Physicians Mutual Life Insurance offers a range of insurance products tailored to the needs of medical professionals. One of the key offerings is the least amount of physicians' mutual life insurance, which provides a comprehensive solution for doctors and other healthcare providers. This insurance plan is designed to offer financial protection and peace of mind, ensuring that medical practitioners can focus on their patients without worrying about their financial well-being. It typically includes coverage for critical illness, disability, and accidental death, providing a safety net for healthcare professionals and their families. Understanding the specifics of this insurance plan is essential for medical professionals to make informed decisions about their financial security.

What You'll Learn

- Definition: Minimal coverage with low premiums, offering basic protection

- Benefits: Provides financial support to beneficiaries upon the insured's death

- Cost: Affordable due to limited coverage, suitable for basic needs

- Features: Simplified underwriting, no medical exams, quick enrollment

- Comparison: Compare with other policies to find the least expensive option

Definition: Minimal coverage with low premiums, offering basic protection

The concept of minimal coverage with low premiums in the context of life insurance refers to a basic level of protection designed to provide financial security at a reduced cost. This type of policy is often tailored for individuals seeking a simple and affordable way to safeguard their loved ones or assets in the event of their passing. It is a cost-effective solution for those who want a safety net without the complexity and higher costs associated with more comprehensive plans.

When considering the least amount of life insurance, it typically involves a smaller coverage amount, usually ranging from $10,000 to $50,000, depending on the insurer and the individual's circumstances. This minimal coverage is intended to cover immediate expenses, such as funeral costs, outstanding debts, or a short-term financial gap, providing a basic level of reassurance. The premiums for such policies are generally lower because the insurance company assumes less risk with a smaller payout amount.

This type of insurance is ideal for individuals who want a quick and straightforward solution without the need for extensive coverage. It is often a good starting point for those new to life insurance or those with limited budgets. The simplicity of these policies allows for easy understanding and decision-making, ensuring that the insurance serves its purpose without unnecessary complexity.

Insurers offering minimal coverage often provide basic benefits, such as a death benefit that pays out a predetermined amount upon the insured's passing. This benefit is designed to cover essential expenses and provide a financial cushion for the policyholder's beneficiaries. Additionally, these policies may include some basic rider options, allowing policyholders to enhance their coverage slightly at an additional cost.

It is important to note that while minimal coverage life insurance offers basic protection, it may not be sufficient for all financial needs. For more comprehensive coverage and long-term financial planning, individuals might consider higher coverage amounts and exploring other insurance options. However, for those seeking an affordable and straightforward solution, the least amount of life insurance can be a valuable tool to ensure some level of financial security.

Understanding Flexible Adjustable Life Insurance: A Comprehensive Guide

You may want to see also

Benefits: Provides financial support to beneficiaries upon the insured's death

The concept of life insurance is a crucial financial tool that offers a safety net for individuals and their loved ones. When it comes to life insurance, one of the key benefits is the financial support it provides to beneficiaries upon the insured's death. This benefit is a cornerstone of life insurance, ensuring that the financial obligations and commitments of the deceased are met, even in their absence.

In the context of Physicians Mutual Life Insurance, this benefit takes on a specific form. When an individual purchases a life insurance policy from Physicians Mutual, they essentially enter into a contract with the insurance company. The primary purpose of this contract is to provide financial security to the policyholder's beneficiaries in the event of their untimely demise. The amount of financial support, or the 'least amount of insurance,' is determined by the policyholder's needs and preferences.

The process of determining the least amount of insurance involves assessing various factors. These factors include the policyholder's age, health, lifestyle, and financial obligations. For instance, a young, healthy individual with no significant financial commitments might require a lower death benefit compared to an older person with a large mortgage, dependent children, or substantial business debts. The insurance company uses these criteria to calculate the appropriate coverage amount, ensuring that the beneficiaries receive adequate financial support.

Upon the insured's death, the beneficiaries named in the policy are entitled to receive the death benefit. This financial support can be used to cover various expenses, such as funeral costs, outstanding debts, mortgage payments, or even to provide financial security for dependent family members. The benefit is designed to ease the financial burden on the beneficiaries, allowing them to focus on grieving and adjusting to life without the insured individual.

