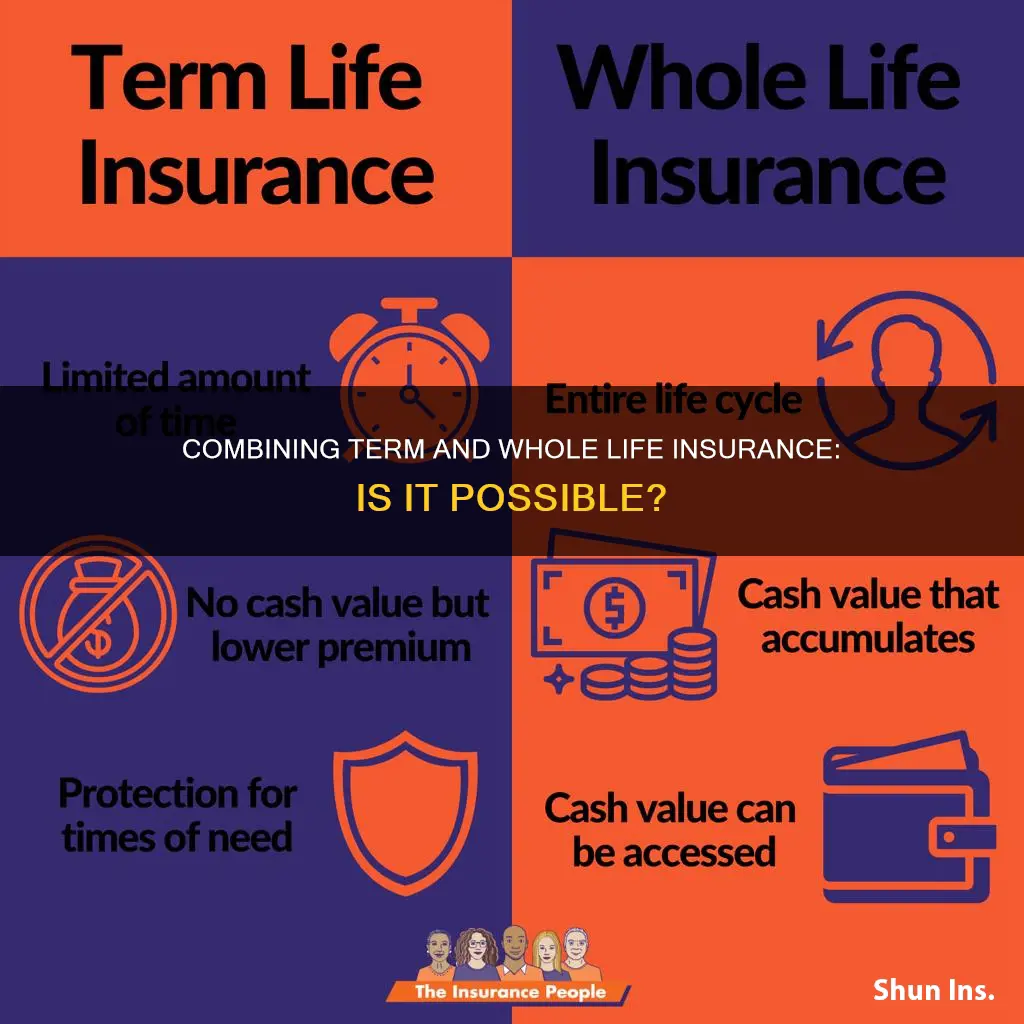

Life insurance is an important financial decision, and choosing the right policy is crucial. Two main types of life insurance are term life and whole life insurance, and understanding the differences between the two can help you decide which one suits your needs. Term life insurance is more affordable but only covers a set period, typically between 10 and 30 years. On the other hand, whole life insurance is more expensive but provides lifelong coverage. It also includes a cash value component that grows over time, which you can borrow against or withdraw. This feature makes whole life insurance more complex and a long-term financial commitment.

Term life insurance appeals to those seeking low-cost coverage, especially young families or seniors, as it offers lower premiums. It is also a good option for individuals who only need financial protection for a specific period, such as the duration of their mortgage. Additionally, term life policies often include a conversion rider, allowing you to switch to whole life insurance later.

