Whole life insurance is a type of permanent life insurance that offers lifelong coverage and a range of benefits in Canada. It provides a guaranteed death benefit to the policyholder's beneficiaries upon their passing and includes an accumulation of cash value over time, which can be borrowed against or withdrawn. This unique feature allows policyholders to build a savings component within their insurance policy, offering both financial protection and a potential investment opportunity. In Canada, whole life insurance is a popular choice for those seeking long-term financial security, as it ensures that beneficiaries receive a payout regardless of the timing of the insured individual's death.

| Characteristics | Values |

|---|---|

| Definition | Whole life insurance is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a guaranteed death benefit and a cash value component that grows over time. |

| Policy Structure | The policy consists of two main parts: the death benefit and the investment component. The death benefit is a fixed amount paid to the beneficiary upon the insured's death. The investment component, also known as the cash value, accumulates over time and can be borrowed against or withdrawn. |

| Premiums | Premiums are typically level, meaning they remain the same throughout the life of the policy. The initial premium is usually higher compared to term life insurance but decreases over time as the cash value grows. |

| Cash Value Accumulation | The cash value of the policy grows through regular premium payments and interest credited by the insurance company. This cash value can be used to pay future premiums, take loans, or withdraw funds (with certain restrictions). |

| Death Benefit | The death benefit is guaranteed and will be paid out as a lump sum to the designated beneficiary when the insured person passes away. |

| Flexibility | Policyholders have some flexibility in how they manage their policy. They can choose to increase or decrease the death benefit, make additional payments, or take advantage of the cash value options. |

| Longevity | Whole life insurance provides coverage for life, ensuring that the beneficiary receives the death benefit regardless of the insured's age or health at the time of death. |

| Tax Advantages | The cash value growth within the policy may be tax-deferred, and certain withdrawals or loans may be tax-free, providing potential tax benefits. |

| Investment Options | Some whole life policies offer optional investment accounts where a portion of the premiums can be invested in various funds, providing potential for higher returns. |

| Cost | The cost of whole life insurance can be higher upfront compared to term life, but it offers long-term financial security and potential investment opportunities. |

What You'll Learn

- Definition: Whole life insurance in Canada is a permanent policy with guaranteed death benefit and cash value accumulation

- Premiums: Premiums are typically fixed and increase over time, providing long-term financial security

- Death Benefit: The death benefit is a lump sum paid to beneficiaries upon the insured's death

- Cash Value: Policyholders can access cash value through loans or withdrawals, offering financial flexibility

- Tax Advantages: Tax-deductible premiums and tax-deferred growth of cash value make whole life insurance attractive

Definition: Whole life insurance in Canada is a permanent policy with guaranteed death benefit and cash value accumulation

Whole life insurance in Canada is a type of permanent life insurance policy that offers a range of unique features and benefits. It is designed to provide coverage for an individual's entire life, hence the term "whole life." This type of insurance is a long-term commitment, ensuring that the policyholder and their beneficiaries receive financial protection throughout their lives.

One of the key aspects of whole life insurance is its guaranteed death benefit. This means that, regardless of the policyholder's age or health at the time of death, the insurance company will pay out a predetermined amount to the designated beneficiaries. The death benefit is typically a fixed amount agreed upon when the policy is taken out, providing financial security for the family or individuals relying on the insurance.

In addition to the death benefit, whole life insurance policies also accumulate cash value over time. This is a significant feature that sets it apart from other insurance products. As the policyholder makes regular premium payments, a portion of these payments goes towards building a cash reserve. This cash value can be used for various purposes, such as borrowing money, paying for college tuition, or even taking out a loan against the policy's cash value. The accumulation of cash value allows policyholders to build a financial asset that can be accessed or borrowed against, providing flexibility and potential financial benefits.

The permanent nature of whole life insurance is another crucial aspect. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force for the policyholder's entire life. This ensures that the coverage is always present, providing peace of mind and financial security for the long term. Policyholders can enjoy the benefits of guaranteed coverage without the need for periodic renewals or re-applications, making it a convenient and reliable choice.

In summary, whole life insurance in Canada is a permanent policy that offers a guaranteed death benefit and the accumulation of cash value. It provides long-term financial protection and security, allowing individuals to build a valuable asset while ensuring their loved ones are financially supported. This type of insurance is an excellent option for those seeking a comprehensive and reliable life insurance solution.

