Variable life insurance is a type of permanent life insurance that includes a death benefit and a cash value component. The cash value component is typically invested in mutual funds, but can also be invested in other assets. This means that the cash value of a variable life insurance policy can change, as it is subject to the performance of the investments chosen. While this offers the potential for higher returns compared to other types of life insurance, it also carries more risk. The cash value of a variable life insurance policy can increase or decrease depending on the performance of the underlying investments, and there is no guarantee that the cash value will always be positive.

| Characteristics | Values |

|---|---|

| Type of life insurance | Permanent life insurance |

| Payout | Death benefit to beneficiaries when the insured person dies |

| Investment component | Yes, cash-value account with money that is invested, typically in mutual funds |

| Risk | Higher than other life insurance policies |

| Tax advantages | Yes |

| Volatility | More volatile than standard life insurance policies |

| Access to cash value | Yes, for other purposes such as paying for a major expense |

| Fixed account | Yes, to receive a fixed rate of interest and reduce overall risk |

| Premium | Variable, depending on the policy |

| Prospectus | Provided by the insurance company, detailing all policy charges, fees, and sub-account expenses |

| Look period | Short period of time after buying the policy when it can be cancelled with no charge and premiums returned |

| Tax on cash value | Not taxable as ordinary income |

What You'll Learn

The cash value of variable life insurance is dependent on market performance

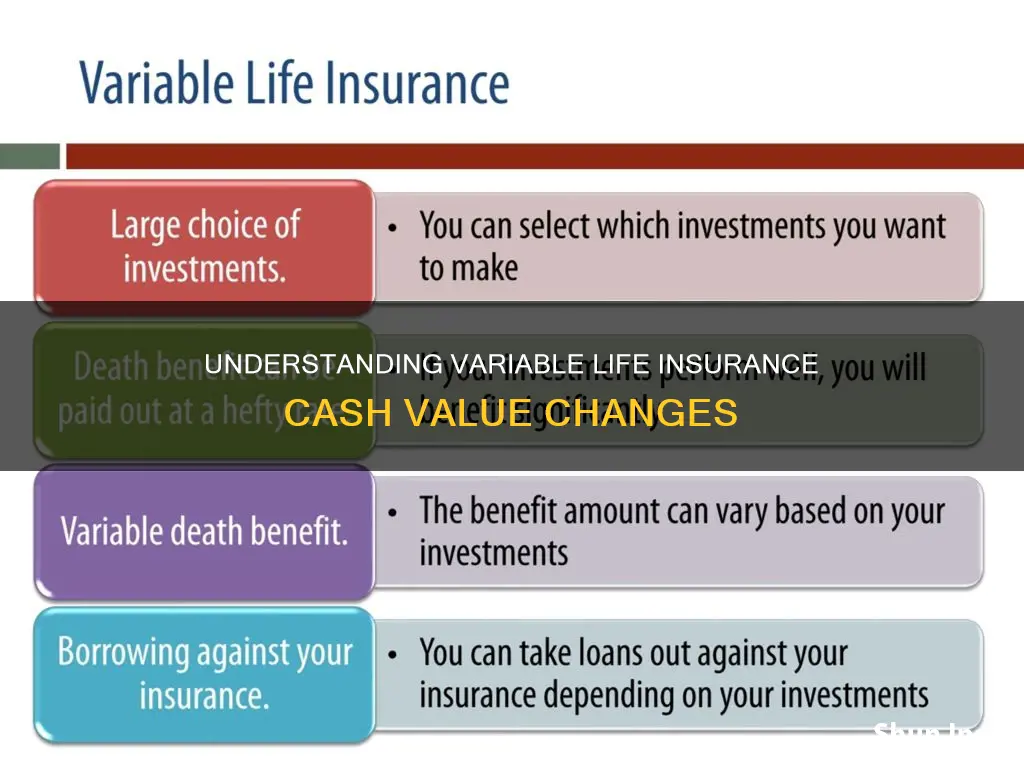

Variable life insurance is a type of permanent life insurance policy that includes a death benefit and a cash value component. The cash value of a variable life insurance policy is dependent on market performance. This means that the cash value can increase or decrease based on the performance of the underlying investments, which are typically mutual funds, bonds, or stocks. While variable life insurance offers the potential for higher returns compared to other types of life insurance, it also carries more risk due to its volatility and exposure to market fluctuations.

The cash value component of variable life insurance is invested in assets, such as mutual funds, which may rise or fall in value. As a result, these policies are considered more volatile and carry more risk compared to other types of life insurance policies. The policyholder can choose how to allocate the cash value across different investment options, allowing them to take an active role in managing their investments. The performance of these investments will then determine the growth of the cash value. If the market performs well, the cash value will increase, providing the potential for higher returns. On the other hand, if the market performs poorly, the cash value may decrease, leading to potential losses.

