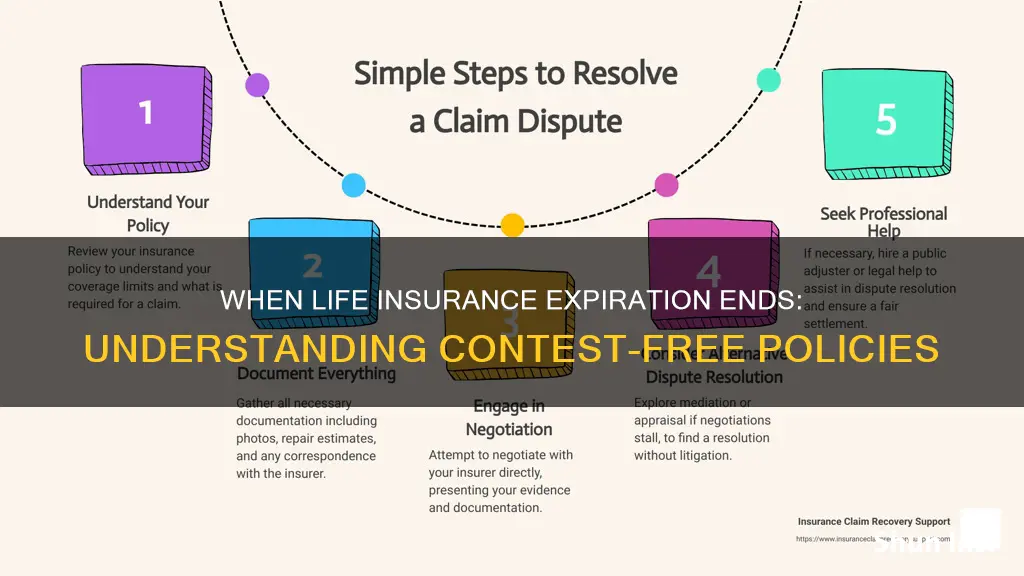

Document Everything: Keep a record of all communications, changes, and updates related to your policy. This documentation can be crucial in case of a dispute, as it provides evidence of your understanding and any agreements made.

By thoroughly understanding the policy terms, you can ensure that your life insurance policy is a reliable safety net for your loved ones. It empowers you to make informed decisions and reduces the likelihood of disputes, providing a smoother claims process when the time comes. Remember, knowledge of your policy is a powerful tool in maintaining a positive relationship with your insurance provider.

Life Insurance and IRS: What's the Deal?

You may want to see also

Death Certificate: A valid death certificate is crucial for a smooth claims process

A valid death certificate is an essential document when it comes to the life insurance claims process. It serves as official proof of the insured individual's death, providing the necessary information to initiate and process the claim. This document is a critical component in ensuring a smooth and efficient claims settlement, especially in cases where the cause of death may be in question or where there are disputes.

The death certificate typically includes vital details such as the deceased's full name, date of birth, place of death, and the date and time of passing. It also provides the cause and manner of death, which are crucial pieces of information for the insurance company to assess the claim. In the event of a sudden or unexpected death, a valid death certificate can help expedite the process by providing immediate confirmation of the insured's passing.

When an insurance company receives a claim, they will often request a copy of the death certificate to verify the insured's death. This document acts as a primary source of evidence, allowing the insurer to confirm the individual's passing and initiate the claims settlement process. Without a valid death certificate, the insurance company may face challenges in verifying the insured's death, potentially leading to delays or even the rejection of the claim.

In some cases, obtaining a death certificate can be a straightforward process, especially if the death occurred in a hospital or other medical facility. These institutions often provide death certificates upon the passing of a patient. However, in other situations, such as deaths occurring at home or in remote areas, obtaining the certificate may require more effort. It is essential for the designated claim representative or the beneficiary to ensure that the death certificate is obtained promptly and accurately.

Furthermore, the information provided on the death certificate is critical for the insurance company to assess the claim accurately. Any discrepancies or missing details can lead to complications and potential disputes. For instance, if the cause of death is not clearly stated or is listed incorrectly, it may trigger a contestability period, where the insurance company has the right to dispute the claim. Therefore, ensuring the accuracy and completeness of the death certificate is vital to avoid any unnecessary delays or challenges in the claims process.

Gold Star Families: Life Insurance Coverage Explained

You may want to see also

Fraud Prevention: Insurance companies take fraud seriously and may contest claims if suspicious activity is detected

Insurance fraud is a serious crime that can have significant financial and legal consequences for both individuals and companies. Insurance companies are increasingly implementing robust fraud detection and prevention measures to protect themselves and their policyholders. When an insurance claim is suspected to be fraudulent, the company has the right and duty to investigate and contest it. This process is a crucial aspect of fraud prevention and helps maintain the integrity of the insurance system.

Fraudulent activities can take various forms in the insurance industry. For life insurance, fraud may involve making false claims, providing misleading information, or even fabricating entire policies. For instance, a claimant might exaggerate the cause of death or provide false medical records to support a claim. Insurance companies employ sophisticated techniques to identify such suspicious behavior. They may use advanced data analytics, risk modeling, and even human investigators to scrutinize claims and detect anomalies.

When an insurance company detects potential fraud, it will initiate a thorough investigation. This process often involves reviewing all relevant documentation, including medical records, death certificates, and witness statements. The company may also contact the policyholder, beneficiaries, or even law enforcement agencies for further inquiries. During this investigation, the insurance provider may temporarily suspend payments or even cancel the policy if fraud is confirmed.

The contestation of a claim is a serious matter and should be handled with transparency and fairness. Insurance companies are required to provide policyholders with clear and detailed explanations of why a claim is being contested. This includes informing them of the specific allegations and the evidence supporting these claims. Policyholders have the right to respond and provide additional information to support their case.

In summary, insurance companies take fraud prevention very seriously and have the authority to contest claims when suspicious activity is detected. This process involves thorough investigations, utilizing various resources to ensure the integrity of the system. By implementing robust fraud detection measures, insurance providers can protect themselves and their policyholders from financial losses and maintain trust in the insurance industry. It is essential for policyholders to understand their rights and responsibilities during such investigations to ensure a fair and transparent process.

Life Insurance Contracts: Effective Activation Explained

You may want to see also

Frequently asked questions

Incontestable life insurance policies typically become incontestable after a certain period, usually two to three years from the date of issue. This means that the insurance company cannot contest the validity of the policy or the accuracy of the information provided by the insured individual during the contestability period. Once incontestable, the policy is considered final, and the insurance company is bound to pay the death benefit as stated in the policy.

The incontestability period is usually triggered by the insured individual's payment of the first premium. Once the insured has paid the initial premium, the policy is considered binding, and the insurance company cannot deny coverage based on any misrepresentations or omissions made during the application process. This protection ensures that policyholders are not unfairly penalized for honest mistakes or misunderstandings.

Yes, there are a few exceptions. One common exception is if the insured individual makes a material misrepresentation of a fact that is relevant to the risk being insured. For example, if the insured lies about having a serious pre-existing medical condition, the insurance company may still contest the policy. Additionally, if the insured intentionally commits fraud or makes false statements with the intent to deceive, the incontestability period may not apply.