Investing in life insurance is an essential step for women to secure their financial future and that of their loved ones. It provides a safety net in the event of unforeseen circumstances, ensuring financial stability and peace of mind. Women often face unique challenges, such as the gender pay gap and the responsibility of caring for children or elderly parents, which can impact their long-term financial planning. Life insurance offers a way to protect against these potential risks, providing financial support to cover expenses, such as mortgage payments, education costs, or daily living expenses. Additionally, it can help women achieve their financial goals, such as building an emergency fund or saving for retirement, by providing a steady stream of income or a lump sum payment. This investment in life insurance is a powerful tool for women to take control of their financial future and ensure their well-being and that of their family.

What You'll Learn

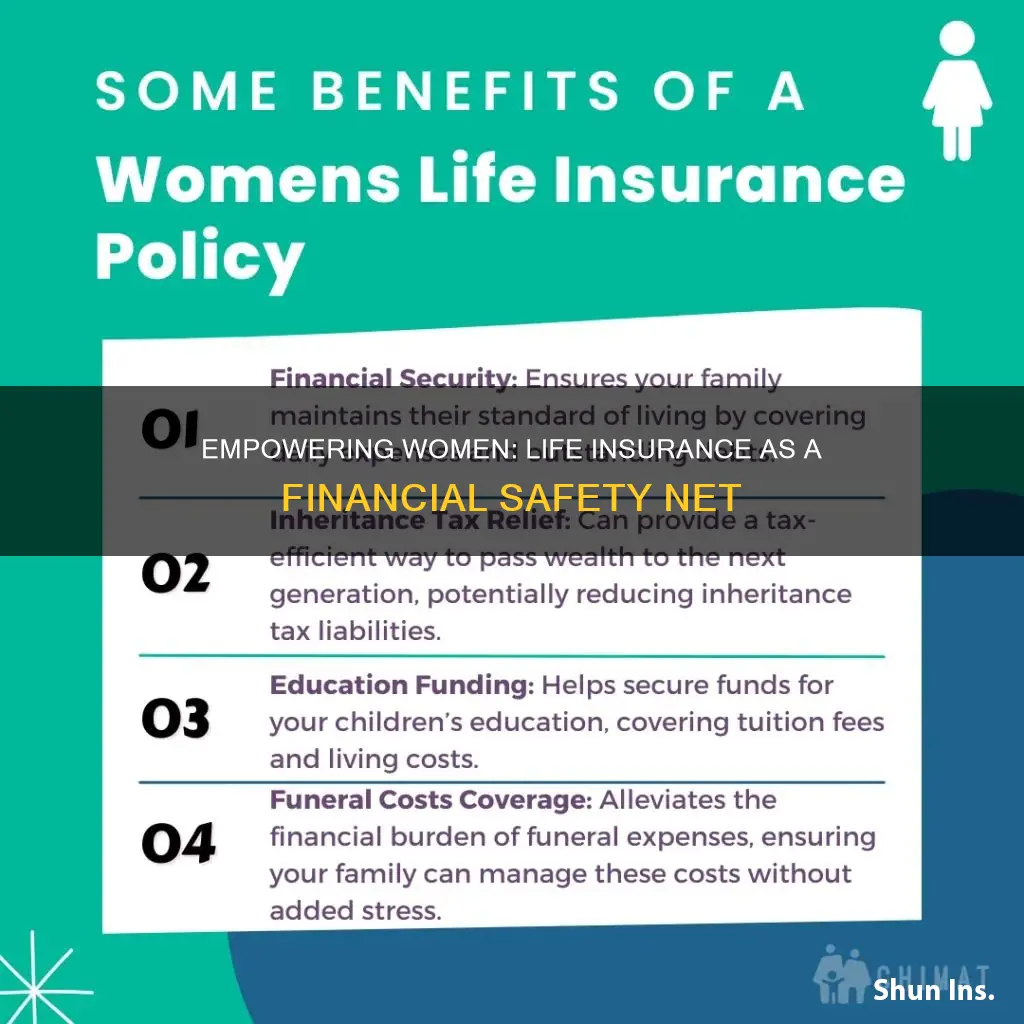

- Financial Security: Women can ensure their loved ones' financial stability in the event of their passing

