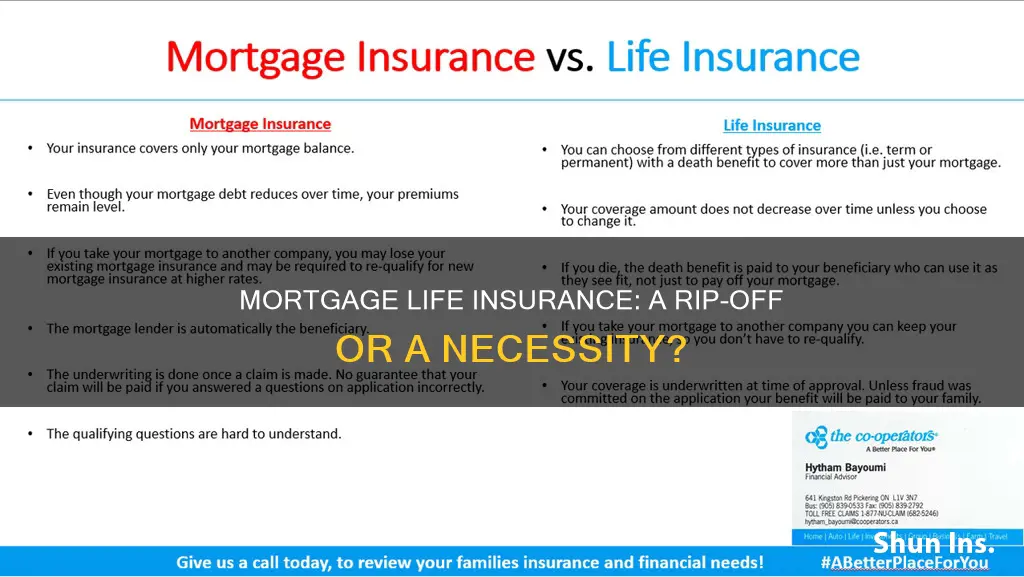

Mortgage life insurance, often sold as a way to protect your loved ones in the event of your death, has been criticized for being a rip-off. This is because many policies come with high fees and low death benefits, making them an expensive and often unnecessary addition to your mortgage. Critics argue that the premiums can be significantly more costly than other forms of life insurance, and the coverage may not be worth the investment, especially if you already have a robust financial safety net in place. This has led to a growing debate about the value and ethics of mortgage life insurance, with many consumers questioning whether it is a wise financial decision.

What You'll Learn

- High Premiums: Mortgagors pay excessive fees for limited coverage

- Limited Benefits: Policyholders may not receive full death benefit

- Misleading Sales Practices: Agents may exaggerate benefits to sell policies

- High Administrative Costs: Expensive management and processing fees

- Lack of Transparency: Complex policies with hidden fees and exclusions

High Premiums: Mortgagors pay excessive fees for limited coverage

Mortgage life insurance, often sold as a convenient add-on to home loans, has been criticized for its high premiums and limited coverage, leaving many homeowners feeling they are paying a premium for a product that may not offer adequate protection. This type of insurance is typically offered by lenders as a way to ensure that the mortgage is paid off in the event of the borrower's death, but the reality is that the costs can be exorbitant, and the benefits may not justify the expense.

One of the primary issues is the lack of transparency in pricing. When taking out a mortgage, borrowers are often pressured to purchase life insurance without fully understanding the financial implications. The premiums can be surprisingly high, especially for those with average health and age, making it a costly addition to an already substantial financial commitment. For instance, a 30-year-old non-smoker might pay hundreds of dollars a month for a policy that only covers the mortgage amount, which may not be a substantial loss for the lender but is a significant financial burden for the policyholder.

The coverage provided by these policies is often limited to the mortgage balance, which may not be a comprehensive solution for families. In the event of the borrower's death, the insurance payout typically only covers the remaining mortgage debt, leaving the family with the burden of other living expenses and potentially no financial cushion. This limited coverage can be a significant disadvantage, especially for those with large families or significant financial obligations.

Furthermore, the high premiums can be a result of the way these policies are structured. Mortgage life insurance is often sold as a guaranteed acceptance product, which means that everyone who applies is approved, regardless of health status. This approach can lead to higher premiums for all policyholders, as the risk pool is not as carefully selected as in other insurance products. As a result, borrowers may find themselves paying more than they would for a similar policy with more stringent acceptance criteria.

