Race affects life insurance rates in the United States. Compared to non-Hispanic whites, African Americans and people of Hispanic origin have persistently lower insurance coverage rates at all ages. This disparity is driven by minority groups' greater propensity to lose insurance. Uninsured African Americans gain insurance faster than non-Hispanic whites, but their high rates of insurance loss negate this advantage. Disparities from greater rates of loss among minority groups emerge rapidly at the end of childhood and persist throughout adulthood.

In the context of auto insurance, a nationwide study by the Consumer Federation of America in 2015 found that predominantly African-American neighbourhoods pay 70% more, on average, for premiums than other areas. This disparity is driven by the use of socio-economic factors in premium setting, such as occupation and credit scores, which do not reflect personal driving history but are proxies for race.

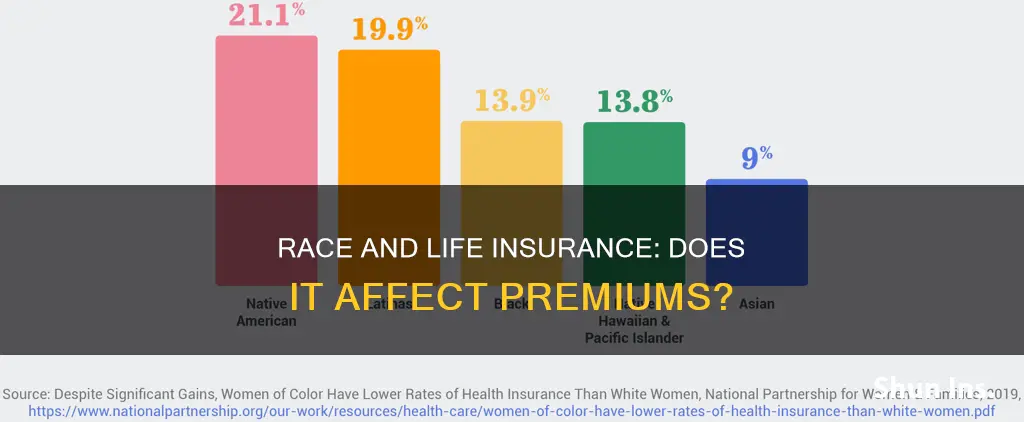

In the realm of health insurance, the Affordable Care Act (ACA) helped reduce racial and ethnic disparities in health insurance coverage and improved access to care, especially in states that expanded eligibility for Medicaid programs. Despite these gains, disparities persist, and in some cases, have widened. For example, between 2010 and 2022, the uninsured rate for American Indian and Alaska Native (AIAN) people grew from 2.5 to 2.9 times higher than the rate for White people.

| Characteristics | Values |

|---|---|

| Racial disparities in health insurance coverage | African Americans and Hispanics have persistently lower insurance coverage rates at all ages compared to non-Hispanic whites. |

| Racial disparities in auto insurance premiums | Auto insurance companies often charge higher premiums to safe drivers who are single, renters, less educated, blue-collar workers, or have lower credit scores. These factors disproportionately affect African Americans. |

What You'll Learn

Racial disparities in health insurance coverage

Health insurance coverage varies significantly between racial and ethnic groups in the United States. Compared to non-Hispanic whites, African Americans and people of Hispanic origin have persistently lower insurance coverage rates at all ages. This disparity in health insurance coverage contributes to a sizable share of the difference in access to healthcare.

African Americans and Hispanics in the United States are more likely to be uninsured throughout adulthood than non-Hispanic individuals. Without insurance, people face considerable barriers in receiving health services. Many healthcare providers require insurance coverage from their patients or charge prohibitively high fees. Inconsistent or unstable insurance coverage also has negative consequences. Patients who frequently change healthcare providers due to insurance loss or change experience more interruptions in their care and are less likely to establish ongoing relationships with their physicians.

The Affordable Care Act (ACA) has helped reduce racial and ethnic disparities in health insurance coverage and improve access to care, especially in states that expanded eligibility for their Medicaid programs. However, after 2016, coverage gains stalled and slightly eroded.

The coverage gap between Black and White adults dropped by 4.6 percentage points between 2013 and 2019, while the gap between Latinx/Hispanic and White adults fell by 9 percentage points. Despite these improvements, racial and ethnic disparities in health insurance coverage remain significant.

Disparities in health insurance coverage by race and ethnicity are driven by socioeconomic characteristics such as income, employment, citizenship, and language—factors that are more prevalent in minority populations. Additionally, certain policies and rules, such as immigration policies, can further constrain coverage options for specific racial and ethnic groups.

Factors affecting racial disparities in health insurance coverage

Several factors contribute to racial disparities in health insurance coverage:

- Socioeconomic characteristics: Income, employment, citizenship, and language are associated with uninsurance and are more prevalent in minority populations. These factors act as barriers to acquiring health insurance.

