Life insurance is a complex and delicate topic, and understanding how it relates to suicide is crucial. Suicide is a leading cause of death, and many individuals have struggled with suicidal thoughts at some point in their lives. When it comes to life insurance policies, there are important considerations regarding coverage in the event of suicide. Generally, life insurance policies include a suicide clause, which stipulates that if the policyholder dies by suicide within a certain period, typically the first one to two years, the insurer may deny the death benefit or refund only the premiums paid. However, after this exclusion period, most policies do cover suicide, and beneficiaries are entitled to receive the full death benefit. It's essential to carefully review the terms and conditions of your specific policy, as well as seek support if you or someone you know is struggling with suicidal thoughts.

| Characteristics | Values |

|---|---|

| Does life insurance cover suicide? | It depends on the type of policy and the specific terms within it. Many policies include a "suicide clause" which states that if the policyholder dies by suicide within a certain period, the insurer may deny the death benefit or only return the premiums paid. |

| How long is the exclusion period? | Usually within the first two years, but can be shorter depending on the insurer and state regulations. |

| What happens after the exclusion period? | After this period, most life insurance policies do cover suicide, and beneficiaries would be entitled to receive the full death benefit. |

| What if the policy does not include a suicide exclusion clause? | The insurance company is required to pay the full death benefit if the insured dies by suicide, premeditated or not. |

| Are there any specific clauses or conditions that impact coverage? | Yes, different types of life insurance policies (military, accidental death, group, traditional) may have specific clauses and conditions that impact coverage. |

| Can I get life insurance with a history of attempted suicide? | Yes, but it may come with specific challenges. Insurers may apply table ratings or flat extras, resulting in higher premiums. The time since the attempt and current mental health status will also be considered. |

What You'll Learn

- Life insurance policies may not pay out if the policyholder dies by suicide within the first 13 months of the policy

- After the exclusion period, most life insurance policies do cover suicide

- Life insurance providers may ask about your mental health as part of a risk assessment

- You have a legal duty to be truthful about your medical history when applying for life insurance

- If you have a history of attempted suicide, you may still be able to get life insurance coverage, but it may be more difficult

Life insurance policies may not pay out if the policyholder dies by suicide within the first 13 months of the policy

Life insurance policies are a crucial financial safety net for many people, but they can be complex, and it's important to understand the specific terms and conditions of your policy. One common question surrounding life insurance is whether it covers suicide. The answer is that it depends on the type of policy and the specific terms within it.

Many life insurance policies include what is known as a "suicide clause," which typically states that if the policyholder dies by suicide within a certain period after the policy is issued, usually within the first year to two years, the insurer may deny the death benefit or only return the premiums paid. This clause is designed to protect insurance companies from financial risk and prevent individuals from taking out a policy with the intention of ending their lives shortly afterward.

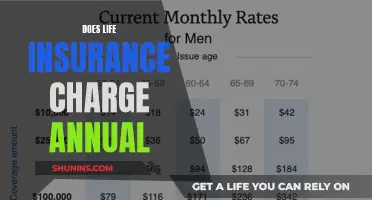

In Australia, for example, Suncorp Life Insurance provides a lump-sum payout as a death benefit or following the diagnosis of terminal illnesses with a life expectancy of less than 12 months. However, this does not include suicide or intentional self-injury in the first 13 months of the policy. Similarly, in the United States, most states enforce a standard two-year exclusion period, while some states, like Missouri, Colorado, and North Dakota, have a shorter one-year period.

After this exclusion period, most life insurance policies do cover suicide, and beneficiaries would be entitled to receive the full death benefit. It's important to note that different types of life insurance policies may have specific clauses and conditions that impact coverage. For example, military-focused life insurance policies often pay out the death benefit regardless of the cause of death, including suicide. On the other hand, accidental death insurance policies may be more nuanced, depending on the circumstances of the death and the information disclosed by the insured when applying for the policy.

