Life insurance for parents is a sensitive topic but it is possible to get a policy for your dad. As an adult, you can buy life insurance for your father, but you'll need to meet certain requirements. Firstly, you must have your dad's consent and signature as the insured person has to provide approval. Secondly, you'll need to prove insurable interest, meaning that you would suffer financial loss upon your father's death. This could include funeral costs, end-of-life medical expenses, or inheriting your father's debts and mortgage. The type of policy you choose will depend on your dad's age, financial situation, and health. It's best to consult a financial advisor and insurance agent to determine the best option for your family's needs.

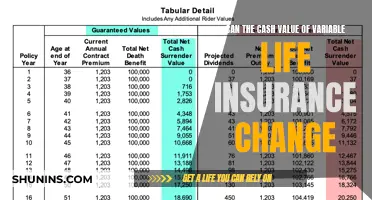

| Characteristics | Values |

|---|---|

| Consent | Required |

| Insurable interest | Required |

| Application | Required |

| Medical exam | May be required |

| Policy owner | You or your parent |

| Policy beneficiary | You or another close loved one |

What You'll Learn

Getting consent from your dad

Initiating the Conversation:

Start by setting a dedicated time to talk with your dad about life insurance. Choose a quiet and private setting where you both feel comfortable and won't be disturbed. It's important to approach the topic with empathy and understanding, especially if it's a difficult conversation for him. Begin by explaining your concerns and the reasons why you think having a life insurance policy is beneficial for both of you.

Explaining the Benefits:

Outline the advantages of the policy, emphasizing how it can provide financial protection for both of you. Discuss how it can help cover end-of-life expenses, including medical costs, funeral services, burial or cremation costs, and any outstanding debts. Highlight that having a policy in place will give you both peace of mind and ensure that you're not burdened by unexpected expenses during a difficult time.

Addressing Concerns and Answering Questions:

Be prepared to address any concerns or questions your dad may have. He might have reservations about the cost, the complexity of the process, or the perceived morbidity of discussing life insurance. Provide clear and honest answers, and reassure him that you're there to help navigate the process together. Explain that while cost is a valid concern, there are various options available, and you can work together to find a plan that suits his needs and your budget.

Involving Him in the Process:

Encourage your dad to actively participate in choosing the type of life insurance that best suits his circumstances. Discuss the different options, such as term life insurance or whole life insurance, and explain the pros and cons of each. Emphasize that his input is valued and respected, and that you want to make sure the policy aligns with his preferences and needs.

Providing Information and Support:

Offer to help gather the necessary information for the application process, but also respect your dad's autonomy in providing his personal details. Explain that the application will require sensitive information, such as his Social Security number, driver's license number, and medical history. Reiterate that this information will be kept confidential and is essential for securing the policy.

Obtaining Signature and Finalizing Consent:

Finally, once your dad has agreed to the policy and understands its benefits and implications, obtain his signature on the necessary documents. Explain that his signature is a legal requirement and that the policy cannot be finalized without it. Reassure him that you are available to answer any further questions or address any concerns that may arise during the application process or in the future.

Remember, this conversation is about ensuring your dad's comfort and agreement with the life insurance policy. By taking the time to explain, involve, and support him throughout the process, you can help make it a more positive and collaborative experience.

Canceling Life Insurance: What You Need to Know

You may want to see also

Proving insurable interest

Insurable interest can be demonstrated in several ways. For example, if you rely on your dad's income for financial support, or if he has a mortgage or medical bills that will need to be paid after he's gone. Other examples include funeral costs, final expenses, and any debts that could be passed down to you.

The insurance company will investigate the relationship between you and your dad to determine if there is an insurable interest. They will likely request identification and conduct a phone interview to inquire about the relationship and insurable interest. If an insurable interest is not found, the policy application will be denied.

It's important to note that you will need your dad's consent to take out a life insurance policy on him. He will need to provide a signature, and he may also need to undergo a medical exam, depending on the type of policy and the insurance company's requirements.

Life Insurance and MS: What Coverage is Offered?

You may want to see also

Filling out the application

Consent and Signature

Firstly, you will need your dad's consent and signature on the application. This is a legal requirement, and it is illegal to forge a signature. Your dad will also need to answer some potentially private medical questions.

Insurable Interest

You will need to prove that you have insurable interest, meaning that you will suffer financial hardship in the event of your dad's death. This could include any debts or financial obligations that would be passed on to you, or if you rely on your dad's financial support.

Identification Information

The application will also require your dad's sensitive identification information, such as his Social Security number, name, and address.

Health Information

Depending on the type of policy, your dad may need to undergo a medical exam. The insurer will also likely ask for information about his height, weight, lifestyle habits, and medical history.

Policy Owner and Beneficiary

You can be both the policyholder and the beneficiary, but check with your insurance agent to see what is best for your situation. The policy owner is responsible for paying the premiums, and the beneficiary will receive the benefits.

Application Review and Approval

Once the application is complete, the insurance company will review your dad's health information and other data, such as his driving record, to determine approval and how much they will charge for the policy.

