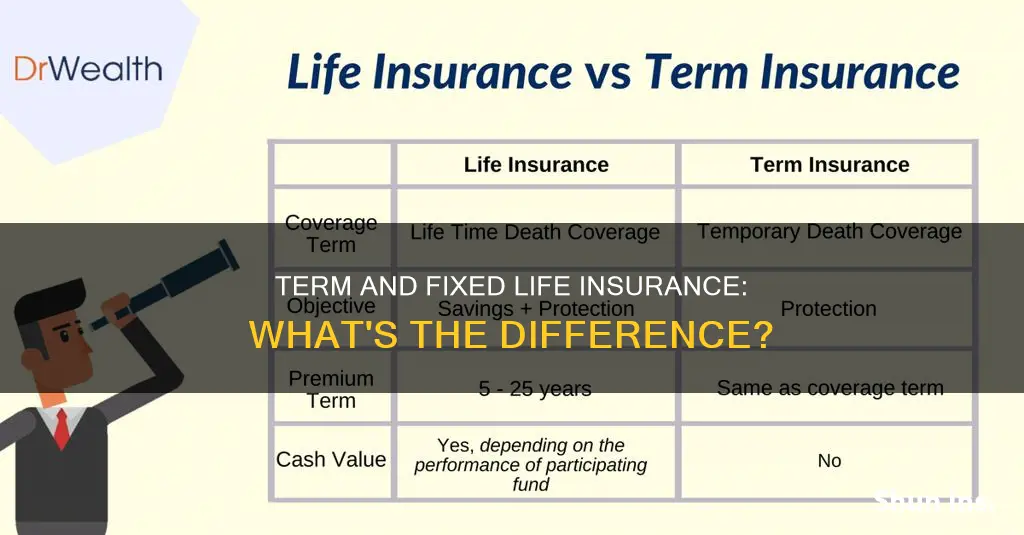

Term life insurance and whole life insurance are two types of life insurance policies. Term life insurance provides coverage for a set period, after which the policy expires. Whole life insurance, on the other hand, is a form of permanent life insurance that covers the insured person for their entire life. While term life insurance is typically cheaper, whole life insurance offers additional benefits such as a cash value component that can be borrowed against or withdrawn. Understanding the differences between these two types of policies can help individuals make informed decisions about their financial planning and ensure their loved ones are protected.

| Characteristics | Values |

|---|---|

| Length of Coverage | Term life insurance provides coverage for a set period, typically 10, 20 or 30 years. Whole life insurance, on the other hand, provides coverage for the entire life of the insured. |

| Cash Value | Term life insurance does not have a cash value component. Whole life insurance accumulates cash value over time, which can be borrowed against or withdrawn. |

| Cost | Term life insurance is generally cheaper than whole life insurance due to its temporary nature and lack of cash value. |

| Premium Payments | Term life insurance premiums may change over time. Whole life insurance premiums are locked in and remain the same throughout the policy. |

| Medical Exam | Term life insurance may or may not require a medical exam, depending on the policy. Whole life insurance often requires a medical exam to determine premiums and insurance risk. |

| Conversion Option | Some term life insurance policies can be converted into whole life policies, but this may be subject to deadlines or age limits. |

What You'll Learn

Term life insurance is temporary

Fixed Term

The most basic type of term life insurance is the fixed term, which usually lasts for 10, 20, or 30 years. During this period, the premiums remain static, and if the policyholder passes away, the beneficiary will receive a death benefit. Fixed-term insurance is the most popular choice as it offers predictable coverage for a specified duration.

Temporary Nature

Term life insurance is designed to provide temporary protection. Once the chosen term ends, the coverage expires, and there is no payout if the policyholder outlives the term. This is in contrast to permanent life insurance, which offers lifelong coverage as long as premiums are paid.

Renewal Options

While term life insurance is temporary, it often comes with renewal options. Policyholders can choose to renew their coverage for another term, but the premiums will increase based on their age at the time of renewal. This allows individuals to extend their coverage if they still have financial obligations or dependents relying on them.

Short-Term Needs

Term life insurance is well-suited for individuals with short-term needs or those who are just starting out and are on a budget. For example, new parents might opt for a 20-year policy to cover them until their child becomes financially independent. Term life insurance provides the flexibility to choose a term length that aligns with specific financial obligations or life stages.

Cost-Effectiveness

One of the main advantages of term life insurance is its cost-effectiveness. It is typically the cheapest type of life insurance because it offers temporary coverage without a cash value component. This makes it a good option for those who need coverage but are working within a limited budget.

Get Life Insurance for Your Dad: A Step-by-Step Guide

You may want to see also

Whole life insurance is permanent

Term life insurance is cheaper than whole life insurance, but it only covers the policyholder for a set number of years. Whole life insurance, on the other hand, is a permanent form of insurance that covers the policyholder for their entire life. Whole life insurance is more expensive because the coverage lasts a lifetime, and the policy grows in cash value.

Whole life insurance is a permanent life plan that provides coverage throughout one's entire life. The premiums tend to be more costly than those of a term plan, but getting this insurance plan may be beneficial in the long run. Whole life insurance premiums are determined by the policyholder's age, medical history, and coverage goals. These factors allow insurance companies to create a plan that suits the policyholder's needs. Once decided, the premiums are fixed throughout the plan, and the death benefit is certain.

