Life insurance is a financial tool that provides a safety net for individuals and their families, offering financial protection and peace of mind. It is a crucial consideration for anyone looking to secure their loved ones' future and manage their financial legacy. When is life insurance worth it? This question often arises as people contemplate the value of such a commitment. The answer lies in understanding the various benefits and protections it offers, including financial support for dependents, debt repayment, funeral expenses, and long-term financial goals. By exploring these aspects, individuals can make an informed decision about whether life insurance is a worthwhile investment for their specific circumstances and needs.

What You'll Learn

- Financial Dependents: Life insurance is essential if you have dependents who rely on your income

- Debt Management: It can help pay off debts, like mortgages or loans, after your passing

- Income Replacement: Provides financial support to replace lost income for surviving family members

- Final Expenses: Covers funeral costs and other final expenses, easing the burden on loved ones

- Long-Term Care: Offers financial security for long-term care needs, ensuring quality of life in later years

Financial Dependents: Life insurance is essential if you have dependents who rely on your income

If you have financial dependents, such as a spouse, children, or other family members who rely on your income, life insurance becomes a critical component of your financial planning. The primary purpose of life insurance in this context is to provide financial security and peace of mind for your loved ones in the event of your untimely death. Here's why it's worth considering:

Income Replacement: When you have dependents, your income is crucial for their daily needs, future education, and overall well-being. Life insurance can step in and replace that income if something happens to you. This ensures that your family can maintain their standard of living and cover essential expenses, such as mortgage or rent payments, utility bills, groceries, and other regular costs. By providing a financial safety net, life insurance allows your dependents to focus on healing and adjusting to life without the immediate worry of financial strain.

Education and Future Planning: For parents, the future education of their children is a significant concern. Life insurance can help secure this aspect of their future. A life insurance policy can provide a lump sum payment or regular income to cover educational expenses, such as tuition fees, books, and living costs, if something happens to the primary breadwinner. This ensures that your children's educational goals remain achievable, even in your absence.

Debt Management: Financial dependents often rely on the primary earner's income to manage household debts, such as a mortgage, car loans, or credit card debt. In the event of your death, life insurance can help pay off these debts, preventing your loved ones from being burdened with financial obligations. This aspect of life insurance is particularly important to ensure that your dependents are not left with overwhelming financial responsibilities.

Emotional Support and Peace of Mind: Beyond the financial benefits, life insurance provides emotional support and peace of mind. Knowing that your dependents will be taken care of can reduce stress and anxiety, allowing your family to grieve and move forward with confidence. It empowers your loved ones to make decisions about their future without the immediate worry of financial instability.

In summary, life insurance is a valuable tool for those with financial dependents, as it ensures the financial security and well-being of your loved ones. It provides the means to replace lost income, secure future plans, manage debts, and offer emotional support during challenging times. When considering life insurance, it's essential to assess your specific circumstances, choose the right policy, and ensure that the coverage amount is sufficient to meet the needs of your dependents.

Discount Rates: Life Insurance's Reasonable Range

You may want to see also

Debt Management: It can help pay off debts, like mortgages or loans, after your passing

Life insurance is a financial tool that can provide a safety net for your loved ones and offer peace of mind, especially when it comes to managing debts. One of the primary benefits of life insurance is its ability to ensure that your financial obligations are taken care of even after your passing. This is particularly relevant when considering debts such as mortgages or loans, which can be a significant financial burden for your family.

When you have a substantial mortgage or loan, the thought of your family having to manage these payments after your death can be daunting. Life insurance can step in to fill this gap and provide the necessary financial support. Upon your death, the life insurance policy's payout can be used to settle these debts, ensuring that your loved ones are not burdened with the additional financial responsibility. This is especially crucial if you have a large mortgage or a substantial loan that your family might struggle to manage without the insurance payout.

The process is straightforward: you can name your beneficiaries, who will receive the death benefit, and specify that it should be used to pay off the debts. This ensures that your family can maintain their standard of living and avoid the stress of financial obligations during an already difficult time. It's a practical way to provide for your loved ones and ensure their financial security.

Moreover, life insurance can be tailored to your specific needs. You can choose the amount of coverage that aligns with the value of your mortgage or loan, ensuring that the debt is fully covered. This personalized approach allows you to create a comprehensive financial plan, providing both protection and peace of mind. By taking this proactive step, you can rest assured that your family will be taken care of, and your debts will be managed efficiently.

In summary, life insurance is a valuable asset when it comes to debt management, particularly for large financial obligations like mortgages and loans. It offers a practical solution to ensure that your loved ones are protected and that your debts are settled, providing a sense of security and financial stability for your family.

Gerber Life Insurance: Does It Have an Expiry Date?

You may want to see also

Income Replacement: Provides financial support to replace lost income for surviving family members

When considering whether life insurance is worth it, one of the most compelling reasons is often tied to providing financial security for your loved ones. Income replacement is a critical aspect of life insurance that ensures your family can maintain their standard of living even if you're no longer there to support them financially. This is especially crucial if you are the primary breadwinner or if your income significantly contributes to the family's overall financial stability.

