Root Insurance, a tech-driven insurance company, utilizes an innovative approach to assess driving behavior and determine premiums. They employ a combination of advanced technology and data analysis to monitor and evaluate how drivers operate their vehicles. This includes the use of a smartphone app that records driving patterns, such as acceleration, braking, and cornering, providing Root with valuable insights into individual driving habits. By analyzing this data, Root can offer personalized insurance policies, ensuring fair pricing based on actual driving behavior rather than traditional factors like age or vehicle type. This method not only benefits Root in providing accurate risk assessments but also empowers drivers with a better understanding of their driving habits and the potential for improved safety and savings.

What You'll Learn

- Data Collection: Root uses various methods to gather driving data, including GPS and app usage

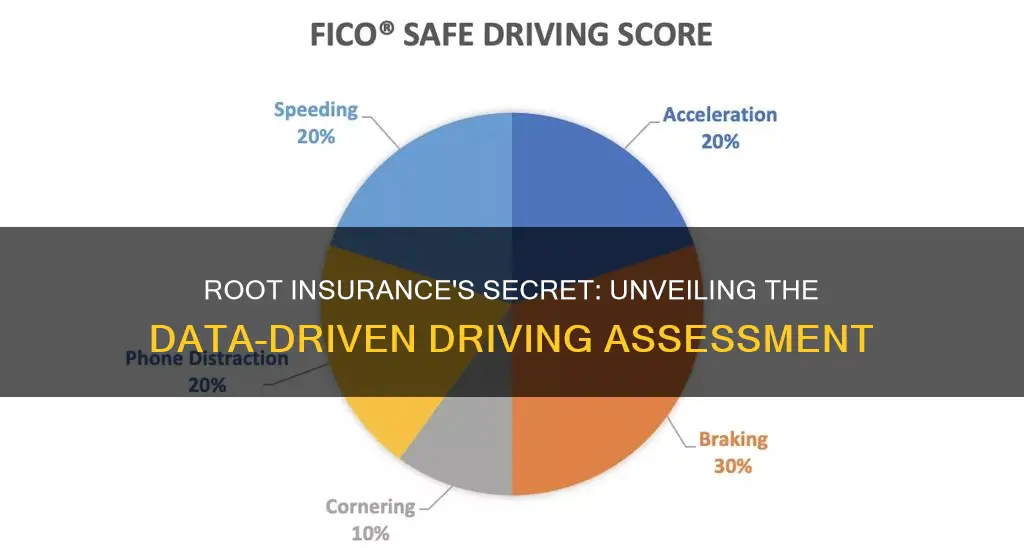

- Behavior Analysis: They analyze driving patterns, such as speed, acceleration, and braking, to assess risk

- Mileage Tracking: Root monitors total mileage to understand driving frequency and potential wear and tear

- Accident Reporting: The company requires drivers to report accidents, which helps in assessing driving behavior

- Usage-Based Insurance: Root's model rewards safe driving habits and penalizes risky behaviors based on data

Data Collection: Root uses various methods to gather driving data, including GPS and app usage

Root Insurance, a relatively new player in the insurance industry, has developed a unique approach to assessing and pricing car insurance policies. At the heart of their model is a data-driven strategy, which involves collecting and analyzing extensive information about how drivers operate their vehicles. This method allows Root to offer personalized insurance rates based on individual driving behavior, a concept that has gained traction in the insurance market.

One of the primary tools Root employs for data collection is GPS technology. They equip vehicles with GPS devices that provide precise location and speed data. This information is crucial for Root to track a driver's movements and patterns. By analyzing GPS data, Root can identify frequent driving routes, estimate commute times, and even detect potential speeding incidents. The GPS system also helps Root understand the overall driving habits of their policyholders, allowing for more accurate risk assessments.

In addition to GPS, Root utilizes app-based technology to gather further insights. They have developed a mobile app that encourages safe driving practices and provides valuable feedback to drivers. The app can track and record various driving behaviors, such as acceleration, braking, and cornering. It also prompts drivers to report any incidents or claims they make, ensuring that Root has a comprehensive record of the driver's interactions with the vehicle. The app's usage data, including engagement and frequency, further contributes to Root's understanding of driver behavior.

The combination of GPS and app data allows Root to create detailed profiles of their insured drivers. These profiles are dynamic and can be updated regularly, ensuring that the insurance company always has the most current information. By continuously collecting and analyzing this data, Root can adjust insurance rates accordingly, rewarding safe drivers with lower premiums and penalizing risky behavior. This real-time data collection and analysis process is a significant differentiator for Root, setting them apart from traditional insurance providers.