The cash value of a variable life insurance policy can be accessed by the policyholder during their lifetime. They can choose to withdraw the money as cash, use it to increase the death benefit, or borrow it as a loan. However, it is important to note that withdrawing or borrowing against the cash value may reduce the death benefit and could also incur taxes and fees. Additionally, if the cash value is insufficient to cover the policy fees and charges, the policy may lapse, and the policyholder would need to make additional premium payments to keep the policy active.

Overall, the cash value of variable life insurance is directly influenced by market performance, providing both the opportunity for higher returns and the risk of potential losses. It offers policyholders the flexibility to invest their cash value and potentially benefit from market gains, but it also exposes them to the volatility and risks associated with the financial markets. Therefore, variable life insurance is suitable for individuals who are comfortable with taking on more risk and actively managing their investments.

Best Indexed Universal Life Insurance: Smart Financial Planning

You may want to see also

Variable life insurance policies carry more risk than other policies

Variable life insurance policies are therefore considered more volatile than standard life insurance policies. They are an option for individuals who don't mind risk and are comfortable with the level of risk involved. However, they are not suitable for everyone.

Variable life insurance policies also tend to have high premiums and fees, and the amount of money that can be made on the cash value is limited. There may also be limited investment options, and the returns may be capped.

If you are considering a variable life insurance policy, it is important to review all the costs and determine whether you can afford this type of policy. You should also consider the financial strength of the insurance company and whether the policy fits within your overall financial plan.

Covid Vaccines: Life Insurance Impact?

You may want to see also

Variable life insurance is a permanent policy

Variable life insurance is a permanent life insurance policy with an investment component. It is designed to last for the entirety of the policyholder's life. It is a combination of a death benefit and a cash-value account that is typically invested in mutual funds.

The cash value component of variable life insurance is what sets it apart from other types of life insurance. This cash value is invested in assets like mutual funds, which means it may rise or fall in value. This feature makes variable life insurance policies more volatile and riskier compared to other life insurance policies.

The cash value of a variable life insurance policy can be invested in various ways, including mutual funds, index funds, equities, bonds, or money market funds. The policyholder has control over how this money is invested, and the value of the account will depend on the premiums paid, investment performance, and associated fees and expenses.

As a permanent policy, variable life insurance provides coverage until the policyholder's death, as long as the premiums are paid and the terms of the policy are met. The beneficiaries will receive a payout, known as the death benefit, which is the specified coverage amount.

Variable life insurance policies offer flexibility, as the death benefit and premiums are adjustable. They also provide tax advantages, as the returns on the variable policies are typically tax-free. However, it is important to note that there are risks associated with these policies due to the potential for investment losses.

Middle-Class Life Insurance: How Big Is Too Big?

You may want to see also

Variable life insurance includes a death benefit

Variable life insurance is a type of permanent life insurance policy. It combines a death benefit with a savings component, called a cash value account. This coverage can last your entire life so long as you continue paying for the insurance costs.

A variable life insurance policy works much like any life insurance policy in that you pay a premium and then your beneficiaries receive a benefit when you die. As a permanent policy, the coverage is in effect until your death.

The death benefit is a guaranteed payout as long as premiums are paid and the terms of the policy are met. Variable life insurance also has an adjustable death benefit and premiums, making it one of the more flexible life insurance policies available.

Variable life insurance policies may have significant benefits, including financial protection for your family, a potentially increased death benefit, and flexibility and choice. However, there are also potential downsides to variable life insurance, such as high premiums, capped returns, and limited investment options.

If you are considering variable life insurance, be sure to review all the costs, determine how much coverage you need and how long you will need the insurance, and ensure that the insurance company providing the policy is reputable.

Hartford Supplemental Life Insurance: What You Need to Know

You may want to see also

Variable life insurance has tax advantages

Variable life insurance has several tax advantages. Firstly, the cash value of a variable life insurance policy accumulates on a tax-deferred basis. This means that you will only be taxed when you withdraw money from the policy. Secondly, policyholders can take loans from their policy without paying federal income taxes, although if the policy terminates with an outstanding loan, federal income taxes may be owed. Thirdly, the death benefit paid to beneficiaries is not subject to federal income tax, and under certain circumstances, it may also be exempt from federal estate tax. Finally, the growth of the cash value account is not taxable as ordinary income, and the accounts can be drawn upon in later years without income taxation if loans are taken out using the account as collateral.

How Life Insurance Inheritance Works for Children

You may want to see also

Frequently asked questions

Yes, the cash value of variable life insurance can change. The cash value of variable life insurance is invested in assets like mutual funds, meaning it may rise or fall in value.

Variable life insurance is a type of permanent life insurance policy with an investment component. The policy has a cash-value account with money that is invested, typically in mutual funds.

Variable life insurance offers several benefits, including:

- A death benefit for beneficiaries when the policyholder dies.

- A cash value component that can be accessed for other purposes, such as paying for a major expense.

- Tax advantages, as returns on variable policies are typically tax-free.

Variable life insurance also carries certain risks, including:

- The potential for the policy's cash value to lose money if the market performs poorly.

- Higher premiums compared to other types of life insurance due to the added investment component.

- The possibility of capped returns on investments.