Life insurance is a financial product that provides peace of mind to those who want to ensure their loved ones are financially supported after they're gone. While it's not a fun topic to consider, it's an important one, and understanding the tax implications of life insurance is crucial. In most cases, life insurance proceeds are not considered taxable income, but there are some exceptions and complications that are important to be aware of when planning.

| Characteristics | Values |

|---|---|

| Are life insurance premiums tax-deductible? | No |

| Are life insurance proceeds taxable? | No, but any interest received is taxable |

| Are life insurance proceeds taxable if they are included as part of your estate? | Yes, if the estate's total value is above the filing threshold |

| Are life insurance proceeds taxable if paid out in installments? | The death benefit is not taxable but any interest that builds up on those payments is taxable |

| Are life insurance proceeds taxable if the policy is a modified endowment contract? | Yes, withdrawals are treated as taxable income until they equal all interest earnings in the contract |

| Are life insurance proceeds taxable if the policy is sold? | Yes, the gain on the sale amount above the premiums paid is taxable |

| Are life insurance proceeds taxable if the policy is a group-term life insurance policy provided by an employer? | No, if the total amount of coverage does not exceed $50,000 |

| Are life insurance proceeds taxable if the policy covers the employee's spouse or dependent? | No, if the face amount of the coverage does not exceed $2,000 |

What You'll Learn

Interest on life insurance proceeds is taxable

Life insurance is a financial product that provides a lump sum to beneficiaries in the event of the policyholder's death. The Internal Revenue Service (IRS) treats life insurance differently from other financial products because it is intended to support beneficiaries.

In most cases, life insurance proceeds are not taxable income and do not need to be reported to the IRS. However, interest on life insurance proceeds is taxable. The interest is considered taxable income and must be reported.

If you receive life insurance proceeds in installments, any interest that accumulates on those payments will be taxed as regular income. This is because the death benefit itself is typically not taxed, but the interest that builds up is considered taxable income.

If you have a whole life insurance policy, the interest generated is not taxed until the policy is cashed out. At that point, the amount you are taxed on is the difference between the cash value received and the total amount paid in premiums.

It is important to carefully review your policy and understand the tax implications to avoid unexpected tax burdens for your beneficiaries.

Gestational Diabetes: Life Insurance Complications and Considerations

You may want to see also

Death benefits are usually tax-free

One exception to the tax-free status of death benefits occurs when a policyholder leaves the death benefit to their estate instead of directly naming a person as the beneficiary. If the estate's total value is large enough, it may trigger estate taxes, reducing what your loved ones ultimately receive. If you own a term life insurance policy when you pass away, the death benefit becomes part of your taxable estate, and this could push your estate's total value above the federal estate tax exemption, triggering estate taxes. While this generally only affects high-net-worth individuals, some states have a lower threshold for state estate tax, so it's important to factor that into your planning. Working with an estate planner can help minimize these tax implications and ensure your loved ones receive as much of the death benefit as possible.

Another exception to the tax-free status of death benefits is when the death benefit is paid out in installments rather than as a lump sum. In this case, any interest that builds up on those payments could be taxed as regular income. Therefore, if your loved ones choose to receive the life insurance payout in installments, they should be prepared to report the interest on their taxes.

A further exception to the usual tax-free status of death benefits arises in what is known as a Goodman Triangle. This occurs when three different individuals are involved in a life insurance policy: one person is the policy owner, another is the insured, and a third is the beneficiary. In this scenario, the IRS could view the death benefit as a gift from the policy owner to the beneficiary, triggering a gift tax if the amount exceeds the annual exclusion limit, which is $18,000 in 2024. To avoid this complication, financial advisors often suggest that only two parties be involved in the policy.

In conclusion, while death benefits are usually tax-free, it is important to be aware of the exceptions to this rule. By understanding the potential tax implications and carefully planning ahead, you can help ensure that your beneficiaries receive the full benefit of the policy and are not burdened with unexpected tax liabilities.

Life Insurance and Section 8 Housing: What's the Verdict?

