Whole life non-participating insurance is a type of permanent life insurance that offers lifelong coverage and a guaranteed death benefit. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force for the entire life of the insured individual. One key feature of this policy is that it does not participate in the profits of the insurance company, meaning policyholders do not receive dividends or any form of participation in the company's earnings. This type of insurance provides a fixed premium and a fixed death benefit, ensuring that the policyholder's beneficiaries receive the full amount specified in the policy upon the insured's passing.

What You'll Learn

- Definition: Whole life non-participating insurance is a permanent life policy with fixed premiums and guaranteed death benefit

- Features: No dividends, investment options, or participation in company profits

- Benefits: Provides lifelong coverage, predictable cash value, and a fixed death benefit

- Cost: Premiums are typically higher than participating policies due to guaranteed benefits

- Comparison: Offers stability and predictability compared to participating whole life insurance

Definition: Whole life non-participating insurance is a permanent life policy with fixed premiums and guaranteed death benefit

Whole life non-participating insurance is a type of permanent life insurance that offers a range of unique features and benefits. It is designed to provide long-term financial security and peace of mind to policyholders and their beneficiaries. This insurance policy is characterized by its permanent nature, meaning it remains in force for the entire life of the insured individual, ensuring that the coverage is always present and cannot be canceled.

One of the key aspects of whole life non-participating insurance is its fixed premiums. Unlike some other life insurance policies, the premiums for this type of insurance remain constant throughout the policy's duration. This predictability allows policyholders to plan their finances effectively, knowing exactly how much they will pay annually without any surprises. The fixed nature of the premiums also means that the insurance company's costs are covered, ensuring that the policy remains viable and sustainable over time.

In addition to fixed premiums, this insurance policy boasts a guaranteed death benefit. This means that, upon the insured individual's passing, the insurance company will pay out a predetermined sum to the designated beneficiary. The death benefit is typically set at the time of policy inception and remains constant, providing a reliable financial safety net for the policyholder's loved ones. This guaranteed payout offers financial security and can help cover various expenses, such as funeral costs, outstanding debts, or the daily living expenses of the beneficiaries.

The non-participating aspect of this insurance refers to the fact that it does not participate in the profits of the insurance company. Unlike participating life insurance policies, where policyholders may receive dividends or bonus payments based on the company's performance, non-participating policies do not offer such returns. Instead, the focus is on providing a stable and predictable form of coverage, ensuring that the policy's benefits are consistent and reliable over the long term.

In summary, whole life non-participating insurance is a permanent life policy with fixed premiums and a guaranteed death benefit. Its permanent nature, combined with the predictability of fixed premiums and the financial security of a guaranteed death benefit, makes it an attractive option for individuals seeking long-term financial protection and peace of mind. This type of insurance provides a stable and reliable form of coverage, ensuring that policyholders and their beneficiaries are protected throughout their lives.

Marriage and Life Insurance: What You Need to Know

You may want to see also

Features: No dividends, investment options, or participation in company profits

Whole life non-participating insurance is a type of permanent life insurance that offers lifelong coverage with a fixed death benefit. Unlike other life insurance policies, it does not include features that allow policyholders to benefit from the company's profits or provide investment opportunities. This type of insurance is designed to provide a consistent and predictable level of coverage without the potential for growth or profit-sharing.

One of the key features of whole life non-participating insurance is the absence of dividends. Traditional life insurance policies often include a dividend component, which allows policyholders to receive a portion of the company's profits as dividends. However, in this type of insurance, there are no dividends paid out to the policyholder or the beneficiary. The premiums are set at a level that ensures the insurance company can meet its obligations and maintain the death benefit, without the need to distribute profits.

Another important aspect is the lack of investment options. Unlike some other life insurance products, whole life non-participating insurance does not offer the policyholder the ability to invest their premiums or any portion of the policy's value. The insurance company uses the premiums solely to fund the death benefit and administrative costs. This means that the policyholder does not have the flexibility to choose investment strategies or benefit from potential market growth.

