Borrowing against your life insurance policy can be a quick and easy way to get cash in hand when you need it. However, there are a few specifics to know before borrowing. Firstly, it's important to understand that you can only borrow against a permanent life insurance policy, such as whole life insurance or universal life insurance, which has a cash value component. Term life insurance, on the other hand, is a cheaper option that does not accumulate cash value and therefore cannot be borrowed against. When borrowing against your life insurance policy, you are essentially using the cash value as collateral for the loan. The process is straightforward and does not require a credit check or approval, but it's important to carefully consider the pros and cons before making a decision.

| Characteristics | Values |

|---|---|

| Type of insurance | Permanent life insurance, including whole life and universal life insurance |

| Cash value | Must have a cash value component |

| Interest rates | Typically lower than personal loans and credit cards |

| Repayment schedule | Flexible, but interest accrues |

| Tax implications | Tax-free unless the policy lapses or the loan balance exceeds the cash value |

| Credit check | No credit check required |

| Approval process | No approval process, but must have sufficient cash value |

| Purpose | No restrictions on how the money is spent |

What You'll Learn

Borrowing from permanent life insurance

Permanent life insurance policies, such as whole life insurance and universal life insurance, build up a cash value over time. This cash value can be used as collateral to take out a loan from your insurance company. Borrowing from your life insurance policy can be a quick and easy way to access cash without the hassle of a traditional loan. There are no credit checks or approvals, and you can use the money for anything you like. The application process is simple, and the funds can be deposited into your account within a few days.

However, it's important to keep in mind that borrowing from your life insurance policy has its risks. If you don't pay back the loan, it will reduce your death benefit, and if the loan amount exceeds the policy's cash value, your coverage could lapse, leaving you without life insurance. Additionally, you'll be charged interest on the loan amount, which can accumulate over time and further reduce your death benefit.

- You can typically borrow up to 90% of the policy's cash value.

- There is no set repayment period, but it's important to make regular interest payments to avoid accruing more debt.

- The loan amount and any unpaid interest will be deducted from your death benefit if you pass away before repaying the loan.

- Borrowing from your life insurance policy can affect the guarantees and benefits associated with your policy.

- It's important to carefully consider the pros and cons before taking out a loan against your life insurance policy to ensure you understand the potential risks and benefits.

Universal Life Insurance: Another Name for Interest-Sensitive Whole Life

You may want to see also

Collateral and cash value

Collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral. If the borrower dies before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of the borrower's life insurance policy. Any remaining funds from the death benefit would then be disbursed to the policy's designated beneficiary or beneficiaries.

Collateral assignment may be a useful option if you want to access funds without placing any of your assets, such as a car or house, at risk. It can also be a credible choice if your credit rating is not high, making it difficult to find attractive loan terms. Since lenders can rely on the policy's death benefit to pay off the loan if necessary, they are more likely to offer favourable terms despite a low credit score.

You may use either of the two main types of life insurance—term and permanent—for collateral assignment. If you are using term life insurance, you will need a policy with a term length that is at least as long as the term of the loan. Subcategories of permanent life insurance, such as whole life, universal life, and variable life, may also be used.

The cash value of a life insurance policy is equivalent to the amount of money the policyholder would receive if they surrendered the policy. Each time the policyholder pays the premium for a cash value life insurance policy, part of the premium is put toward the cash value. The cash value grows over time at an interest rate set by the policy's terms.

If you have a permanent life insurance policy that accumulates cash value, you can borrow money from the insurer, using the cash value as collateral. However, this option is typically only available once your life insurance policy's cash value has reached a specific size, which may take five to ten years of paying premiums.

When you borrow against a life insurance policy, there is no approval process or credit check since you are essentially borrowing from yourself. There are also no restrictions on how you can spend the money. The loan is also not recognised by the IRS as income, so it remains free from tax as long as the policy stays active.

However, borrowing against a life insurance policy is not risk-free. If you do not pay back the loan, it will reduce your death benefit. Interest is added to the balance and accrues, putting your loan at risk of exceeding the policy's cash value and causing your policy to lapse. If that happens, you will likely owe taxes on the amount you borrowed.

Life Insurance with Sleep Apnea: Is It Possible?

You may want to see also

Pros and cons of life insurance loans

Borrowing from your life insurance policy can be an easy way to get cash in hand when you need it. However, there are several pros and cons to consider before taking out a life insurance loan.

Pros of a Life Insurance Loan

- It doesn't take long to access your loan funds: Getting a life insurance policy loan is quick and easy. There is no approval process, credit check, or income verification.

- You can use the loan funds for whatever you choose: Because your policy's cash value acts as collateral for the loan, you can use the money for anything from household bills to a vacation. The insurance company does not require you to explain how you intend to use the funds.

- Loans do not have to be paid back: There is no required monthly payment for a policy loan and no payback date. However, an unpaid loan accrues interest that is added to your owed balance.

- Money from an insurance policy loan is not taxed as income: Policy loans are not considered taxable income. You can borrow all your cash value without owing income tax.

