Life insurance payouts are usually exempt from tax in the UK. However, in certain circumstances, life insurance payouts can be subject to inheritance tax. The inheritance tax threshold is currently £325,000 per person, and any amount above this may be taxed at 40%. There are ways to avoid paying inheritance tax on your life insurance payout, such as by putting your policy 'in trust'.

What You'll Learn

Life insurance proceeds are usually tax-free

Life insurance payouts are usually tax-free, meaning there is no income tax or capital gains tax to pay on the proceeds of the policy. However, this is not the end of the story. While the payout itself is tax-free, for tax purposes, the money is considered to be transferred to the beneficiary, usually the next of kin or whoever was named in the will. This means that the payout may be subject to inheritance tax (IHT) if it takes the value of the deceased's estate above the IHT threshold.

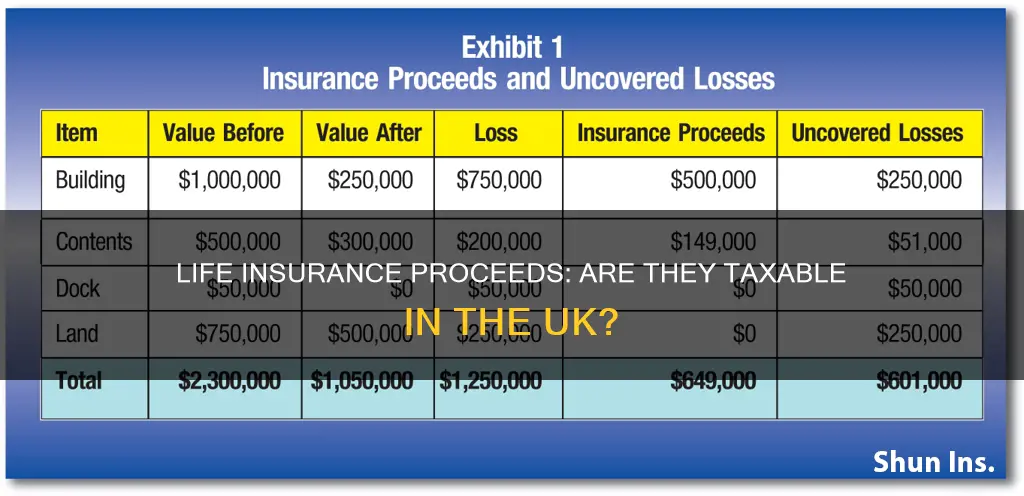

The IHT threshold in the UK is currently £325,000 per person. This means that if the total value of an estate is more than £325,000, any amount above this threshold may be taxed at 40%. For example, if someone has an estate worth £500,000, they would face an IHT bill of £70,000 (40% of £175,000, which is the amount over the threshold). It is important to note that the estate includes not just the value of the life insurance payout but also any property, cars, money, jewellery, and other possessions owned by the deceased.

There are ways to avoid paying IHT on a life insurance payout. One way is to put the life insurance policy 'in trust', which means it is separate from the estate and not subject to inheritance tax. This can be done by appointing trustees, such as a solicitor or family members, to look after the policy on behalf of the beneficiaries. Another way to reduce inheritance tax liability is to give away assets while still alive, as there is an annual exemption that allows individuals to give up to £3,000 per year without any tax being due after death.

It is worth noting that the rules around inheritance tax can be complex, and it is always recommended to seek advice from a financial adviser or solicitor when planning for inheritance tax. Additionally, while life insurance payouts are usually tax-free, there may be rare circumstances where a life insurance payout could be subject to income tax if the policy is non-qualifying, meaning it includes some sort of investment element.

Uncover Credit Life Insurance: Check Your Policy Status

You may want to see also

Inheritance tax may be applied to proceeds

While life insurance payouts are usually exempt from tax, they can be subject to inheritance tax (IHT) in certain circumstances. IHT is a tax on the estate of a deceased person, which can include their property, money, cars, and other possessions, as well as the proceeds of a life insurance policy. The current IHT threshold in the UK is £325,000, which means that if the total value of your estate is more than this amount, IHT will be deducted from your insurance payout at a rate of 40%estate worth £500,000, the tax bill will be £70,000 (40% of £175,000, which is the difference between £500,000 and £325,000).

There are a few ways to avoid paying IHT on your life insurance payout. One way is to put your policy 'in trust', which means that the payout will go directly to your beneficiaries and will not form part of your legal estate. This can be done by setting up a trust, which is a legal arrangement that appoints trustees to look after the policy on behalf of your beneficiaries. The trustees can be solicitors, family members, or friends, and they will ensure that the money is distributed according to your wishes. Setting up a trust is relatively straightforward and is usually free of charge. It can also result in a quicker payout, as the policy does not need to go through probate, the legal process of sorting out a deceased person's estate.

Another way to avoid IHT is to give away assets while you are still alive. You can give up to £3,000 per year as a tax-free gift, and this can be carried forward for one year if you don't use the full amount. You can also make unlimited gifts of up to £250 per person per year. Additionally, you can make gifts in consideration of marriage or civil partnership up to £1,000, and give up to £2,500 to grandchildren and £5,000 to children. However, these gifts must be made before the wedding or civil partnership takes place. If you make gifts within seven years of your death, they may still be included in your estate for IHT purposes, but this can be reduced by using taper relief.