Furthermore, this type of insurance does not participate in the company's profits. In traditional life insurance, policyholders may benefit from the company's success through increased dividends or policy value growth. However, with whole life non-participating insurance, the policyholder's benefits are fixed and do not depend on the company's performance. This feature ensures that the coverage remains consistent and predictable over the life of the policy.

In summary, whole life non-participating insurance provides a straightforward and consistent approach to life coverage. It offers lifelong protection without the potential for dividend payments, investment opportunities, or profit-sharing. This type of insurance is suitable for individuals who prefer a predictable and fixed level of coverage, without the complexities and potential risks associated with investment-linked policies.

Life Insurance Brokers and Your Arrest History: What's the Link?

You may want to see also

Benefits: Provides lifelong coverage, predictable cash value, and a fixed death benefit

Whole life non-participating insurance is a type of permanent life insurance that offers a range of benefits, primarily providing lifelong coverage, predictable cash value accumulation, and a fixed death benefit. This insurance policy is designed to be a long-term financial commitment, ensuring that the insured individual and their beneficiaries receive financial protection throughout their lives.

One of the key advantages of whole life non-participating insurance is its lifelong coverage. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force as long as the policyholder pays the premiums. This means that the insured individual is protected from financial loss due to death at any point during their lifetime, providing peace of mind and security for their loved ones. The policy's longevity ensures that the death benefit is guaranteed, offering a financial safety net that can be relied upon.

In addition to lifelong coverage, this insurance product offers predictable cash value accumulation. As the policyholder pays premiums, a portion of the money is invested, and the cash value grows over time. This feature allows the policyholder to build a substantial cash reserve, which can be borrowed against or withdrawn (subject to certain restrictions) if needed. The predictability of cash value growth is a significant benefit, as it provides a known and stable financial asset that can be utilized for various purposes, such as funding education, starting a business, or planning for retirement.

The fixed death benefit is another critical aspect of whole life non-participating insurance. Upon the insured individual's death, the policy pays out a predetermined amount, which is typically the face value of the policy. This fixed benefit ensures that the beneficiaries receive a clear and certain financial payout, providing financial support during a difficult time. The predictability of the death benefit is a valuable feature, especially for those who want to ensure their family's financial stability in the event of their passing.

Furthermore, the non-participating nature of this insurance means that any profits or surpluses generated by the insurer are not shared with the policyholder. This approach ensures that the policy's cash value and death benefit remain consistent and predictable, providing a stable financial product. Policyholders can rely on the guaranteed benefits without the potential fluctuations associated with participating policies.

In summary, whole life non-participating insurance offers a comprehensive set of benefits, including lifelong coverage, predictable cash value accumulation, and a fixed death benefit. These features make it an attractive financial tool for individuals seeking long-term financial protection and stability for themselves and their beneficiaries.

Life Insurance and Pandemics: What's Covered?

You may want to see also

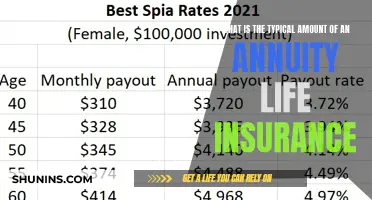

Cost: Premiums are typically higher than participating policies due to guaranteed benefits

When considering whole life non-participating insurance, one of the most significant factors to understand is the cost. This type of insurance is known for its higher premiums compared to other life insurance policies, particularly those that offer a degree of flexibility in how they are structured. The primary reason for this higher cost is the guaranteed benefits that come with whole life non-participating insurance.

Guaranteed benefits are a cornerstone of this insurance type. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers lifelong coverage. This means that once you've paid your initial premiums, the insurance is in force for the rest of your life, regardless of any changes in your health or financial situation. The guaranteed death benefit is a key feature, ensuring that your beneficiaries receive a payout upon your passing, which can be a significant amount, especially if you have a large family or financial obligations.

The cost of these guaranteed benefits is reflected in the premium rates. Insurance companies must account for the long-term commitment they are making to provide coverage for the entire life of the insured. This is in contrast to participating policies, which may adjust premiums based on the performance of the policy's investment component. In non-participating policies, the premiums are set and do not change, providing a level of certainty for the insured.

