Annuity life insurance is a financial product that combines the benefits of life insurance and an annuity. When considering annuity life insurance, one important aspect to understand is the typical amount of coverage provided. The amount of annuity life insurance coverage can vary depending on several factors, including the individual's age, health, and financial goals. Typically, annuity life insurance policies offer a fixed amount of coverage, which can be a lump sum or a series of payments over time. This coverage amount is determined by the insurance company based on the policyholder's needs and the terms of the policy. Understanding the typical amount of annuity life insurance coverage is crucial for individuals seeking to protect their loved ones and ensure financial security for their families.

What You'll Learn

- Annuity Duration: The length of time an annuity payment is made, often tied to life expectancy

- Guaranteed Income: Annuities provide a steady income stream, typically for life, ensuring financial security

- Death Benefit: The payout to beneficiaries upon the annuitant's death, often a lump sum or income

- Longevity Risk: Annuities mitigate the risk of outliving savings, ensuring income for a longer lifespan

- Payout Options: Annuities offer flexibility in choosing how and when payments are received

Annuity Duration: The length of time an annuity payment is made, often tied to life expectancy

Annuity duration is a critical aspect of understanding the financial commitment and benefits associated with annuity life insurance. It refers to the length of time for which the annuity payments are made, typically extending until the death of the annuitant. This duration is often closely tied to an individual's life expectancy, ensuring that the payments align with the expected lifespan of the policyholder. The concept is fundamental to annuity life insurance, as it determines the total amount paid out over the policy's lifetime.

When considering annuity duration, it's essential to recognize that life expectancy plays a pivotal role. Insurance companies use statistical data and tables to estimate an individual's life expectancy based on various factors, including age, health, and gender. This estimation helps in determining the number of years the annuity payments will be made. For instance, a 65-year-old purchasing an annuity might have a guaranteed payment period of 20 years, reflecting the average life expectancy at that age.

