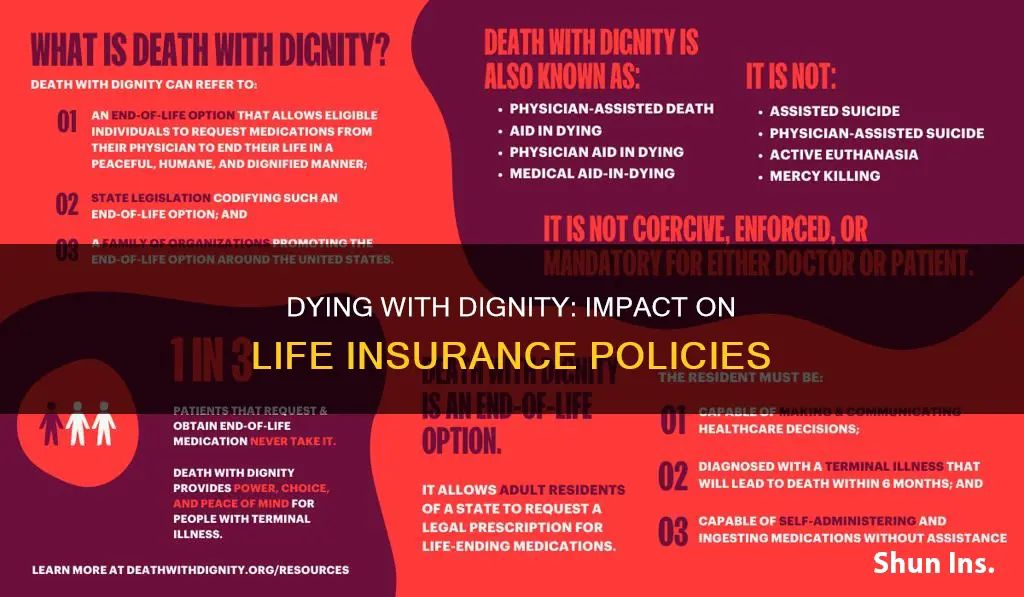

The topic of death with dignity and its impact on life insurance policies is a complex and sensitive issue. While the laws and regulations surrounding death with dignity vary across different states and countries, it's important to understand how this practice might affect life insurance coverage. Generally, death with dignity, also known as assisted suicide or physician-assisted death, refers to situations where individuals choose to end their lives with medical assistance to alleviate suffering, especially in cases of terminal illnesses. This practice raises questions about the role of insurance companies in providing financial support to the families of those who opt for death with dignity.

| Characteristics | Values |

|---|---|

| Does death with dignity void life insurance? | Generally, death with dignity does not void life insurance if it occurs in a state where the practice is legal and follows the legal protocols. |

| Life insurance exclusions | Suicide within the first two years of the policy, non-disclosure of pre-existing conditions, illegal activity, dangerous activity, and fraud. |

| Life insurance coverage | Death with dignity is covered by life insurance if the contestability and suicide provisions have expired. |

| Life insurance and medically assisted death | Life insurance companies treat medically assisted death and euthanasia in the same way. If health and legal conditions are met, claims are paid in full. |

What You'll Learn

- Life insurance policies typically cover death with dignity if it occurs in a state where the practice is legal and the policy is at least two years old

- If death with dignity occurs within the first two years of the policy, the insurance company will not pay out

- If the insured dies after the exclusionary period, the insurance company usually pays the benefit to the designated beneficiaries

- The relationship between death with dignity and life insurance is influenced by the laws of the state where it occurs

- In death with dignity states, insurers may insert their own clauses that affect the distribution of death benefits

Life insurance policies typically cover death with dignity if it occurs in a state where the practice is legal and the policy is at least two years old

Life insurance policies are generally designed to provide financial protection for loved ones in the event of the policyholder's death. In the context of death with dignity, also known as assisted suicide or euthanasia, it is important to understand how life insurance coverage may be impacted.