Capitalization Rules: Life Insurance and Beyond

You may want to see also

Premiums: Premiums are typically fixed and increase over time, providing long-term financial security

Whole life insurance is a type of permanent life insurance policy available in Canada, offering a range of benefits and a unique premium structure. When it comes to premiums, whole life insurance policies have a distinct advantage over other insurance products.

Premiums for whole life insurance are typically fixed, meaning they remain the same throughout the life of the policy. This is in contrast to term life insurance, where premiums can vary based on the term length. By locking in a fixed premium, whole life insurance provides policyholders with long-term financial security and predictability. As the policyholder, you can rest assured that your premium payments will not increase unexpectedly, allowing for better financial planning.

The fixed nature of these premiums is a significant advantage, especially for those seeking long-term financial stability. It enables individuals to budget effectively, knowing their insurance costs will not fluctuate. This predictability is particularly beneficial for long-term financial goals, such as saving for a child's education or planning for retirement. With a fixed premium, you can allocate your funds accordingly without the worry of sudden increases in insurance expenses.

Over time, the fixed premiums contribute to the accumulation of cash value within the policy. This cash value grows tax-free and can be borrowed against or withdrawn, providing an additional layer of financial security. As the policy matures, the cash value can be utilized to cover future expenses or even provide a source of income during retirement.

In summary, whole life insurance in Canada offers a fixed premium structure, ensuring long-term financial security and predictability. This feature sets it apart from other insurance products, making it an attractive choice for individuals seeking stable and reliable coverage. With the potential for cash value accumulation, whole life insurance provides a comprehensive financial solution, catering to various life goals and ensuring peace of mind.

Life Insurance Counselors: Your Guide to Peace of Mind

You may want to see also

Death Benefit: The death benefit is a lump sum paid to beneficiaries upon the insured's death

Whole life insurance is a type of permanent life insurance policy available in Canada, offering a range of benefits and features that provide financial security for individuals and their loved ones. One of its key components is the death benefit, which is a crucial aspect of this insurance policy.

When an individual purchases whole life insurance, they essentially enter into a contract with an insurance company. This contract guarantees a death benefit, which is a predetermined amount of money paid out to the designated beneficiaries upon the insured person's death. The primary purpose of this death benefit is to provide financial support to the beneficiaries, ensuring they have the necessary resources to cover various expenses and maintain their standard of living.

The death benefit is typically a lump sum payment, which means it is provided as a single, fixed amount. This lump sum can be used by the beneficiaries for numerous purposes, such as paying off debts, covering funeral expenses, funding education, or even starting a new business. The flexibility of this payment allows beneficiaries to make decisions based on their unique needs and circumstances.

One of the advantages of the death benefit in whole life insurance is its certainty. Unlike some other insurance policies, whole life insurance guarantees that the death benefit will be paid out as long as the premiums are up-to-date. This provides peace of mind, knowing that the financial security of beneficiaries is assured, regardless of future economic fluctuations or changes in the insurance market.

Furthermore, the death benefit can also serve as a valuable asset for the insured individual. It can be borrowed against or used as collateral for loans, providing access to funds that can be utilized for various financial goals. This feature makes whole life insurance a versatile tool for managing personal finances and ensuring long-term financial stability.

Life Insurance and Vaccines: What's the Connection?

You may want to see also

Cash Value: Policyholders can access cash value through loans or withdrawals, offering financial flexibility

Whole life insurance is a long-term financial commitment that provides coverage for the entire lifetime of the insured individual. In Canada, this type of insurance offers a range of benefits, including a guaranteed death benefit and a cash value component. The cash value is a significant feature that sets whole life insurance apart from other insurance products. It allows policyholders to build up a substantial amount of money over time, which can be used for various financial purposes.

One of the key advantages of the cash value in whole life insurance is the ability to access funds through loans or withdrawals. Policyholders can borrow against the cash value of their policy, providing a source of immediate cash without the need for a separate loan application process. This feature is particularly useful for individuals who may require additional funds for various reasons, such as starting a business, funding education, or covering unexpected expenses. By accessing the cash value, policyholders can leverage their insurance policy as a financial tool, ensuring they have the necessary resources when needed.