When considering life insurance, it is beneficial to carefully review the terms and conditions outlined in the product disclosure statement (PDS) to understand any exclusions or limitations on coverage, especially regarding suicide. Additionally, if you have a history of attempted suicide, it is important to be honest during the application process and provide detailed information about your medical history, treatments, and current mental health status. This information will help the insurer assess your eligibility for coverage and determine the level and terms of coverage offered.

Child Support: Life Insurance Coverage for Dependents?

You may want to see also

After the exclusion period, most life insurance policies do cover suicide

Life insurance is a category of insurance that includes different types of cover, such as term life insurance, trauma insurance cover, total and permanent disability (TPD) cover, and income protection insurance. These can be bought separately or bundled into one policy, and you can also have a life insurance policy in a private fund or as part of your superannuation.

When it comes to suicide, there are often exclusions that apply to a life insurance policy. Generally, no benefit will be payable by an insurer for terminal illness or death as a result of suicide or intentional self-injury within the first 13 months of your policy. This exclusion period is typically referred to as the "suicide clause". After this time, suicide may still be covered, depending on the eligibility requirements outlined in the product disclosure statement (PDS).

The suicide clause is intended to protect insurance companies from financial risk by preventing individuals from taking out a policy with the intention of ending their life shortly afterward. This clause usually applies for the first one to two years after a policy is issued, and during this period, if the policyholder dies by suicide, the insurer may limit or deny the death benefit payout. Instead, they might refund the premiums paid up to that point.

Once the exclusion period has passed, most life insurance policies do cover suicide. This means that beneficiaries would be entitled to receive the full death benefit as outlined in the policy. Traditional life insurance policies, including term and permanent life insurance, typically contain a suicide clause that applies for a specific period, after which the policy generally covers suicide.

It's important to note that different types of life insurance policies may have specific clauses and conditions that impact coverage. For example, military-focused life insurance policies often pay out the death benefit regardless of the cause of death, including suicide. On the other hand, accidental death insurance policies may be more nuanced, depending on the circumstances of the death and the information disclosed during the policy application.

When comparing life insurance policies, be sure to review the PDS to understand the specific benefits and exclusions, including whether suicide is covered and what the applicable exclusion period is.

Understanding COBRA: Life Insurance Coverage and Benefits

You may want to see also

Life insurance providers may ask about your mental health as part of a risk assessment

When you apply for life insurance, insurers might ask questions such as: 'Have you ever attempted suicide?'. You may also be asked broader questions about your mental health, such as whether you have ever experienced suicidal thoughts or mental health issues, and whether you are currently undergoing any treatments.

The answers you provide will be used, alongside other factors, to determine your eligibility for cover and the amount you will be charged. Being open and honest about your mental health history is important, as failing to disclose relevant information could result in your policy being avoided, varied, or refused by the insurer.

If you have experienced mental health issues, it may be beneficial to seek professional advice when applying for life insurance. This can help you navigate the process and ensure you are treated fairly and without discrimination.

It is worth noting that different life insurance providers will have varying eligibility criteria, and your personal circumstances will also play a role in the outcome of your application. Some providers may deny you eligibility for life cover, while others may approve you but apply exclusions or require you to pay a higher premium.

It is always a good idea to do detailed research and seek out providers that offer policies suited to your individual needs and circumstances.

Cerebral Palsy: Life Insurance Underwriting Considerations

You may want to see also

You have a legal duty to be truthful about your medical history when applying for life insurance

When applying for life insurance, it is crucial to be honest and forthcoming about your medical history. You have a legal duty to take reasonable care not to make a misrepresentation to the insurer, and this includes being truthful about your medical history, including any diagnosis of mental illness or suicide attempts.

The duty of disclosure is the insured person's responsibility to disclose all known information to the insurer when applying, increasing, or extending an insurance policy. This means providing a full and complete picture of your relevant information and ensuring that your responses accurately and truthfully represent the facts. If you are unsure whether certain information is relevant, it is best to disclose it anyway.

The consequences of not disclosing important information or being untruthful on your life insurance application can be serious. The insurer may deny your application, increase your insurance premium, cancel your policy, or deny a beneficiary's claim to the death benefit. In some cases, intentional fraud or forgery may even be punishable in criminal court.

