The exclusion period in life insurance is a critical concept that can significantly impact policyholders and their beneficiaries. This period, often referred to as the waiting period or contestability period, is a time frame during which the insurance company can contest the validity of a life insurance policy. During this period, typically ranging from 1 to 3 years, the insurer can challenge the cause of death or any misrepresentations made by the insured individual. Understanding this exclusion period is essential for individuals to ensure they receive the full death benefit as intended by the policy, and it highlights the importance of transparency and accuracy in the application process.

| Characteristics | Values |

|---|---|

| Exclusion Period Definition | The time frame during which a life insurance policy is not in effect for a specific reason, typically a pre-existing condition. |

| Common Duration | 1 to 2 years |

| Purpose | To protect the insurance company from fraud and ensure the policyholder's health is stable before coverage begins. |

| Pre-existing Conditions | May include chronic illnesses, injuries, or other health issues that were present before the policy was applied for. |

| Variability | Exclusion periods can vary based on the insurance company, policy type, and individual health factors. |

| Review and Removal | After the exclusion period, the insurance company may review the policyholder's health and potentially remove the exclusion if no significant changes occur. |

| Impact on Premiums | Policies with longer exclusion periods often have higher premiums to account for the increased risk. |

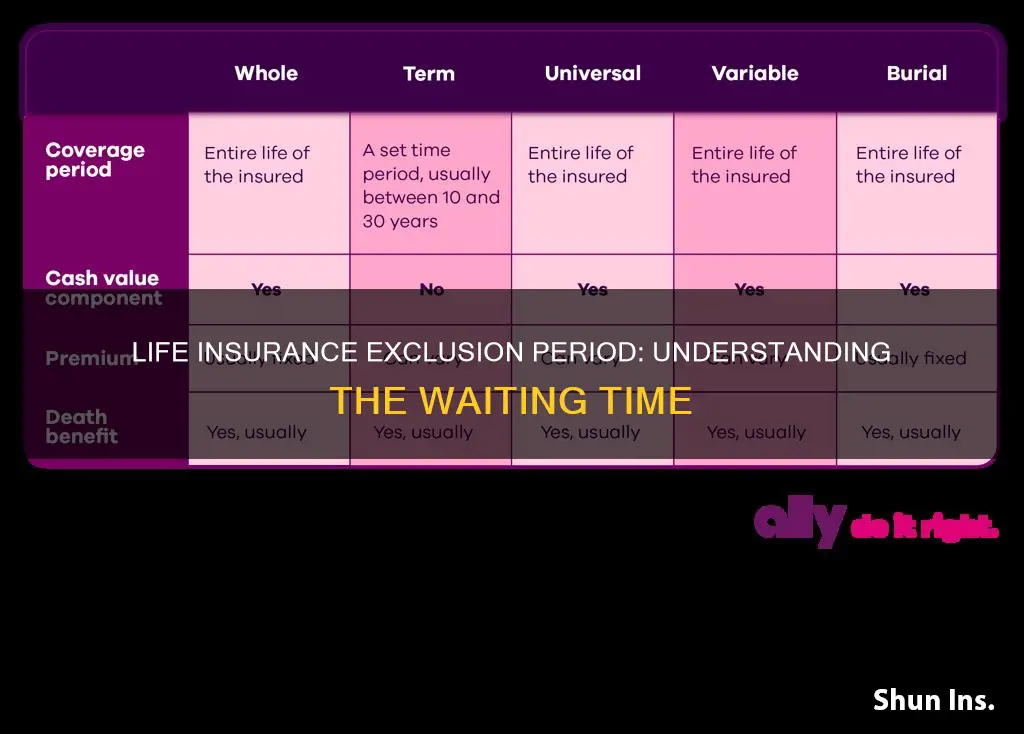

| Policy Types | Common in term life insurance and some whole life insurance policies. |

| Legal Considerations | Insurance companies must adhere to regulations regarding the disclosure of exclusion periods and the treatment of pre-existing conditions. |

| Customer Awareness | Policyholders should be informed about the exclusion period and its implications during the application process. |

What You'll Learn

Definition: The exclusion period is a waiting period before a life insurance policy pays out

The exclusion period, also known as the waiting period or the grace period, is a critical component of life insurance policies. It is a predetermined time frame during which the insurance company does not pay out any benefits upon the insured individual's death. This period is designed to protect the insurer from fraudulent claims and to ensure that the policy is not triggered by accidental or premeditated deaths.

When an individual purchases a life insurance policy, the exclusion period typically begins on the policy's effective date. During this time, the insurer closely monitors the insured's well-being and activities. If the insured dies during this period, the insurance company may deny the claim, especially if the death is deemed suspicious or if the insured engaged in high-risk activities known to the insurer. The length of the exclusion period varies depending on the insurance company, the type of policy, and the insured's health and lifestyle.