- Job-based insurance: Hispanics and African Americans are more likely to work in jobs without health benefits, contributing to higher uninsurance rates.

- Language barriers: Language barriers can hinder Hispanics from understanding and navigating the insurance system, leading to lower coverage rates.

- Immigration rules: Immigration rules that prevent undocumented and recent immigrants from enrolling in public insurance plans disproportionately affect Hispanics, further contributing to their higher uninsurance rates.

- Public insurance take-up: Lower take-up rates of public insurance among Asians have been cited as a factor in their higher uninsurance rates relative to non-Hispanic whites.

- Age: Health insurance coverage varies by age, with children under 18 having lower uninsurance rates due to state-sponsored insurance options. The uninsurance rate increases sharply between ages 18 and 24, then declines thereafter. However, a substantial number of near-elderly individuals (ages 55–64) remain uninsured.

- Healthcare policies: Policies such as the Affordable Care Act (ACA) have helped reduce racial and ethnic disparities in health insurance coverage by expanding access to affordable coverage.

Addressing racial disparities in health insurance coverage

To address racial disparities in health insurance coverage, it is essential to identify and address the underlying factors contributing to these disparities. Efforts should focus on reducing the socioeconomic and systemic barriers that disproportionately affect minority groups. This includes improving access to affordable health insurance options and ensuring that public insurance programs are equitably accessible to all eligible individuals.

Cigna's Individual Life Insurance: What You Need to Know

You may want to see also

The impact of higher premiums

For individuals, being uninsured means facing barriers to accessing healthcare. Uninsured individuals are less likely to have a usual source of care, such as a personal doctor, and are more likely to forgo preventive care and routine care for chronic conditions. They are also more likely to be hospitalized for conditions that could have been avoided if treated earlier. This can lead to worse health outcomes and even premature death.

The financial risks associated with being uninsured are also significant. Uninsured individuals often face higher charges for healthcare services and are more likely to incur medical debt. This can lead to financial instability and even bankruptcy.

The consequences of being uninsured extend beyond individuals to their families. A health crisis affecting one family member can quickly drain the financial resources of the entire family.

Communities are also impacted when a large number of residents are uninsured. Safety-net providers, such as hospital emergency rooms and community clinics, can become overburdened, leading to reduced quality of care for all community members.

Additionally, the impact of higher premiums is felt disproportionately by certain racial and ethnic groups. In the United States, racial and ethnic minorities, particularly African Americans and Hispanics, have historically faced higher uninsured rates than their white counterparts due to socioeconomic factors and limited access to affordable coverage options.

Higher premiums contribute to this disparity and further widen the racial gap in insurance coverage. This is especially concerning given that racial and ethnic minorities often have higher rates of adverse health events and are more likely to experience serious illnesses at any age compared to whites. As a result, they bear a heavier burden when faced with the financial and health risks associated with being uninsured.

Addressing the issue of higher premiums is, therefore, crucial to improving health outcomes and reducing racial disparities in access to healthcare.

Crohn's Impact: Life Insurance and Your Health

You may want to see also

The effect on access to healthcare

Racial and ethnic disparities in health insurance coverage rates have a significant impact on access to healthcare in the United States. Research shows that African Americans and Hispanics are more likely to be uninsured throughout adulthood compared to non-Hispanic individuals. This disparity in insurance coverage translates into considerable barriers in receiving healthcare services.

Uninsured individuals often face significant financial obstacles when seeking healthcare. Many healthcare providers require insurance coverage from their patients or charge prohibitively high fees for those without insurance. As a result, individuals without insurance may delay or forgo necessary medical care due to the high costs involved.

Inconsistent or unstable insurance coverage can also have negative consequences. Patients who frequently change healthcare providers due to insurance loss or changes may experience interruptions in their care and may struggle to establish ongoing relationships with their physicians. This can lead to fragmented and uncoordinated care, potentially impacting the quality and continuity of healthcare received.

The consequences of limited access to healthcare due to insurance disparities can be far-reaching. Uninsured individuals may experience worse health outcomes, higher morbidity and mortality rates, and increased financial burdens from medical expenses. Additionally, communities with a high proportion of uninsured residents may strain safety-net providers, such as hospital emergency rooms and community clinics, affecting the quality of care for all community members.

Addressing these racial and ethnic disparities in health insurance coverage is crucial to improving access to healthcare and reducing health inequities. Efforts should focus on identifying and addressing the underlying socioeconomic factors that contribute to higher uninsurance rates among minority populations. This includes addressing issues such as income, employment, citizenship, and language barriers, which have been associated with higher rates of uninsurance in these communities.