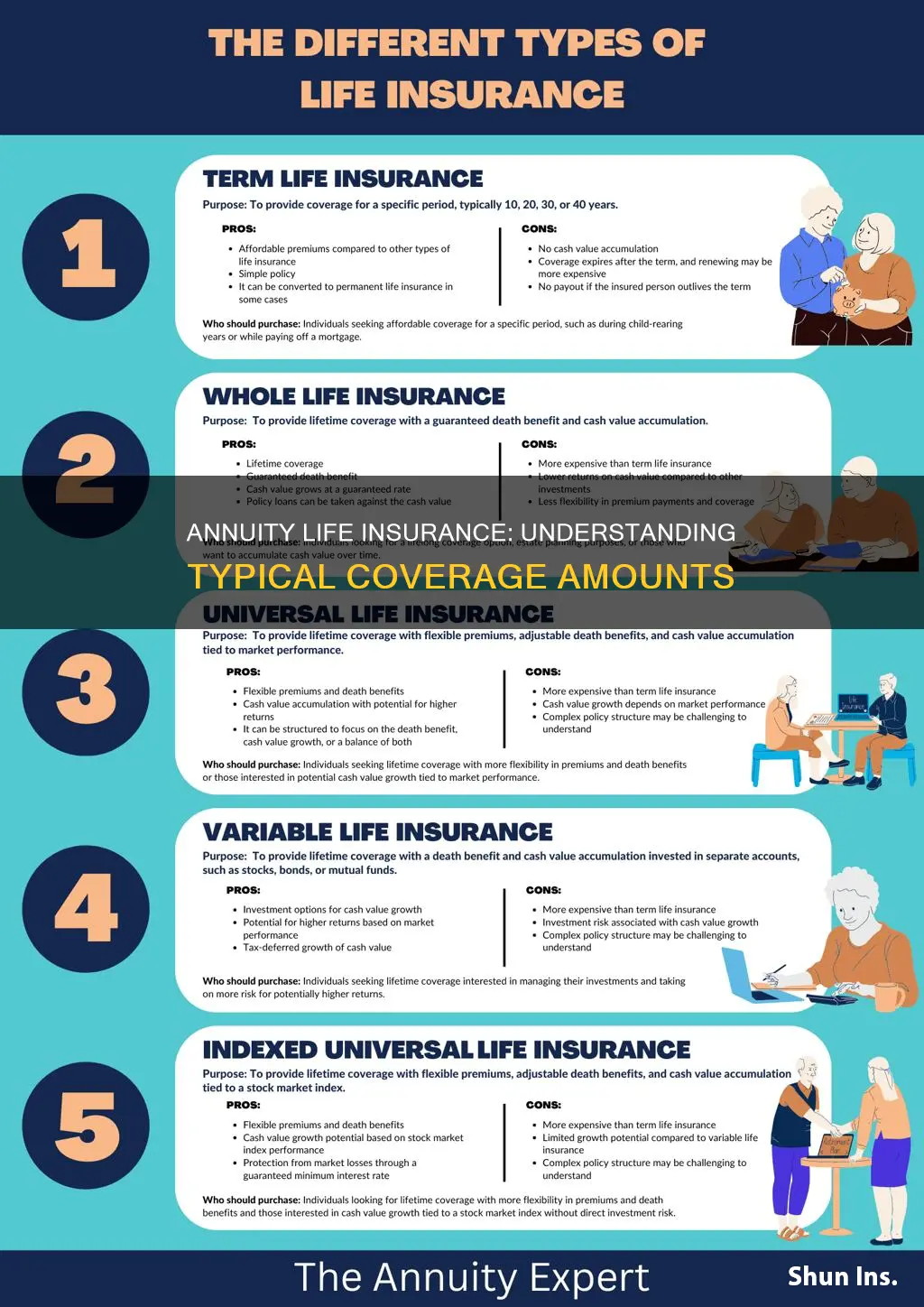

The duration of an annuity can be fixed or variable. In a fixed annuity, the payment period is predetermined and remains constant throughout the policy's term. This type of annuity provides a stable and predictable income stream for the annuitant. On the other hand, variable annuities offer flexibility, allowing the policyholder to adjust the payment period based on their changing needs or life circumstances.

Understanding the typical annuity duration is crucial for several reasons. Firstly, it helps individuals plan their finances effectively, ensuring they have a steady income stream during their retirement years. Secondly, it allows for better comparison between different annuity products, as the duration directly impacts the overall cost and benefits of the policy. Moreover, knowing the expected payment period can help individuals make informed decisions about their long-term financial strategies.

In summary, annuity duration is a critical factor in annuity life insurance, determining the length of financial commitment and the total payout. It is often closely tied to life expectancy, ensuring that the annuity payments align with the expected lifespan of the policyholder. By understanding the typical duration, individuals can make informed decisions about their retirement planning and financial security.

AFBA Life Insurance: Is It a Good Choice?

You may want to see also

Guaranteed Income: Annuities provide a steady income stream, typically for life, ensuring financial security

Annuities are financial instruments designed to provide a steady and reliable income stream to individuals, offering a sense of financial security, especially in retirement planning. The concept of an annuity is straightforward: you make regular or one-time payments to an insurance company, and in return, they guarantee a fixed income for a specified period or for the rest of your life. This feature of providing guaranteed income is what sets annuities apart from other investment vehicles.

When it comes to the amount of income an annuity can provide, it is directly linked to the individual's life expectancy and the amount invested. The insurance company uses complex actuarial tables and statistical models to determine the typical payout amounts. These calculations consider various factors, including the annuitant's age, health, and the chosen payment frequency. The goal is to ensure that the income stream is sustainable and can provide financial security for the annuitant's lifetime.