In most cases, life insurance policies will cover death with dignity if it occurs in a state where the practice is legal and the policy meets certain requirements. One crucial factor is the duration of the policy. Most life insurance policies include a "suicide clause" or an "exclusionary period," which typically lasts for the first two years of the policy. During this period, if the insured individual chooses death with dignity, the insurance company may not pay out the death benefit to the beneficiaries. Instead, they may only refund the premiums paid up to that point. This provision is in place to prevent individuals from taking out life insurance with the intention of immediately opting for assisted suicide.

However, if death with dignity occurs after the exclusionary period has passed (usually after two years), life insurance companies will typically honour the claim and pay the death benefit. This is because the suicide clause and contestability period have expired, and the policy is now considered in full effect. It is important to note that insurance companies may still investigate claims to ensure there was no misrepresentation or non-disclosure of relevant information, such as pre-existing health conditions or mental health issues, when the policy was purchased.

Additionally, the legality of death with dignity plays a significant role in insurance coverage. In states where it is legal, insurance companies generally do not treat assisted suicide as a "suicide" for policy purposes, provided that the legislated process has been followed. This means that as long as the individual meets the eligibility criteria and adheres to the legal protocols, their beneficiaries should receive the death benefit.

It is worth noting that each insurance company and policy may have its own specific terms and conditions regarding death with dignity. Therefore, it is essential to carefully review the policy document and consult with the insurance provider to understand their approach to this sensitive issue.

Overall, while life insurance policies typically cover death with dignity under certain circumstances, it is a complex and evolving topic. Each state's laws and insurance company's policies can vary, so it is important for individuals to be well-informed and seek guidance from experts in the field.

Overdose Death: Life Insurance Payouts and Consequences

You may want to see also

If death with dignity occurs within the first two years of the policy, the insurance company will not pay out

Death with dignity, or assisted suicide, is a complex issue for insurance companies. If death with dignity occurs within the first two years of the policy, the insurance company will typically not pay out. This exclusionary period, also known as the contestability period, is in place to prevent insurance fraud, such as an individual taking out a policy with the intention of committing suicide and leaving money to their beneficiaries.

The contestability period allows insurance companies to investigate claims and void coverage in certain cases, such as if the insured had a pre-existing condition that was not disclosed or if there was inaccurate information on the application. During this time, insurance companies can deny coverage if the policyholder intentionally caused their own death. If death with dignity occurs within this period, the insurance company will likely deny the claim and not pay out.

In the case of death with dignity, the insurance company will review the specific circumstances surrounding the death. They may consider factors such as the insured's medical and mental health history, the presence of a suicide note, and testimony from friends and family. If the insurance company determines that the death was a result of suicide, the claim will likely be denied.

It is important to note that the laws and regulations regarding death with dignity vary by state and insurance company. While some states have legalized this practice, it is still considered controversial. Insurance companies may have their own clauses and policies regarding death with dignity cases, which can affect the distribution of death benefits. Therefore, it is crucial to review the specific terms and conditions of the policy and consult with the insurance provider to understand how death with dignity may impact coverage.

Schwab's Life Insurance: What You Need to Know

You may want to see also

If the insured dies after the exclusionary period, the insurance company usually pays the benefit to the designated beneficiaries

Death with dignity, or assisted suicide, is a complex issue for insurance companies. Typically, life insurance involves the insured paying premiums to ensure their beneficiaries receive a death benefit when they pass away. However, this dynamic changes when someone opts for assisted suicide.

In most cases, if the insured dies within the exclusionary period, their beneficiaries will not receive the life insurance death benefit. The exclusionary period, also known as the contestability period, is a specific timeframe after purchasing a life insurance policy during which the insurer can contest the claim. This period is usually the first two years of the policy but can vary depending on the insurer, state, and policy type. The purpose of this period is to safeguard the insurance company from insurance fraud.

On the other hand, if the insured dies after the exclusionary period is over, life insurance companies usually pay the benefit to the designated beneficiaries as long as the claim is valid. This is because, after the exclusionary period, most policies cover suicide like any other cause of death. It's important to note that insurers investigate most claims and will deny them if they find misrepresentations or non-disclosures of relevant information, such as pre-existing health conditions.

In summary, the payment of a death benefit depends on whether the insured dies within or after the exclusionary period. If the insured dies within this period, beneficiaries may not receive the payout unless the insurance company is satisfied that no fraud took place. If the insured dies after the exclusionary period, the insurance company will typically pay the death benefit as long as the claim meets the policy's terms and conditions.