Additionally, if you pass away during the contestability period—a period during which your life insurance provider may review your policy for false statements or misrepresentations—and the insurer discovers that you lied on your initial application, it could result in a claim denial or a decreased death benefit.

It is important to note that each insurer has different underwriting guidelines, and the outcome of retroactive underwriting may vary. However, some possible remedies for non-disclosure include altering the contract and offering modified terms, reducing the sum insured, or cancelling the policy from inception and treating it as if it never existed.

To summarize, when applying for life insurance, it is your legal duty to be truthful about your medical history and to disclose all relevant information. Failure to do so can have significant consequences and may affect your coverage and the benefits paid out to your beneficiaries.

Chlamydia's Impact on Life Insurance Rates: What You Need Know

You may want to see also

If you have a history of attempted suicide, you may still be able to get life insurance coverage, but it may be more difficult

If you have a history of attempted suicide, it may be challenging to obtain life insurance coverage, but it is not impossible. Here are some key points to consider:

- Honesty is crucial: When applying for life insurance, it is essential to be honest about your medical history, including any mental health diagnoses or suicide attempts. Failing to disclose this information could result in your policy being avoided, varied, or denied, or your claim being refused.

- It may be treated as a pre-existing condition: Insurers may treat your history of attempted suicide as a pre-existing condition and ask detailed questions about your mental health, treatments, and current symptoms. The information you provide will influence the level of coverage offered and the terms of your policy.

- Table ratings and flat extras: Insurers may apply table ratings, which are extra costs added to your standard premium based on their assessment of your risk. A higher table rating means higher premiums due to the increased risk associated with your history. Flat extras are specific dollar amounts added to your premium to account for the insurer's perceived risk.

- Time and stability are factors: The more time that has passed since your suicide attempt, the better your chances of obtaining coverage. Insurers look for stability in your mental health over several years, so if you have been stable and treatment-free for a while, it can positively influence their decision.

- Consider specialised insurers: Working with an insurance professional who specialises in high-risk cases can improve your chances of finding suitable coverage. They can guide you through the process and help you navigate any challenges.

- Understand the suicide clause and contestability period: Most life insurance policies include a suicide clause, which prevents the insurer from paying out if the insured dies by self-inflicted injury within a certain period, typically one to three years, from the start of the policy. There is also a separate contestability period, usually two years, during which the insurer can deny a claim if they find undisclosed health conditions or discrepancies in the application. Switching life insurance policies restarts these periods.

- Disclose all relevant information: When purchasing life insurance, it is crucial to disclose all relevant information, including any history of drug or alcohol use, medications, mental health diagnoses, and participation in risky activities. While it may be difficult, providing false information could result in your beneficiary's claim being denied.

Child Life Insurance: Rollover Options for Parents

You may want to see also

Frequently asked questions

Generally, no benefit will be payable by an insurer for terminal illness or death as a result of suicide or intentional self-injury within the first 13 months of your policy. After this time, suicide may still be excluded based on eligibility requirements. Whether or not a life insurance policy covers suicide will depend on the terms and conditions in your product disclosure statement (PDS).

A life insurance suicide clause typically applies for the first one to two years after a policy is issued. During this period, if the policyholder dies by suicide, the insurer may limit or deny the death benefit payout. After this exclusion period ends, the life insurance policy generally covers suicide, ensuring the beneficiaries receive the full death benefit.

Denials may occur if the death falls within the policy's suicide exclusion period, which can range from one to two years. To contest a denial, carefully review the insurer's denial letter and gather any relevant documentation, such as the insured's medical records or investigative reports. Consulting with an experienced attorney or insurance professional can further bolster your efforts to secure the benefits owed to you.

Obtaining life insurance after a history of attempted suicide is possible but may come with specific challenges. Insurers evaluate the risk of insuring someone based on their medical and personal history, including mental health. Table ratings and flat extras are extra costs added to your standard premium based on the insurer's assessment of your risk. The more time that has passed since the suicide attempt, and the more stable your current mental health status, the better your chances of getting coverage.