You may want to see also

Employer-paid life insurance is taxable above $50,000

If your employer provides you with life insurance, it is important to be aware of the tax implications. The Internal Revenue Service (IRS) considers employer-paid life insurance as a taxable fringe benefit. This means that if your employer pays for more than $50,000 in life insurance coverage, you will be subject to taxes on the portion of the premium that exceeds this threshold. This is because the IRS views this additional coverage as part of your taxable income.

For example, if your employer pays for a $100,000 life insurance policy, you will need to pay taxes on the portion above $50,000. The taxable amount is determined by IRS tables, which calculate the monthly or annual taxable income based on the age of the insured and the amount of coverage. It is worth noting that this taxation only applies if the policy is considered carried directly or indirectly by the employer, which means that the employer pays some or all of the cost of the insurance or arranges for the premium payments.

The first $50,000 of group-term life insurance coverage provided by your employer is excluded from taxable income and will not impact your income tax bill. However, the cost of coverage above this amount is considered "phantom income" and is included in the taxable wages reported on your Form W-2. This means that you will be responsible for paying federal, state, and local taxes, as well as Social Security and Medicare taxes, on the excess amount.

To determine if you are subject to these taxes, check Box 12 of your Form W-2 for a specific dollar amount with the code "C". This amount represents your employer's cost of providing group term life insurance coverage above $50,000, minus any amount you contributed. This amount is already included in your total "Wages, tips, and other compensation" in Box 1 of the W-2, which is the figure reported on your tax return.

It is important to consider the tax implications when deciding whether to opt for employer-paid life insurance or purchase your own policy. While employer-provided life insurance can be a valuable benefit, the additional taxes may outweigh the benefits of the coverage.

NFL Players: Lifetime Health Insurance Coverage?

You may want to see also

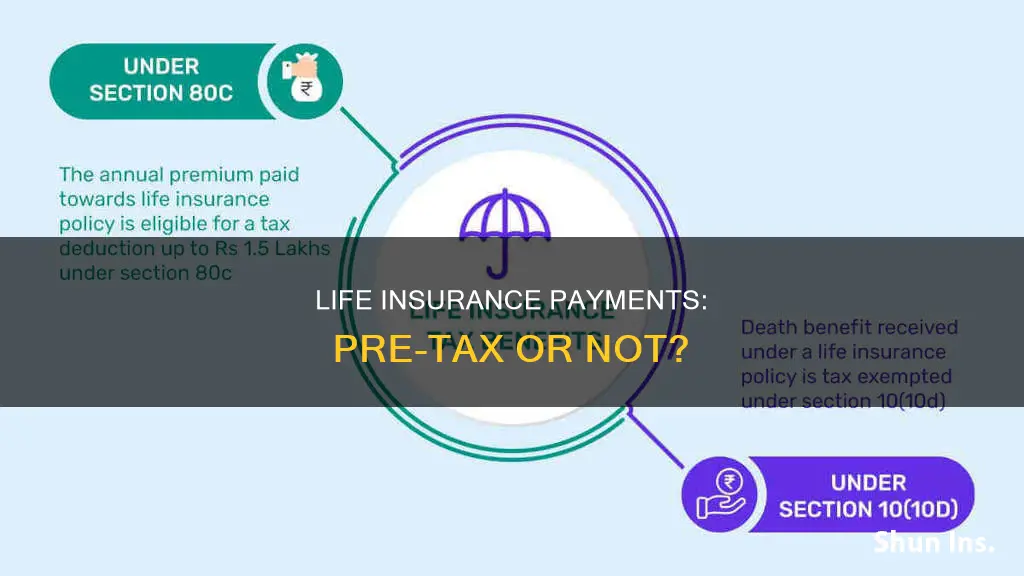

Pre-tax benefits reduce taxable income

Pre-tax benefits are a great way to reduce your taxable income. In the context of life insurance, there are a few scenarios where pre-tax benefits can come into play.