Physicians Mutual Life Insurance policies offer flexibility in choosing the death benefit amount. Policyholders can select a coverage amount that aligns with their financial goals and risk tolerance. This customization ensures that the insurance policy is tailored to the individual's specific needs, providing the least amount of insurance required to protect their loved ones. By offering this flexibility, Physicians Mutual empowers individuals to make informed decisions about their financial security and the well-being of their beneficiaries.

Whole Life Insurance: Surrender Charges and You

You may want to see also

Cost: Affordable due to limited coverage, suitable for basic needs

The concept of "least amount of physician's mutual life insurance" refers to a type of insurance policy that provides minimal coverage, often tailored for individuals seeking basic protection without extensive benefits. This type of insurance is designed to cater to those who want a simple, cost-effective solution for life insurance needs.

One of the key advantages of this insurance is its affordability. The minimal coverage offered ensures that the premiums are relatively low, making it accessible to a wide range of individuals. This is particularly beneficial for those who may have limited financial resources or prefer to keep their insurance expenses as low as possible. By opting for a policy with limited coverage, individuals can ensure that the cost remains manageable, allowing them to allocate their financial resources to other essential aspects of their lives.

The limited coverage aspect of this insurance means that it is suitable for basic needs. It typically provides a fixed amount of coverage, which may be sufficient for individuals who want a safety net for their families or themselves. For instance, it could cover funeral expenses, provide a financial cushion for dependents, or offer a small inheritance to beneficiaries. This type of coverage is straightforward and direct, ensuring that the insurance serves its primary purpose without unnecessary complexities.

When considering this type of insurance, it is essential to understand the terms and conditions to ensure it aligns with your specific requirements. The coverage amount, duration, and any exclusions should be carefully reviewed to make an informed decision. Additionally, comparing different policies from various providers can help you find the best option that suits your needs while maintaining affordability.

In summary, the least amount of physician's mutual life insurance is a cost-effective solution for individuals seeking basic coverage. Its affordability and limited scope make it an attractive choice for those who prioritize keeping insurance expenses low while still having a safety net in place. By understanding the coverage options and comparing policies, individuals can make a well-informed decision regarding their life insurance needs.

Understanding Standard Status: Life Insurance Simplified

You may want to see also

Features: Simplified underwriting, no medical exams, quick enrollment

When considering life insurance, many people are drawn to the idea of having a safety net for their loved ones, but the process of obtaining coverage can often be daunting and time-consuming. This is where the concept of "simplified underwriting" comes into play, offering a streamlined approach to life insurance. Simplified underwriting is a process that allows insurance companies to assess risk and determine eligibility for coverage without the extensive medical exams and paperwork traditionally required. This method is particularly appealing to those who may have health concerns or lead busy lives, as it significantly reduces the time and effort needed to secure a policy.

One of the key features of simplified underwriting is the absence of medical exams. In the past, obtaining life insurance often involved a thorough medical examination, including blood tests and physical assessments. However, with simplified underwriting, this step is eliminated, making the process more accessible and convenient. This approach is especially beneficial for individuals with pre-existing health conditions or those who may not have the time or resources for a traditional medical exam. By removing this barrier, insurance companies can offer coverage to a wider range of individuals, ensuring that financial protection is available to those who need it most.

The process typically involves a quick and straightforward application, where applicants provide detailed information about their health, lifestyle, and other relevant factors. This information is then used to determine the level of risk associated with the individual, allowing the insurance company to offer a policy with appropriate coverage. The speed of enrollment is another advantage, as many companies now provide instant quotes and the ability to complete the entire application process online. This real-time assessment and approval process can provide immediate peace of mind, especially for those seeking coverage to protect their families or businesses.