The process of accessing cash value is relatively straightforward. Policyholders can typically request a loan by submitting an application to their insurance provider. The loan amount is usually based on the policy's cash value, and the interest rate may be linked to the policy's interest rate or a market-based rate. Repayments are made over time, often in monthly or quarterly installments, ensuring the policy remains in force and the death benefit remains intact. This structured repayment plan allows policyholders to manage their finances effectively while maintaining the insurance coverage.

In addition to loans, policyholders can also choose to withdraw cash value from their policy. This option provides more flexibility, as it allows individuals to access the accumulated funds without taking out a loan. Withdrawals can be made in various amounts, depending on the policy's cash value and the insurance company's guidelines. The cash value can be used for various purposes, such as investing in other financial instruments, paying for retirement, or simply building an emergency fund. This flexibility ensures that policyholders can utilize their insurance policy to meet their evolving financial needs.

The ability to access cash value through loans or withdrawals is a significant advantage of whole life insurance in Canada. It provides policyholders with financial flexibility, allowing them to make the most of their insurance policy. This feature enables individuals to build a substantial cash reserve over time, which can be utilized for various financial goals. By understanding and utilizing the cash value component, policyholders can ensure they have a reliable source of funds while still maintaining the essential insurance coverage for their loved ones.

Life Insurance Payouts: Taxable or Tax-Exempt?