- Long-Term Savings: Life insurance can act as a long-term savings tool, providing financial security for future goals

- Peace of Mind: Knowing they've protected their family's future brings peace of mind to women

- Empowerment: Investing in life insurance empowers women to take control of their financial destiny

- Legacy Planning: It allows women to leave a financial legacy for their children or beneficiaries

Financial Security: Women can ensure their loved ones' financial stability in the event of their passing

Investing in life insurance is a crucial step for women to take control of their financial future and provide long-term security for their loved ones. While it might not be the most glamorous aspect of personal finance, life insurance offers a safety net that can significantly impact the lives of those you care about. Here's how women can leverage life insurance to ensure financial stability for their families:

Protecting Dependents: Women often play a vital role in raising and supporting their children. In the event of their passing, life insurance can provide a steady income to cover the costs of raising a family, including education, healthcare, and daily expenses. This financial support can ensure that your children's needs are met and that they have the resources to build a bright future. For instance, a life insurance policy can provide a lump sum payout or regular payments to cover the costs associated with raising a child until they become financially independent.

Debt Management: Life insurance can also help manage and pay off debts, such as mortgages, car loans, or student loans. When a woman passes away, the remaining debt can be a significant burden for her family. By having a life insurance policy in place, the proceeds can be used to settle these debts, preventing the loved ones from inheriting financial obligations. This ensures that the family's financial stability is not compromised by outstanding debts.

Income Replacement: For women who are primary breadwinners or contribute significantly to the family income, life insurance can replace the lost income. This is especially important if the family relies on a single income. The policy's death benefit can provide a financial cushion to cover living expenses, mortgage payments, or other regular commitments, ensuring that the family's standard of living is maintained even in the absence of the primary earner.

Long-Term Financial Planning: Life insurance is a valuable tool for long-term financial planning. It allows women to plan for their family's future, including retirement savings for themselves and their partners, or education funds for their children. By naming beneficiaries and regularly reviewing and updating policies, women can ensure that their life insurance strategy evolves with their family's changing needs. This proactive approach to financial planning can provide peace of mind and security for the future.

In summary, life insurance empowers women to take charge of their financial destiny and provide for their loved ones. It offers a practical solution to ensure that the family's financial stability is not disrupted in the event of an unexpected passing. By understanding the benefits and taking the necessary steps to secure appropriate coverage, women can leave a lasting legacy of financial security for their families.

Accessing Life Insurance Benefits for Deceased Veterans

You may want to see also

Long-Term Savings: Life insurance can act as a long-term savings tool, providing financial security for future goals

Life insurance is often associated with providing financial protection and peace of mind in the event of an untimely death, but it can also be a powerful tool for long-term savings and financial planning, especially for women. This is particularly relevant as women often face unique financial challenges and responsibilities throughout their lives. By understanding how life insurance can serve as a long-term savings strategy, women can take control of their financial future and ensure they have the resources to achieve their goals.

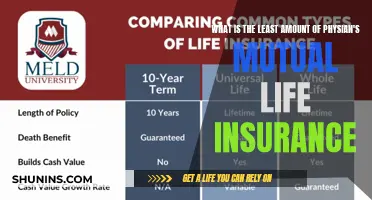

One of the key benefits of life insurance for long-term savings is the ability to build a substantial cash value over time. Term life insurance, in particular, offers a straightforward way to accumulate wealth. When you pay premiums for a term life policy, a portion of that payment goes towards building cash value, which grows tax-deferred. This cash value can be borrowed against or withdrawn, providing a source of funds for various financial needs. For women, this can be a valuable asset, especially if they are the primary caregivers or breadwinners in their families. The long-term savings aspect of life insurance allows women to build a financial cushion that can be used for future expenses, such as education costs for children, retirement planning, or even starting a business.

Over time, the cash value in a life insurance policy can grow significantly, providing a substantial financial resource. This is particularly advantageous for women who may have limited access to traditional retirement savings options, such as employer-sponsored pension plans. By utilizing life insurance as a savings tool, women can ensure they have a dedicated pot of money set aside for their future, which can be a significant advantage in retirement planning.

