Mortgage protection life insurance is a type of insurance policy that helps your family make mortgage payments if you, the policyholder and mortgage borrower, die before your mortgage is fully paid off. It can also help you avoid foreclosure if you can no longer work to pay your mortgage. Certain policies also offer coverage for a limited time if you lose your job or become disabled after an accident.

Mortgage protection insurance is also called mortgage life insurance or mortgage protection life insurance. It is a policy that pays off the balance of your mortgage when you die. The life insurance death benefit from a mortgage protection insurance policy typically decreases as you pay off your mortgage, while your premiums stay the same.

| Characteristics | Values |

|---|---|

| Type of insurance policy | Mortgage protection insurance (MPI) |

| Purpose | Helps your family make monthly mortgage payments if you die before your mortgage is fully paid off |

| Payout | Only pays out when the policyholder passes away |

| Beneficiary | The beneficiary of an MPI policy is typically the mortgage company, not the family |

| Cost | Depends on the remaining balance on the mortgage loan, time left on the loan term, age and amount of coverage wanted |

| Comparison to life insurance | MPI is less flexible than life insurance as it only covers mortgage payments and does not provide a lump sum |

| Comparison to other insurance types | MPI is not the same as private mortgage insurance (PMI) or mortgage insurance premium (MIP) |

What You'll Learn

Who does mortgage protection insurance benefit?

Mortgage protection insurance is designed to benefit the mortgage lender and the policyholder's family.

The mortgage lender benefits from mortgage protection insurance because they are the beneficiary of the policy. This means that, in the event of the policyholder's death, the insurance payout will go directly to the lender, who will use it to pay off the remaining balance of the mortgage. This ensures that the lender will not suffer financial losses due to the policyholder's death.

The policyholder's family also benefits from mortgage protection insurance, as it helps them remain in their home after the policyholder's death. Without this insurance, the family may struggle to make mortgage payments and could ultimately lose their home. Mortgage protection insurance provides peace of mind and financial stability for the policyholder's loved ones.

Additionally, mortgage protection insurance can benefit individuals who are unable to obtain traditional life insurance due to health conditions or the cost of premiums. It offers guaranteed acceptance and does not require a medical evaluation, making it more accessible to those with underlying health issues or high-risk occupations.

However, it's important to note that mortgage protection insurance has limitations. The payout decreases as the mortgage is paid down, while the premiums remain the same. This can be a drawback for those who plan to pay off their mortgage early. Furthermore, the policy's beneficiary is the mortgage company, limiting the flexibility of the payout for the family.

Life Insurance and Suicide: What's the Verdict?

You may want to see also

How does mortgage protection insurance work?

Mortgage protection insurance is a type of insurance policy that helps your family make your monthly mortgage payments if you—the policyholder and mortgage borrower—die before your mortgage is fully paid off. Certain MPI policies also offer coverage for a limited time if you lose your job or become disabled after an accident.

MPI is also known as mortgage life insurance because most policies only pay out when the policyholder passes away. However, it is not the same as private mortgage insurance (PMI), which safeguards the owners of your home loan if you stop paying your mortgage.

With MPI, your mortgage lender is the beneficiary of the policy rather than the beneficiaries you designate. If you pass away, your lender is paid the balance of your mortgage. This means your mortgage will be paid off, but your survivors or loved ones won't see any of the proceeds.

With standard term insurance, you get a level benefit and pay level premiums for the term of the policy. With MPI, the premiums may remain the same, but the value of the policy decreases over time as the balance of your mortgage declines.

MPI policies have guaranteed acceptance, meaning you can't be denied coverage based on your health condition. They also don't require underwriting, so most policies don't need you to submit a medical exam to qualify for coverage. However, this means the average MPI premium is higher than a life insurance policy for the same balance.

When buying MPI, you can choose between a declining payout policy, where the policy size decreases as the mortgage loan drops, or a level term insurance policy, where the payout remains the same.

Get Life Insurance for Your Mom: What You Need to Know

You may want to see also

Pros and cons of mortgage protection insurance

Pros of Mortgage Protection Insurance:

- Guaranteed acceptance: Most MPI policies are issued on a "guaranteed acceptance" basis, which can be beneficial if you have a health condition that leads to higher life insurance rates or if you struggle to obtain coverage.

- No underwriting required: MPI plans typically don't require underwriting because most policies don't need you to submit a medical exam to qualify for coverage.

- Peace of mind: An MPI policy ensures that your mortgage payments will be covered if you pass away or become disabled, protecting your family from the responsibility of paying off the mortgage or losing the house due to foreclosure.

Cons of Mortgage Protection Insurance:

- Extra monthly payment: MPI requires an additional payment every month, which may be a burden to your budget.

- Limited payout options: The MPI payout only goes towards your mortgage debt, leaving your family without financial support for taxes, bills, or funeral costs.