Borrowers should carefully consider alternative options to ensure they are not overpaying for insurance. Term life insurance, for instance, can provide more comprehensive coverage at potentially lower costs, allowing individuals to protect their families and assets more effectively. It is essential to shop around and compare policies to find the best value, ensuring that the coverage meets individual needs without breaking the bank.

Colonial Life Disability Insurance: What You Need to Know

You may want to see also

Limited Benefits: Policyholders may not receive full death benefit

Mortgage life insurance, often marketed as a convenient way to protect your family's financial future, can come with significant limitations that may leave policyholders with less than they expected. One of the most concerning aspects is the potential for limited death benefits, which can leave families in a difficult financial position.

When you purchase mortgage life insurance, the policy is typically structured to cover a specific amount to pay off your mortgage in the event of your death. However, this coverage may not be as comprehensive as it seems. Many policies have a cap on the death benefit, meaning that the insurance company will only pay out up to a certain amount, regardless of the mortgage balance. This limitation can be detrimental, especially if the mortgage balance exceeds the policy's death benefit. In such cases, the surviving family members may still be responsible for the remaining mortgage debt, leaving them with a substantial financial burden.

For instance, imagine a scenario where a family takes out a mortgage of $300,000 and purchases a mortgage life insurance policy with a death benefit of $150,000. If the primary breadwinner passes away, the insurance company will pay out $150,000, which may not even cover half of the mortgage balance. The family would still be left with a significant debt, potentially impacting their long-term financial stability and the ability to maintain their standard of living.

Furthermore, some policies may have restrictions on the eligibility of beneficiaries. For example, the policy might only pay out to the spouse and not to other dependents, such as children or other family members. This limitation can be particularly challenging for families with complex financial needs or those who rely on multiple sources of income.

To avoid such pitfalls, it is crucial for policyholders to carefully review the terms and conditions of their mortgage life insurance policy. Understanding the coverage limits, eligibility criteria, and any potential exclusions can help individuals make informed decisions and ensure that their loved ones are adequately protected. Additionally, considering alternative forms of life insurance with more comprehensive benefits might be a wise choice to safeguard against potential financial losses.

Life Insurance Interviews: What Questions to Expect

You may want to see also

Misleading Sales Practices: Agents may exaggerate benefits to sell policies

Mortgage life insurance is often marketed as a crucial financial tool to protect families in the event of a breadwinner's death. However, the reality is that this type of insurance can be a costly and potentially misleading investment. One of the most concerning aspects is the practice of agents exaggerating the benefits to entice customers into purchasing policies.

When considering mortgage life insurance, it's essential to understand the true value and limitations of the policy. Agents sometimes use aggressive sales tactics, promising benefits that may not be entirely accurate or relevant to the individual's specific situation. For instance, they might claim that the policy will cover a significant portion of the mortgage balance, ensuring the family's financial security. While this can be a genuine concern, it's important to note that the coverage amount is typically limited and may not align with the exaggerated promises made.

The exaggeration often lies in the details. Agents might fail to disclose that the policy has a limited benefit period, usually lasting only a few years, which may not align with the long-term financial goals of the policyholder. They might also overlook the fact that the policy's cash value, which can be borrowed against or withdrawn, is often insufficient to cover the mortgage balance, especially in the long run. This lack of transparency can lead to customers feeling misled and disappointed once they realize the actual value of their investment.

Furthermore, the high cost of mortgage life insurance is another red flag. These policies tend to be more expensive compared to other life insurance types, and the premiums can be a significant expense for the policyholder. Agents may not always disclose the full cost implications, including the potential for the policy to become a long-term financial burden if the need for coverage diminishes over time.

To avoid falling victim to such misleading sales practices, consumers should conduct thorough research and carefully review the policy documents. It is crucial to compare different insurance providers and understand the specific terms and conditions of the mortgage life insurance policy. By doing so, individuals can make informed decisions and ensure they are not paying for exaggerated benefits that may not provide the long-term financial security they believe they are getting.

Life Insurance: When the Benefits Outweigh the Costs

You may want to see also

High Administrative Costs: Expensive management and processing fees

Mortgage life insurance, often marketed as a convenient way to protect your loved ones in the event of your death, comes with a significant catch: exorbitant administrative costs. These costs can eat into the value of the policy, leaving you with a fraction of the coverage you initially thought you were getting.