Whole life insurance, on the other hand, is ideal for those seeking lifelong coverage and the ability to build cash value. The premiums remain constant throughout your life, and the death benefit is guaranteed. This type of insurance is suitable for end-of-life planning, covering funeral expenses, and providing an inheritance for children. It is also beneficial for those who want to provide ongoing financial support for loved ones with special needs or elderly parents.

Ultimately, the decision to choose between term and whole life insurance depends on your financial goals, budget, and individual circumstances. Some individuals even opt to have both types of policies, combining short-term and long-term coverage. Consulting a financial professional can help you make an informed choice that aligns with your specific needs.

| Characteristics | Values |

|---|---|

| Cost | Term life insurance is cheaper than whole life insurance |

| Coverage length | Term life insurance covers a set period of time, e.g. 10, 20 or 30 years |

| Cash value | Term life insurance has no cash value component, whereas whole life insurance accumulates cash value that can be borrowed against |

| Complexity | Term life insurance is simpler and easier to understand than whole life insurance |

| Conversion | Some term life insurance policies can be converted to whole life insurance, but this may be subject to deadlines or age limits |

| Coverage needs | Term life insurance is suitable for those who only need coverage for a specific period, e.g. while their children are still dependent on them |

| Investment | Whole life insurance can be used as an investment vehicle, as it accumulates cash value over time |

| Lifelong coverage | Whole life insurance provides coverage for the entire life of the policyholder, as long as premiums are paid |

What You'll Learn

Term life insurance is cheaper but has no cash value

Term life insurance is a more affordable option than whole life insurance, but it does not have a cash value. This means that you cannot borrow against the policy or cash it out. Term life insurance is a straightforward insurance option that offers a death benefit for your beneficiaries if you pass away while the policy is in force. The policy only lasts for a set number of years, such as 10, 20, or 30 years, and the premiums tend to be much lower than those of whole life insurance.

The lack of cash value in term life insurance policies makes them significantly more affordable than permanent life insurance policies, such as whole life insurance. Term life insurance is designed to provide a financial safety net for your loved ones in the event of your death, without any additional features that can be utilized while you are alive. This simplicity makes term life insurance a cheaper option, but it also means that you won't have access to the cash value benefits offered by whole life insurance.

Term life insurance is a good choice for those who want coverage for a specific period, such as the number of years until retirement or until their children become financially independent. It is also a good option for those who want the most affordable coverage, especially if they are young and healthy. However, if you are looking for lifelong coverage and the ability to build cash value, whole life insurance may be a better option.

Whole life insurance is a form of permanent life insurance that offers lifelong protection and includes a cash value component. The cash value grows over time, and you can borrow against it or withdraw it while you are still alive. However, whole life insurance is significantly more expensive than term life insurance due to its additional features.

In summary, term life insurance is cheaper but has no cash value, while whole life insurance is more expensive but offers lifelong coverage and the ability to build cash value. The choice between the two depends on your coverage needs, budget, and preferences for flexibility and benefits.

Life Insurance: Geico's Accelerated Rider Option Explained

You may want to see also

Whole life insurance is more expensive but lasts your whole life

Whole life insurance is more expensive than term life insurance, but it does last your entire life. This type of insurance is a form of permanent life insurance that remains in force as long as you make your premium payments on time and do not let the policy lapse. Whole life insurance also includes an investment or "cash value" account that grows tax-deferred over time. This means that you can withdraw or borrow against the cash value, which can be useful for emergency expenses or other financial needs.

The cost of whole life insurance varies depending on factors such as age, gender, health, and coverage amount. Generally, younger and healthier individuals pay lower premiums, as they are less likely to die and will make more payments on the policy before their death. Women also tend to pay lower premiums than men due to their longer life expectancy.

While whole life insurance is more costly, it offers several benefits. The premiums typically remain the same over time, and the coverage lasts your entire life as long as you keep up with the payments. Whole life insurance also includes a guaranteed death benefit for your beneficiaries and a cash value account that grows at a guaranteed rate. Additionally, some policies may offer annual dividends or allow you to use the cash value to cover your premiums.

However, there are also drawbacks to consider. The main disadvantage is the significantly higher cost compared to term life insurance. Whole life insurance is more expensive because it includes both insurance and investment components. The high cost may make it challenging for some individuals to keep up with the payments. Additionally, the death benefit and cash value are linked, so any loans or withdrawals from the cash value will reduce the death benefit.