Root's data-centric approach has been met with both enthusiasm and skepticism. While it offers a more personalized and potentially cost-effective insurance solution, some drivers may be concerned about the extensive data collection and privacy implications. However, Root emphasizes that the data is used solely for risk assessment and improvement of their services, and it is subject to strict privacy policies and regulations. This transparency and focus on data accuracy have helped Root establish a reputation for innovation in the insurance industry.

Mileage and Auto Insurance: How Your Driving Habits Impact Your Rates

You may want to see also

Behavior Analysis: They analyze driving patterns, such as speed, acceleration, and braking, to assess risk

Root Insurance, a unique player in the insurance industry, takes a highly personalized approach to understanding its customers' driving habits. At the heart of this process is behavior analysis, a sophisticated method that delves into the very essence of how drivers operate their vehicles. This analysis is a powerful tool that allows Root to assess risk and tailor its insurance policies accordingly.

The analysis begins with the collection of data from various sources. Root employs a range of technologies, including sensors and telematics devices, which are installed in the insured vehicle. These devices capture a wealth of information, such as speed, acceleration, braking patterns, and even the duration of the journey. By gathering this data, Root can start to paint a detailed picture of the driver's behavior.

The next step is the interpretation of this data. Root's team of experts employs advanced algorithms and machine learning techniques to analyze the collected information. They look for patterns and trends, identifying how a driver accelerates, brakes, and navigates different road conditions. For instance, frequent hard braking or rapid acceleration might indicate a more aggressive driving style, which could be a factor in risk assessment.

Speed is another critical aspect of this analysis. Root considers the average speed of the vehicle and how it varies over different types of roads. For example, a driver who consistently exceeds speed limits, especially in residential areas or school zones, is likely to be deemed a higher-risk driver. This information is crucial in determining the premium and coverage options for the policyholder.

Additionally, Root takes into account the time of day and frequency of driving. Patterns such as early morning or late-night drives, or the regularity of weekend trips, can provide insights into a driver's lifestyle and potential risks. By considering these factors, Root can offer personalized insurance solutions, ensuring that the coverage is tailored to the specific driving behavior and needs of each customer. This approach not only benefits Root in terms of risk assessment but also provides drivers with a more accurate and fair insurance experience.

Higher Deductible, Lower Premium: Navigating the Trade-offs in Auto Insurance

You may want to see also

Mileage Tracking: Root monitors total mileage to understand driving frequency and potential wear and tear

Root Insurance utilizes a sophisticated mileage tracking system to gain insights into your driving habits and assess the potential risks associated with your vehicle's usage. This method is a crucial component of their innovative approach to insurance, allowing them to offer personalized rates and coverage. Here's how it works:

Data Collection: Root installs a small, unnoticeable device, often referred to as a 'plug-in' or 'OBD-II device,' in your vehicle's OBD-II port. This device acts as a data collector, continuously monitoring various parameters related to your driving. The primary data point it tracks is your total mileage.

Mileage Tracking: The device records the distance traveled by your vehicle, providing Root with a comprehensive log of your driving patterns. This data is then transmitted securely to Root's servers. By analyzing this information, Root can determine how frequently you drive and the overall usage of your vehicle. Frequent short trips might indicate a higher risk of wear and tear on certain vehicle components, while longer, less frequent journeys could suggest a more stable driving pattern.

Risk Assessment: Root's algorithm processes the mileage data to assess the potential risks associated with your driving. For instance, a high annual mileage could increase the likelihood of accidents or mechanical issues. This assessment helps Root understand the wear and tear on the vehicle and the potential for claims, allowing them to offer tailored insurance policies.

Personalized Rates: Based on the mileage tracking and risk assessment, Root provides personalized insurance quotes. Drivers with lower mileage and less frequent trips might receive more competitive rates, as they pose a lower risk to the insurance company. This approach ensures that the insurance premiums reflect the actual driving habits and usage of the vehicle, creating a fair and transparent pricing model.

Transparency and Control: Root's mileage tracking system also empowers drivers with transparency and control. Drivers can access their driving data through the Root app, allowing them to monitor their mileage and understand how it impacts their insurance rates. This transparency encourages safe driving habits and provides an opportunity for drivers to take control of their insurance costs.

Idaho In-State Auto Insurance Requirements: What You Need to Know

You may want to see also

Accident Reporting: The company requires drivers to report accidents, which helps in assessing driving behavior

Root Insurance, a unique player in the insurance industry, takes a proactive approach to understanding its customers' driving habits and behaviors. One of the key methods they employ is accident reporting, which is an essential part of their risk assessment process. When an accident occurs, Root requires its policyholders to report the incident promptly. This reporting mechanism is not just a formality but a crucial step in evaluating the driver's behavior and making informed decisions.

