Variable life insurance is a type of whole life insurance that offers permanent life insurance protection. It is similar to an ordinary whole life insurance policy but offers several benefits that a standard policy does not. Variable life insurance policies allow policyholders to allocate a portion of their premium to various investment options, such as stocks, bonds, equity funds, and money market funds. Due to the investment component, variable life insurance is considered a security and is regulated by both state insurance departments and federal securities laws. As a result, agents selling variable life insurance must hold a life insurance license and a securities license. The specific securities license required to sell variable life insurance is called a Variable Contract Authority (Series 6 or 7) license. This license allows agents to sell variable life insurance products and annuities, which include Modified Endowment Contracts (MECs). Obtaining a securities license in addition to a life insurance license enables agents to expand their service portfolio, stand out in a competitive marketplace, and uncover new revenue streams.

| Characteristics | Values |

|---|---|

| Type of license required | Securities license |

| Type of securities license required | Variable Contract Authority (Series 6) license or Series 7 license |

| Who issues the license? | Financial Industry Regulatory Authority (FINRA) |

| Who regulates variable life insurance? | FINRA and U.S. Securities and Exchange Commission (SEC) |

| What is the basic exam required to sell variable life insurance? | Securities Industry Essentials exam (SIE) |

| What is the purpose of the SIE? | To test basic knowledge of the securities industry |

| What is the duration of the SIE? | 1 hour and 45 minutes |

| How many questions are on the SIE? | 75 |

| What is another requirement to sell variable life insurance? | Life insurance license from the resident state and nonresident states where the agent works |

| What is required to maintain the Series 6 and Series 63 licenses? | Complete continuing education and testing every business quarter |

| How often is continuing education and testing required to maintain the life insurance license? | Typically every two years |

| What is the range of combined continuing education credits required by most states for the Series 6 and 63 licenses? | 15 to 30 credit hours |