Whole life insurance is a popular choice for those who want to maximise the cash value for their loved ones. The beneficiary is not required to pay any income taxes on the death benefit. Whole life insurance is also a good option for those who have maxed out their tax-advantaged retirement accounts or have lifelong dependents, such as children with special needs.

Whole life insurance policies build cash value over time, which can be used to help pay for college, supplement retirement income, or cover emergencies. Policyholders are also eligible to receive valuable dividends, which can be used to increase the death benefit or help pay premiums. The cash value of whole life insurance policies grows at a guaranteed fixed rate, and the death benefit is also guaranteed.

Life Insurance and Cirrhosis: What Coverage is Offered?

You may want to see also

Term life insurance is cheaper

Term life insurance is significantly cheaper than whole life insurance. This is because term life insurance offers temporary coverage for a specific period, such as 10, 20, or 30 years, while whole life insurance provides coverage for an entire lifetime. Term life insurance also does not build cash value, which further contributes to its lower cost.

The cost of term life insurance is generally based on the policy's value, the age, gender, and health of the insured person, and other factors like the company's business expenses and mortality rates. The premiums for term life insurance remain the same throughout the policy period and do not increase with age. This makes it an attractive option for young people with children or those with growing families, as they can obtain substantial coverage at a low cost.

Term life insurance is also ideal for those who want substantial coverage at a low price. It is a good choice for individuals who want to provide financial protection for their loved ones but are on a tight budget. By choosing term life insurance, they can ensure their family's financial security without incurring high insurance costs.

Additionally, term life insurance offers flexibility. Policyholders can choose the term length that suits their unique needs and can adjust their coverage as their circumstances change. This adaptability makes term life insurance a popular choice for those who want control over their financial planning.

In summary, term life insurance is significantly more affordable than whole life insurance due to its temporary nature and lack of cash value accumulation. It is a cost-effective option for individuals seeking financial protection for their loved ones, especially those with limited budgets or specific timelines they want to plan around.

Haven Life: Insuring Innovation for the Reporter's Life

You may want to see also

Whole life insurance has a cash value component

Whole life insurance is a form of permanent life insurance that covers the insured person for their entire life. It also has a savings component, known as the cash value, which functions similarly to a retirement savings account. The policyholder can use the cash value for several purposes, including borrowing or withdrawing cash from it, or using it to pay policy premiums.

The cash value of a whole life insurance policy earns interest, and taxes are deferred on the accumulated earnings. While premiums are paid and interest accrues, the cash value builds over time. As the life insurance cash value increases, the insurance company's risk decreases, as the accumulated cash value offsets part of the insurer's liability.

The cash value of a whole life policy typically earns a fixed rate of interest. However, some policies are eligible for dividend payments, which can be used to increase the cash value. The policyholder may also be able to make additional payments into the cash value, which can further increase the final death benefit.

Withdrawals and outstanding loan balances reduce the death benefit. If the policyholder withdraws more than the amount they have paid into the cash value, that portion will be taxed as ordinary income.

Whole life insurance is more expensive than term life insurance because of the cash value element. Term life insurance does not have a cash value component, and only pays out a death benefit if the insured person dies within a specified time frame.

Life Insurance Payouts: Are They Taxable?

You may want to see also

Whole life insurance premiums are fixed

Term life insurance and whole life insurance are two different types of life insurance policies. Term life insurance is a temporary policy that covers the policyholder for a specific period, such as 10, 15, or 20 years, while whole life insurance is a permanent policy that covers the policyholder for their entire life. Whole life insurance policies also have a cash value component, which allows the policyholder to borrow against the policy or withdraw funds. This feature is not available with term life insurance.

The fixed nature of whole life insurance premiums also has some disadvantages. For individuals with variable incomes, it may be challenging to make premium payments during years when earnings are lower. In such cases, a universal life insurance policy, which offers more flexibility in premium payments, may be a more suitable option. Additionally, the fixed premiums may limit the ability to adjust the death benefit over time.

While whole life insurance premiums are fixed, the cash value component of the policy can grow over time. This growth is guaranteed and insulated from financial market performance, providing a sense of financial confidence to policyholders. The cash value accumulates on a tax-deferred basis, and any withdrawals or loans taken against the cash value are typically tax-free up to the amount of premiums paid.

In summary, whole life insurance premiums are fixed for the duration of the policy, providing stability and predictability for policyholders. However, the fixed nature of the premiums may also limit flexibility, especially for those with variable incomes. The cash value component of whole life insurance policies offers additional benefits, such as tax-efficient growth and the ability to borrow or withdraw funds. Overall, whole life insurance can be a valuable tool for individuals seeking lifelong coverage and a way to build financial assets.

Life Insurance and Coronavirus: What's Covered?

You may want to see also

Frequently asked questions

Term life insurance provides coverage for a set period, after which the policy expires. Basic term life insurance lengths are 10, 20, or 30 years.

Fixed life insurance, also known as whole life insurance, is a form of permanent life insurance that covers the policyholder for their entire life rather than a fixed period of time.

No. Term life insurance is temporary and provides coverage for a set period, whereas fixed life insurance is permanent and covers the policyholder for their entire life.

Term life insurance is generally the cheapest option and allows the policyholder to choose the term length that suits them best. However, it only provides coverage for a set period, after which the policy expires.

Fixed life insurance offers permanent coverage and includes a cash value component that can be withdrawn or borrowed against. However, it is usually more expensive than term life insurance.