The accident reporting process is designed to be straightforward and efficient. After an accident, drivers are instructed to provide details such as the date, time, location, and a description of the incident. This information is then carefully analyzed by Root's team of experts. They examine factors like the severity of the accident, the circumstances surrounding it, and the driver's actions leading up to the event. By doing so, Root can gain valuable insights into the driver's behavior and make assessments about their driving skills and habits.

Accident reports also help Root identify patterns and trends in driving behavior. For instance, they might notice that certain drivers are more prone to accidents in specific weather conditions or during particular times of the day. This data-driven approach allows Root to tailor their policies and services accordingly. For example, they could offer additional discounts or incentives to drivers who consistently report safe driving habits and low-risk behaviors.

Moreover, accident reporting serves as a form of feedback to drivers, encouraging them to reflect on their actions and make improvements. When drivers report accidents, they are more likely to take responsibility for their actions and learn from their mistakes. This aspect of transparency and accountability is vital in Root's mission to promote safe driving and reduce the number of accidents on the road.

In summary, Root Insurance's requirement for accident reporting is a powerful tool for assessing driving behavior. It enables them to gather critical data, identify patterns, and provide feedback to policyholders. By combining this information with other data sources, Root can offer personalized insurance solutions, ensuring that drivers receive the support they need to become safer and more responsible on the road. This innovative approach to insurance not only benefits the company but also contributes to a culture of safer driving among its customers.

Insurance Drop: When You're Not Covered

You may want to see also

Usage-Based Insurance: Root's model rewards safe driving habits and penalizes risky behaviors based on data

Usage-Based Insurance, often referred to as 'Pay-How-You-Drive' or 'Usage-Based' insurance, is a type of car insurance that uses data and technology to assess and adjust premiums based on how a driver actually uses their vehicle. One of the leading companies in this field is Root Insurance, which utilizes a unique model to determine driving habits and adjust premiums accordingly.

The Root model is designed to be fair and transparent, rewarding safe drivers and penalizing those who engage in risky behavior. This approach is made possible through the use of a smartphone app and a small, discreet device installed in the vehicle. The app and device work together to collect data on various driving habits, such as acceleration, braking, cornering, and overall driving patterns. This data is then analyzed to determine the driver's risk profile.

Safe driving habits are rewarded through a points system. For instance, consistent, smooth driving with minimal sudden accelerations or hard braking earns points. These points can lead to lower premiums or even a discount on the insurance policy. On the other hand, risky behaviors such as rapid acceleration, frequent hard braking, or driving at high speeds in unsafe conditions, are penalized by a temporary increase in the premium. This increase is designed to encourage safer driving and can be avoided by improving driving habits.

The beauty of this model is its adaptability. Premiums are not set in stone and can change based on the driver's actions. This dynamic nature of the insurance policy encourages drivers to maintain a safe driving record, as any improvement in driving habits can lead to immediate financial benefits. Additionally, the app provides drivers with insights into their driving behavior, allowing them to make informed adjustments to their driving style.

Root Insurance's usage-based model is a game-changer in the insurance industry, offering a more personalized and fair approach to car insurance. It provides an opportunity for drivers to take control of their insurance costs by demonstrating safe driving habits. This innovative method of insurance is not only beneficial for drivers but also for insurance companies, as it reduces the risk and encourages a culture of safe driving.

Full Auto Insurance Coverage in North Carolina: What's Included?

You may want to see also

Frequently asked questions

Root Insurance uses a combination of technology and data analysis to assess your driving habits. They employ a device called the Root Insurance Box, which is installed in your vehicle. This box records various driving metrics, including acceleration, braking, cornering, and speed. The data is then transmitted to Root's servers, where it is analyzed to create a personalized driving profile for you.

Root takes into account multiple aspects of your driving behavior. This includes hard braking, rapid acceleration, frequent hard cornering, and driving at night. They also consider the time of day, day of the week, and weather conditions. By analyzing these patterns, Root can determine your risk level as a driver and tailor their insurance policies accordingly.

Root Insurance prioritizes data security and user privacy. The Root Insurance Box is designed with encryption to protect the collected data. Root also has strict privacy policies in place, ensuring that your personal information is handled confidentially. They provide transparency by allowing you to view your driving report and understand how your habits are being assessed. Additionally, Root offers the option to opt-out of certain data collection practices, giving you control over the level of monitoring.