Copart's Comprehensive Life Insurance: What You Need to Know

You may want to see also

The relationship between death with dignity and life insurance is influenced by the laws of the state where it occurs

The relationship between death with dignity and life insurance is a complex one, influenced primarily by the laws of the state where it occurs. In the United States, only a handful of states have legalized death with dignity or physician-assisted suicide, including California, Colorado, Montana, Oregon, Vermont, Washington State, and Washington, D.C.

The legality of the act plays a crucial role in determining whether life insurance policies will cover death by suicide. Generally, if the insured individual dies within the first two years of the policy, known as the exclusionary or contestability period, the insurance company will not pay out the death benefit to the beneficiaries. This period is designed to safeguard the insurance company from insurance fraud. However, after this initial period, most policies will cover suicide like any other form of death, provided there are no additional exclusions or non-disclosures.

In the context of death with dignity, the situation becomes more nuanced. While there is no inherent connection between the utilization of medical aid in dying and the denial of insurance coverage, the specific laws and regulations of the state in question come into play. In states where death with dignity is legal, insurance companies typically honor the claims as long as the act is carried out in accordance with the legal protocols. This means that the insured individual must meet certain eligibility criteria and follow the established procedures to ensure that the insurance policy remains valid.

However, it is important to note that insurance companies may still investigate claims to ensure there were no misrepresentations or non-disclosures of relevant information, such as pre-existing health conditions or mental health issues. If the insured individual is found to have withheld pertinent information, the insurance company may decide not to pay the claim, even if the death with dignity was conducted lawfully.

Therefore, it is essential for individuals considering death with dignity to carefully review their specific life insurance policies, understand the laws and regulations of their state, and consult with their insurance providers to ensure they have a comprehensive understanding of the potential implications on their coverage.

Combined Insurance: Life Insurance Options and More

You may want to see also

In death with dignity states, insurers may insert their own clauses that affect the distribution of death benefits

In the United States, there are several death with dignity states, including Maine, New Jersey, Hawaii, Oregon, and Washington. In these states, patients can actively plan for their deaths. While death with dignity laws allow individuals to end their lives with assistance from a physician, it is essential to understand how this may impact life insurance policies and payouts.

In death with dignity states, the rules regarding insurance payouts can vary. Life insurance companies often insert specific clauses in death with dignity cases, which may influence the distribution of death benefits. These clauses can vary depending on the state and the insurance provider.

One crucial aspect to consider is the exclusionary or contestability period. This period, typically lasting two years, applies to both permanent and term life insurance policies. During this time, if the insured individual dies, the beneficiaries may not receive the full death benefit unless the insurance company is satisfied that no fraud occurred. This provision is in place to protect insurance companies from fraud.

Additionally, life insurance policies often include a suicide clause, which may void coverage if the insured individual dies by suicide within the first two years of the policy. This clause is designed to prevent individuals from taking out life insurance with the intention of providing financial benefits to their families after their death by suicide.

It is important to carefully review the specific terms and conditions of your life insurance policy and consult with your insurance provider to understand how death with dignity laws may impact your coverage and any potential payouts.

Chewing Tobacco: Life Insurance Premiums and Health Risks

You may want to see also

Frequently asked questions

Death with dignity does not void life insurance if it occurs in a state where the practice is legal and follows the legal protocols. Each policy and state may have specific terms and conditions, so it's important to review the policy details and consult with the insurance provider.

The exclusionary period is a specific time frame after purchasing an insurance policy during which the insurer can contest the claim. If the insured person dies within this period, the beneficiaries may not receive the death benefit unless it is determined that no fraud took place. The length of the exclusionary period can vary depending on the policy, insurer, and state.

The waiting period is usually about 60 to 90 days from the day you purchase coverage. If someone dies within this period, their beneficiaries won't receive any payment as the coverage has not been fully activated yet.

Insurance exclusions are specific hazards or situations that are not covered by the insurance policy. For example, many policies have a suicide exclusion clause that voids the policy if the insured commits suicide within a certain period after purchasing it. Exclusions vary by policy and insurer.