For example, a standard life insurance policy might have an exclusion period of 1 to 2 years. During this time, the insurer expects the insured to remain in good health and not engage in activities that could be considered risky or detrimental to their well-being. If the insured survives this period without any major health issues or accidents, the policy becomes active, and the death benefit is paid out to the designated beneficiaries.

It's important for individuals to understand the exclusion period when selecting a life insurance policy. This period can significantly impact the overall cost and coverage of the policy. Longer exclusion periods often result in lower premiums, as the insurer takes on less risk during the initial stages of the policy. Conversely, shorter exclusion periods may provide quicker coverage but at a higher cost.

In summary, the exclusion period is a waiting phase in life insurance, allowing the insurer to assess the insured's health and lifestyle before committing to a payout. This mechanism ensures the integrity of the insurance system and provides a safety net for both the insurer and the policyholder.

Discontinuing Colonial Life Insurance: A Step-by-Step Guide

You may want to see also

Length: It varies by policy, typically 1-3 years

The exclusion period in life insurance is a crucial aspect of understanding how your policy works. This period, also known as the "waiting period" or "elimination period," is a time during which the insurance company may not pay out a death benefit if the insured person dies. The length of this exclusion period can vary significantly, and it's essential to know what to expect.

As the name suggests, the primary purpose of this period is to exclude certain events or conditions that might be considered high-risk by the insurance company. During this time, the insurance provider assesses the insured individual's health and lifestyle to determine the risk they pose. This assessment is vital as it influences the premium rates and the overall terms of the policy.

The duration of the exclusion period is a critical factor in life insurance policies. Typically, it ranges from one to three years, but this can vary widely depending on the insurance company, the type of policy, and the individual's circumstances. For instance, a term life insurance policy might have a standard exclusion period of one year, while a whole life insurance policy could offer a longer period, sometimes up to three years or more.

During this exclusion period, if the insured person passes away, the insurance company may not provide a death benefit to the policyholder or beneficiaries. This means that the policy's value might not be immediately accessible to the intended recipients. However, once the exclusion period ends, the policy becomes active, and the death benefit is typically paid out as per the terms of the contract.

It's important for individuals to carefully review their life insurance policies and understand the specific exclusion period applicable to their situation. This knowledge ensures that they are aware of any potential delays in receiving the death benefit and can plan accordingly. Additionally, understanding the exclusion period can help individuals make informed decisions when choosing a life insurance policy that best suits their needs and risk profile.

Whole Life Insurance Dividends: Annual or Monthly Payouts?

You may want to see also

Reasons: Exclusions often apply to pre-existing conditions

The concept of pre-existing conditions is a critical aspect of life insurance, and it's essential to understand why these conditions often lead to exclusions in coverage. When an individual applies for life insurance, the insurer carefully evaluates their health history, including any pre-existing medical issues. These conditions can range from chronic illnesses like diabetes or heart disease to mental health disorders or even injuries sustained before the insurance policy is in effect.

Insurers typically exclude coverage for pre-existing conditions during the initial policy period, often referred to as the 'exclusion period.' This period can vary significantly, depending on the insurance company and the specific policy. During this time, the insurer may not provide any benefits if the insured individual passes away due to a pre-existing condition. For instance, if someone with a history of heart disease purchases a life insurance policy, the insurer might exclude coverage for heart-related issues for a certain period, say 2 to 5 years.

The primary reason for these exclusions is to assess the risk associated with the pre-existing condition. Insurers want to ensure that they are providing coverage for a relatively healthy individual. By excluding pre-existing conditions, they can offer competitive rates to those who are considered lower-risk. This practice also helps in maintaining the financial stability of the insurance company.

However, it's important to note that the exclusion period for pre-existing conditions can vary widely. Some policies may have a standard exclusion period of 2 years, while others might be as long as 5 years or more. Additionally, the length of the exclusion period can be influenced by the type of policy and the insurer's underwriting guidelines.

For individuals with pre-existing conditions, it's crucial to shop around and compare policies from different insurers. Some companies may offer extended coverage for pre-existing conditions after the exclusion period, while others might provide limited coverage or even deny coverage altogether. Understanding these nuances can help individuals make informed decisions and find suitable life insurance options that cater to their specific health needs.