The primary goal of income replacement is to ensure that your family can cover their essential expenses, such as mortgage or rent, utilities, groceries, and other daily costs. It also helps in covering long-term commitments like education expenses for children or any ongoing medical treatments. By having a life insurance policy that provides income replacement, you can rest assured that your family will have the financial resources they need to continue their lives as planned, even in the event of your untimely passing.

The amount of income replacement coverage you need will depend on several factors, including your current income, the number of dependents you have, and the overall financial obligations of your family. It's essential to carefully assess your family's financial situation and consider the potential impact of your death on their ability to maintain their lifestyle. A financial advisor can be a valuable resource in determining the appropriate coverage amount.

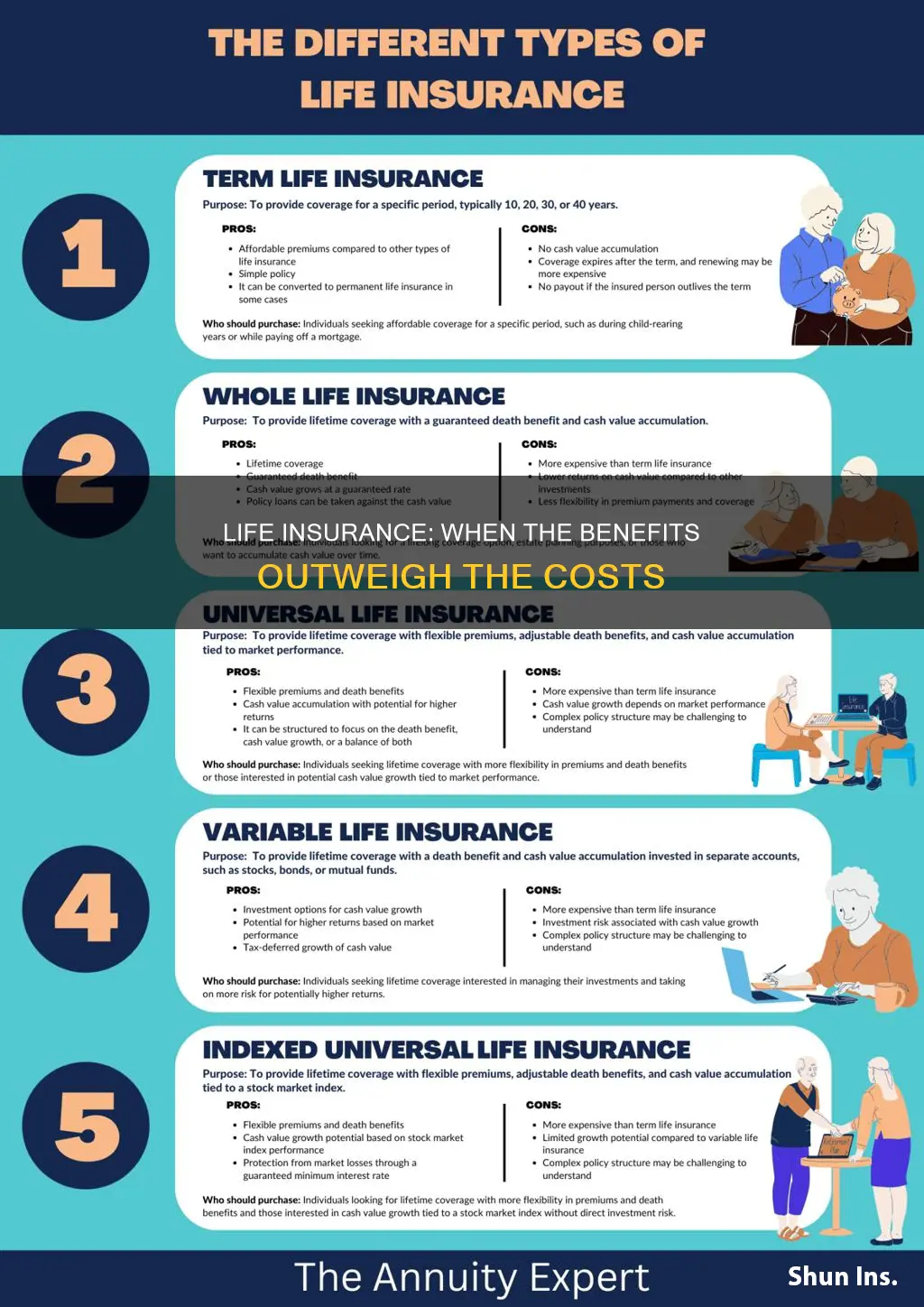

Term life insurance is often a popular choice for income replacement because it provides a fixed amount of coverage for a specific period, typically 10, 20, or 30 years. This type of policy is designed to cover a particular period, such as the duration of a mortgage or until a child finishes college, ensuring that your family has the financial support they need during those critical years. Once the term ends, the policy can be renewed, or you can choose to convert it into a permanent policy if necessary.