It is important to carefully plan your life insurance and estate to ensure that your beneficiaries receive the maximum benefit. If you are unsure about setting up a trust or have complex finances, it is recommended to seek advice from a solicitor or an independent financial adviser.

Life Insurance and Terrorism: What Coverage Looks Like

You may want to see also

Placing a policy in trust avoids inheritance tax

In the UK, life insurance payouts are usually exempt from tax. However, in certain circumstances, they can be subject to inheritance tax (IHT). IHT is levied on the estate of a deceased person, which includes their property, money, cars, and other possessions, as well as the proceeds of a life insurance policy. If the value of the estate is more than £325,000, and the situation doesn't meet certain other criteria, the portion of the estate above this threshold could be liable for IHT at a rate of 40%.

To avoid paying IHT on your life insurance payout, you can place your policy in trust. A trust is a legal arrangement where you give cash, property, or investments to a trustee (such as a solicitor or family member) so they can look after them for the benefit of a third person, known as the beneficiary. When you put your life insurance policy in trust, it is separate from your estate and is therefore exempt from inheritance tax.

Placing your life insurance policy in trust means that the payout will go directly to your chosen beneficiaries, rather than forming part of your legal estate. This can also ensure that the right people receive the money quickly, without having to wait for probate. Additionally, setting up a trust allows you to decide who will be your trustees and who will receive the money from your policy. This can be particularly important if you're not married or in a civil partnership, as it ensures your assets go to the intended beneficiaries.

While it is generally better to set up a trust when you first buy your life insurance policy, you can put your policy in trust at any time. To do this, simply contact your insurer and ask if you can write your insurance policy in trust. They will usually be able to help you with standard trust wordings. Keep in mind that placing your policy in trust means that you are giving up ownership of the assets it holds, so it is important to understand the implications before making this decision.

Life Insurance Benefits: Florida's Public Record Law Explained

You may want to see also

Non-qualifying policies may be liable for income tax

Life insurance payouts are usually exempt from tax in the UK. However, in certain circumstances, the payout may be subject to inheritance tax (IHT). This typically occurs when the payout is considered part of the insured person's estate, and the total value of the estate exceeds the IHT threshold.

It's important to understand that while the payout itself is tax-free, it is treated as income for tax purposes and is transferred to the beneficiary. This means that if the total value of the estate, including the payout, exceeds the IHT threshold, the excess amount may be taxed at a rate of 40%.

To avoid this, individuals can choose to put their life insurance policies "in trust". This means that the policy is legally owned by trustees, who manage the payout on behalf of the beneficiaries. By doing so, the payout is separate from the estate and is not subject to IHT. This option also offers other benefits, such as quicker access to the payout and ensuring the right people receive the correct amount. However, it is a complex issue, and seeking professional advice is recommended.

Now, let's focus on the scenario where non-qualifying policies may be liable for income tax. A non-qualifying policy typically refers to a life insurance policy that includes an investment element. In such cases, the policyholder may be liable for income tax at the higher and additional rates on the payout. The definition of a non-qualifying policy is complex, and it is advisable to consult the insurance provider to determine if a specific policy falls into this category.

It is essential to understand that tax laws and regulations can be intricate, and seeking personalised advice from a qualified financial adviser or tax specialist is always recommended. They can provide guidance tailored to individual circumstances and help navigate the complexities of life insurance and tax liabilities.

Financial Advisors and Life Insurance: What's the Real Deal?

You may want to see also

Whole life insurance can cover inheritance tax

In the UK, life insurance payouts are usually exempt from tax. However, in certain circumstances, they can be subject to inheritance tax (IHT). If the payout and the deceased's estate exceed the IHT threshold, then the amount above the threshold will be taxed at 40%.

To avoid this, you can put your life insurance policy 'in trust'. This means that the payout will go directly to your beneficiaries and will not be considered part of your estate, so no IHT will be due. This can be particularly important for those who are not married or in a civil partnership, as it ensures that your assets go to the intended beneficiaries. Additionally, writing your policy in trust means that your loved ones will receive the money more quickly, as it bypasses probate.

If you know that your beneficiaries will be liable for IHT when you die, you could take out a whole life insurance policy to cover the full amount of the IHT bill. Whole life insurance policies pay out whenever you die and can help to ensure that your loved ones receive the full amount of financial support that you intended. To avoid the proceeds of the policy incurring IHT, your whole life insurance policy must be written in trust. The premium paid for the policy will also help to reduce the value of your estate, which can further reduce the amount of IHT due when you die.

Life Insurance Payout: Investing for Security and Growth

You may want to see also

Frequently asked questions

Life insurance payouts are usually exempt from tax in the UK. However, in certain circumstances, they can be subject to inheritance tax.

Inheritance Tax (IHT) is a tax on the estate (the property, money, assets and possessions) of the deceased person's estate after all other debts and funeral expenses have been deducted. The standard IHT rate is 40% of anything in your estate over the £325,000 threshold.

One way to avoid paying IHT on your life insurance payout is to put your policy 'in trust'. This means that the payout will go directly to your beneficiaries and not form part of your legal estate, and thus no IHT will be due.