The typical amount of income an annuity can provide varies widely. For instance, a 65-year-old in good health might receive a higher guaranteed income compared to an older individual with health issues. Generally, the longer the annuity term, the higher the guaranteed income, as the insurance company assumes a longer commitment. Additionally, the more substantial the initial investment or premium, the higher the potential income stream, as the insurance company earns interest on the accumulated funds.

Annuities offer a unique advantage in that they provide a predictable and stable income, which is especially valuable in retirement planning. This guaranteed income can be a significant factor in ensuring financial security, especially for those who may have limited access to other sources of income during retirement. It provides a safety net, allowing individuals to maintain their standard of living and cover essential expenses.

In summary, annuities are powerful financial tools for those seeking guaranteed income. The amount of income provided is tailored to the individual's circumstances and needs, ensuring a steady and reliable financial stream. With annuities, individuals can have peace of mind, knowing their financial security is guaranteed, even in their later years. It is a popular choice for retirement planning, offering a practical solution to the challenge of maintaining a consistent income over a lifetime.

AAA Life Insurance: Leaving AAA, Losing Coverage?

You may want to see also

Death Benefit: The payout to beneficiaries upon the annuitant's death, often a lump sum or income

When considering an annuity life insurance policy, understanding the death benefit is crucial. This is the financial payout made to the policy's beneficiaries when the annuitant passes away. The death benefit is a key feature of the policy and can significantly impact the financial security of the policyholder's loved ones.

The amount of the death benefit can vary depending on several factors. Typically, the policyholder chooses the initial payout amount, which can be a lump sum or an income stream. This choice is often influenced by the policyholder's financial goals and the level of financial support needed for their beneficiaries. For instance, a lump sum payout might be more suitable for covering large expenses like education costs or a mortgage, while an income stream could provide a regular financial safety net for beneficiaries.

In many cases, the death benefit is designed to provide a guaranteed income for the beneficiaries for a specified period. This can be a fixed term, such as 10 years, or even for the rest of their lives. The longer the term, the more secure the income stream, but it also means a larger initial payout may be required. The policyholder can also choose to increase the death benefit amount, which would typically require additional premium payments.

It's important to note that the death benefit is often tax-free, providing a significant financial benefit to the beneficiaries. This is a key advantage of annuity life insurance, ensuring that the entire payout goes directly to the intended recipients without being subject to income tax. This feature can be particularly valuable for estate planning and ensuring that the policyholder's financial legacy is protected.

When selecting an annuity life insurance policy, it is essential to carefully consider the death benefit options and choose the one that best aligns with your financial goals and the needs of your beneficiaries. Understanding the potential payout and its implications can help you make an informed decision and ensure your loved ones are financially protected.

Equitable National Life: A Good Medicare Supplement Insurance Option?

You may want to see also

Longevity Risk: Annuities mitigate the risk of outliving savings, ensuring income for a longer lifespan

Annuities are financial instruments designed to provide a steady income stream for individuals, particularly those concerned about longevity risk. This risk refers to the possibility of outliving one's savings, where retirement funds may not be sufficient to cover expenses over an extended period. Annuities offer a solution by guaranteeing a regular payment to policyholders, ensuring financial security and peace of mind.

The concept of longevity risk is becoming increasingly relevant as life expectancy rises. With people living longer, there is a higher chance that an individual's savings might not last as long as anticipated. Annuities address this concern by providing a structured approach to income generation. When an individual purchases an annuity, they essentially make regular contributions or receive a lump sum, which is then invested or managed by an insurance company. In return, the company promises to pay out a predetermined amount at regular intervals, typically for a specified period or even for the rest of the annuitant's life.

One of the key advantages of annuities in managing longevity risk is the certainty they offer. Annuity payments are designed to provide a reliable income source, ensuring that individuals have a consistent financial cushion. This is particularly important for those who may have limited access to other retirement income sources or who want to ensure their savings are protected against the potential risks of outliving their funds. By locking in a guaranteed income, annuities provide a sense of financial security and stability.