What You'll Learn

- Variable life insurance requires a Series 6 or 7 securities license

- Variable life insurance is a security due to its investment risk

- State-specific requirements for selling variable life insurance

- Variable life insurance is a type of whole life insurance

- Variable life insurance offers permanent protection

Variable life insurance requires a Series 6 or 7 securities license

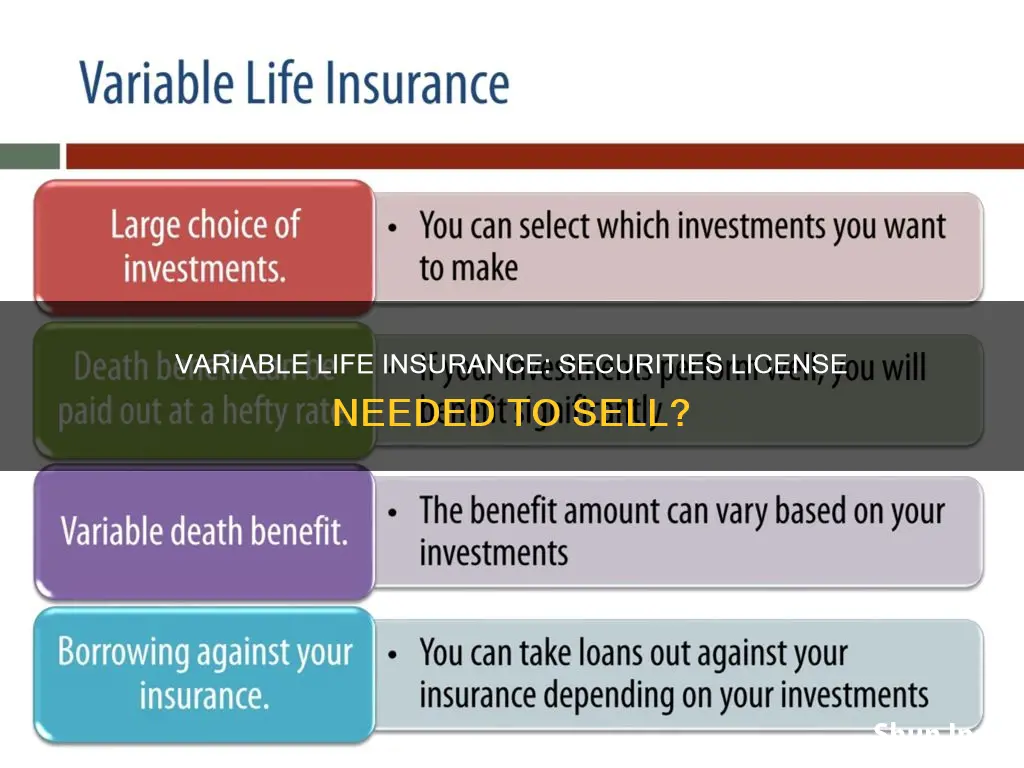

Variable life insurance is a type of whole life insurance that offers permanent life insurance protection. It is similar to an ordinary whole life insurance policy, except that it invests the premiums in mutual fund sub-accounts. Variable life insurance is considered a security because it involves investment funds. The variable life insurance policies allow policyholders to allocate a portion of their premium dollars to a separate account comprising various instruments and investment funds within the insurer's portfolio, such as stocks, bonds, equity funds, money market funds, and bond funds.

Due to the investment component of variable life insurance, it is regulated by both state insurance departments and federal securities laws. This means that, in addition to a life insurance license from their resident state and nonresident states in which they work, an agent needs to pass a securities exam to sell variable life insurance. Specifically, a Series 6 or Series 7 license is required to sell variable life insurance. These licenses are issued by the Financial Industry Regulatory Authority (FINRA) and allow holders to sell financial products that use or contain mutual funds and other variable-return securities.

The Series 6 license is also called the Variable Contract Authority license. It allows insurance producers to sell variable life insurance products and annuities, including Modified Endowment Contracts (MECs) and variable life insurance. The Series 6 exam covers fund-based group securities such as mutual funds and variable insurance products. Most states also require the Series 63 exam in addition to the Series 6 license. The Series 63 exam covers "blue sky" laws, which are state variations of the Uniform Securities Act.

The Series 7 license is the more rigorous option and is preferred by those planning for a long-term career in the financial services industry. It allows the holder to discuss and sell a wide range of group and individual securities, from variable annuities to real estate investment trusts (REITs). The Series 7 exam covers a broader range of products than the Series 6 exam and is considered more challenging due to the wide range of products covered. In most states, a Series 7 license must be accompanied by a Series 63 license.

To obtain either a Series 6 or Series 7 license, individuals must pass a comprehensive exam covering various aspects of securities regulations. These exams are administered by FINRA and require a corporate sponsor, which means an existing FINRA-member firm reports to FINRA that the individual is associated with them. Often, the sponsoring firm will pay for the exam. To maintain their Series 6 and 7 licenses, individuals must complete continuing education and testing every business quarter.

Chronic Tonic Seizures: Life Insurance Impact and Exclusions

You may want to see also

Variable life insurance is a security due to its investment risk

Variable life insurance is a type of permanent life insurance that accumulates cash value on a tax-deferred basis. It is considered a security due to its investment risk.

Variable life insurance policies are often compared to mutual funds. This is because the insured pays premiums into a separate investment account that they own. The cash value of the policy varies based on the performance of the investments, and part of the death benefit may also be variable. Due to these investment risks, variable life insurance policies are considered securities contracts and must comply with federal securities laws and state insurance regulations.

The investment risks associated with variable life insurance policies mean that regulators require companies to clearly explain the risks to individuals and distinguish investment accounts and policies from other types of insurance. Sales professionals must provide a prospectus of available investment products to potential buyers, as required by federal regulations. The prospectus is a document that discloses important information about the policy, including fees, expenses, investment options, death benefits, and other features. It is available free of charge and must be provided by law when the policy is presented.

Variable life insurance policies also typically have higher premiums than other types of life insurance policies. These premiums help cover administrative fees and the management of the plan's investments. The policyholder may need to increase their premium payments to keep the policy active or maintain a specific death benefit, depending on the performance of the investments and the premiums paid.

To sell variable life insurance, an agent must hold both a life insurance license from their resident state and pass a Financial Industry Regulatory Authority (FINRA) Series 6 or Series 7 securities exam.

Guardian Insurance: Accepting Tricare for Life Insurance?

You may want to see also

State-specific requirements for selling variable life insurance

To sell variable life insurance, you must follow special regulations and obtain specific licensing. Variable life insurance is a type of whole life insurance that offers permanent life insurance protection. It is similar to ordinary whole life insurance but invests the premiums in mutual fund sub-accounts.