Additionally, life insurance can provide financial security and peace of mind, knowing that your loved ones will be taken care of in the event of your passing. This aspect of life insurance is often overlooked in the context of long-term savings, but it is equally important. The financial security provided by life insurance can help ensure that your family's lifestyle and financial goals are met, even if you are no longer around. This is especially crucial for women who may have specific financial obligations or dependents, such as children or elderly parents, who rely on their income.

In summary, life insurance is not just about providing coverage in the event of death; it can also be a powerful long-term savings strategy. Women can leverage the cash value accumulation and tax-advantaged growth of life insurance policies to build a substantial financial resource. This can be a valuable tool for achieving financial goals, providing security for loved ones, and ensuring a stable financial future. By incorporating life insurance into their financial plans, women can take a proactive approach to their long-term savings and financial well-being.

Life or Mortgage Insurance: Which Offers Better Protection?

You may want to see also

Peace of Mind: Knowing they've protected their family's future brings peace of mind to women

Investing in life insurance is a crucial step for women to ensure the financial security and well-being of their families. While it might seem like a daunting task, the peace of mind it provides is invaluable. Here's why women should consider this investment:

Women often take on the role of primary caregivers and decision-makers within a family. By purchasing life insurance, they can alleviate the stress and worry associated with providing for their loved ones. This financial product offers a safety net, knowing that in the event of their untimely demise, their family will have a steady income to cover essential expenses. It empowers women to take control of their family's future, ensuring that their loved ones are cared for and their financial obligations are met.

The process of securing life insurance can be a learning curve, but it is an educational journey. Women will gain a deeper understanding of their family's financial needs and the various insurance policies available. This knowledge is empowering, as it enables them to make informed decisions and tailor a plan that suits their family's unique circumstances. With this awareness, women can feel more confident in their ability to provide and protect their loved ones.

Moreover, life insurance provides a sense of security and stability. It allows women to envision a future where their family can maintain their standard of living, even if they are no longer around. This foresight is a powerful motivator, encouraging women to take action and make provisions for their family's long-term well-being. Knowing that their family's future is protected can bring immense comfort and peace of mind.

In summary, investing in life insurance offers women the opportunity to become guardians of their family's financial future. It provides the assurance that, despite life's uncertainties, their loved ones will be taken care of. This sense of security and control over one's family's destiny is a powerful incentive for women to take this important step towards financial protection.

Life Insurance Beneficiary: Can I Choose My Boyfriend?

You may want to see also

Empowerment: Investing in life insurance empowers women to take control of their financial destiny

Investing in life insurance is a powerful step towards financial empowerment for women, offering a means to secure their future and that of their loved ones. It provides an opportunity to take charge of one's financial affairs and make a lasting impact on their lives. Here's how this decision can be a transformative choice:

Financial Security: Life insurance acts as a safety net, ensuring financial stability for women and their families. By purchasing a policy, women can provide for their dependents, covering essential expenses and everyday costs. This financial security is especially crucial for single women or those who are primary caregivers, as it offers peace of mind and the ability to plan for the future without constant worry. The policy's payout can be utilized to cover mortgage payments, education costs, or even start a business, enabling women to achieve their financial goals and protect their assets.

Long-Term Planning: Empowering women to take control of their financial destiny involves strategic long-term planning. Life insurance policies often come with various investment options, allowing policyholders to grow their money over time. This feature enables women to build a substantial financial cushion, which can be used to fund retirement, education, or other significant life goals. With proper guidance, women can make informed decisions about their investments, ensuring their money works hard for them and providing a sense of financial independence.

Legacy Building: Beyond financial security, life insurance can be a tool for creating a lasting legacy. Women can leave a financial inheritance for their children or other beneficiaries, providing them with a solid foundation for their future. This aspect of investing in life insurance goes beyond the immediate benefits, offering a way to impact future generations and ensure their financial well-being. It allows women to take a proactive approach to their family's future, making a significant difference in the lives of their loved ones.

Personal Growth: The process of researching and purchasing life insurance can be an educational journey, fostering financial literacy. Women can learn about different policy types, investment strategies, and the importance of regular reviews. This knowledge empowers them to make informed decisions and adapt their financial plans as their circumstances change. By taking control of their financial affairs, women can develop a sense of self-reliance and confidence, which can extend to other areas of their lives, encouraging a proactive and empowered mindset.

