Whole life insurance is a long-term financial product that provides coverage for the entire lifetime of the insured individual. It offers a range of benefits, including a guaranteed death benefit, which is paid out to the policyholder's beneficiaries upon their passing. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers permanent coverage and a cash value component that grows over time. This feature allows policyholders to build a savings element within their insurance policy, which can be borrowed against or withdrawn, providing financial security and flexibility. Understanding the features and advantages of whole life insurance is essential for individuals seeking comprehensive and reliable coverage.

What You'll Learn

- Definition: Whole life insurance provides lifelong coverage, offering a fixed death benefit and cash value accumulation

- Benefits: It offers guaranteed death benefit, investment growth, and flexible loan options

- Premiums: Premiums are typically level, ensuring consistent costs throughout the policy's life

- Flexibility: Policyholders can access cash value, make loans, or surrender the policy for its cash value

- Longevity: Whole life ensures coverage for the entire life of the insured, providing peace of mind

Definition: Whole life insurance provides lifelong coverage, offering a fixed death benefit and cash value accumulation

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. It is a long-term financial commitment that offers a range of benefits and features. One of the key advantages of whole life insurance is the guarantee of lifelong coverage. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force as long as the policyholder pays the premiums. This ensures that the insured individual and their beneficiaries are protected financially throughout their lives.

The primary purpose of whole life insurance is to provide a financial safety net for the insured's loved ones. In the event of the insured's death, the death benefit is paid out to the designated beneficiaries. This fixed death benefit is a predetermined amount agreed upon when the policy was taken out and remains constant over the policy's lifetime. It provides a secure financial foundation for the beneficiaries, ensuring they receive the intended financial support during a challenging time.

In addition to the death benefit, whole life insurance also accumulates cash value. This is a significant feature that sets it apart from other insurance products. As the policyholder makes regular premium payments, a portion of the premium goes towards building cash value. This cash value grows over time, earning interest, and can be used for various purposes. Policyholders can access this cash value through policy loans or withdrawals, providing financial flexibility and the potential for tax-advantaged growth.

The cash value accumulation in whole life insurance offers several benefits. Firstly, it ensures that the policy remains in force even if the insured individual faces financial difficulties and cannot afford the premiums. The cash value can be used to pay for the premiums, ensuring continuous coverage. Secondly, the cash value can be a valuable asset that can be borrowed against or withdrawn, providing financial resources for the policyholder during their lifetime. This feature also allows for potential tax-efficient growth, as the cash value may grow tax-deferred until it is withdrawn or borrowed.

In summary, whole life insurance provides lifelong coverage, offering a fixed death benefit and the accumulation of cash value. It is a comprehensive financial tool that ensures the insured individual's loved ones are protected financially and provides the policyholder with potential financial flexibility and growth opportunities. Understanding the definition and features of whole life insurance is essential for individuals seeking long-term financial security and a reliable safety net for their beneficiaries.

Unraveling the Mystery: What is the CEFLI in Life Insurance?

You may want to see also

Benefits: It offers guaranteed death benefit, investment growth, and flexible loan options

Whole life insurance is a comprehensive and long-term financial protection plan that provides a range of benefits to policyholders. One of its key advantages is the guaranteed death benefit, which ensures that the beneficiary receives a specified amount of money upon the insured individual's death. This guarantee is a significant feature, offering financial security and peace of mind to the policyholder's loved ones. The death benefit is typically paid out tax-free, providing a substantial financial cushion during a challenging time.

In addition to the death benefit, whole life insurance also offers investment growth potential. Policyholders can allocate a portion of their premium payments into an investment account, often referred to as the cash value. This cash value grows over time, providing a tax-deferred investment opportunity. The investment growth can accumulate and be used for various purposes, such as funding education expenses, starting a business, or simply building a substantial savings pot. This feature allows individuals to make the most of their insurance policy while also growing their wealth.

Another advantage of whole life insurance is the flexibility it provides in terms of loan options. Policyholders can borrow against the cash value of their policy, allowing them to access funds without selling the policy or disrupting their insurance coverage. These loans can be used for various financial needs, such as home improvements, debt consolidation, or funding business ventures. The interest rates on these loans are typically lower than those of traditional loans, making it an attractive and cost-effective borrowing option.

Furthermore, the loan options associated with whole life insurance provide a safety net during financial emergencies. Policyholders can borrow against their policy's cash value, providing immediate access to funds without the need for extensive paperwork or credit checks. This flexibility ensures that individuals can manage unexpected expenses or take advantage of investment opportunities without disrupting their insurance coverage.