HIV and Life Insurance: What You Need to Know

You may want to see also

Impact: It can affect premium costs and coverage

The exclusion period in life insurance is a critical concept that can significantly impact both the cost of your policy and the coverage you receive. This period, often referred to as the "waiting period" or "grace period," is a time frame during which the insurance company may not pay out a death benefit if the insured individual passes away. The primary purpose of this exclusion period is to provide a safety net for the insurance company, ensuring that they are not paying out benefits for pre-existing conditions or accidents that occurred shortly before the policy was taken out.

During this exclusion period, the insurance company typically reviews the insured's medical history and lifestyle choices to assess the risk associated with the policy. If the insured individual has a pre-existing medical condition or engages in high-risk activities, the exclusion period may be longer, or the insurance company might even decline coverage. This is because the insurance company wants to ensure that the policy is not taken out due to a recent health issue or lifestyle change that could significantly impact the insured's longevity.

The impact of the exclusion period on premium costs is direct and significant. Longer exclusion periods often result in higher premiums because the insurance company is taking on more risk during that time. For instance, if the exclusion period is 90 days, the insurance company will not pay out if the insured dies within those 90 days. This risk is factored into the premium calculation, making the policy more expensive. Conversely, a shorter exclusion period may lead to lower premiums, as the risk to the insurance company is reduced.

Additionally, the exclusion period can affect the coverage amount. Some insurance policies offer a reduced death benefit during the exclusion period, which means the beneficiary receives a lower payout if the insured dies within this time frame. This is another way the insurance company manages risk and ensures that the policy is not misused. It's important for policyholders to understand these terms to make informed decisions about their life insurance coverage.

In summary, the exclusion period in life insurance is a crucial aspect that influences both the cost and the terms of your policy. It provides a safety net for the insurance company and can significantly impact your premium costs and the coverage amount you receive. Understanding this period is essential for anyone considering life insurance, as it allows for better decision-making and ensures that the policy meets your specific needs and financial goals.

Whole Life Insurance: Over 60 and Covered?

You may want to see also

Variations: Some policies have no exclusion period

The concept of an exclusion period in life insurance is an important aspect to understand when considering a policy. This period typically refers to a time frame during which the insurance company may deny a claim if the insured individual's death is deemed to be related to a pre-existing condition or a specific event. For instance, if someone has a pre-existing health condition and passes away shortly after purchasing a policy, the insurance company might exclude the claim, especially if the condition was not disclosed during the application process.

However, there are variations in life insurance policies, and some offer unique features that set them apart from traditional plans. One such variation is the absence of an exclusion period. These policies provide coverage without any waiting time, allowing beneficiaries to receive the death benefit immediately upon the insured's passing. This type of policy is particularly attractive to those who require immediate financial support or have specific needs that must be addressed promptly.

In these policies, the insurance company takes on a higher risk as they are providing coverage without a cooling-off period. This means that the insurer must carefully assess the insured's health and lifestyle to determine the likelihood of potential claims. As a result, these policies often come with higher premiums to compensate for the increased risk.

It's essential for individuals to carefully review the terms and conditions of their life insurance policies. Understanding the exclusion period and its implications can help policyholders make informed decisions and ensure they have the appropriate coverage for their needs. Some policies may offer a combination of an exclusion period and other unique features, providing flexibility and tailored solutions for different life insurance requirements.

For those seeking immediate financial security, exploring life insurance options without an exclusion period can be beneficial. These policies can provide peace of mind, knowing that the death benefit will be accessible right away, which can be crucial for various financial obligations and beneficiaries' well-being.

Universal Life Insurance: Index-Linked Benefits and Drawbacks

You may want to see also

Frequently asked questions

The exclusion period, also known as the "waiting period" or "elimination period," is a clause in life insurance policies that typically lasts for a specific timeframe, often ranging from 1 to 2 years. During this period, the insurance company may not pay out a death benefit if the insured individual dies due to a pre-existing condition or a specific cause listed in the policy. This exclusion period is designed to protect the insurance company from insuring individuals with serious health issues that could have been influenced by their lifestyle choices or medical history.

When an individual purchases a life insurance policy, the insurance company will assess their health and medical history. If the applicant has any pre-existing conditions or engages in activities that could be considered risky (e.g., extreme sports, smoking), the policy may have an exclusion period. During this time, the insurance company monitors the insured's health, and if they survive the exclusion period, the policy becomes effective, and the death benefit is payable upon their passing.

In some cases, the exclusion period can be waived or shortened, but it depends on the insurance company's policies and the individual's health status. Some insurers offer a "waiver of premium" option, where the insured can pay an additional premium to waive the exclusion period. This is often available for individuals with no significant health issues. Additionally, some policies may have a "reduced exclusion period" for specific causes of death, allowing the policy to become effective sooner for certain risks. It's essential to review the policy terms and consult with an insurance advisor to understand the specific conditions and options available.