- Low-interest rates: Life insurance loans typically have lower interest rates than personal loans or credit cards. Interest rates usually range from 5% to 8%.

Cons of a Life Insurance Loan

- The death benefit will decrease if the loan isn't repaid: If you die before paying back your policy loan, the loan balance plus the interest accrued is subtracted from the death benefit that would be given to your beneficiaries.

- You will owe interest on the loan: The insurance company will charge you interest on the outstanding balance until it is entirely paid off.

- Failing to repay your loan may result in losing insurance coverage: If the loan balance increases above the amount of the cash value, your policy could lapse and be terminated by the insurance company. You would lose your insurance protection and owe income tax on the amount you received above what you paid in premiums.

- You may have to wait several years for the policy to build cash value: It can take several years of premium payments for your policy to accumulate enough cash value to borrow against.

Finding VCU Life Insurance: A Comprehensive Guide

You may want to see also

Interest rates and repayment

Interest rates on life insurance loans are typically lower than those for personal loans and credit cards, ranging from 5% to 8% according to MarketWatch. The interest rate will depend on the insurance company and the type of policy. The interest on the loan compounds annually and must be paid back to avoid the policy lapsing.

Unlike a bank loan or credit card, policy loans do not affect your credit score and there is no approval process or credit check. There is also no fixed repayment schedule, but it is in your best interest to pay back the loan as soon as possible to avoid accruing interest. If the loan is not paid back before the policyholder's death, the insurance company will deduct the amount owed from the death benefit, reducing the amount received by beneficiaries.

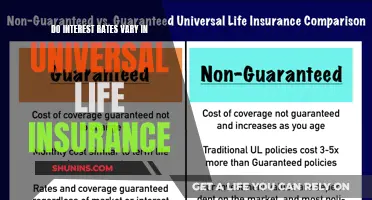

There are two types of life insurance policy loans: variable and fixed-rate. Variable loans have a floating interest rate determined by the insurance company and occasionally adjusted, while fixed-rate loans have a guaranteed interest rate that does not change over the life of the loan. The interest rate is declared in advance, making it easy to calculate the total interest of the loan.

It is important to consider the potential downsides of life insurance policy loans, such as the risk of reducing the death benefit if the loan is not repaid, and the possibility of the policy lapsing if the loan amount exceeds the cash value. Consulting a financial advisor can help weigh the pros and cons of all options before taking out a life insurance policy loan.

Supplemental Healthcare Plans: Life Insurance Benefits Explained

You may want to see also

Applying for a life insurance loan

Check your life insurance policy

Before applying for a life insurance loan, it is important to check that you have the right type of policy. Life insurance loans are only available on permanent life insurance policies, such as whole life and universal life, that have a cash value component. Term life insurance policies, which are generally cheaper and more suitable for many people, do not have a cash value and therefore cannot be borrowed against.

Ensure you have sufficient cash value

In addition to having the right type of policy, you need to have accumulated enough cash value in your policy to borrow against. This can take several years, depending on the structure of your policy. Most insurers will allow you to borrow up to 90% of the policy's cash value, so you will need to ensure that you have enough cash value built up to cover the amount you wish to borrow.

Contact your insurance company

Once you have confirmed that you have the right type of policy and sufficient cash value, you can contact your insurance company to initiate the loan process. You will need to fill out a basic form and provide some information, such as your policy details and the amount you wish to borrow. Some insurers may also require you to confirm your identity or provide additional documentation.

Understand the terms and conditions

It is important to carefully review the terms and conditions of the loan before proceeding. This includes understanding the interest rate, repayment schedule, and any potential penalties for late or missed payments. Interest rates on life insurance loans are typically lower than those for personal loans or credit cards, but it is still important to ensure that you can afford the repayments.

Be aware of the risks

While borrowing against your life insurance policy can be a convenient way to access cash, it is important to be aware of the risks involved. If you are unable to repay the loan, the outstanding balance, including any accrued interest, may be deducted from the death benefit, reducing the amount your beneficiaries will receive. Additionally, if the loan amount exceeds the policy's cash value, your coverage may lapse, leaving you without life insurance and potentially resulting in tax penalties.

Seek financial advice

Before taking out a life insurance loan, it is recommended to speak with a financial advisor to understand the potential tax implications and how the loan may impact your long-term financial goals. It is also important to consider alternative sources of funding, such as traditional loans or other types of insurance policies, to ensure that borrowing against your life insurance policy is the best option for your specific situation.

Life Insurance Beneficiaries: Taxable or Not?

You may want to see also

Frequently asked questions

You can borrow from permanent life insurance policies that build cash value, such as whole life and universal life insurance policies. Term life insurance policies do not have a cash value component, so you cannot borrow against them.

The amount you can borrow is typically up to 90% of the policy's cash value, with a minimum that varies by insurer.

Life insurance loans do not have a strict repayment schedule, but it is in your best interest to pay back the loan as soon as possible to avoid accruing interest. If you die with an outstanding loan, the amount owed will be deducted from the death benefit paid to your beneficiaries.