- Alternative policies may be preferable: If you want an insurance policy that provides a more comprehensive financial safety net for your family, a traditional life insurance policy may be a better option.

- May not be the best use of your money: If your mortgage is almost paid off or you have sufficient funds to cover the remaining payments, investing in an MPI policy may not be the most financially prudent decision.

- Payoff amount declines: If you plan to make extra payments to pay off your mortgage early, the benefit of MPI decreases as the loan payoff amount decreases.

- Potentially better alternatives: Since MPI is paid directly to the lender, it may not provide optimal financial protection for your loved ones. A life insurance policy might be preferable as the payout can be used by beneficiaries for any purpose.

Marketing Term Life Insurance: Strategies for Success

You may want to see also

Mortgage protection insurance vs. life insurance

Mortgage protection insurance and life insurance are both designed to protect your family in the event of your death, but they do have some key differences. Here is a detailed comparison of the two types of insurance to help you understand their similarities and differences.

Mortgage protection insurance (MPI) is a type of insurance policy that helps your family make monthly mortgage payments if you, the policyholder and mortgage borrower, die before your mortgage is fully paid off. MPI provides peace of mind and ensures that your family won't be responsible for paying off the mortgage or lose their home due to foreclosure. Certain MPI policies also offer coverage for a limited time if you lose your job or become disabled after an accident.

Life insurance is a financial product that pays out a sum of money to your beneficiaries in the event of your death. It is designed to provide financial stability and protect your loved ones after you're gone. Life insurance policies can be used to cover various expenses, including mortgage payments, living costs, and other debts.

Similarities:

Both MPI and life insurance provide a means of paying off your mortgage and ensuring that your family can remain in their home. They both involve paying regular premiums to keep the coverage in force. Additionally, both types of insurance can provide financial protection for your loved ones, giving them peace of mind and security.

Differences:

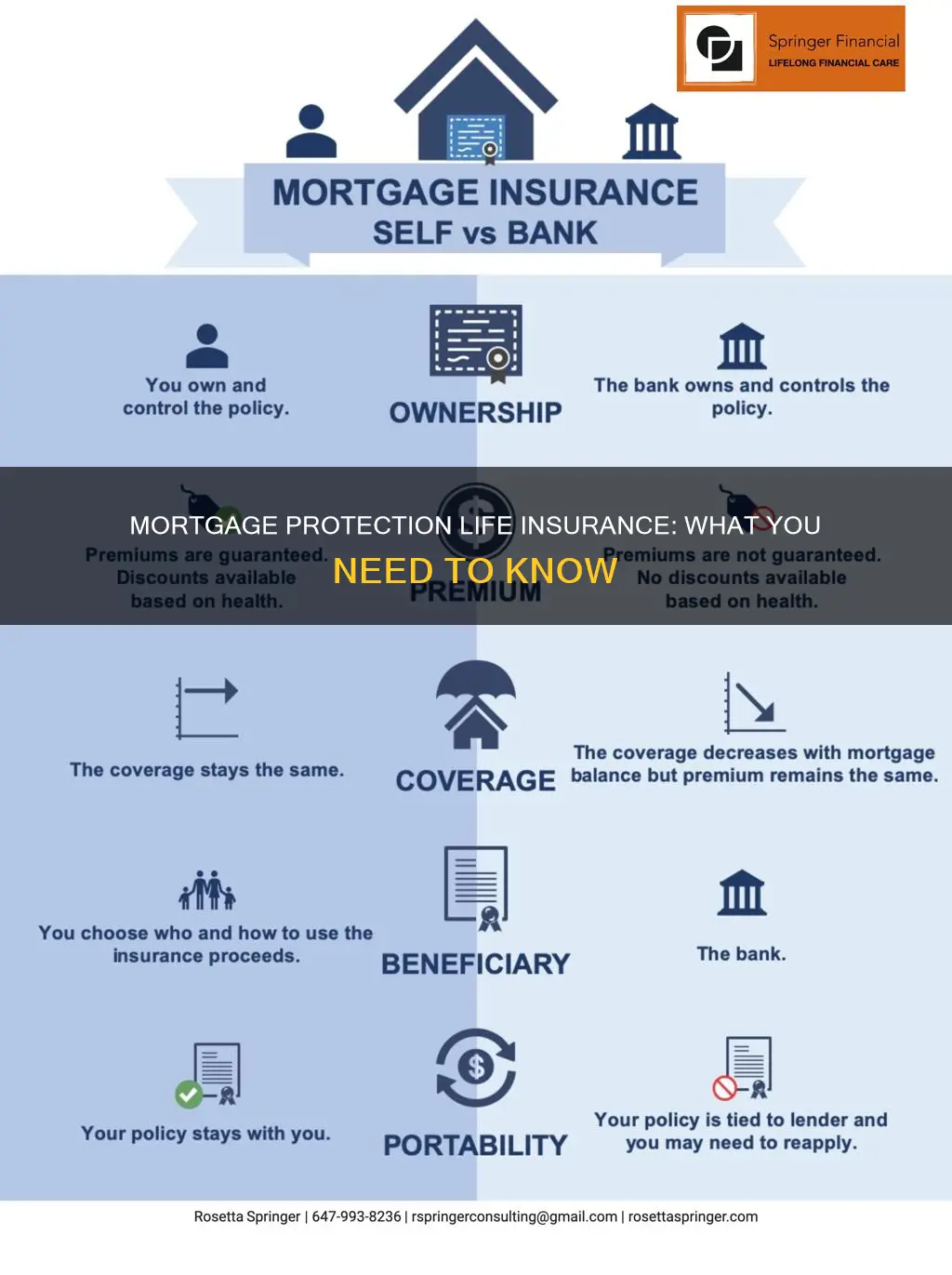

One of the main differences between MPI and life insurance is the beneficiary. With MPI, the beneficiary is typically the mortgage company, whereas with life insurance, the beneficiaries are usually your family members or loved ones. This means that with MPI, the money goes directly to the lender to pay off the mortgage, while with life insurance, your family receives a lump sum that they can use for various expenses, not just the mortgage.

Another difference lies in the acceptance rates and insurance premiums. MPI policies have guaranteed acceptance, regardless of health conditions or occupation. In contrast, the cost of life insurance premiums is influenced by factors such as health, occupation, and risk factors. MPI premiums tend to be higher than life insurance for the same balance due to the guaranteed acceptance.

Additionally, MPI policies have limitations and strings attached that can change the benefits. The balance of the death benefit follows the balance of the mortgage, so the longer you hold the policy, the less valuable it becomes. On the other hand, life insurance policies typically maintain the same balance for the entire term.

The choice between MPI and life insurance depends on your specific needs and circumstances. If you have health conditions or work in a high-risk job, MPI could provide peace of mind and ensure your family can keep their home. However, if you want your family to have more financial flexibility and be able to use the payout for expenses beyond the mortgage, a traditional life insurance policy may be a better option.

NRA Membership: Life Insurance Benefits and Beyond

You may want to see also

When is mortgage protection insurance worth it?

Mortgage protection insurance is a type of insurance policy that helps your family make your monthly mortgage payments if you—the policyholder and mortgage borrower—die before your mortgage is fully paid off. Certain MPI policies also offer coverage for a limited time if you lose your job or become disabled after an accident.

You have underlying health conditions

If you are a homeowner with underlying health conditions that could affect your long-term well-being, MPI could be a good option. MPI policies typically don't require a medical exam for qualification, making it a viable choice for those who may struggle to get approved for a life insurance policy or would have to pay higher rates.

You are employed in a high-risk job

Similarly, if you work in a high-risk job, MPI could be a suitable option as it usually doesn't involve underwriting and is not dependent on factors like your occupation.

You are a young person

Young people often face challenges in getting approved for life insurance policies. MPI can be a good alternative for them to provide peace of mind for themselves and their loved ones.

You want to ensure your family can stay in the home

If you are concerned about your family's ability to continue living in the home after your passing, MPI can offer reassurance. It ensures that the mortgage payments will be covered, allowing your family to remain in their home without the burden of additional financial stress.

You want to avoid the hassle of foreclosure

MPI can help you and your family avoid the complex and costly process of foreclosure by guaranteeing that the mortgage payments will be made. This is beneficial for both the homeowner and the lender.

However, it's important to weigh these benefits against the potential drawbacks of MPI, such as higher premiums, lack of flexibility in payout options, and declining payout amounts over time. In some cases, a traditional life insurance policy or other alternatives may be a more suitable choice.

Moose Membership: Life Insurance Benefits and Beyond

You may want to see also

Frequently asked questions

Mortgage protection life insurance is a type of insurance policy that helps your family make mortgage payments if you, the policyholder and mortgage borrower, pass away or become unable to work before your mortgage is fully paid off.

The beneficiary of a mortgage protection life insurance policy is typically the mortgage lender, not the policyholder's family. The death benefit is paid directly to the lender to cover the remaining balance of the mortgage.

Traditional life insurance policies offer more flexibility as they allow the policyholder to choose their beneficiary, typically a family member, who can use the funds as they see fit. Mortgage protection life insurance is specifically tied to the mortgage and does not provide a lump-sum payout.

Mortgage protection life insurance is not a requirement, and it may not be the best option for everyone. It is important to consider your specific needs and compare it with other types of insurance, such as term life insurance, which may offer more flexibility and financial benefits for your loved ones.