In summary, income replacement through life insurance is a vital component of financial planning, especially for those who are the primary earners in their families. It ensures that your loved ones can maintain their financial independence and continue to live comfortably even if you're no longer there to provide for them. By carefully evaluating your family's needs and choosing the right coverage, you can provide a valuable safety net for your loved ones and give them the peace of mind that comes with knowing they are financially secure.

MassMutual Whole Life Insurance: Steps to Apply

You may want to see also

Final Expenses: Covers funeral costs and other final expenses, easing the burden on loved ones

When considering whether life insurance is a worthwhile investment, it's essential to think about the specific needs and circumstances of your life. One area where life insurance can be particularly valuable is in covering final expenses, such as funeral costs and other related expenses, which can be a significant financial burden for loved ones left behind.

Final expenses insurance, also known as burial insurance, is designed to provide financial support during a challenging time. It ensures that your family doesn't have to worry about the monetary aspects of your funeral and burial, allowing them to focus on grieving and honoring your memory. This type of insurance typically covers various costs associated with end-of-life arrangements, including funeral services, casket or urn, burial or cremation, and even legal and administrative fees. By having this coverage in place, you can provide peace of mind, knowing that your loved ones won't be burdened with unexpected expenses during an already difficult period.

The benefits of final expenses insurance extend beyond just funeral costs. It can also cover other final expenses, such as outstanding debts, medical bills, and even estate administration fees. These expenses can quickly accumulate and cause financial strain for your family, especially if they are not adequately prepared. With final expenses insurance, you can ensure that your loved ones are protected from the financial impact of these unforeseen costs, allowing them to move forward with their lives more comfortably.

In addition to providing financial security, final expenses insurance offers a sense of reassurance. It allows you to take control of a potentially stressful situation and make arrangements according to your wishes. By having this coverage, you can rest easy knowing that your family will have the necessary funds to handle your final wishes without the added worry of financial obligations.

When considering life insurance, it's crucial to evaluate your unique circumstances and priorities. Final expenses insurance can be a valuable component of your overall financial plan, especially if you want to alleviate the financial burden on your loved ones during a time of grief. It provides a practical solution to a challenging aspect of life, ensuring that your family can focus on honoring your memory rather than worrying about monetary matters.

Unlocking the Mystery: Legal Age for Life Insurance Signatures

You may want to see also

Long-Term Care: Offers financial security for long-term care needs, ensuring quality of life in later years

Long-term care insurance is a crucial aspect of financial planning, especially as we consider the potential challenges and expenses associated with aging. This type of insurance provides a safety net for individuals who may require assistance with daily activities and medical care as they grow older. The primary goal is to offer financial security and peace of mind, ensuring that one's quality of life is maintained or even enhanced during the later years.

As people age, the likelihood of developing chronic illnesses, disabilities, or requiring extended periods of rehabilitation increases. Long-term care insurance steps in to cover the associated costs, which can be substantial. It typically covers services such as nursing home care, assisted living, and even in-home care, depending on the policy's terms. By having this insurance, individuals can focus on their well-being and comfort, knowing that their financial needs are addressed.

The value of long-term care insurance lies in its ability to provide financial protection against the high costs of long-term care services. Without such insurance, individuals and their families might face significant financial strain, potentially depleting savings or even incurring debt to cover these expenses. Moreover, it empowers individuals to make choices about their care, allowing them to select the level of assistance and environment that best suits their preferences and needs.

When considering long-term care insurance, it is essential to evaluate one's current and future financial situation. This includes assessing the potential need for long-term care, understanding the associated costs in the region, and determining the desired level of coverage. Consulting with a financial advisor can help individuals navigate the options available and choose a policy that aligns with their goals and circumstances.

In summary, long-term care insurance is a valuable tool for ensuring financial security and maintaining a good quality of life as one ages. It provides the means to address the financial challenges that may arise during the later years, allowing individuals to focus on their well-being and make choices that suit their personal preferences. By proactively considering this type of insurance, individuals can take control of their future and ensure they are prepared for the potential needs of long-term care.

Life Insurance: Is Decreasing Coverage Worth the Cost?

You may want to see also

Frequently asked questions

Life insurance is a valuable financial tool to consider when you have people or financial commitments that depend on your income. It can provide financial security and peace of mind for your loved ones in the event of your untimely death. Common life events that may prompt you to consider life insurance include starting a family, purchasing a home, or having significant financial obligations like student loans or a mortgage.

While it is true that younger and healthier individuals may have a lower risk of death, life insurance can still be beneficial. Young adults often have financial responsibilities, such as student loans or a growing family, that life insurance can help cover. Additionally, life insurance can be a valuable investment tool, allowing you to build cash value over time, which can be used for various financial goals.

The choice between term life insurance and permanent life insurance depends on your specific needs and financial goals. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, and is often more affordable. It is ideal for covering short-term financial obligations. Permanent life insurance, on the other hand, offers lifelong coverage and includes an investment component, making it suitable for long-term financial planning and building wealth.