There are various types of annuities available, each tailored to different needs and risk preferences. Fixed annuities, for instance, offer a consistent interest rate, providing a stable income over time. Variable annuities, on the other hand, allow for potential higher returns but also come with more market-related risks. Annuity riders, additional features or benefits, can further enhance the policy, such as providing income guarantees or additional death benefits.

In summary, annuities play a crucial role in addressing longevity risk by providing a structured and reliable income solution. They offer individuals a way to mitigate the fear of outliving their savings, ensuring a steady financial stream for an extended period. With various annuity options available, individuals can choose a plan that aligns with their financial goals and risk tolerance, ultimately providing a sense of security and peace of mind during retirement.

Who Gets the Payout? POA and Life Insurance Beneficiaries

You may want to see also

Payout Options: Annuities offer flexibility in choosing how and when payments are received

Annuities provide a range of payout options, offering policyholders the flexibility to choose how and when they receive their insurance benefits. This flexibility is a significant advantage of annuities over other forms of life insurance, as it allows individuals to tailor their payout strategy to their specific needs and financial goals.

One of the primary payout options is the fixed-period annuity, where the insurance company agrees to make regular payments to the policyholder for a specified period, such as 5, 10, or 20 years. This option is ideal for those who want a steady income stream for a defined period, providing financial security and peace of mind. For example, a policyholder might choose a 15-year fixed-period annuity to ensure a consistent income for their retirement years, allowing them to plan and budget effectively.

Another popular choice is the flexible payment annuity, which offers more customization. With this option, policyholders can decide the frequency of payments, whether it's monthly, quarterly, or annually. They can also choose the amount of each payment, allowing for a personalized payout strategy. This flexibility is particularly beneficial for those who want to adapt their annuity payments to changing financial circumstances or retirement plans. For instance, a retiree might opt for higher monthly payments during their early retirement years and then adjust the amount as their financial needs evolve.

In addition, some annuities offer a lump-sum payment option, where the entire death benefit is paid out as a single sum upon the insured's passing. This can be advantageous for those who prefer a one-time payout or want to leave a substantial inheritance to their beneficiaries. Alternatively, a gradual payout over a longer period can be chosen, providing a steady income stream that can be adjusted as needed.

The flexibility of payout options in annuities empowers individuals to make informed decisions about their financial future. Whether it's ensuring a consistent income for a specific period, adapting payments to changing circumstances, or providing a lump-sum inheritance, annuities offer a tailored approach to life insurance, catering to diverse financial goals and preferences.

Fidelity: Life Insurance or Financial Investment Options?

You may want to see also

Frequently asked questions

The typical amount of an annuity life insurance policy can vary significantly depending on several factors, including your age, health, financial goals, and the insurance company's guidelines. Generally, the death benefit of an annuity life insurance policy is a predetermined amount that the insurance company agrees to pay out to your beneficiaries upon your death. This amount is often calculated based on your age and health, with younger and healthier individuals typically qualifying for higher death benefits.

The death benefit is typically calculated using a formula that considers your age, health, and the insurance company's underwriting guidelines. This calculation may involve a medical examination, where your health and lifestyle factors are assessed to determine your risk profile. The insurance company uses this information to determine the amount of coverage you qualify for and the premiums you need to pay.

Yes, the death benefit of an annuity life insurance policy can be adjusted, but it depends on the specific policy and the insurance company's terms. Some policies offer an annual review process where the death benefit can be increased or decreased based on your changing circumstances and the insurance company's guidelines. It's essential to review your policy regularly to ensure it aligns with your current financial goals and needs.

Yes, there are certain limitations and restrictions to consider. The amount of coverage you can qualify for may be limited by the insurance company's maximum limits or by your personal circumstances. Additionally, some policies may have restrictions on the age range they cover or specific health conditions they don't provide coverage for. It's crucial to understand these limitations when choosing an annuity life insurance policy.