The primary culprit behind these high administrative fees is the complex nature of mortgage life insurance itself. This type of insurance is typically offered as a rider or add-on to an existing mortgage, requiring close coordination between the insurance company, the mortgage lender, and the borrower. This intricate process involves multiple parties, each demanding a cut of the fees.

Insurance companies often charge substantial processing fees to handle the paperwork, administration, and underwriting associated with mortgage life insurance. These fees can vary widely, but they often amount to a significant percentage of the policy's face value. For instance, a policy with a $100,000 death benefit might come with processing fees of $1,000 or more, reducing the actual coverage to just $99,000.

Moreover, mortgage lenders frequently require borrowers to pay an upfront fee to secure the insurance. This fee is typically a percentage of the loan amount and is paid to the insurance company to cover the initial costs of setting up the policy. These lender fees can be substantial, further diminishing the overall value of the insurance.

The combination of these high administrative costs and lender fees means that mortgage life insurance can be far more expensive than traditional term life insurance. While mortgage life insurance may offer some convenience, the significant costs involved make it a less attractive option for many consumers. It's crucial to carefully review the policy details and consider the potential savings from other insurance options before making a decision.

Life Insurance: A Prerequisite for Business Loans from Banks?

You may want to see also

Lack of Transparency: Complex policies with hidden fees and exclusions

Mortgage life insurance, often sold as a convenient add-on to home loans, is a complex financial product that can be fraught with hidden costs and exclusions, leaving policyholders with a less-than-ideal experience. One of the primary issues is the lack of transparency in these policies, which can lead to significant financial disappointment for those who rely on them.

Many mortgage life insurance policies are designed with intricate terms and conditions, often buried in fine print that most consumers don't have the time or expertise to scrutinize. These policies may include various fees, such as application, administration, and policy management fees, which are not always clearly disclosed. For instance, some companies charge a one-time application fee, a monthly administration fee, and even a policy management fee for each premium payment, adding up to significant costs over the life of the policy. These hidden fees can be a substantial burden, especially for those on a tight budget, and may not be fully understood until the policy is in effect.

Exclusions are another critical aspect of mortgage life insurance that lacks transparency. These are specific events or circumstances that the policy does not cover, and they can vary widely. For example, a policy might exclude death caused by pre-existing medical conditions, accidents, or certain high-risk activities. These exclusions can render the policy largely useless in the event of a covered death, leaving the insured with a sense of false security. Without proper understanding and awareness, policyholders might assume that their loved ones are fully protected, only to find out later that critical aspects of the policy were not covered.

The complexity of these policies often makes it challenging for consumers to compare different providers and their offerings. Each company may use different terminology and structure their policies uniquely, making it difficult for shoppers to make informed decisions. As a result, consumers might choose a policy based on a perceived benefit, only to discover that it doesn't align with their actual needs due to the intricate web of exclusions and fees.

In summary, the lack of transparency in mortgage life insurance policies can lead to significant financial strain and disappointment. Hidden fees and carefully worded exclusions can render these policies less valuable than advertised, leaving policyholders with a sense of regret. It is crucial for consumers to carefully review and understand the terms and conditions of any insurance policy they consider, ensuring that they are fully informed before making a commitment.

Grow Your Career as a Bajaj Life Insurance Agent

You may want to see also

Frequently asked questions

Mortgage life insurance is a policy designed to protect lenders in case of the borrower's death, ensuring that the remaining mortgage balance is covered. However, it has faced criticism for being an expensive and often unnecessary product. Many argue that it can be a rip-off because the premiums can be high, and the benefits might not outweigh the cost, especially for those with existing life insurance coverage.

When you take out a mortgage, the lender may offer or require mortgage life insurance as a condition. This policy typically pays off the mortgage debt in the event of the borrower's death. Critics argue that it can be controversial because the premiums are often automatically deducted from the mortgage payment, and borrowers might not fully understand the terms. Additionally, some people believe that the insurance is overpriced, especially for those with pre-existing health conditions, who might be charged higher rates.

Yes, there are alternatives that borrowers can explore. One option is to increase the mortgage payment to build up equity in the property, ensuring that the lender is protected. Another alternative is to take out a term life insurance policy, which provides coverage for a specific period, such as the duration of the mortgage. This allows borrowers to have more control over the cost and ensures that the coverage is tailored to their needs. It's essential to review all options and consider one's financial situation before making a decision regarding mortgage life insurance.