For those who prefer a more personalized approach, some insurance providers offer a hybrid model. This model combines simplified underwriting with a limited medical exam, ensuring a balance between convenience and a thorough assessment. During this process, applicants may be asked to provide basic health information and undergo a brief physical examination, which can be conducted by a nurse or a similar medical professional. This method allows for a more tailored experience while still offering the benefits of a simplified process.

In summary, simplified underwriting, coupled with the absence of medical exams and quick enrollment, has revolutionized the way life insurance is obtained. It provides an efficient and accessible way to secure coverage, ensuring that individuals can protect their loved ones or businesses without the traditional hurdles. This approach is particularly valuable for those with busy lifestyles or health concerns, as it offers a streamlined path to financial security. With the right insurance provider, individuals can find a policy that suits their needs, providing peace of mind and long-term financial protection.

Life Insurance: Who Benefits and How?

You may want to see also

Comparison: Compare with other policies to find the least expensive option

To find the least expensive option for a physician's mutual life insurance policy, it's essential to compare it with other insurance products in the market. Here's a detailed comparison to guide you:

Understanding Physician's Mutual Life Insurance:

Physician's Mutual Life Insurance is a type of whole life insurance designed specifically for doctors and healthcare professionals. It offers lifelong coverage and various benefits tailored to the medical profession. The key advantage is often the guaranteed acceptance, making it accessible to individuals who might face challenges with other life insurance policies.