Variable life insurance is regulated by both the state and the SEC as securities. This means that, in addition to a life insurance license from their resident state, agents selling variable life insurance must also pass a Series 6 or Series 7 securities exam.

While the specific requirements for an agent to become licensed vary considerably from state to state, all states mandate the Series 6 and Series 63 licenses, which allow holders to sell financial products that use or contain mutual funds and other variable-return securities.

- In Florida, agents must complete a licensing exam that covers variable annuities in addition to the standard life insurance licensing requirements.

- Michigan requires variable lines brokers to pass a specific variable lines exam to get a variable line of authority.

- Kansas asks variable lines questions as part of its life insurance exam, and you must hold a life insurance line of authority to be a variable lines broker. However, once you’ve gotten the requisite Series exam, you can apply to have a separate variable line of authority in the state (without needing to take a separate insurance exam).

- Texas lets you sell variable lines if you have a life insurance license and submit your Central Registration Depository (CRD) number and other FINRA data to the state to obtain the appropriate variable insurance carrier appointment.

Life Insurance and SSI Disability: How Does OPM Affect You?

You may want to see also

Variable life insurance is a type of whole life insurance

Variable life insurance policies have a higher earning potential compared to traditional policies. This is because the policyholder decides how to invest the cash value. The cash value can be invested in certain securities, often called subaccounts, which resemble mutual funds. The insurer may also offer a fixed interest investment option, which has less risk but also a lower potential reward.

Variable life insurance policies are considered more volatile than standard life insurance policies. They are regulated by both the state and the SEC as securities. As such, selling variable life insurance requires a securities license in addition to a standard insurance license. To obtain a securities license, an exam must be passed.

Variable life insurance policies have three primary components: a death benefit, cash value, and premiums. The death benefit is left to the beneficiaries. A portion of the premium goes towards the cost of insurance and the fees of the insurer, while the remainder goes towards the policy's cash value. The cash value can be used to increase the death benefit, withdrawn as cash, or used as collateral for a loan.

Life Insurance Annual Charges: What You Need to Know

You may want to see also

Variable life insurance offers permanent protection

Variable life insurance is a permanent life insurance policy with an investment component. It is a type of whole life insurance that is relatively new to the United States. It is a permanent policy, meaning it lasts for the full lifetime of the insured person, unlike term life insurance, which only covers a certain period. Variable life insurance combines a death benefit with a savings component that earns interest on a tax-deferred basis. The savings component is typically invested in mutual funds, but can also be invested in other financial instruments such as stocks, bonds, and money market mutual funds.

Variable life insurance policies are considered more volatile than standard life insurance policies due to the investment component. The cash value of the policy may rise or fall depending on the performance of the underlying securities. This means that variable life insurance carries more risk, but also offers the potential for higher returns. The policyholder assumes any additional investment risk.

In addition to the death benefit, variable life insurance provides the opportunity to build savings with tax advantages. The cash value of the policy grows tax-free, and withdrawals up to the total of premiums paid are generally not taxed. The policyholder can borrow funds against the cash value or withdraw cash to meet expenses such as medical costs or a child's education. However, taking out the cash value reduces the future death benefit for heirs.

Variable life insurance also offers flexibility in premium payments. The policyholder may have the option to alter their premium payments if they have enough money in their savings account. This can be useful if the policyholder's economic situation changes.

Overall, variable life insurance offers permanent protection, investment opportunities, and savings benefits, making it a valuable option for individuals seeking comprehensive financial planning.

Life Insurance and HIPAA: What's the Connection?

You may want to see also

Frequently asked questions

Yes, because variable life insurance has an investment component and contains substantial levels of risk to the policyholder, it’s regulated by both state insurance departments and federal securities laws.

Variable life insurance is a type of whole life insurance that offers permanent life insurance protection. It invests the premiums in mutual fund sub-accounts.

The simplest way to deal with these types of variable insurance products is to not deal with them at all. You can refer clients to someone with the credentials to advise on and sell these lines of business.

Variable life insurance offers your clients several benefits that they cannot get with ordinary whole life policies. It also allows you to uncover new revenue streams.

To sell variable life insurance, you need a life insurance license and a Series 6 or Series 7 license issued by the Financial Industry Regulatory Authority (FINRA).