While the higher premiums might seem like a significant drawback, it's essential to consider the long-term financial security that whole life non-participating insurance provides. The guaranteed benefits ensure that your loved ones are financially protected, and the policy can also accumulate cash value over time, which can be borrowed against or withdrawn if needed. This feature can be particularly valuable for those seeking a long-term financial planning tool.

In summary, the cost of whole life non-participating insurance is typically higher due to the guaranteed lifelong coverage and the associated benefits. This type of insurance provides a sense of security and long-term financial planning, making it an attractive option for those seeking a comprehensive life insurance solution. Understanding these costs and benefits is crucial in making an informed decision about your insurance needs.

Fidelity's Ladder Life Insurance: What You Need to Know

You may want to see also

Comparison: Offers stability and predictability compared to participating whole life insurance

Whole life non-participating insurance is a type of permanent life insurance that offers a guaranteed death benefit and a fixed premium for the entire term of the policy. Unlike participating whole life insurance, which allows the insurance company to invest a portion of the premiums in various investment options, non-participating policies do not share the investment returns with the policyholder. This means that the cash value accumulation and the death benefit are predetermined and do not fluctuate based on market performance.

One of the key advantages of whole life non-participating insurance is the stability and predictability it offers. With this type of policy, the insured individual can rely on a consistent and fixed death benefit, ensuring financial security for their beneficiaries. The premiums are also locked in for the life of the policy, providing long-term financial planning and peace of mind. This predictability is particularly valuable for those seeking a stable financial commitment without the uncertainty associated with market-linked investments.

In contrast, participating whole life insurance provides a more dynamic approach. The insurance company invests a portion of the premiums in various investment vehicles, and the policyholder may benefit from the investment returns through increased cash value and potential dividends. However, this also means that the death benefit and cash value can vary over time, depending on market performance. While this can be advantageous if the investments perform well, it also introduces an element of risk and uncertainty.

Non-participating whole life insurance is an excellent choice for individuals who prioritize stability and predictability in their financial planning. It provides a reliable and consistent financial commitment, ensuring that the death benefit and cash value growth are known quantities. This type of policy is particularly suitable for long-term financial goals, such as providing for a child's education or securing a retirement fund, where a stable and guaranteed outcome is essential.

In summary, the comparison between whole life non-participating and participating insurance highlights the trade-off between stability and potential growth. Non-participating policies offer a secure and predictable financial commitment, making them ideal for those seeking long-term stability. On the other hand, participating policies provide the opportunity for higher returns but with the added risk of market volatility. Understanding these differences is crucial in making an informed decision when choosing the right life insurance policy to meet individual financial needs.

Understanding MEC Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Whole life non-participating insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike participating life insurance, it does not include any additional features that allow the insurer to share profits with policyholders. This means the policy's cash value and dividends are not invested in the insurer's business and are instead paid out as guaranteed death benefits.

The key difference lies in the profit-sharing aspect. Traditional whole life insurance policies often have a participating feature, where a portion of the premiums is allocated to a separate account that can earn dividends. These dividends can then be used to increase the policy's cash value or paid out to the policyholder. In contrast, non-participating whole life insurance does not offer this profit-sharing mechanism, resulting in more predictable and guaranteed death benefits.

Non-participating whole life insurance offers several advantages. Firstly, it provides lifelong coverage, ensuring financial security for your loved ones. Secondly, the guaranteed death benefit means the policy will pay out a specific amount upon the insured's passing, providing a stable financial foundation. Additionally, the cash value accumulation can be borrowed against or used to pay premiums, offering some flexibility.

While non-participating whole life insurance has its benefits, there are a few considerations. The lack of profit-sharing means policyholders may not benefit from market performance. Additionally, the premiums for this type of policy can be higher compared to traditional whole life due to the guaranteed death benefit and lifelong coverage. It is essential to evaluate your specific financial goals and consult with an insurance advisor to determine if this policy aligns with your needs.