In summary, whole life insurance offers a comprehensive package of benefits, including a guaranteed death benefit, investment growth potential, and flexible loan options. These features provide financial security, wealth accumulation, and the ability to access funds when needed, making it a valuable tool for long-term financial planning and protection. Understanding these advantages can help individuals make informed decisions about their insurance coverage and overall financial strategy.

U.S.A.A. Life Insurance: What You Need to Know

You may want to see also

Premiums: Premiums are typically level, ensuring consistent costs throughout the policy's life

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. One of the key features that sets whole life insurance apart from other types of policies is its level premiums. When you purchase a whole life insurance policy, you agree to pay a fixed premium amount at regular intervals (usually monthly, quarterly, or annually) for the duration of the policy. This level premium structure is a defining characteristic of whole life insurance and offers several advantages.

Level premiums mean that your insurance costs remain consistent and predictable over the life of the policy. Unlike term life insurance, where premiums increase annually based on age and other factors, whole life insurance premiums are set at the time of purchase and do not change. This predictability allows policyholders to plan their finances more effectively, as they know exactly how much they will pay each period. It also ensures that the policyholder's coverage remains at the agreed-upon level without any surprises or sudden increases in costs.

The consistency of premiums is a significant benefit for policyholders, especially those who have already made long-term financial commitments or have planned their retirement savings. With a level premium, individuals can budget their expenses more accurately, knowing that their insurance payments will remain stable. This predictability can provide peace of mind, knowing that your loved ones will be financially protected for the long term, and you won't have to worry about unexpected premium hikes.

Additionally, the level premium structure of whole life insurance encourages long-term savings. As the premiums are consistent, a portion of each payment goes towards building a cash value within the policy. This cash value grows tax-deferred and can be borrowed against or withdrawn, providing a source of funds for various financial needs. Over time, the accumulation of cash value can become a substantial asset, offering both insurance protection and a potential investment opportunity.

In summary, the level premiums of whole life insurance provide policyholders with the assurance of consistent costs and predictable financial planning. This feature, combined with the permanent nature of the policy, makes whole life insurance an attractive option for those seeking long-term financial security and insurance coverage. Understanding the premium structure is essential when evaluating the benefits of whole life insurance and making informed decisions about your insurance needs.

Life Insurance for Students: Protecting Your Future and Well-Being

You may want to see also

Flexibility: Policyholders can access cash value, make loans, or surrender the policy for its cash value

Whole life insurance offers a unique advantage in terms of flexibility, providing policyholders with various options to manage their financial needs. One of the key benefits is the ability to access the cash value built up within the policy. Over time, as premiums are paid, a portion of the money goes into a cash value account, which grows tax-free. This cash value can be utilized in several ways. Policyholders can borrow against this value, taking out a loan with interest, allowing them to access funds for various purposes without selling the policy. This feature is particularly useful for those who need immediate financial resources but want to keep their insurance coverage intact.

Additionally, the flexibility of whole life insurance extends to the option of policy surrender. If a policyholder decides to terminate the policy, they can surrender it and receive the accumulated cash value. This provides a financial safety net, especially if the individual no longer requires the insurance coverage or needs the funds for other commitments. The cash value can be withdrawn, providing a lump sum amount, which can be a valuable financial resource. This flexibility ensures that policyholders have control over their insurance and can adapt it to changing financial circumstances.

The ability to make loans against the policy's cash value is another advantage. Policyholders can borrow funds, often at favorable interest rates, using the cash value as collateral. This can be beneficial for various financial needs, such as starting a business, funding education, or making significant purchases. By accessing the cash value, individuals can leverage their insurance policy to achieve their financial goals without disrupting their insurance coverage.

Furthermore, the flexibility of whole life insurance allows policyholders to adapt their coverage as their financial situation changes. If an individual's needs evolve, they can adjust the policy accordingly. This might involve increasing or decreasing the death benefit or making changes to the premium payments. The policy can be tailored to suit the policyholder's preferences, ensuring that the insurance remains relevant and beneficial over time.

In summary, whole life insurance provides policyholders with a flexible financial tool. The ability to access cash value, make loans, and surrender the policy for its cash value offers individuals control over their financial resources. This flexibility ensures that whole life insurance can be a valuable long-term financial strategy, providing both protection and a means to manage personal finances effectively. Understanding these options empowers individuals to make informed decisions about their insurance coverage and overall financial planning.

Life Insurance Payouts: Understanding the Minimum Coverage

You may want to see also

Longevity: Whole life ensures coverage for the entire life of the insured, providing peace of mind

Whole life insurance is a type of permanent life insurance that offers coverage for the entire life of the insured individual. This means that as long as the policyholder pays the premiums, the insurance company will provide a death benefit to the beneficiary upon the insured's passing. One of the key advantages of whole life insurance is its longevity guarantee. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in force for the entire life of the insured, ensuring that the policyholder's loved ones are protected financially, no matter how long they live.