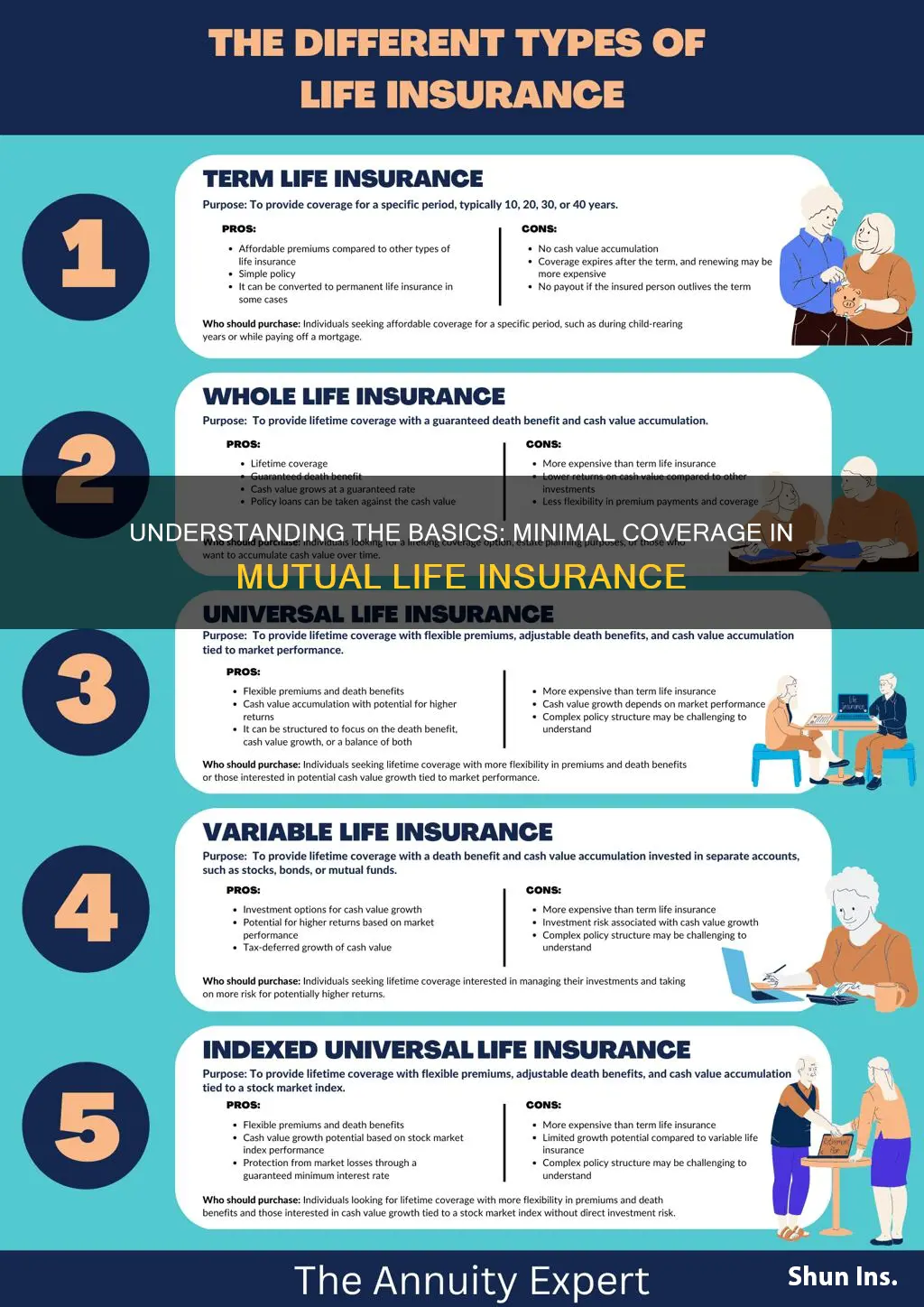

Comparison with Term Life Insurance:

Term life insurance is a more affordable option for temporary coverage, typically for a set period, such as 10, 20, or 30 years. While it is generally less expensive than whole life insurance, it doesn't offer the same level of lifelong benefits. Term policies are ideal for those seeking coverage for a specific period, such as covering mortgage payments or providing financial security for children's education. However, if you require lifelong coverage, term life insurance might not be the most cost-effective choice.

Comparing with Whole Life Insurance:

Whole life insurance, like Physician's Mutual, provides permanent coverage and a cash value component. It offers a guaranteed death benefit and a fixed premium. While it is more expensive than term life, it provides long-term financial security. When comparing with other whole life policies, consider the following:

- Premiums: Compare the annual premiums of different whole life insurance providers. Physician's Mutual, being a specialized policy, might offer competitive rates for doctors.

- Benefits: Evaluate the additional benefits provided by Physician's Mutual, such as professional-specific coverage and guaranteed acceptance.

- Medical History: Since Physician's Mutual caters to healthcare professionals, it may offer more favorable rates for doctors with specific medical histories compared to general whole life insurance policies.

Online Research and Quotes:

Conducting an online search can provide valuable insights. Many insurance comparison websites allow you to input your details and receive quotes from various providers. This process helps you understand the price range for different coverage amounts and policy types. Additionally, reaching out to insurance brokers or agents who specialize in physician's mutual insurance can offer personalized advice and quotes tailored to your needs.

Finding the least expensive option involves a thorough comparison of premiums, benefits, and coverage types. While Physician's Mutual Life Insurance might be more expensive than term life, its specialized nature and benefits could make it a cost-effective choice for doctors. Researching and comparing multiple policies will enable you to make an informed decision and find the best value for your specific requirements.

Skydiving: Is Your Life Insurance Policy Still Valid?

You may want to see also

Frequently asked questions

Physicians Mutual Life Insurance offers a range of coverage options, and the least amount of coverage typically starts at $1,000. This basic coverage can be a good starting point for individuals seeking affordable life insurance without extensive benefits.

Yes, absolutely! One of the advantages of many life insurance policies, including those from Physicians Mutual, is the ability to increase the coverage amount over time. You can typically review and adjust your policy during annual reviews or when you experience significant life changes that may warrant higher coverage.

The medical requirements for life insurance can vary depending on the policy and the insurance company's underwriting guidelines. For the least coverage, some insurers may offer simplified issue or no-medical-exam options, allowing for easier qualification without extensive medical history reviews. However, it's essential to disclose any pre-existing medical conditions to ensure accurate coverage and pricing.

The least coverage offered by Physicians Mutual Life Insurance is likely to be a term life policy, which provides coverage for a specific period, typically 10, 15, or 20 years. Term life insurance is generally more affordable than permanent life insurance (e.g., whole life or universal life) and can be a cost-effective way to secure coverage for a defined period.