In summary, investing in life insurance is a strategic move for women to gain financial control and security. It provides the means to protect loved ones, plan for the future, and build a legacy. With the right guidance and understanding of the various policy options, women can make informed choices, ensuring their financial well-being and that of their families. This decision is a powerful step towards financial independence and a testament to the ability to shape one's destiny.

Is Cash Value Life Insurance Beneficial for Small Businesses?

You may want to see also

Legacy Planning: It allows women to leave a financial legacy for their children or beneficiaries

Legacy planning is an essential aspect of financial strategy, especially for women who want to ensure their loved ones are taken care of and their wishes are honored. When it comes to life insurance, it can be a powerful tool to create a lasting financial legacy. Here's how women can utilize life insurance for this purpose:

Securing the Future of Dependents: One of the primary reasons women should consider life insurance is to provide financial security for their children or any dependents. In the event of an untimely passing, a life insurance policy can ensure that the financial needs of the family are met. This includes covering expenses such as education, healthcare, and daily living costs, ensuring that the dependents' future is protected and their well-being is guaranteed. By leaving a financial legacy, women can give their loved ones the peace of mind that comes with knowing they are financially secure.

Leaving a Financial Gift: Life insurance proceeds can be an excellent way to pass on a significant financial gift to beneficiaries. When a woman purchases a life insurance policy, she can name beneficiaries, who could be her children, grandchildren, or any other individuals she wishes to support. Upon her passing, the policy's payout will be received by these beneficiaries, providing them with a substantial financial gift. This can be a valuable asset, especially for young adults starting their lives or those facing significant financial milestones.

Customizing the Legacy: The beauty of life insurance for legacy planning is the flexibility it offers. Women can choose the policy amount and type that best suits their needs and financial goals. Term life insurance, for instance, provides coverage for a specific period, ensuring that the financial legacy is secure during the years when dependents might need it the most. Additionally, women can select beneficiaries, allowing them to leave the proceeds to specific family members or even charitable organizations, further personalizing the legacy they wish to create.

Long-Term Financial Strategy: Legacy planning through life insurance is a long-term strategy that can have a profound impact on the future. By investing in this type of insurance, women can ensure that their financial legacy is built and protected over time. This allows them to leave a substantial amount for their beneficiaries, providing financial stability and opportunities for their loved ones. It is a proactive approach to wealth management, offering peace of mind and a sense of accomplishment.

In summary, life insurance is a powerful tool for women to create a financial legacy that benefits their children and other dependents. It provides a means to secure their future, offer financial gifts, and customize the legacy according to personal wishes. By incorporating life insurance into their financial plans, women can take control of their legacy and ensure a lasting impact on the lives of those they care about.

Boeing Retiree Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Life insurance is a crucial financial tool for women, as it provides financial security and peace of mind. It ensures that your loved ones are protected in the event of your untimely demise, covering expenses such as funeral costs, outstanding debts, and daily living expenses. This is especially important for women who may have a higher life expectancy and could face unique financial challenges, such as caring for aging parents or raising children alone.

Investing in life insurance can be a strategic move for women to secure their financial future. It offers a way to build wealth over time through various investment options. Term life insurance, for instance, provides coverage for a specific period, and any premiums paid beyond the initial term can be invested, potentially growing your money significantly. This can be a valuable tool for women looking to create a financial safety net and achieve long-term financial goals.

Yes, life insurance policies often offer unique benefits tailored to women's needs. For example, some insurers provide additional coverage for critical illnesses or offer lower premiums for non-smokers and healthy individuals. Certain policies also include riders or optional benefits that can enhance coverage, such as waiver of premium, which ensures your policy remains in force even if you become unable to pay due to illness or injury.

Absolutely! Life insurance can be a valuable asset in estate planning. It can help minimize estate taxes, ensuring that your beneficiaries receive the full death benefit tax-free. This is particularly beneficial for women who want to leave a financial legacy for their children or grandchildren. Additionally, life insurance can be used to secure a loan for business ventures or real estate purchases, providing women with opportunities to build and grow their wealth.