You may want to see also

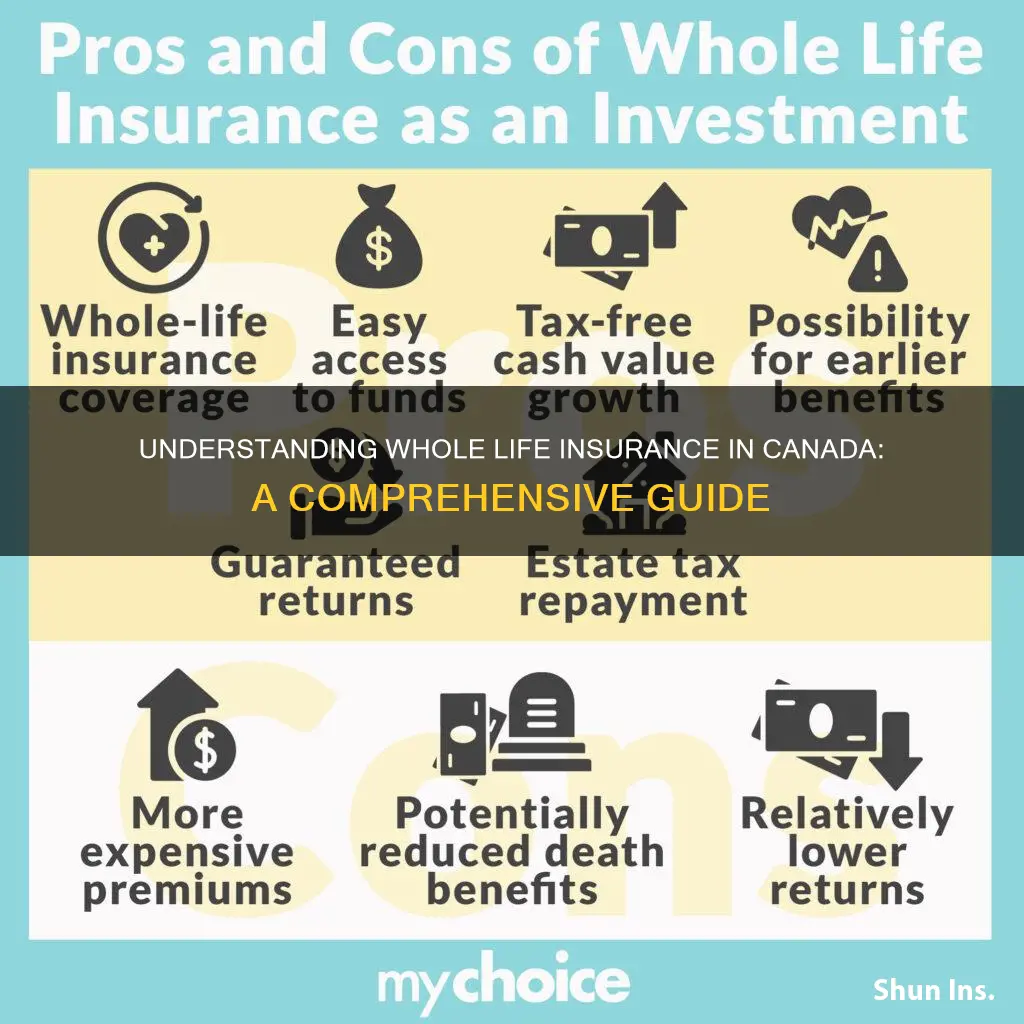

Tax Advantages: Tax-deductible premiums and tax-deferred growth of cash value make whole life insurance attractive

Whole life insurance in Canada offers significant tax advantages that can make it an attractive financial tool for individuals seeking long-term financial security. One of the key benefits is the ability to claim tax deductions on insurance premiums. When you pay premiums for whole life insurance, you can typically deduct these expenses from your taxable income, reducing your overall tax liability. This deduction is particularly valuable for those in higher tax brackets, as it provides a substantial tax break. By maximizing this tax advantage, individuals can effectively lower their taxable income and, consequently, their tax payments.

In addition to tax-deductible premiums, whole life insurance also provides tax-deferred growth of cash value. As the policyholder, you can accumulate cash value over time, which grows tax-free. This means that the cash value in your policy can increase without being subject to annual income taxes. The tax-deferred nature of this growth allows your investments to compound more efficiently, potentially resulting in a larger payout when you need it. This aspect is especially beneficial for long-term financial planning, as it enables you to build a substantial fund that can be used for various purposes, such as retirement, education, or other financial goals.

The tax advantages of whole life insurance extend beyond the initial premium deductions. As the cash value in your policy grows, it can be used to pay for future premiums, ensuring the policy remains in force. This strategy, known as "level funding," allows you to maintain coverage without the need for additional premium payments, further enhancing the tax efficiency of your insurance. Moreover, the tax-deferred nature of the cash value growth means that you can access the funds without incurring penalties or taxes, providing flexibility and control over your financial resources.

For high-income earners, the tax benefits of whole life insurance can be particularly advantageous. By deducting substantial premiums, individuals can significantly reduce their taxable income, which can be a substantial benefit in a higher tax bracket. This tax efficiency becomes even more valuable as the policyholder ages, as the potential tax savings can contribute to a more secure financial future. Additionally, the tax-deferred growth of cash value ensures that the funds can accumulate without the burden of annual taxes, allowing for more substantial savings over time.

In summary, whole life insurance in Canada provides tax advantages through tax-deductible premiums and tax-deferred growth of cash value. These benefits make it an attractive option for individuals seeking to optimize their financial planning and secure their long-term financial goals. By taking advantage of these tax efficiencies, policyholders can build a substantial fund that grows tax-free, providing financial security and flexibility for various life events. Understanding these tax advantages is essential for anyone considering whole life insurance as a part of their comprehensive financial strategy.

Understanding 1031 Exchanges: Life Insurance as a Smart Investment Strategy

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a combination of insurance protection and an investment component, ensuring a guaranteed death benefit and a fixed cash value accumulation over time.

In Canada, whole life insurance policies typically involve regular premium payments from the policyholder. These premiums are invested in a separate account, allowing the policy to grow tax-deferred. The cash value accumulated can be borrowed against or withdrawn, providing financial flexibility. Upon the insured's death, the death benefit is paid out to the designated beneficiaries, and the policy's cash value is also transferred to the beneficiaries or can be used to pay for future premiums.

The advantages of whole life insurance include lifelong coverage, providing financial security to your loved ones in the event of your passing. It offers a guaranteed death benefit, ensuring a fixed amount is paid out regardless of when the insured passes away. Additionally, the cash value accumulation can be used for various purposes, such as loaning money for educational expenses or business ventures, or it can be withdrawn tax-free to access the money when needed.

While whole life insurance provides valuable benefits, it may not be the most cost-effective option compared to term life insurance. The premiums can be higher due to the guaranteed death benefit and investment features. Additionally, once the policy is fully paid up, the cash value growth slows down, and the policy may not offer the same level of investment growth as other investment vehicles. It's essential to consider your financial goals and consult with an insurance advisor to determine the most suitable type of coverage.