Insurers' Investment Risk: Whole Life Insurance Explained

You may want to see also

Choosing the right type of life insurance

There are several types of life insurance policies available, and it is important to select one that suits your needs. Here are some options to consider:

Term life insurance

Term life insurance covers a set period, often between 5 and 30 years. The coverage ends when the policy term ends, unless there is an option to renew, which would come at a higher premium. Term life insurance is a good option if you want to cover the years of a mortgage or other debt or replace income if your father passes away. It is also less expensive than other types of life insurance.

Whole life insurance

Whole life insurance, on the other hand, never expires as long as the premium is paid and will pay out a death benefit regardless of when the policyholder passes away. Whole life insurance policies can potentially build cash value, although this can take many years. While whole life insurance offers more security, the premiums tend to be higher.

Universal life insurance

Universal life insurance is another type of permanent life insurance. Even though some universal life policies have a maximum age specified, it ensures a policy is in place no matter when your father dies. Universal life insurance policies can also potentially build cash value.

Final expense life insurance

Final expense life insurance, also known as burial insurance, is designed to cover funeral costs and unpaid medical bills. It typically supplies a small payout when the insured person dies. This type of insurance is ideal if you are concerned about funeral costs, which can be upwards of $9,000 on average.

Guaranteed issue life insurance

Guaranteed issue life insurance does not require a medical exam, but it is one of the most expensive ways to buy life insurance. The death benefits are usually very low, between $5,000 and $25,000, and there is usually a waiting period of two years before the full policy payout can be claimed.

When choosing a life insurance policy for your father, consider factors such as his age, financial situation, and overall health. Additionally, assess any debts and income goals to determine the coverage amount needed. Remember that you will need your father's consent to purchase a life insurance policy for him, and he will likely need to undergo a medical exam and provide sensitive identification information.

Military Life Insurance: Discharge and Your Coverage

You may want to see also

Paying the premiums

- Understanding Premium Costs: The cost of life insurance premiums varies depending on several factors, including your dad's age, health, and the type of policy chosen. Term life insurance, which covers a specific period, is generally more affordable but may be challenging to qualify for if your dad has pre-existing health conditions. On the other hand, whole life insurance tends to have higher premiums but offers lifelong coverage as long as the premiums are paid. The policy's death benefit amount and your dad's age will also impact the premium cost.

- Determining Payment Responsibility: When purchasing life insurance for your dad, you can decide who will own the policy and be responsible for paying the premiums. In some cases, your dad can own the policy and make the premium payments himself, especially if he wants to maintain control over the policy. However, if your dad is on a limited income, you or another family member can own the policy and handle the premium payments. As long as you are listed as the beneficiary, you will receive the benefits when your dad passes away.

- Insurable Interest and Consent: To purchase life insurance for your dad, you must demonstrate "insurable interest," meaning that you would suffer financial hardship in the event of his death. This could include financial dependence on your dad, co-signing loans or mortgages, or expecting to inherit his debts and end-of-life expenses. Additionally, remember that you need your dad's consent to buy life insurance for him. He will need to sign the insurance application and may need to disclose private medical information.

- Selecting a Policy: The type of life insurance policy you choose will impact the premium payments. Term life insurance offers coverage for a specific term, such as 10, 20, or 30 years, and is generally more affordable. Whole life insurance, on the other hand, provides coverage for your dad's entire life as long as the premiums are paid and tends to have higher premiums. Consider your dad's age, health, and the financial obligations you want to cover when selecting a policy.

- Payment Frequency and Methods: Life insurance premiums are typically paid on a monthly or annual basis. When setting up the policy, you can choose the payment frequency that works best for your budget and financial situation. Most insurance companies offer various payment methods, including automatic payments from your bank account, credit card payments, or paying through an online portal or mobile app. Be sure to ask about the available payment options and select the one that suits you best.

- Maintaining Regular Payments: It is essential to stay on top of the premium payments to keep the life insurance policy active. Missing payments or paying late may result in penalties or even policy cancellation. Set up a reliable system for making the payments, such as setting reminders or automating the payments if possible. Additionally, review the policy documents to understand the grace period allowed for late payments and any other relevant terms and conditions.

CVS and Tricare: Insurance and Life Coverage Options

You may want to see also

Frequently asked questions

No, you cannot get life insurance for your dad without his consent. He will need to provide a signature and may need to undergo a medical exam.

You will need to fill out an application form with sensitive identification information, such as your dad's Social Security number, and information about his health.

This depends on several factors, including your dad's age, health, and the duration of the financial obligation you want to cover. Term life insurance covers a set period, whereas whole life insurance never expires as long as the premium is paid.

This depends on how his loss will affect you financially. Consider any debts he has that you will be responsible for, any monthly expenses or medical bills, and the type of funeral services he may want.

The cost of life insurance depends on various factors, including your dad's age and health. Generally, the older and less healthy your dad is, the higher the cost of the premium.