In summary, whole life insurance offers lifelong coverage and the ability to build cash value, but it comes at a higher price. It is important to weigh the benefits and drawbacks to determine if whole life insurance is the best option for your needs and budget.

Teachers' Pension: Life Insurance Inclusion and Benefits Explained

You may want to see also

Whole life insurance has a cash value component

The ability to borrow against the cash value provides a source of funds that can be used for various purposes, such as college tuition, home repairs, or supplementing retirement income. It's important to note that any outstanding loans or withdrawals from the cash value will typically reduce the death benefit paid out to beneficiaries.

Whole life insurance policies also offer fixed premiums, which remain level throughout the duration of the policy. This helps with budgeting and ensures that policyholders know exactly how much they need to pay each month. Additionally, the death benefit is guaranteed, providing lifelong coverage as long as the premiums are paid.

However, it's important to consider the higher cost of whole life insurance compared to term life insurance. The premiums are significantly more expensive due to the permanent coverage and the inclusion of the cash value component. Policyholders should carefully evaluate their financial situation and goals to determine if the benefits of the cash value component align with their needs.

Term vs Universal Life Insurance: Key Differences Explained

You may want to see also

Term life insurance is best for specific time periods

Term life insurance is best suited for those who want coverage for a specific period, such as the number of years until their children are through with college or the duration of their mortgage. It is also ideal for those who want to replace their income if they die while they still have major financial obligations.

Term life insurance is often the most affordable option for those who want life insurance to cover financial obligations that are temporary. It is a good choice for those who want to cover specific financial concerns with a defined timeline, such as a mortgage. It is also a good option for single parents who want a safety net for their child if they die.

The length of a term life insurance policy can vary, with common durations being 10, 15, 20, 25, or 30 years. Some companies even offer terms of up to 40 years. The most common term life length purchased is 20 years. When choosing the duration of a term life insurance policy, it is important to consider the length of the debt or situation you want to cover. For example, if you want to cover the years until your children finish college, you might choose a 10-year term, whereas if you want to cover a 30-year mortgage, you would likely opt for a 30-year term.

Term life insurance is also a good option for those who cannot afford the much higher monthly premiums associated with whole life insurance. It is a relatively inexpensive way to provide a lump sum to your dependents if something happens to you, making it a good option for young, healthy individuals supporting a family.

Life Insurance: Getting Mortgage Covered

You may want to see also

Whole life insurance is best for lifelong coverage

Whole life insurance is a type of permanent life insurance that can provide coverage for your entire life. It is more expensive than term life insurance but comes with additional benefits.

Whole life insurance policies offer three kinds of guarantees: a guaranteed minimum rate of return on the cash value, the promise that your premium payments won't increase, and a guaranteed death benefit amount. This makes whole life insurance a good option for those seeking lifelong coverage.

Whole life insurance policies also have a cash value component that lets you tap into it while you're alive. This cash value accumulates over time and can be accessed through a withdrawal or loan, or by surrendering the policy. The money in the cash value account grows tax-free, similar to a 401(k) or IRA.

Whole life insurance is a good option for those who want lifelong coverage and the ability to build cash value that can be accessed during their lifetime. It is also beneficial for long-range financial planning, such as funding a trust for children or paying estate taxes.

Additionally, whole life insurance policies offer the flexibility to choose from different payment types. You can pay premiums on a regular basis (monthly, quarterly, semi-annually, or annually), opt for a single premium where you pay the entire cost upfront, or choose a limited payment option where you pay regular premiums for a set number of years.

Superannuation: Life Insurance Coverage and Your Options

You may want to see also

Frequently asked questions

Term life insurance is temporary and only lasts for a set number of years, whereas whole life insurance is permanent and lasts your entire life. Term life insurance is also much cheaper than whole life insurance, which can cost up to 17 times more. Whole life insurance has a cash value component that grows over time, whereas term life insurance does not.

Term life insurance is a good option for those who only need coverage for a specific period, such as while they have children or a mortgage. It is also much more affordable than whole life insurance. However, term life insurance does not offer lifelong coverage and does not build cash value over time.

Whole life insurance offers lifelong coverage and includes a cash value component that can be borrowed against or withdrawn. It also has fixed premiums that do not change over time. However, whole life insurance is significantly more expensive than term life insurance and can be more complex and difficult to evaluate.