Firstly, let's understand what pre-tax benefits are. Pre-tax benefits are when the cost of a benefit is deducted from an employee's paycheck before income and employment taxes are applied. This reduces the total income amount that is taxed, resulting in lower income taxes for the employee. One example of this is when employees have Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). By pre-taxing reimbursement account contributions, employees save money immediately since they're contributing before taxation.

Now, let's explore how this applies to life insurance. If you have an employer-provided life insurance policy, the premium paid on policy amounts above $50,000 is generally considered part of your taxable income. This means that if your employer pays for a life insurance policy worth more than $50,000, you will have to pay taxes on the portion above that threshold. However, if the policy amount is $50,000 or less, there are no tax consequences, and you won't have to include it in your income.

Another scenario where pre-tax benefits can apply is when you choose to pay for your life insurance policy with pre-tax dollars. While life insurance premiums are not usually tax-deductible, there are certain exceptions. For example, if you are divorced and your divorce agreement was executed before 2019, any life insurance premiums you pay as part of that agreement are considered alimony and can be deducted from your income taxes. Additionally, if you own a business and provide life insurance for your employees, the premiums you pay may be tax-deductible as a business expense.

It's important to note that the tax implications of life insurance can vary depending on the type of policy you have and the specific circumstances. For example, if you have a whole life insurance policy, the interest generated is not taxed until the policy is cashed out. On the other hand, if you have a term life insurance policy, there is generally no cash value component, so the taxation is usually straightforward.

In conclusion, pre-tax benefits can indeed reduce your taxable income when it comes to life insurance. By taking advantage of employer-provided policies, exploring exceptions for tax deductions, and understanding the tax implications of different types of policies, you can minimize your tax burden and maximize the benefits of your life insurance coverage.

Haven Life Insurance: MyVisaJobs' Comprehensive Guide

You may want to see also

Post-tax benefits may provide future relief

Post-tax benefit contributions are taken from an employee's paycheck after taxes have already been deducted. This means that the employee generally won't owe any income tax on the benefits when they use the plan in the future. This is advantageous as it provides future relief when it's time to utilize the benefits.

While post-tax contributions for benefits do not reduce the overall tax burden, they can result in savings in the future. For example, if an employee's disability premium is deducted from their salary on a pre-tax basis, or if their employer pays the premium, the benefits will be taxable at the time they receive claim payment. It is typically preferred to deduct premiums post-tax because employees won't have to pay taxes on the benefits they receive in the future if they experience a disability.

In the context of life insurance, death benefits are typically tax-free, but there are exceptions. For instance, if your loved ones choose to receive the life insurance payout in installments instead of a lump sum, any interest that builds up on those payments could be taxed. On the other hand, if you receive life insurance proceeds as a beneficiary due to the death of the insured person, you generally don't have to include them in your gross income and don't need to report them to the IRS.

Additionally, life insurance premiums are not usually subject to sales tax, and they are also not tax-deductible under most circumstances. However, there are certain circumstances where the IRS will treat life insurance premiums differently, and you may face tax consequences. These cases often arise when a business owns or pays for the life insurance policy.

Life Insurance: Investing in Peace of Mind

You may want to see also

Frequently asked questions

Life insurance premiums are not usually subject to sales tax, and they are also not tax-deductible under most circumstances. However, states typically charge insurers a tax on the premiums they collect, which is likely passed on to the consumer.

Life insurance death benefits are typically tax-free, but there are exceptions. For example, if your beneficiary chooses to receive the life insurance payout in installments instead of a lump sum, any interest that builds up on those payments could be taxed.

Life insurance premiums are typically not tax-deductible for personal policies. However, there are a few exceptions. If you gift a life insurance policy to a charity and continue to pay the premiums, those payments are generally considered charitable donations and may be tax-deductible.

Yes, there are a few other tax implications to consider. If your employer pays for your life insurance, the premium paid on policy amounts above $50,000 is considered part of your taxable income. Additionally, interest generated from whole life insurance policies is not taxed until the policy is cashed out.