Furthermore, expanding access to affordable health insurance options, such as through the Affordable Care Act (ACA) or other initiatives, can help reduce coverage disparities and improve healthcare access for racial and ethnic minority groups.

Life Insurance Mystery: What If Someone Vanishes?

You may want to see also

The role of state policy

- Medicaid Expansion: States that expanded Medicaid eligibility under the Affordable Care Act (ACA) generally witnessed improved health coverage rates and reduced disparities between racial and ethnic groups. The expansion provided a comprehensive and affordable coverage option for low-income individuals, who are disproportionately Black and Latinx/Hispanic. As a result, these states often reported lower uninsured rates and narrower disparities between racial groups.

- Impact of Non-Expansion: States that chose not to expand Medicaid eligibility, particularly those with large Black and Latinx/Hispanic communities, experienced some of the highest uninsured rates for these racial groups. The coverage gap was more pronounced in these non-expansion states, and adults with income below the poverty line in these states were more likely to be Black and Latinx/Hispanic.

- Policy Incentives: The American Rescue Plan Act (ARP) offered incentives for non-expansion states to broaden Medicaid eligibility. States adopting expansion received a temporary boost in federal funding and continued to pay a smaller portion of the cost for new enrollees. This incentivized some states to expand coverage, helping to reduce racial disparities.

- Addressing Immigration Status: Immigration policies have influenced coverage rates, particularly for Latinx/Hispanic communities. Restrictions on undocumented immigrants' access to Medicaid and marketplaces, as well as public-charge rules, have discouraged eligible Latinx/Hispanic families from seeking coverage. Reversing these policies can help narrow racial gaps.

- Special Enrollment Periods: Opening special enrollment periods, as done by the Biden administration, can increase coverage rates. This strategy, combined with enhanced outreach and advertising efforts, can boost awareness and encourage eligible individuals to enroll, potentially reducing racial disparities.

- Addressing State Waivers: Some states have obtained waivers to implement policies that may undermine coverage, such as work requirements for Medicaid. Reversing these waivers and focusing on enrollment and renewal process improvements can help maintain and expand coverage, benefiting marginalized communities.

- Proposed Policy Changes: President Biden's American Families Plan proposes to make ARP's enhanced marketplace subsidies permanent. This could significantly reduce the number of uninsured individuals and lower healthcare costs for those enrolled in marketplaces.

Primerica's Term Life Insurance: Loan Options Explored

You may want to see also

The influence of socio-economic factors

Income is one of the most significant socio-economic factors influencing life insurance rates. Individuals with lower incomes often struggle to afford private coverage, as the cost of premiums can be high. This is particularly true for those who do not have access to employer-sponsored insurance or government-funded programs. As a result, they may be left uninsured or underinsured, leading to higher rates of uninsurance in certain socio-economic groups.

Employment is another crucial factor. Those who are unemployed or work in jobs without health benefits are more likely to be uninsured. This is especially true for part-time or contingent workers, who may not be eligible for employer-sponsored insurance. Additionally, job loss or changes in employment can result in a loss of insurance coverage.

Citizenship and language skills can also play a role in insurance rates. Immigrants, particularly those who are undocumented or have recently arrived, may face barriers in accessing public or private insurance. Language barriers can make it difficult to navigate the insurance system and understand their options.

These socio-economic factors often disproportionately affect racial and ethnic minorities, contributing to racial disparities in insurance coverage. For example, minorities are more likely to have lower incomes, work in jobs without health benefits, and face challenges due to language or citizenship status. As a result, they may have higher rates of uninsurance or inadequate coverage.

It is important to note that the relationship between socio-economic factors and insurance rates is dynamic and can change over time, influenced by broader economic trends, policy changes, and other factors. Additionally, the impact of these factors can vary across different racial and ethnic groups, and there may be interactions between multiple socio-economic factors that further complicate the picture.

Erie Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, race affects life insurance rates. Research shows that there are racial and ethnic disparities in health insurance coverage rates. Non-Hispanic whites have higher insurance coverage rates compared to African Americans and people of Hispanic origin.

The disparity in insurance coverage rates is due to socioeconomic characteristics such as income, employment, citizenship, and language, which are more prevalent in minority populations. Additionally, minority groups have a greater propensity to lose the insurance they already have.

The ACA helped reduce racial and ethnic disparities in health insurance coverage by expanding eligibility for Medicaid and providing subsidies for individuals to purchase Marketplace coverage. However, the effects of the ACA have stalled since 2016, and coverage gains have slightly eroded.

A nationwide study found that predominantly African-American neighborhoods pay 70% more in premiums on average compared to other areas. Additionally, some car insurance companies charge higher premiums in minority neighborhoods than in predominantly white neighborhoods with similar risk profiles.