The concept of longevity in whole life insurance is particularly appealing to those seeking long-term financial security. By locking in coverage for the entire life of the insured, whole life insurance provides a sense of stability and peace of mind. Policyholders can rest assured that their loved ones will receive the intended financial support, even if it means the insurance company will continue to pay out benefits for decades or even centuries after the initial policy purchase. This longevity aspect is especially valuable for those who want to ensure their family's financial well-being over an extended period.

In addition to the longevity benefit, whole life insurance also offers other valuable features. It typically includes a cash value component, which grows tax-deferred over time. This cash value can be borrowed against or withdrawn, providing policyholders with a source of funds that can be used for various purposes, such as education expenses or business ventures. Furthermore, the death benefit in whole life insurance is often guaranteed, meaning it will not decrease in value due to market fluctuations, providing a stable and predictable financial safety net.

When considering whole life insurance, it is essential to understand the commitment it entails. Policyholders must ensure they can afford the long-term premiums, as missing payments could result in coverage lapse. However, once the policy is in force, the coverage is permanent, and the benefits are locked in, providing a reliable source of financial protection for the insured's entire life.

In summary, whole life insurance offers a unique and valuable proposition with its longevity guarantee. By providing coverage for the entire life of the insured, it offers peace of mind and financial security to policyholders and their beneficiaries. The combination of long-term coverage, cash value accumulation, and guaranteed death benefits makes whole life insurance an attractive option for those seeking comprehensive and reliable financial protection.

Group Variable Universal Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

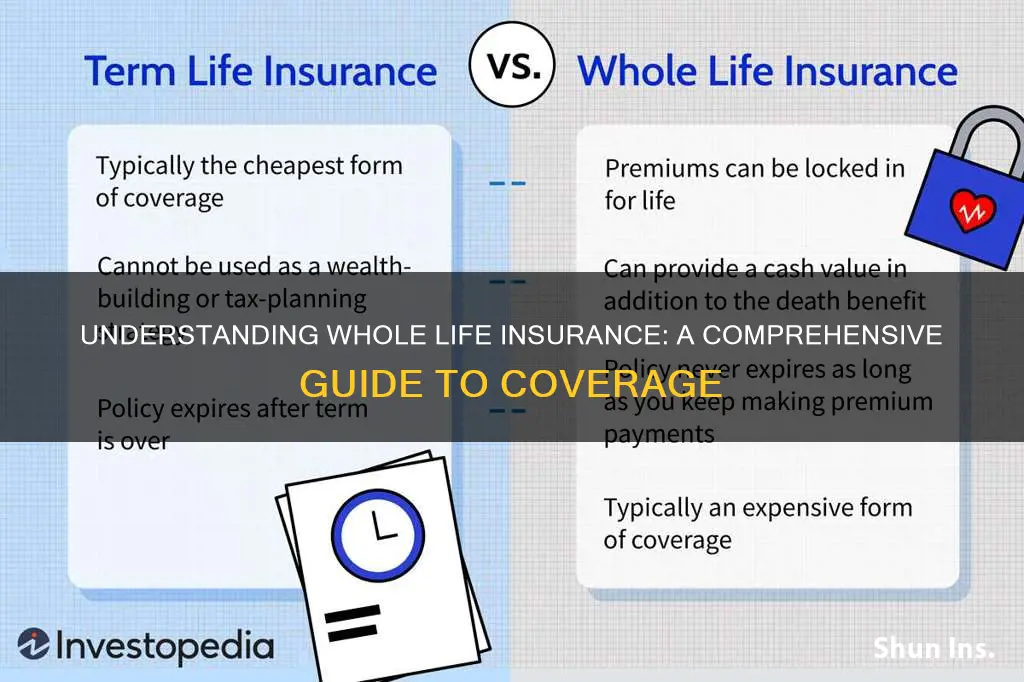

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a death benefit if the insured person passes away during this term. Whole life insurance, on the other hand, is a permanent policy that provides coverage for the entire lifetime of the insured individual. It offers a death benefit and also includes a cash value component that grows over time.

Whole life insurance provides a guaranteed death benefit, which means the insurance company will pay out a specified amount to the policyholder's beneficiaries upon the insured's death. This coverage is in place for the entire life of the insured, hence the term "whole life." Additionally, whole life policies accumulate cash value, which can be borrowed against or withdrawn, providing financial flexibility.

Yes, one of the advantages of whole life insurance is the flexibility it offers. You can typically adjust the coverage amount by increasing or decreasing the policy's death benefit during the policy's lifetime. This can be done by paying additional premiums or by taking out a policy loan, which uses the accumulated cash value as collateral. It's important to review and update your policy regularly to ensure it aligns with your changing needs and financial goals.